WeChat is the must-have app for the average smartphone user in China. Known as the “do-everything app”—a messaging platform, social media site, and digital wallet rolled into one—its billion-plus users rely on it to talk with friends, pay for goods and stay in the loop about what’s going on.

However, despite its enormous reach, WeChat is losing its appeal among young people. This has caused Tencent, its creator, to worry. In the quest to stay relevant, the internet giant has embarked on a plethora of launches and investments to revitalize the company.

The story might sound familiar to those in the West. When Facebook lost its cool-factor, the company purchased other social apps—Snapchat and Instagram—to remain competitive. Until now, the move has proved successful.

Tencent, a 21-year-old company, has also been trying to expand its offering beyond its flagship app WeChat to seek new hits in the social segment and, with them, more young users.

The tech giant’s “midlife crisis” comes as a time when Tencent finds itself fending off major tech rivals including ByteDance, Alibaba, Sina, and NetEase, which all introduced their own new social offerings in 2019.

The Chinese app factory

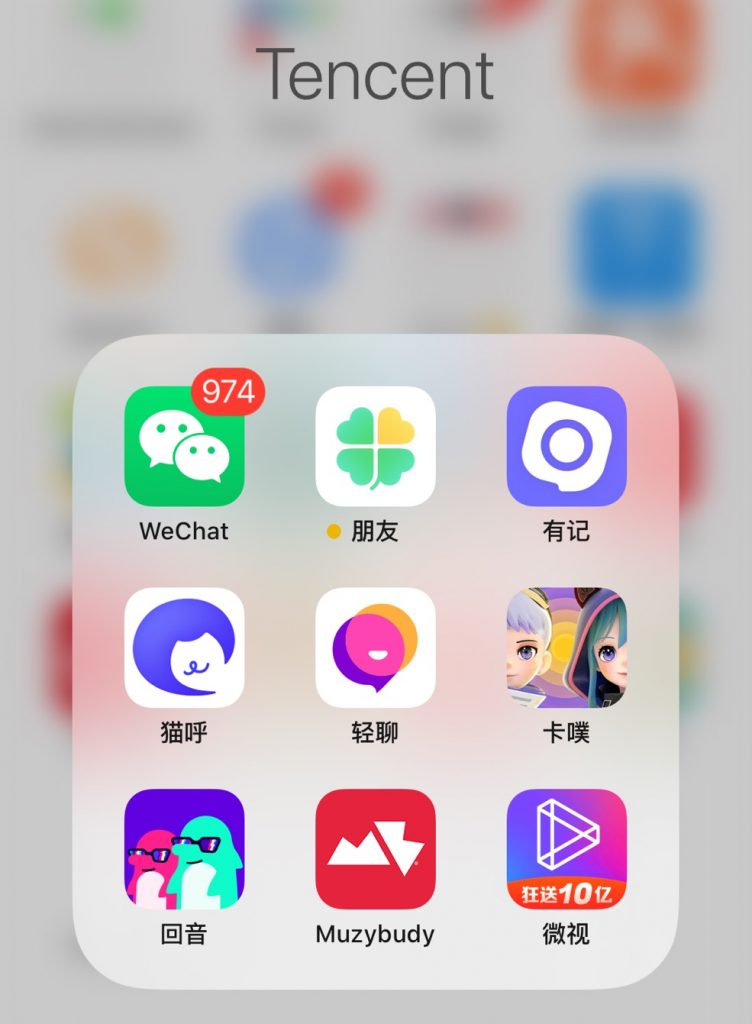

Tencent has released at least 11 different apps in 2019 alone.

The company’s new offerings can be divided into different categories, the main one being social networking. Tencent released anonymous-chatting social app Dengyu in December 2019, Video-calling application Maohu just a month later, and audio chat social app Huiyin, or “Echo”, right after. It also resurrected its long-failed Facebook copycat Pengyou.com into an app combining traces of Facebook, Instagram, and Tinder, aiming to get people connected through campuses or workplaces.

Matchmaking is another category Tencent is betting on. In December 2019, it released video-based service Huanyu, or “Happy Meetup” in Chinese, targeting users interested in marriage, while Tinder-style dating app Qingliao, meaning “Light Chat” was launched in November, focusing on younger users.

Tencent has also targeted the lifestyle sharing category with Youji, released at the end of November, a platform to browse content based on trending topics. Additionally, the Shenzhen-headquartered tech company also launched a cartoon avatar maker app called Kapu, which allows users to design virtual characters—a novel way of social networking among young people.

“China’s big-name tech companies are just gambling. They develop apps in every niche and wait to see which one will succeed. They don’t have clear thoughts on what the social networking products will be like,” said Kong Meng, an investor from early-stage investment firm Cyanhill Capital to local media TechPlanet.

Although none of Tencent’s new apps have failed to win a slot in any the most-downloaded app stores’ chart, their debuts caused a stir in China’s social networking landscape.

WeChat’s growing pains

Introduced as an instant messaging app in 2011, WeChat has evolved into a platform where users do everything without leaving the app’s interface. From paying for services, chatting, reading, booking movie tickets, ordering food, consult a doctor, and many other functions.

Thanks to the rapid popularization of smartphones and mobile internet in China, WeChat has expanded quickly. The platform counts over 1.15 billion monthly active users as of September, or roughly 82% of the nation’s overall population. Still, the enormous user base narrows the space for its further user growth, and also, makes Tencent increasingly cautious about redesigning the product. After all, even a tiny tweak could affect millions of users.

Remember how Facebook became “uncool” and began losing young users? WeChat is facing the same threat. According to industry data provider Jiguang, only 15% of users born after 2000, known as Gen Z, post every day on WeChat’s news feed-like section, Moments. By comparison, 57% of people born in the 1960s—who are now in their fifties—update their Moments every day.

The average time spent on WeChat also decreased by 8.4% to 32.4 hours per month between December 2018 and June 2019, stats from third-party research firm QuestMobile showed. Data from September 2019 revealed that although Chinese netizens spent 42% of their online time using Tencent apps, the number was down 4.2% year-over-year.

Courting Gen Z

The biggest threat to Tencent is ByteDance and its short-video apps Douyin and international version TikTok.

Short videos now take up 9% of Chinese mobile phone users’ screen time, according to Chinese media reports, while Douyin, launched in September 2016, nearly doubled its daily active users (DAUs) users in 2019, surpassing 400 million DAUs in January 2020. What’s more, 51% of Douyin users are Gen Z.

As WeChat struggles to entice young active users, other challengers have been pushing Tencent to redesign its offerings.

Baidu launched a location-based social app called Tingtong, aimed at university students, while Sina, the creator of Weibo, one of the most important social platforms in China, is pushing a new Instagram-like app named Oasis. The app, which got exposure from Weibo’s in-app ads and influencers’ recommendations, has become one of the most-downloaded social networking apps in China in January 2020.

NetEase, one of the largest gaming companies in China, also introduced a new audio live streaming app called Shengbo, or “Sound Wave,” in November, to test out audio-based social platforms.

In light of this, Tencent started to test a new feature on WeChat allowing content creators to post short-videos and photos in a news feed-like section, KrASIA reported. “Short-form content on WeChat has always been a focused direction,” said Allen Zhang, the app’s founder, during WeChat’s annual conference last January.

Also, Tencent has continued to invest heavily in Douyin’s biggest rival in the short-video arena, Kuaishou. At the end of 2019, Tencent reportedly poured USD 2 billion into Kuaishou’s pre-IPO round, which values the firm at roughly USD 28.6 billion. Short videos from Kuaishou are now included in WeChat Search’s results.

Weishi, an in-house short-video app, is also growing slowly on the back of WeChat’s huge user pool. Tencent expects the DAU of Weishi to reach 50 million by 2020. During the Lunar New Year holiday, Weishi released a new WeChat feature letting users give out red packets in formats of short videos. The company said that from Feb. 4 to Feb. 6, nearly 80 million video-red-packets were received.

Tencent is also the second-largest investor in video-sharing and live-streaming platform Bilibili, after pouring USD 320 million for a 12.3% stake in 2018. Bilibili enjoys great popularity among Chinese Gen Z, and Tencent hopes to reach a part of those users through a partnership in content sharing.

Despite the rising rivalry, some think that Tencent has little to worry.

“I may believe that Douyin will probably be upended after a few years, but I can’t imagine that WeChat will be taken on,” said Xu Danei, the CEO of Xinbang, a third-party industry data provider. He added that WeChat is part of the “Chinese society infrastructure,” because it meets people’s needs in various ways, including payment and social networking.