Hujiang Education & Technology (Shanghai) Corp. Ltd., one of China’s largest web-based digital education platforms, has filed with HKEX for an initial public offering (IPO) that could see it raise between US$250 to US$300 million and emerge as the first mainland Chinese education technology (edtech) stock on the Hong Kong stock exchange.

According to information from Crunchbase, Hujiang has raised $187 million in funding across four investment rounds since 2009, with its last funding round being a $157 million Series D round it closed in October 2015. The company counts Baidu’s co-founder Li Yanhong among its investors,

One of the services that Hujiang operates is the CCtalk mobile application, which offers community-based learning through that connects students and teacher, as well as permitting third parties to list their courses for a fee.

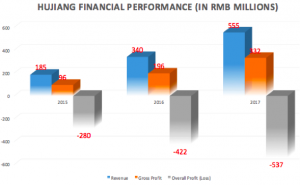

Hujiang posted revenue growth of 63% to 555 million ($83.3 million) in 2017, while its loss widened over that same period to 537 million yuan from 422 million yuan in 2016. At end-2017, it reported that its platform had 170 million registered users and offered 2,000 courses target primary, secondary and tertiary education segments, as well as professional education.

Despite revenue growing at a compound annual growth rate (CAGR) of 73% over the past three years to an estimated 555 million yuan, the year-on-year (YOY) growth declined from 84% in 2015/2016 to 63% in the 2016/2017 period, which could be a warning sign to some of its potential investors.

According to the company, these substantial losses are due to rising costs rooted in increased expenses for administration, sales and distribution, as well as expenditures on research and development (R&D) efforts, as well as brand development and marketing efforts.

In an official statement, the company said, “We consider our (education technology) capacity the key to ensure our success and have been focused on developing technological tools, media, processes and data resources that are crucial for facilitating learning and improving study performance.

They added, “We paid particular attention to the development of big data analytical capacity and appropriate AI algorithm to derive useful information from study behavior of users, based on which, we further combine our practical insight into study-related psychology, cognitive and other disciplines to upgrade or innovate our internet education products and services.”

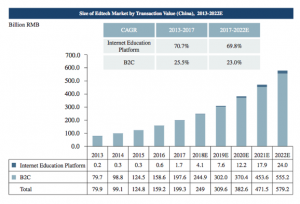

With the the education technology market in China estimated to be worth US$30 billion (199.3 billion yuan) in 2017, based on transaction value estimates from Frost & Sullivan, the market is set to undergo further growth in both value and volume.

However, despite being a pre-profit tech stock, Hujiang may be able to leverage its partnership with business networking platform LinkedIn – Hujiang users will be able to update their LinkedIn profiles with digital certificates issued by Hujiang – to expand its reach and grow its revenues. It is also likely to be buoyed by the overall growth of China’s online revenue, with Frost & Sullivan bullish about China’s online education revenue growth.