MediConCen banks USD 6.85 million in Series A funding

MediConCen, an insurtech company that automates insurance claims using artificial intelligence and blockchain technology, has banked USD 6.85 million in a Series A funding round led by HSBC Asset Management. The round also drew the participation of Wings Capital Ventures as well as existing investors G&M Capital and ParticleX.

The completion of this round brings the total amount raised by MediConCen to USD 12.7 million. The newly raised capital will be used to expedite the company’s growth in the international market, including the Middle East and Southeast Asia.

“Insurance’s true value is realized the moment policyholders experience an insured event. We are supportive of MediConCen’s aim to improve this experience by simplifying and speeding up the claims journey, including ensuring that the claim amount is fair, with a technology backbone that supports the scaling up of these benefits.” said Kara Byun, head of fintech, venture, and growth investments at HSBC Asset Management.

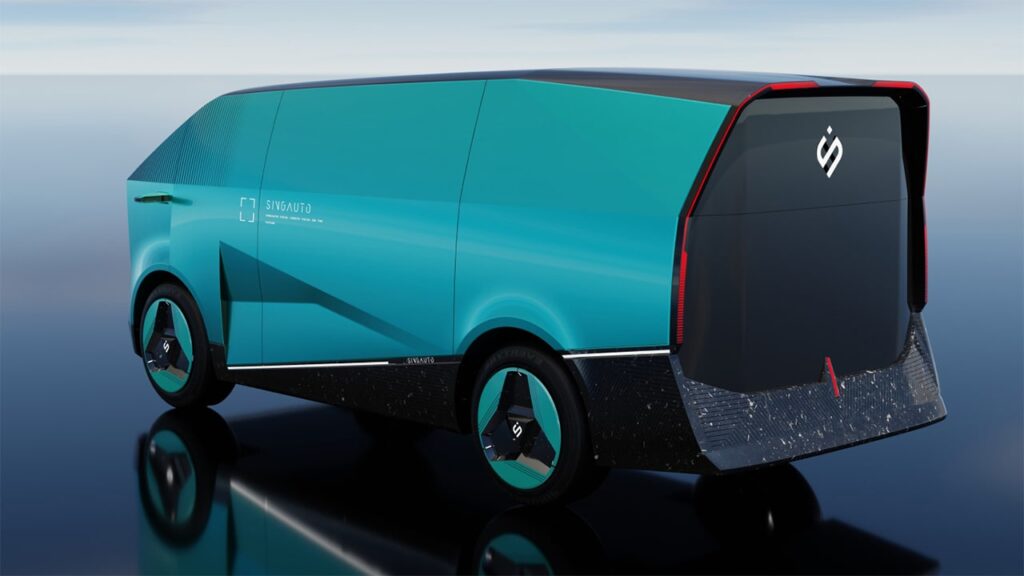

SingAuto secures USD 45 million in Series A round

SingAuto, a Singapore-headquartered technology company that specializes in the development of new energy intelligent refrigerated vehicles and related solutions, has completed a Series A funding round, raising USD 45 million from an unnamed investment firm based in the UAE.

SingAuto will use the newly raised capital to construct its production line, develop software as well as trial vehicles, and refine its products. The company is also presently exploring a new model that integrates the internet and logistics, providing customers with a comprehensive range of technical services.

Singapore-based Amperesand raises USD 12.5 million in seed round

Amperesand, a Singapore-based provider of grid infrastructure solutions powered by novel solid-state transformer (SST) technology, has reportedly raised USD 12.5 million in a seed funding round jointly led by Xora Innovation and Material Impact. TDK Ventures and Foothill Ventures also participated in this round.

Amperesand is a spin-off of the Nanyang Technological University of Singapore (NTU) and backed by a team with vast experience in power systems. The company is focused on enhancing the hardware behind electric vehicle charging infrastructure, supporting ongoing initiatives for vehicle electrification in various parts of the world.

“We are thrilled to partner with Amperesand, a company tackling a critical issue that threatens the entirety of global electrification. … [Its] solid-state transformer technology has the potential to shore up power infrastructure to handle the already present EV future and do so in an efficient, reliable, sustainable way,” said Nicolas Sauvage, president of TDK Ventures.

Recent deals completed in China:

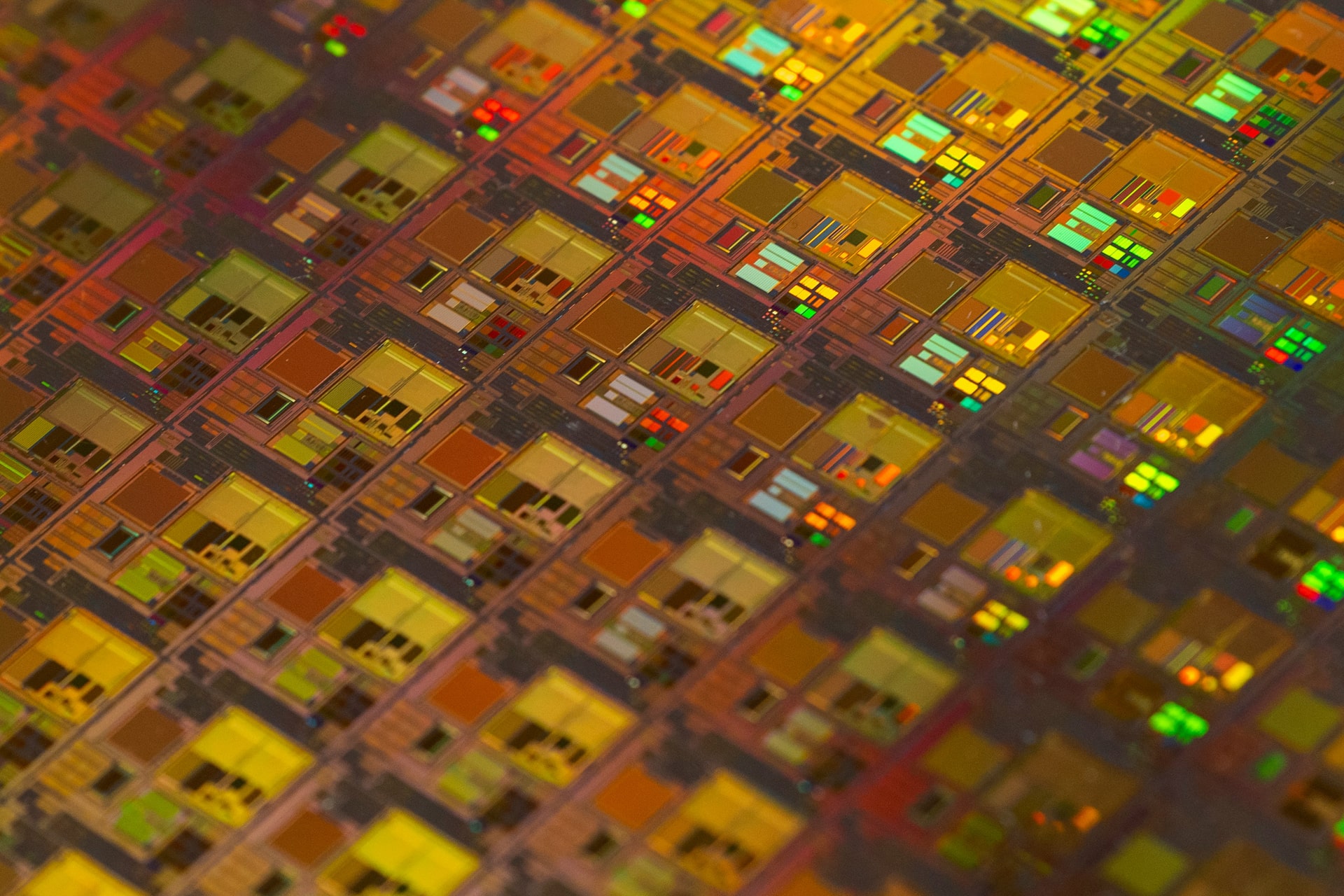

- Kniulink, a Shenzhen-headquartered technology company specializing in the development of high-end semiconductor IPs, has secured an undisclosed amount in a Series C+ funding round. The investment was led by the second phase of China Integrated Circuit Industry Investment Fund, with participation from the Guangdong Semiconductor and Integrated Circuit Industry Fund, Aerospace Jingkai, Longding Capital, Wanchuang Huahui Equity Investment Fund Management, China Capital Management, and Gaoyun Private Equity Fund Management, among others. —36Kr

- Matribox, a Shenzhen-based industrial solutions provider, has completed a pre-Series A funding round, bagging an eight-figure RMB sum. The round was jointly led by Tongfang Investment and Shenzhen Zhongke Advanced Industry Private Equity Fund Management, with support from existing investor Cowin Capital. The capital will be used for R&D, production capacity enhancements, and more. —36Kr

- SPU, a Shenzhen-based confidential computing firm focused on safeguarding data using hardware-based trusted execution environment (TEE) technology, has received an eight-figure RMB sum in angel financing, led by a fund under CICC Capital. The funds will be used primarily to accelerate the R&D, production, and commercialization of its products. —36Kr

- Hope Medicine, a Shanghai-headquartered biopharmaceutical company that engages in the development and commercialization of innovative medicines for endocrine, cardiovascular, and metabolic diseases, has snagged around RMB 200 million (USD 28.1 million) in a Series B+ funding round. The round was jointly led by Wuxi Capital Group and VMS Group, with participation from Huairou Science City, Ennovation Ventures, Zhongyin Investment, and continued support from existing shareholders Trustbridge Partners, Grand Flight Investment, Qiming Venture Partners, and Sinovation Ventures. —36Kr

- Gold Morning, a Chengdu-headquartered integrated service platform for the gold and jewelry industry, has completed a new round of financing with an investment from Hainan Anchengda Venture Capital. The company did not disclose the amount raised. —36Kr

Latest deals in India:

- BigHaat, an agritech startup based in Bengaluru, has secured USD 8.4 million in a Series C funding round jointly led by Ashish Kacholia and the RBA Finance and Investment Company. The round also saw participation from VPK Global, Anshul Anil Goel, Advik Tecnocommercial, Amee Shah Mehta, Rupaben Shailesh Mehta, Viren Ajit Joshi, Rohhan Viren Joshi, and Nishchay Goel. —Entrackr

- Upliance.ai, a Bengaluru-based startup focused on developing innovative kitchen appliances, has raised INR 340 million (USD 4.09 million) in a seed funding round led by Khosla Ventures. The company plans to utilize the capital to scale the production of its artificial intelligence-powered cooking assistant. —Inc42

- Metafin, a clean tech-focused non-bank financial company (NBFC), has raised USD 5 million in funding from Prime Venture Partners and Varanium Capital. The funds will be used to expand its operations, issue more loans, enhance technology infrastructure, and recruit talent. —VCCircle

- Cashinvoice, a supply chain finance platform, has secured USD 3.4 million in a Series A funding round from Pravega Ventures, HDFC Bank, and existing investor Accion Venture Lab. The company plans to expand its operations, enhance its market presence, and develop new products tailored to buyers and suppliers of medium and large corporations. —VCCircle

- ControlZ, a Gurugram-based company that specializes in the renewal of pre-owned devices and components, has secured USD 3 million in a seed funding round jointly led by 9 Unicorn and Venture Catalysts. The deal comprised a mix of debt and equity funding. —VCCircle

- Piscium Health Sciences, a Navi Mumbai-based dental and medical device manufacturer, has raised INR 60 million (USD 723,130) in a Series A funding round led by Unicorn India Ventures. The funds will be utilized to strengthen the company’s sales and marketing team, build its brand, scale its production and operations, and expand internationally. —VCCircle

- Koparo Clean, a plant-based home care brand, has bagged INR 60 million in a funding led by 4P Capital Partners, with additional investment from angel investors. The funds will be invested in brand building and distribution to expand the company’s reach. —VCCircle

- Torus Robotics, a Chennai-based deeptech startup specializing in the development of powertrain solutions, has secured USD 470,000 in a seed funding round led by Tamil Nadu Infrastructure Fund Management Corporation (TNIFMC), with participation from Forge Innovation and Ventures, Coimbatore, and SINE IIT Bombay. —VCCircle

TSMC, Incomlend, Ambience Healthcare, and more led yesterday’s headlines:

- Japan Advanced Semiconductor Manufacturing (JASM), the Japanese subsidiary of Taiwan Semiconductor Manufacturing (TSMC), secured an undisclosed amount of investment from Toyota Motor to fund the construction of a second chip plant in Japan’s Kumamoto prefecture. Existing investors, including Sony and Denso, will also make additional investments into the unit.

- Incomlend, a Singapore-based invoice financing marketplace, acquired LC Lite, a blockchain-based trade finance marketplace, for an undisclosed amount. This acquisition will enable Incomlend to operate through a new fintech platform, reaching both crypto and fiat investors in the trade finance sector, and will also facilitate the integration of Web3 technology into Incomlend’s platform, thus introducing a new asset class.

- Ambience Healthcare, the developer of an artificial intelligence-based operating system for healthcare organizations, has raised USD 70 million in a Series B funding round jointly led by Kleiner Perkins and the OpenAI Startup Fund. The round also includes participation from existing investors Andreessen Horowitz and Optum Ventures.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].