Jala Tech confirms closure of Series A round

Following DealStreetAsia’s report on November 27 regarding Jala Tech completing its Series A funding round, the Indonesian aquaculture tech company has released a statement today confirming the milestone and providing clarification on the correct amount raised, which is USD 13.1 million.

The round was led by Intudo Ventures, with participation from Sinar Mas Digital Ventures (SMDV) as well as existing investors Mirova and Meloy Fund (Deliberate Capital).

“As the world’s fourth-largest producer of shrimp, Indonesia plays a critical role in the global seafood supply chain. With the continued evolution of the country’s shrimp industry, the demand for modern cultivation solutions has risen in tandem. Jala’s suite of digital solutions helps farmers create tangible economic value, increasing farming yields, and leading to more sustainable cultivation practices,” said Patrick Yip, founding partner at Intudo Ventures.

AnotherBall raises USD 12.7 million in seed funding

The Singapore-based entertainment company has announced the completion of its seed funding round, securing USD 12.7 million. The round was led by ANRI and Hashed, with the participation of various investors including Global Brain, Globis Capital Partners, Sfermion, HashKey Capital, Everyrealm, Ethereal Ventures, Emoote, and Kun Gao (Crunchyroll).

The completion of this round brings AnotherBall’s total funding raised to date to approximately USD 14.8 million, providing substantial support for its ongoing expansion.

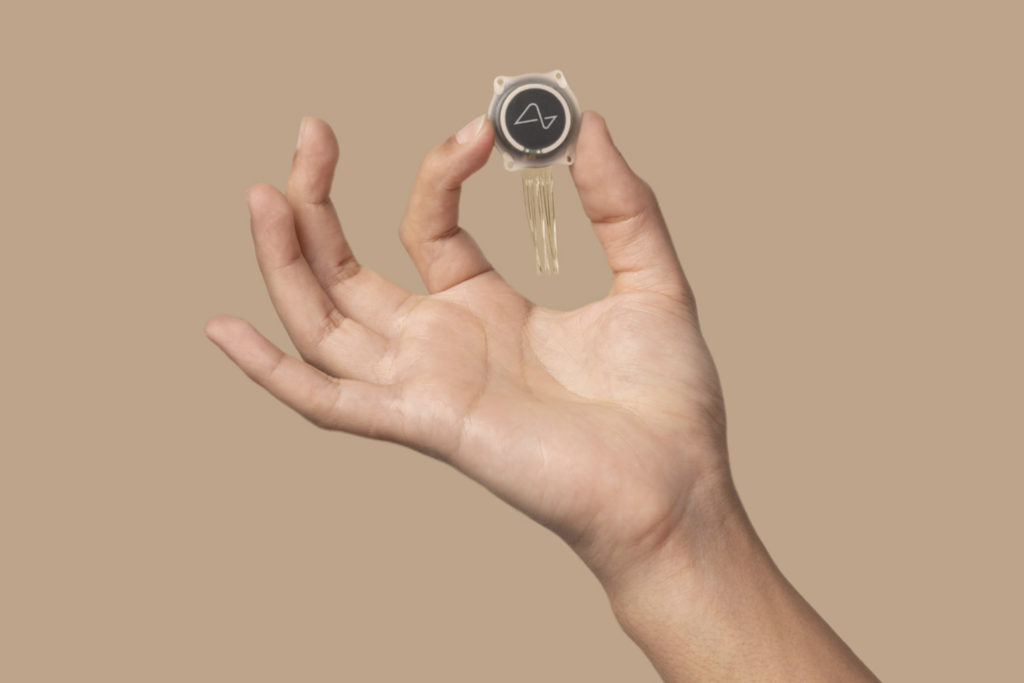

Elon Musk’s Neuralink secures USD 43 million in funding

The neurotechnology company has raised an additional USD 43 million in venture capital, according to a recent filing with the US Securities and Exchange Commission.

The filing, published this week, showed that Neuralink increased its previous tranche, led by Peter Thiel’s Founders Fund, from USD 280 million to USD 323 million in August this year. A total of 32 investors participated in this round, according to the disclosed information. —TechCrunch

Soho secures AUD 750,000 in funding

The Sydney-based prop tech firm has secured USD 750,000 in equity investment from Feedback Ventures, valuing the company at USD 20 million. Having raised over USD 8 million to date, Soho has achieved positive cash flow and has unexpectedly launched a pre-Series B round exclusively for Feedback Ventures, preceding a larger Series B round in 2024. —Australian Financial Review

Avarni raises AUD 2.5 million for carbon management

The Sydney-based decarbonization platform has raised AUD 2.5 million (USD 1.65 million) in a funding round led by Main Sequence. New investors Sprint Ventures and Afterwork Ventures also participated in this round. —Australian Financial Review

Earlywork secures AUD 1.5 million in seed funding

The Australian online careers platform has closed its seed funding round, raising AUD 1.5 million (USD 990,000) from No Brand, Jelix Ventures, and Archangel Ventures. Earlywork will allocate the funds to expand its Earlywork Academy to Singapore. —Australian Financial Review

Accelerating Asia leads investment in Nitex

The Singapore-based B2B apparel commerce platform has raised an undisclosed amount in a funding round comprising a mix of equity and convertible notes. The funding was led by Accelerating Asia. —DealStreetAsia

Recent deals completed in China:

- Inuchip, a technology enterprise specializing in visual processing artificial intelligence chips and solutions, has announced the completion of a Series A funding round, raising over RMB 500 million (USD 70.7 million). Hefei Industry Investment and Accurate Capital led this round with the support of other investors. Inuchip will utilize the funds for R&D and to expand its team. —36Kr

- Safe Care, a medical R&D company, has completed a pre-Series A funding round, securing an eight-figure RMB sum from Puhua Capital. The funds will be allocated toward product and technology R&D, as well as the commencement of clinical trials for various early-stage product pipelines. —36Kr

- Tupu Intelligence, a Hefei-based digital intelligence solution provider, has completed a Series C round of financing, raising an eight-figure RMB sum of investment from Guoke New Energy Venture Capital. —36Kr

- Shuyun, a Hangzhou-based digital technology company, has announced the completion of a Series D1 funding round, raising close to RMB 100 million (USD 14.12 million) from Forebright Capital. The funds will be used for R&D and to build a comprehensive channel for consumer operations. —36Kr

- City Cloud Data Center (CCDC), a Hefei-based data technology service platform, has secured an eight-figure RMB sum in investment from Guoyuan Fund. It will use the funds to construct data centers and expand its production capacity. —36Kr

- QL Biopharm, a Beijing-based biopharmaceutical company, has bagged RMB 200 million (USD 28.28 million) in a Series B+ funding round. Imeik Technology and the China-US Green Fund led the investment, with participation from Jiayuan Fund, Chengdu Capital Group, Jincheng Equity Investment Fund Management, and existing investor BlueRun Ventures, among others. CEC Capital acted as the exclusive financial advisor. —36Kr

Latest venture capital deals in India:

- Frendy, a convenience store network, has raised INR 160 million (USD 2 million) in a bridge funding round led by existing investor Desai Ventures. The round also saw the participation of several new investors, including Auxano Capital, AT Capital Singapore, Metara Ventures, Priya Joseph, Rohan Jain, Rishabh Jain (The Wellness Co), and the family office of Apurva Salarpuria. —Inc42

- Elivaas, a luxury apartment maintenance startup, has secured USD 2.5 million in a seed funding round. The round was led by Surge by Peak XV Partners, with the support of various angel investors including Naveen Kukreja (Paisabazaar), Kunal Shah (Cred), Mohit Gupta (Zomato), Amit Lakhotia (Park+), Ravi Singhvi (Ares Asia), Anant Apurv Kumar (Brij Hotels), Parag Aggarwal (Gobolt), and Toranj Mehta (De Beers). —Inc42

- EMotorad, a Pune-based electric two-wheeler startup operated by Inkodop Technologies, has raised USD 20 million in a seed funding round led by Panthera Growth Partners. Other investors that participated include Binny Bansal’s Xto10x, Alteria Capital, and existing investor Green Frontier Capital. The round comprised USD 17.5 million in equity investment and USD 2.5 million in debt infusion. EMotorad intends to use the funds for product development, geographical expansion, and strategic growth, with a specific focus on investments in component manufacturing companies. —VCCircle

- True North, a private equity firm, has raised INR 10 billion (USD 120 million) for its maiden private credit fund. The fund has received backing from a diverse array of domestic institutions, family offices, high-net-worth individuals, and wealth partners. It is anticipated to conclude its fundraising by the end of December this year. —VCCircle

- Allen Career Institute, a Kota-based coaching institute, has agreed to acquire Indian edtech company Doubtnut. Sources told Entrackr that the acquisition will be executed through a combination of stock and cash, positioning it as a “distress sale.” —Entrackr

- Brightpoint Studios, a new startup incorporated by the co-founders of Bengaluru-based vocational training startup Vah Vah, has secured funds in preparation for its upcoming public launch. Peak XV Partners and Nexus Venture Partners are reportedly leading the startup’s funding round, totaling between USD 5–6 million. —Entrackr

Alchemy Foodtech, Broncus Hangzhou, Modus Capital, and more led yesterday’s headlines:

- Alchemy Foodtech, a Singaporean food tech startup, raised SGD 8 million (USD 5.98 million) in strategic funding from Ting Li Development, the investment arm of Ting Hsin International Group.

- Broncus Hangzhou, a subsidiary of medtech company Broncus, reached an agreement to acquire 100% equity interest in Hangzhou Jingliang, a company specializing in the production, processing, and development of medical devices.

- Modus Capital allocated USD 2.8 million in investments to eight startups through its Ventures Lab program. The beneficiary startups are part of Modus Capital’s USD 50 million Venture Builder Fund, which operates programs in Abu Dhabi, Riyadh, and Cairo.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].