Indian startup ecosystem, the third-largest in the world with almost 40,000 startups, is on its way to reach pre-COVID-19 growth levels, according to a joint report by Zinnov and TiE Delhi-NCR.

Entrepreneurs in the country have adapted quickly and effectively to COVID-19 in response to the rapidly evolving market dynamics, customer preferences, and operating conditions, the report noted.

“The immediate impact of the lockdowns on the Indian startup ecosystem was severe; however, we have been amazed to witness how quickly Indian founders have acted to reimagine their businesses,” said Rajan Anandan, managing director, Sequoia Capital, who unveiled the report.

“What has been most impressive is how many startups have reduced burn and improved their unit economics very rapidly. Digitally-led segments have recovered much faster than anyone expected and in many spaces, demand is well ahead of pre-COVID levels,” he said. “Investor sentiment has also recovered quickly and we expect the Indian unicorn club to steadily expand through 2020 and 2021.”

According to the report, India is on track to have 100 billion-dollar companies or unicorns by 2025, up from the 33 unicorns at present. The overall startup ecosystem is projected to expand significantly to over 60,000 firms by 2025.

The path to recovery

COVID-19 induced nation-wide lockdown in April and May, and the economic slump that followed had a severe impact on the startup ecosystem in the South Asian nation. While 15% of startups halted operations, 44% of startups were left with a cash runway for less than six months, the report noted.

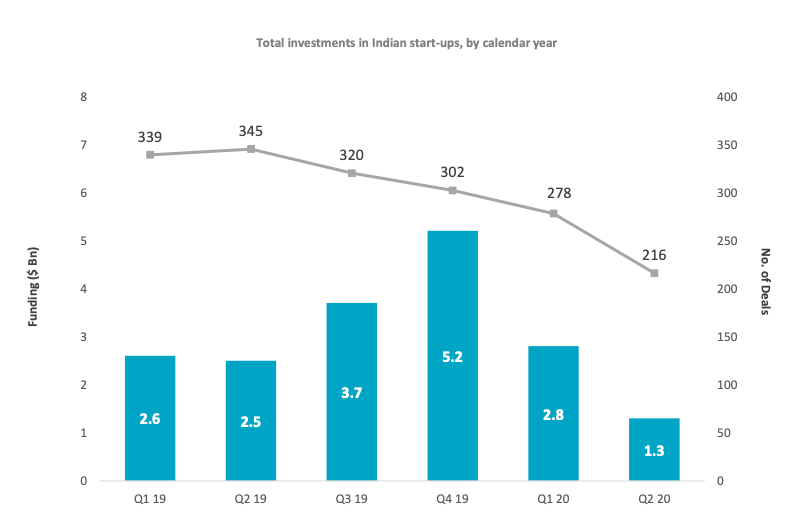

Investments witnessed a decline, especially from April to June 2020. The amount of funding and the total number of deals fell by 48% and 37%, respectively, in Q2 2020 over the corresponding period last year. Less than 50 startups raised their first round of funds in Q2 2020, while 52% of startups struggled to raise additional funding.

This decline was even more prominent in seed and early-stage investments. The researchers found that seed and early-stage funding nosedived by 55% year-on-year in Q2 as compared to a 38% dip in late-stage funding in the same time period. As VCs largely placing their bets on mature startups, seed-stage investments dropped the most (30%) in Q2, the report noted.

To deal with the critical situation, entrepreneurs first focused on reducing cash burn and improve unit economics. After ensuring a cash runway, they leveraged existing capabilities for new offerings, pivoted to seize new business opportunities, shifted from offline-first to online-first model, and diversified product offerings, the researchers noted.

Two quarters down the line since COVID-19 first disrupted the Indian economy, key indicators have turned positive on the back of upbeat investor and entrepreneur sentiments, they added.

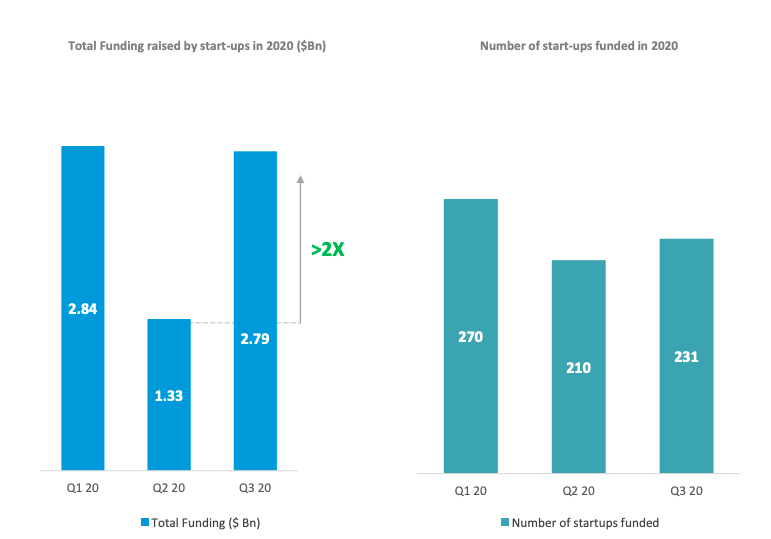

For instance, out of the seven unicorn startups that entered the club in 2020, four reached the status during the peak of the pandemic. Meanwhile, equity investments have almost reached pre-COVID-19 levels.

Investments have recovered to 98% of pre-COVID-19 levels, the report said. In the third quarter of 2020, Indian startups raised USD 2.7 billion across 231 deals. VC funding in Q3 more than doubled compared to USD 1.33 billion that startups raised in Q2.

Edtech was the top-funded sector in the third quarter of 2020 with 40% of investments going towards it, followed by enterprise tech, BFSI, and gaming sector which cumulatively raised more than USD 800 million in Q3.

B2C startups raised 75-80% of total funding in Q3 compared to 30-35% in Q2, primarily on account of large ticket investments in startups such as Byju’s, Dream11, and Unacademy. There were seven mega funding rounds with 100 million deal value which contributed to about 50% of the total funding in the September quarter.

Seed and late-stage investments appear to have returned, the report said, while the pace of early-stage deals is gradually recovering and is likely accelerate due to a positive investor outlook.

A key hurdle for slower recovery in the absolute number of deals is prolonged due-diligence time, which is expected to ease as travel restrictions are lifted, it added. Overall, investments are expected to reach pre-COVID-19 levels by end of 2020.