China’s largest ride-hailing company Didi Chuxing is mulling a multibillion-dollar IPO in the second half of 2018, WSJ reports on Thursday. The IPO may come as part of Didi’s plan to raise capital in a bid to fend off archrivals and new enemies.

Pressure on Didi Chuxing partly comes from Dida Chuxing, China’s second-largest ride-hailing company by weekly penetration rate according to data analysis platform Cheetah Data. Dida Chuxing, formally known as Dida Pinche, meaning Dida carpooling in Mandarin Chinese, was founded in 2014 and formally focused on providing carpooling service.

Dida’s CEO SONG Zhongjie announced on Tuesday that LI Bin, CEO of EV maker NIO, will take office at Dida as Chairman of the Board. LI could create a synergy between NIO and Dida in EV sharing, an area in which Didi Chuxing is eager to beef up its presence, as it could be the next disrupter to the transportation businesses.

Apart from endangering Didi’s ambition to dominate the future, Dida is also eyeing to encroach on Didi Chuxing’s current market share. Dida kicked off a taxi-hailing service in last October and is giving out coupons and subsidies to entice passengers and drivers. Its efforts have since paid off. The Dida Chuxing app has outperformed Didi Chuxing in terms of download, now ranking #5 on iOS App Store in China with Didi app lagging behind at #32. The company says on its website that it has 80 million users and 12.5 million drivers on its platform.

Meituan-Dianping, the world’s largest O2O e-commerce service that counts Tencent as a backer, is also doubling down on ride-hailing. The company has launched its pilot services in Nanjing and Shanghai, claiming one-third of the market share in these two cities with a plan to spend around $ 159.2 million for a step-up in the Chinese market. Meituan-Dianping might get listed before Didi Chuxing and is reportedly in talks with underwriters for an HK IPO.

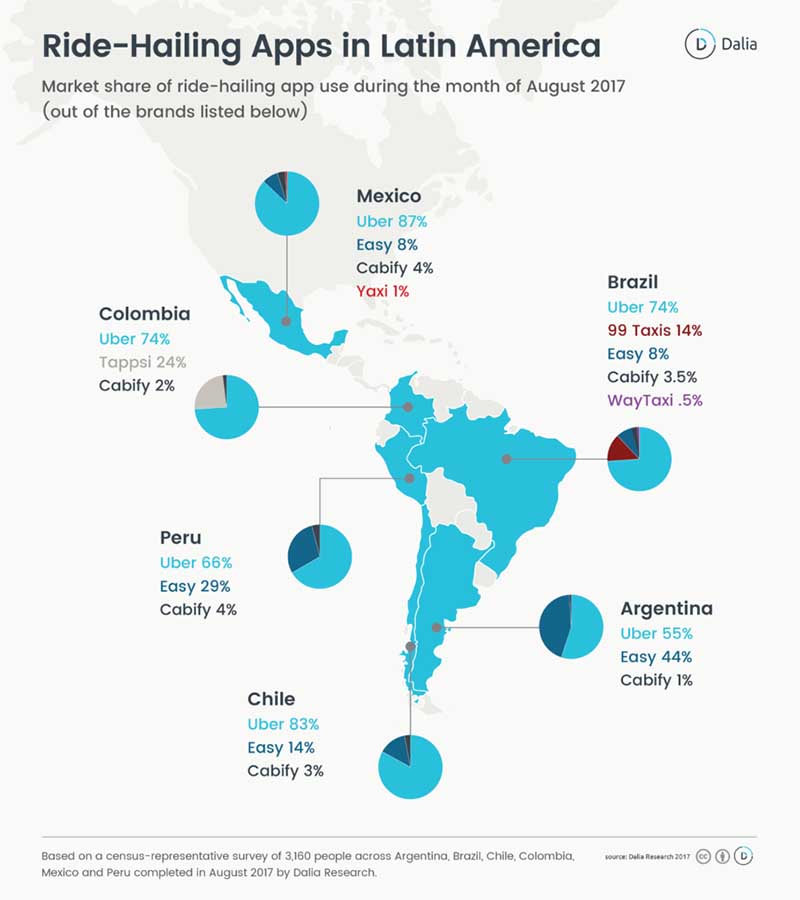

Outside of China, Didi Chuxing also needs to amass its war chest because it’s expecting a costly war against Uber in Latin America. Didi Chuxing started offering its service in Mexico on Monday and has acquired Brazilian 99 in January to take on Uber in key markets in the region. In both Mexico and Brazil, Uber holds a dominant market share of over 70 percent, according to data service Dalia Research.