Asia VC investment in the third quarter of this year seems to still be in bad shape, owing to a mix of factors including the on-going Sino-US trade war and a slowing Chinese economy, but it is not that bad. Some sectors in China and some countries in the region are still going strong in spite of the overall headwind, says a report by accountancy KPMG.

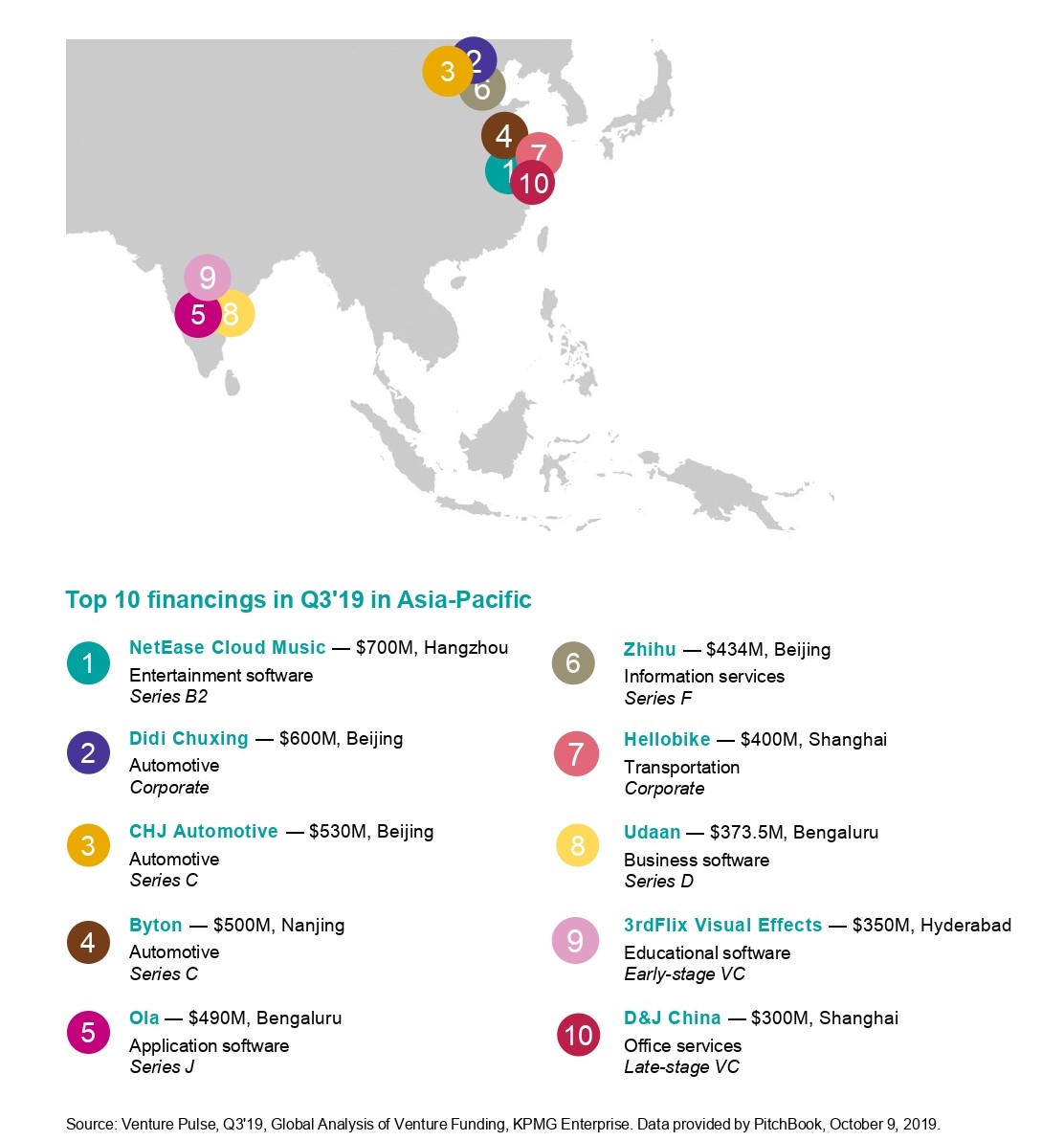

In China, the transportation sector drives into the spotlight. As four out of the top ten fundraising activities in Asia in Q3 involve Chinese automotive and mobility companies. And across Asia, five out of the top ten VC deals happened in the area.

These deals included a USD 600 million raise by Toyota into Didi Chuxing, a USD 530 million funding round in CHJ Automotive, a USD 500 million raise in Byton, a USD 400 million investment in Hellobike, and a USD 490 million funding in India ride-hailing company Ola.

Other China companies included in the top ten VC deals were entertainment software company NetEase Cloud Music (USD 700 million), Q&A platform Zhihu (USD 434 million), and office services provider D&J China (USD 300 million), which ranked first, fifth and seventh respectively.

Although VCs in Asia have invested 922 deals in the third quarter of 2019, up nearly 10% from the number in the previous quarter, the total investment amount in Asia has shrunk about 20% from the second quarter to USD 14.9 billion. The report pointed out that none of the deals in China exceeded the USD 1 billion benchmark during the third quarter.

The report also mentioned that many VC investors remain a more cautious attitude and focus on companies with proven technologies, mature business models, or well-defined paths to profitability.

Looking forward to the fourth quarter, KPMG predicts that VC investment in China will remain moderate, as the tension in its economy will last. However, the Chinese government is taking on policy reforms to improve regulations in a wide range of industries including insurance, finance, capital markets, and healthcare, which may leave a positive effect on China’s VC investment.