The consumer fintech adoption rate in Singapore rose sharply from 15% in 2015 to 67% in 2019, Ernst & Young’s Global Fintech Adoption Index 2019 shows. This is also the first year Singapore has exceeded the world’s average since EY released its first fintech index report in 2015.

In 2015, the average adoption rate worldwide was 16% and that rose to 31% in 2017 before hitting 64% in 2019. Comparatively, in 2015 only 15% of surveyed Singaporeans used fintech services. While the figure increased to 23% in 2017, Singapore has still lagged behind the world’s average until this year.

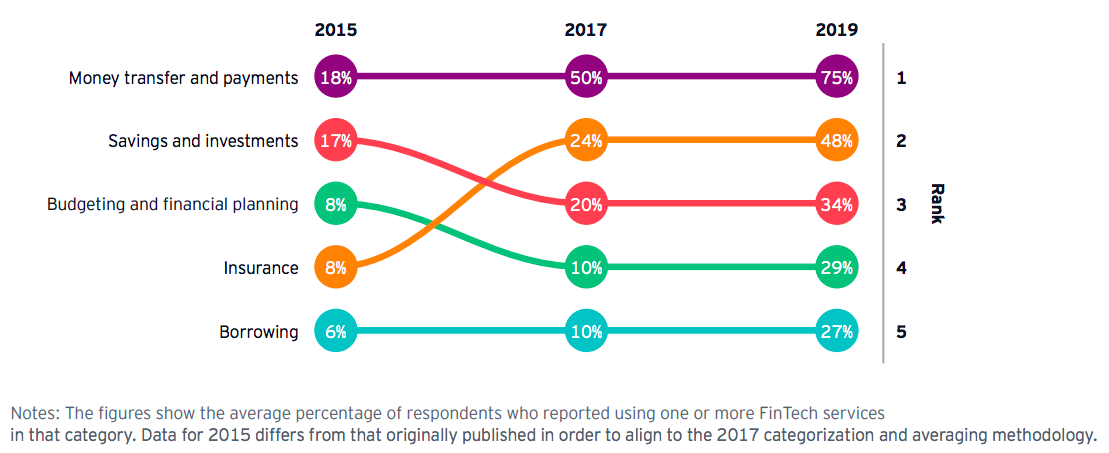

For clarification, EY groups fintech services into five categories—money transfer and payments, budgeting and financial planning, savings and investment, borrowing and insurance. Each category is called a “bucket” and a fintech adopter is someone who uses two or more “buckets” of services.

The report shows that there is a clear upward trend globally in terms of the adoption of fintech services across the board, but the “money transfer and payments” sector grew the most. The percentage of surveyed consumers who use services in this bucket rose from 18% in 2015 to 75% in 2019.

One reason for this upward trend is the inclusion of incumbent financial institutions such as banks, insurers, brokers, and wealth managers into the survey from which the results in this year’s reports were generated.

In the previous two reports, EY focused on non-traditional financial institutions and but later realized that established players have also developed digital offerings that can compete with those offered by fintech players. Hence, in order to paint a clearer picture of the developments, the company included traditional players.

The 2019 survey results from Singapore reflected this trend. Notably, there have been more product offerings from banks over the past few years in the e-payment sector, such as PayLah!, offered by DBS Bank and PayNow which is a peer-to-peer money transfer service available to retail customers of the participating banks in Singapore.

Singapore is strongly supportive of fintech innovations. It has a well-established financial sector, outstanding digital infrastructure, and a vibrant ecosystem of investors and innovation labs. All these contributed to the marked increase in fintech adoption rate as reported by EY.

The country’s monetary authority recently announced its intention to issue up to five new digital banking licenses, which will be extended to non-bank actors.