Velocity Ventures invests in ByHours

The Singapore-based travel and hospitality-focused venture capital firm has announced its strategic investment in ByHours, a microstay booking platform. The funds are expected to help ByHours expand into the Asian market.

“One of the key challenges that hotels face is the number of intermediaries involved in transactions between users and hotels. … ByHours presents an unparalleled proposition to help hoteliers reduce their operating costs while optimizing their resources where they can resell their room once a microstay guest has checked out,” said Bennett Lee, partner and investment director at Velocity Ventures.

[Updated] Edamama completes Series A+ round

The Philippines-based parenting-focused e-commerce platform has completed its Series A+ funding round, bringing its total funds raised to USD 35 million. The latest round was led by the Ayala Corporation Technology Innovation Venture (ACTIVE) Fund, jointly managed by Kickstart Ventures and Ayala Corporation. Existing investors Gentree Fund and Innoven Capital also participated in this round, along with new investor GS Group.

Edamama will use the funds raised in this round to execute its expansion strategy, in particular expanding its offline retail footprint across the Philippines.

Update: In our initial report on Edamama’s fundraise, the amount raised in its Series A+ funding round was reported as USD 35 million. The actual amount remains undisclosed. The USD 35 million mentioned refers to the total funds raised by Edamama to date, including the latest round, as clarified by Edamama. This news brief has been edited to reflect the correction.

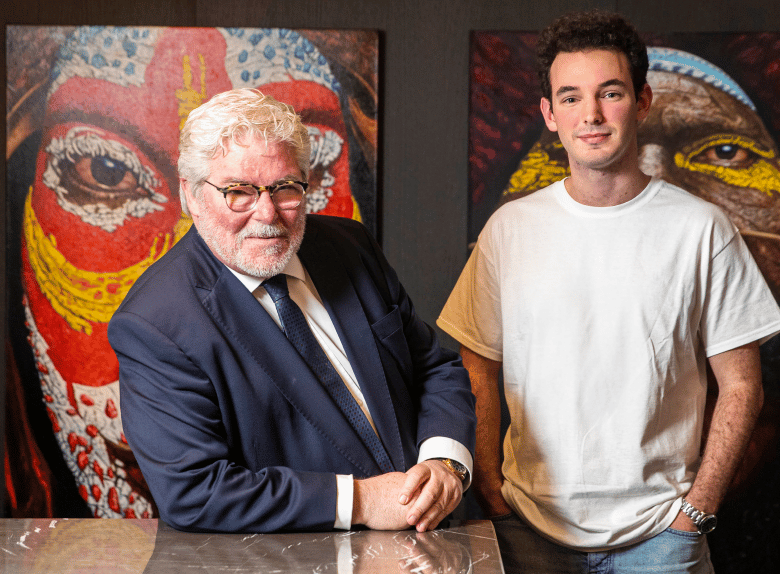

Investible leads Seminal’s USD 3 million pre-seed round

The early-stage venture capital firm has announced its lead investment in Seminal, a Melbourne-based startup developing a copyright register and IP marketplace.

The investment culminated in a USD 3 million pre-seed round, providing funds for Seminal to develop its platform with the aim of changing how art is licensed, monetized, and integrated into the brand strategies of businesses.

Mirae Asset launches Global X China Little Giants ETF

The global asset management firm has announced the launch of the Global X China Little Giant ETF, which will provide investors with exposure to the securities of 50 nationally recognized “little giant” enterprises that have been selected by the Chinese government.

“We are pleased to launch the Global X China Little Giant ETF, providing investors with a simple and efficient way to invest in China’s rapidly growing technology industry. By introducing this ETF into our thematic product lineup, Mirae Asset continues to offer our clients investment products with growth potential,” said Wanyoun Cho, CEO of Mirae Asset Global Investments (Hong Kong).

Binance Labs invests in Arkham’s native token

Binance Labs, the venture capital and incubation arm of Binance, has invested an undisclosed amount in $ARKM, the native token of Arkham.

Arkham is an artificial intelligence-powered blockchain intelligence and data platform that aims to provide information and visualization tools for on-chain activity.

Recent deals completed in China:

- Viva Biotech, a Hong Kong-listed biotechnology company, has secured approximately USD 210 million following the completion of a strategic funding round that saw the participation of Temasek, Highlight Capital, and True Light Capital. Around USD 150 million was secured in this round through the transfer of approximately 24.21% equity in its clinical research organization (CRO) business entity, whereas the remaining USD 60 million had been previously secured in convertible bond financing, which will be automatically converted into shares at the price of HKD 2 (USD 0.25) per share on the delivery date.

- Rokid, an augmented reality wearables maker, has concluded its Series C funding round, raising USD 112 million at a valuation of USD 1 billion. The round was led by NetDragon Websoft, which committed USD 20 million of the total sum invested. —Bloomberg

- Santoni Shanghai Knitting Machinery, a circular knitting machine manufacturer, has received regulatory approval to acquire Terrot, a German manufacturer of circular knitting machines.

- I2Cool, a Shenzhen-based cooling technology developer, has raised an undisclosed amount of investment in a pre-Series A+ funding round. The funds were invested by Silicon Harbour and will be used for the R&D of non-electric refrigeration technology. —36Kr

- Quantisan, a Shenzhen-based artificial intelligence-powered manufacturing company, has completed a RMB 10 million (USD 1.39 million) angel funding round. The investor for this round was Unity Ventures. Quantisan will utilize the funds for technology R&D, team and business expansion, and to support its operations. —36Kr

- CVA Chip, a Shenzhen-based chip design and development company, has raised RMB 200 million (USD 27.8 million) in a Series B+ funding round from Greenwoods Asset Management, Hongtai Aplus, Shandong Luxin High-Tech Industry, and Hony Capital. The funds will be used to enhance the R&D of its automotive-focused products and to prepare for mass production. —36Kr

- Qixin Mould, a Guangdong-based die-casting mold manufacturer, has secured a nine-figure RMB sum in a Series B funding round from Honor Venture Capital, Midea, and TopoScend Capital. —36Kr

- Slowgar, a Shenzhen-based food and health tech company, has raised an eight-figure RMB sum in angel funding from Cyanhill Capital. It has earmarked the funds to be used for R&D, product development, and marketing activities. —36Kr

- Jiuzhi Technology, a Guangdong-based provider of healthcare-focused wearable devices and auxiliary diagnostic services, has bagged an eight-figure RMB sum in an angel funding round led by Vertex Holdings. Other investors that participated in this round include Qingbo fund, Gao Bingqiang, Brizan Ventures, and existing shareholder Westlake Innovation Capital. —36Kr

- Llewellyn & Partners (LPC), an architecture and construction technology platform, has raised HKD 25 million (USD 3.2 million) in a Series A funding round from Jiateng Middle East. —36Kr

- JoinChina Materials (Nano-metal Advanced Materials), a Guangzhou-based enterprise specializing in nanocrystalline applications, has completed a pre-Series A funding round, raising an eight-figure RMB sum. The round was led by an Oriental Fortune Capital-managed fund, while Winsoul Capital served as the exclusive financial advisor. The company will use the funds for product and technology R&D, as well as capacity building. —36Kr

- Zhongke Electronic Ink Intelligent Technology, a Hangzhou-based electrochromic materials company, has raised an eight-figure RMB sum in an angel round of financing. It will deploy the funds toward product R&D and the construction of its production line. —36Kr

Latest venture capital deals in India:

- Baaz Bikes, a Delhi-based electric two-wheeler startup, has raised USD 8 million in its Series A funding round. The round was led by BIG Capital, with participation from Rakuten Capital as well as existing investors including Kalaari Capital, 9Unicorns, and Sumant Sinha. The startup will utilize the funds to enhance its e-bike offerings for last-mile deliveries. —Inc42

- Purple Style Labs, a Mumbai-based fashion and lifestyle company, has secured USD 8 million in a Series D funding round led by Sanket Parekh (Pidilite Family Office), with participation from Signet (Harish Shah Family Office), the Hira Group Family Office, as well as various individual investors including Neelesh Bhatnagar, Masaba Gupta, Rahul Garg, Atul Gupta, and the Singularity Growth Opportunities Fund I. —Entrackr

- Hanto, a Bengaluru-based prop tech company, has secured USD 1.8 million in a seed funding round. The funds were raised using a mix of debt and equity financing, in a round led by Anurag Jain (Kred) with the support of several angel investors. Hanto will use the funds to expand its team, acquire new buildings, and expand its footprint in India. —VCCircle

- Sohamm, a health-focused snack brand, has received INR 10 million (USD 120,000) in an angel funding round from Aparna Thyagarajan (Shobhitam) and Rikant Pittie (EaseMyTrip). Half of the funds were raised in exchange for a 15% equity stake in the company while the remainder (INR 5 million) was raised through debt, requiring a 12% return on investment. —VCCircle

- Yogify, a wellness platform, has secured INR 5 million (USD 60,000) in a mixed funding round. INR 3.5 million (USD 42,000) was raised in exchange for a 10% equity stake while the remaining INR 1.5 million (USD 18,000) involves debt financing requiring a 12% return on investment. The deal saw the participation of Kunal Kishore (Value360), Shreedha Singh (The Ayurveda Co), Ankit Agrawal (InsuranceDekho), and Ajinkya Firodia (Kinetic Group). —VCCircle

- Furry Feedz, a Nashik-based pet food brand, has secured INR 3.5 million (USD 42,000) in angel investment from Ankit Agrawal and Kunal Kishore in exchange for a 35% equity stake. —VCCircle

- Phases Skincare, a skincare brand, has secured INR 3 million (USD 36,000) in an angel funding round from Aparna Thyagarajan. Thyagarajan received a 20% equity stake in the company from the deal. —VCCircle

- Centa, a Bengaluru-based teacher accreditation platform, has secured USD 1 million in a funding round from various angel investors including Leo Puri (JP Morgan), Bahram Vakil (AZB & Partners), Pankaj Sahni (Medanta), Prem Kumar, Govind Iyer, and Kabir Narang (B Capital Group). Centa will use the funds to enhance its technological capabilities. —VCCircle

- Vastu Dairy (Vastu Ghee), a dairy manufacturer, has secured INR 20 million (USD 240,000) in a funding round from Ajinkyo Firodia, Ankit Agrawal, Kunal Kishore, Rikant Pittie, and Shreeda Singh. —VCCircle

- Sorin Investments, an Indian venture capital firm, has secured about INR 13 billion (USD 156 million) in a funding round for its inaugural investment vehicle, exceeding its initial target. —DealStreetAsia

Deals closed in the Middle East:

- Mafhoom Technologies, a Saudi Arabian personal finance platform, has secured USD 1.4 million in a pre-seed funding round led by Al-Watra Al-Thanya. Angel investors also participated in the round. Mafhoom will use the newly raised funds to expand its services in Saudi Arabia and increase its team size. —VCCircle

- Tamara, a Riyadh-based fintech startup, has received USD 250 million in debt funding to facilitate its expansion. This includes USD 200 million of senior debt from Goldman Sachs and a USD 50 million mezzanine tranche led by Shorooq Partners. This deal follows a USD 150 million debt facility arranged with Goldman Sachs in March this year. Tamara will use the funds to support its growth initiatives and develop its position in the buy now, pay later industry. —VCCircle

- Lynk, a Riyadh-based fintech startup, has secured an undisclosed amount of funding from Al Fozan Holding and Ramla Holding Group. It will utilize the funds to develop new products for financial institutions, foster its development in the financial services sector, and expand its market presence. —VCCircle

- Cognna, a Saudi Arabian cybersecurity startup, has secured USD 2.3 million in a seed funding round led by Impact46, with participation from Vision Ventures, Faith Capital, and other investors. The funds will be used to support Cognna’s ongoing efforts to enhance its cyber threat detection capabilities. —VCCircle

- Ajras, a Saudi Arabian prop tech startup, has secured USD 28 million in a seed funding round led by Madarek International. The deal involved a mix of debt and equity financing. Ajras will use the funds to enhance its product offerings. —VCCircle

Accelerating Asia, Pawprints Inspired, Wize, and more led yesterday’s headlines:

- Accelerating Asia, an early-stage venture capital fund and startup accelerator, announced its investment in eight startups from its ninth cohort.

- Pawprints Inspired, an Indonesian insect-based pet food company, secured USD 1.7 million in a funding round led by Creative Gorilla Capital. Other participants included Altrui, Tujuh Bersaudara Investindo, and other undisclosed investors.

- Wize, a Dubai-based startup specializing in sustainable last-mile delivery solutions, raised USD 16 million in a pre-seed funding round. The funding was jointly led by a group of undisclosed MENA-focused angel investors.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].