Writer: Zhang Yuxin

On November 10, at 9:30 a.m. EST, the four founders of PPDAI – Zhang Jun, Gu Shaofeng, Li Tiezheng and Hu Honghui – rang the bell at the New York Stock Exchange to officially launch the company’s flotation on the U.S. stock market.

Shares were priced at $13.4 in its U.S. debut,, up slightly by 4% from the $13 offer price, with its market value reaching $4.234 billion.

The prospectus of PPDAI, a company founded in 2007 and one of China’s earliest P2P lending platforms, has some dazzling figures, but since its inception, the company had, for a long time, showed mediocre performance and was marginalized in the market at the end of 2015.

The story of PPDAI, which went from a pure online marketplace for financial services that refused to generate revenue from interest spread to a now highly profitable business offering offline consumer installment loans and cash credit, stands as a typical example of an idealist giving in to the rules of the business world.

Revenue and profit performance

According to its prospectus, PPDAI achieved 1.216 billion yuan in net revenue in 2016, showing a growth of up to 520% from the 196 million yuan recorded in 2015. For the six months ending June 30, 2017, PPDAI’s net revenue amounted to 1.735 billion yuan, while the number for the same period of 2016 was 352 million yuan..

Staggering growth was recorded in profit as well. The company reported a net loss of 72.14 million yuan in 2015, but managed to turn the tables a year later with a net profit of 501.5 million yuan. This year, PPDAI’s net profit had reached 1.0486 billion yuan as of June 30, soaring by 25-fold compared with the 41.93 million yuan reported in the same period last year.

Meanwhile, the latest statistics show that in the first three quarters of 2017, PPDAI achieved 2.9837 billion yuan in revenue, with net profit standing at 1.59 billion yuan. As of November 2, 2017, the company had amassed over 60 million registered users and facilitated more than 30 million transactions whose combined value exceeded 80 billion yuan.

Early attempt and setback

As China’s first pure online P2P lending platform, PPDAI actually started its business offline.

Then in early 2008, Zhang Jun shifted the company’s attention from the then mainstream offline loan services to online P2P lending on the grounds that PPDAI’s interest is in small loans (a few ten thousand yuan per borrower). Besides, the cost of labor and that of opening brick-and-mortar stores for the offline model are too high. What’s more, when it comes to small loan business, risk management can be done faster and more effectively through data analysis than by loan officers.

With no precedents to look to or experience to draw on, Zhang went for a simple but also bold method to grant loans – allowing a loan of 3,000 yuan to all first-time borrowers and basing future loan extensions on users’ credit records built later on.

In terms of profit model, PPDAI positioned itself as an online marketplace for loan services. While traditional financial institutions generate revenue from interest spread, PPDAI wanted to be different. As a result, the company decided to instead collect a service fee from each loan. The initial standard for the fee was 2% for loans with a term of six months or shorter and 4% for loans whose term is between seven and 12 months. Since it didn’t provide guarantee for loans, the platform didn’t have to bear risks and its revenue performance wouldn’t be affected by the quality of loans.

However, the decision led to more than eight years of continuous loss for the company.

Fortunately, the 170 million yuan PPDAI raised from its three funding rounds allowed it to pull through and eventually turn high profits. Sequoia Capital led the first financing round, which took place in October 2012, investing $25 million in the company. The venture capital firm participated in the Series B and C funding round as well, joined by Lightspeed China Partners, Noah Private Wealth Management, Legend Capital and SIG, among others.

Benefiting from favorable policies

Until recently, PPDAI had focused on online small loans, which partly explained why its business had been unable to grow all this time.

The company’s average loan size in 2016 and the first half of 2017 were 2,795 yuan and 2,347 yuan respectively, way lower than that of most P2P lending platforms in the market. The average term for the loans was 9.7 months and 8.2 months.

In the first quarter of 2016, nine years into its operation, the cumulative transaction volume facilitated by PPDAI was still only 10.762 billion yuan, with 4.784 billion yuan in loan balance.

However, following the rollout of new regulatory policies for the online lending market, PPDAI’s small loan-focused business model, which once turned the company into a marginal player, became its intrinsic advantage.

On August 24, 2016, the regulator rolled out the Interim Measures to Regulate Activities of Online Lending Information Intermediaries (hereinafter referred to as the “Measures“), placing a cap on the amount that can be borrowed and urging lending platforms to keep loans small and decentralized. All of a sudden, PPDAI became a role model in the eyes of the regulators. The fact that online P2P lending platforms are referred to as information intermediaries in the Measures also coincides with how PPDAI has always positioned itself.

According to statistics published on the official website of PPDAI, its trading volume has surged by 39%, new loan balance by 34% and the investment volume of its users by 31% after 37 days since the Measures was issued. The newly registered users of PPDAI.com, in Q3 of 2016, recorded a 132% growth compared with Q2 of 2016 when the average number of investors in P2P sector was down by 2%.

A decisive leap

The online lending platform dedicated to short-term and small loans sprouted not until 2016 and PPDAI launched its own application “Caocao” for the same purpose shortly after in April 2016. The application then turned into PPDAI’s money-spinner.

In 2016, PPDAI racked up a whopping 19.424 billion yuan of lending, while its total lending in 2015 was only 5 billion yuan according to its prospectus. In the first half of 2017 alone, PPDAI managed to lend a total of 26.43 billion yuan, which far exceeded the total lending throughout 2016.

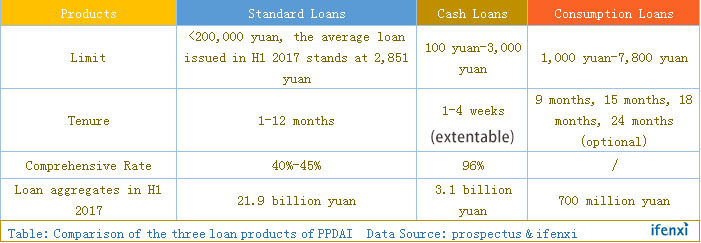

PPDAI could not have garnered so many new users so quick should it not be for the favorable environment brought by the newly issued policy. The characteristics of cash loans like high interest rate, quick payback and high repeat borrowing rate have also, in some way, boosted PPDAI’s profitability. The cash loans, which only occupy 12% of all its lending products, are offered at twice as much comprehensive rate as that of standard loans.

The newly registered users of PPDAI.com topped 48 million by the end of June 2017. Of that 48 million, 6.9 million are borrowers with a repeat borrowing rate of 68.3%. PPDAI’s performance is not any paler even compared with Qudian, which recorded a repeat borrowing rate of 82.7% in the first half of 2017, and with the average repeat borrowing rate of about 60% in the entire P2P sector. High repetition rate often translates into stronger profitability.

It is reckoned by ifenxi that the “Caocao” app is poised to harvest 17.5 billion yuan of trading volume and 700 million-900 million yuan of revenue in 2018 for PPDAI.

For players involved in cash loans, the biggest threat comes not from the market, but from the government. Rumors have swirled that the government is prepared to tighten its grips on cash loans with some serious moves.

Luckily, PPDAI is marching ahead with strong momentum. Following its IPO, PPDAI will have more capital to lower its interest rate and adjust its business structure, thereby cushioning the shock posed by government policies.

PPDAI, surely, will have a leg up on all the other online lending companies scrambling to get listed in the United States.

Writer: Zhang Yuxin

Featured image: credit to airpix