Early-stage investors displayed greater confidence in the Indian startup ecosystem this year as the larger venture capital community leaned toward growth and late-stage deals.

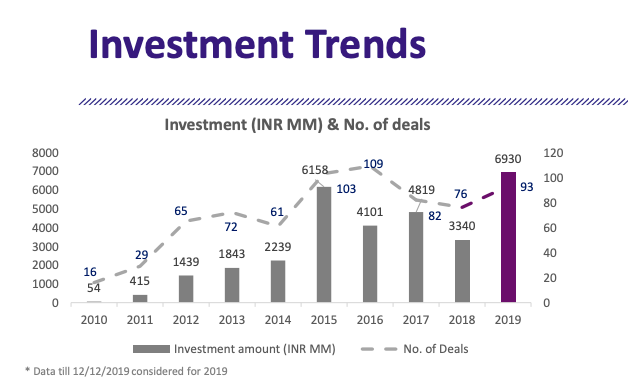

In 2019, the early-stage investors committed USD 97.1 million in the South Asian nation, double the USD 46.8 million they had invested last year, said a report titled ‘Early Stage Investment Insights Report 2019’ released by Asian venture debt firm Innoven Capital on Friday.

“Early-stage investment activity has been very robust this year, with increased deal flow, bigger transaction sizes, and higher valuations,” said Ashish Sharma, CEO, InnoVen Capital India. “The competitive intensity in early-stage has gone up, with a large set of institutional and angel investors looking to find the right opportunities.”

The growth in early-stage investments was driven by a 22% increase in the number of deals, the report said, adding the average deal size also increased to USD 1.05 million this year from about USD 617,000 last year. The average valuation in early-stage deals also went up by 15% to USD 2.6 million.

“Almost 50% of early-stage investors felt that the valuations in 2019 were on the higher side due to intense competition for quality deals,” the report noted. “However, the majority (56%) foresee some correction in the valuations in 2020.”

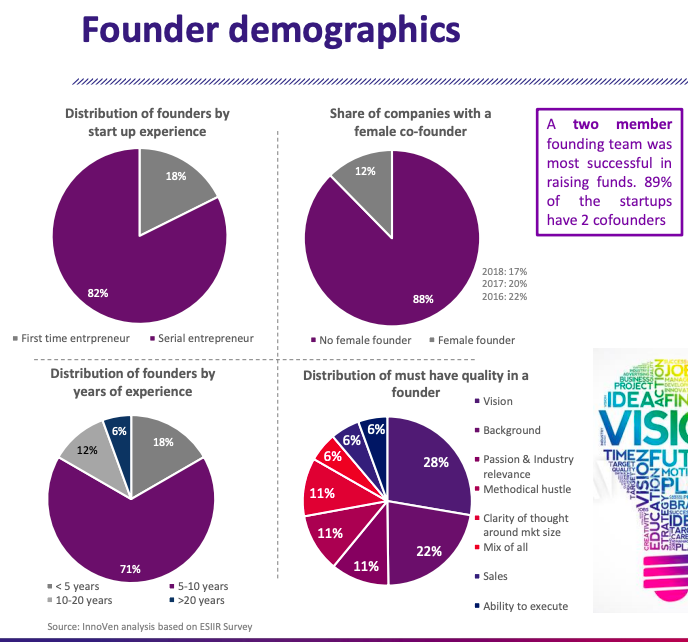

To mitigate the risk, early-stage investors increasingly took bets on the experienced founders as against rookies.

“Investors continue to show preference toward backing more experienced founders, with the proportion of founders with at least five years of experience going up from 55% in 2017 to 82% this year,” the report stated.

Driven by concept stage ventures launched by the second-time entrepreneurs and experienced first-time operators, the early-stage investors also showed more willingness to fund start-ups in the pre-revenue stage. Consequently, the share of pre-revenue funded start-ups rose to 17% this year from 12% in 2018.

The report also noted that investors preferred start-ups with more than one founder, with 89% of funded start-ups having two co-founders. As “the two most important qualities that investors look for in founders are vision and prior experience/background”.

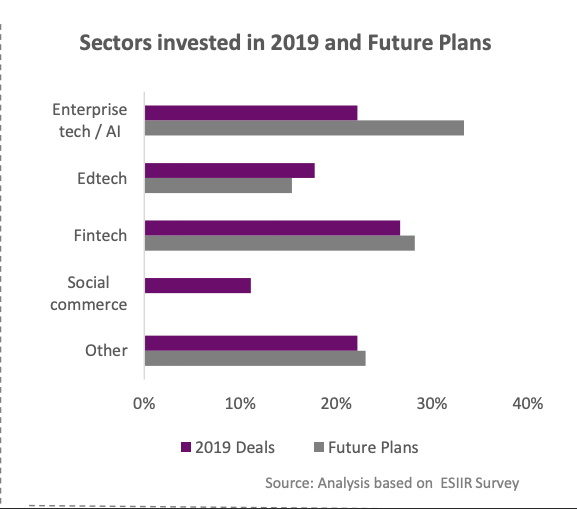

However, the number of start-ups with at least one female co-founder went down in 2019 to 12% as compared to 17% in 2018. Meanwhile, Consumer Internet, Enterprise Tech/AI, Fintech, and EdTech emerged as the most active sectors for early-stage investors.

Investors believe that this trend will continue but indicated that they would like to do more in Enterprise Tech, AI, and FinTech in 2020, according to the report.