Mamaearth’s parent company secures USD 92 million ahead of IPO

Honasa Consumer, the parent company of skin and personal care brand Mamaearth, has raised approximately USD 92 million in an anchor round before its IPO commences on October 31, later today.

In an official filing made late Monday, the company disclosed that a group of over three dozen asset management firms, including the likes of Abu Dhabi Investment Authority, Fidelity, Norges Bank, Invesco, Goldman Sachs, CDPQ, White Oak, Franklin Templeton, Kotak, DSP, Carmignac Gestion, Loomis Sayles, Matthews, Pictet, and Hornbill, participated in this funding round by acquiring shares through the anchor book.

These investors, a group that notably encompassed several Indian mutual funds, collectively subscribed to nearly half of the targeted USD 204.3 million that Mamaearth is aiming to raise through its public market debut.

Mamaearth, which boasts notable backers such as Peak XV Partners and Sofina, is poised to launch its IPO with shares priced within the range of USD 3.7–3.9. —TechCrunch

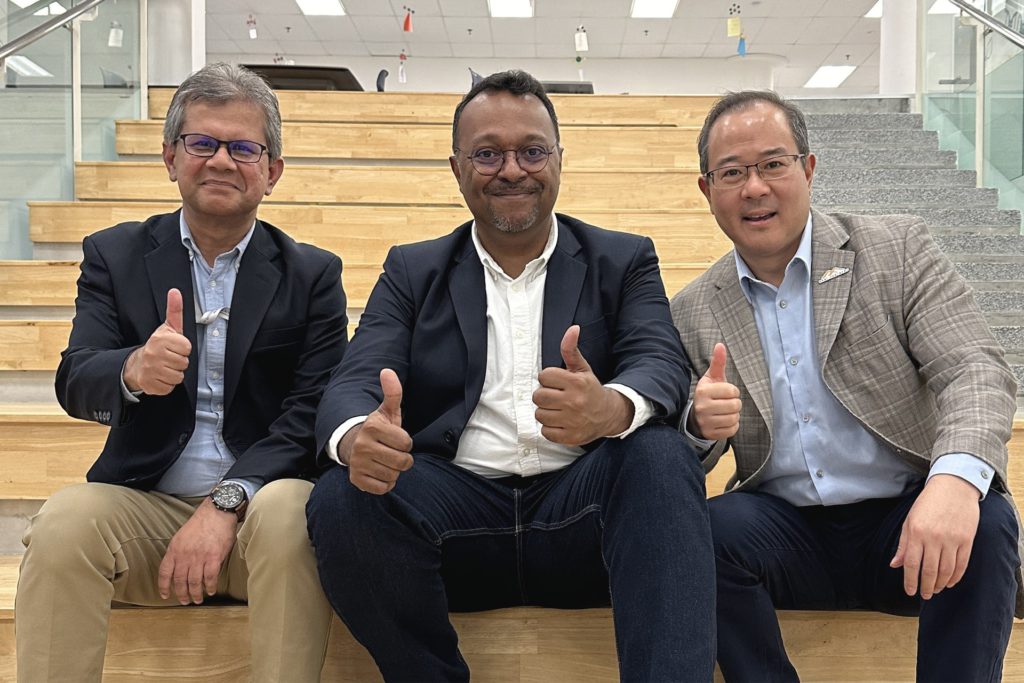

Kumpuluan Modal Perdana and Gobi Partners invest in Vircle

Vircle, a Malaysian neobank tailored for children, has secured an undisclosed amount of seed funding from Kumpalan Modal Perdana (KMP) and Gobi Partners. The latter invested in Vircle through its Gobi Dana Impak Ventures (GDIV) fund, which is backed by Khazanah Nasional Berhad, Malaysia’s sovereign wealth fund.

“In a region where 160 million children lack access to banking services, Vircle emerges as a beacon of hope, introducing a safe passage into the cashless world. With an emphasis on cultivating crucial money management skills, Vircle addresses a significant gap in both the educational system and households across Southeast Asia,” said Thomas Tsao, co-founder and chairperson of Gobi Partners.

Neom Investment Fund proposes USD 50 million investment in Animoca Brands

The investment arm of the Neom future city project in Saudi Arabia has proposed investing USD 50 million in Animoca Brands. This investment rides on the confirmation of a strategic partnership between both entities to drive the development of Web3 initiatives according to the Saudi Vision 2030.

The investment will be allocated in two parts: USD 25 million will be allocated through convertible notes at a conversion cap price of AUD 4.5 (USD 2.8) per share, while the other USD 25 million will be used to acquire shares of Animoca Brands from the secondary market. A memorandum of understanding has been jointly announced to formalize this partnership.

Redex secures USD 10 million in Series A round

The Singapore-based renewable energy certifier has secured USD 10 million in a Series A funding round led by Aramco Ventures, the venture arm of Saudi Arabian state-owned oil company Aramco. The round also saw the participation of undisclosed investors from the Middle East, Southeast Asia, and Japan.

Redex will utilize the capital to broaden its operations outside of Asia and digitize the issuance and trading of renewable energy certificates, making the process more efficient.

Recent deals completed in China:

- ZDL Group, a human resource solution provider, has announced the completion of a financing round, raising an eight-figure RMB sum. It will use the funds to update its business model and expand its partnerships. —36Kr

- HC Medical, a medtech company, has completed a Series B financing round, raising over RMB 100 million (USD 13.6 million). The investors that participated in this round include Addor Capital, Tsing-Yuan Capital, Tao Capital, among others. The company will allocate the funds toward the development of its brain functional imaging products and the clinical trials of its transcranial optical modulation therapy for degenerative diseases. —36Kr

- Tianfu Energy, a redox flow battery developer, has completed an angel funding round, raising an eight-figure RMB sum from various investors. These funds will be allocated toward advancing vanadium redox flow battery technology through R&D, establishing an industry chain, and expanding the company’s team. —36Kr

- Cloud Energy Cube, a Suzhou-based energy storage company, has secured an eight-figure RMB sum in a strategic financing round led by ZJMI Environmental Energy and Wuchan Zhongda Group. Other investors also participated in the round. The company will use the funds to expand its production capacity, develop a new generation of technology products, and expand its business channels. —36Kr

- Chengqiang Hutong, a steamed bun specialty brand, has secured a seven-figure RMB sum in a strategic funding round from Newcorn Food. It will utilize the funds to develop its brand and establish its organizational structure. —36Kr

- Jiangsu Silicon Integrity Semiconductor Technology (JSSI), a semiconductor company, has raised RMB 600 million (USD 82 million) from KQ Capital. —DealStreetAsia

Latest venture capital deals in India:

- Skyroot Aerospace, a Hyderabad-based space technology company has completed a USD 27.5 million funding round. The round was led by Temasek. The company will use the newly raised funds to conduct more launches. It is aiming to expedite its launch schedule over the next two years, building upon the success of its prior missions. —Reuters

- Aequs, a Belagavi-based aerospace components manufacturer, has secured USD 54 million in an equity funding round led by Amansa Capital. The round also saw participation from other investors including Steadview Capital, Catamaran, Sparta Group, the family office of Narayana Murthy, the investment office of Desh Deshpande, among others. —VCCircle

- Sweet Karam Coffee, a Chennai-based snack brand, has raised USD 1.5 million in funding from Fireside Ventures. The funds have been earmarked for the company’s expansion plans, focusing on offline growth strategies, expanding into new geographic regions, and enhancing its product portfolio. —VCCircle

- Fruitfal, an agritech startup, has raised an undisclosed amount of funding from iAngels, the angel investor network of India Accelerator. The startup will utilize the fresh capital to enhance its technology and bolster its market presence in India. —VCCircle

- Vridhi Home Finance, a Bengaluru-based housing finance company, has received USD 18 million in a Series A funding round led by Elevation Capital. The company intends to use the capital to expand its footprint in India, targeting regions like North Karnataka and Andhra Pradesh. The company is also aiming to enhance its technological infrastructure and scale its workforce. —VCCircle

J&T Express, Mandiri Capital Indonesia, Investible, Korea Investment Partners, and more led yesterday’s headlines:

- J&T Express, a logistics service provider, has made its debut on the Hong Kong Stock Exchange at a public offer price of HKD 12 (USD 1.53) per share, resulting in net proceeds of HKD 3.53 billion (USD 450 million) from the global offering.

- Mandiri Capital Indonesia (MCI), the corporate venture capital subsidiary of Bank Mandiri, and Investible, an early-stage venture capital firm headquartered in Sydney and Singapore, have jointly an early-stage climate tech fund.

- Korea Investment Partners Southeast Asia (KIPSEA), the Singapore-based unit of Korea Investment Partners, has closed a USD 60 million fund to invest in Southeast Asian startups.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].