Chinese automotive marketplace Tuanche.com (团车, meaning group buying cars) filed Tuesday with the US Securities and Exchange Commission (SEC) for initial public offering and is looking to raise up to US$150 million. Maxim Group LLC and AMTD Asset Management are the main underwriters for this IPO.

The Beijing-based firm aims to use the proceeds to further its reach in the automotive space by expanding and also strengthening its technologies such as its data analytics capabilities, and information technologies.

Founded in 2010, the firm is an omnichannel automotive marketplace offering both so-called integrated marketing solutions and virtual dealership services for China’s automobile market via both online and offline channels.

Specifically, it has two types of online platform – one for new cars to match auto dealers with prospective car buyers and the other is an online used car auction platform. Offline channels are auto shows that provide customers with physical access to a wide range of automobiles.

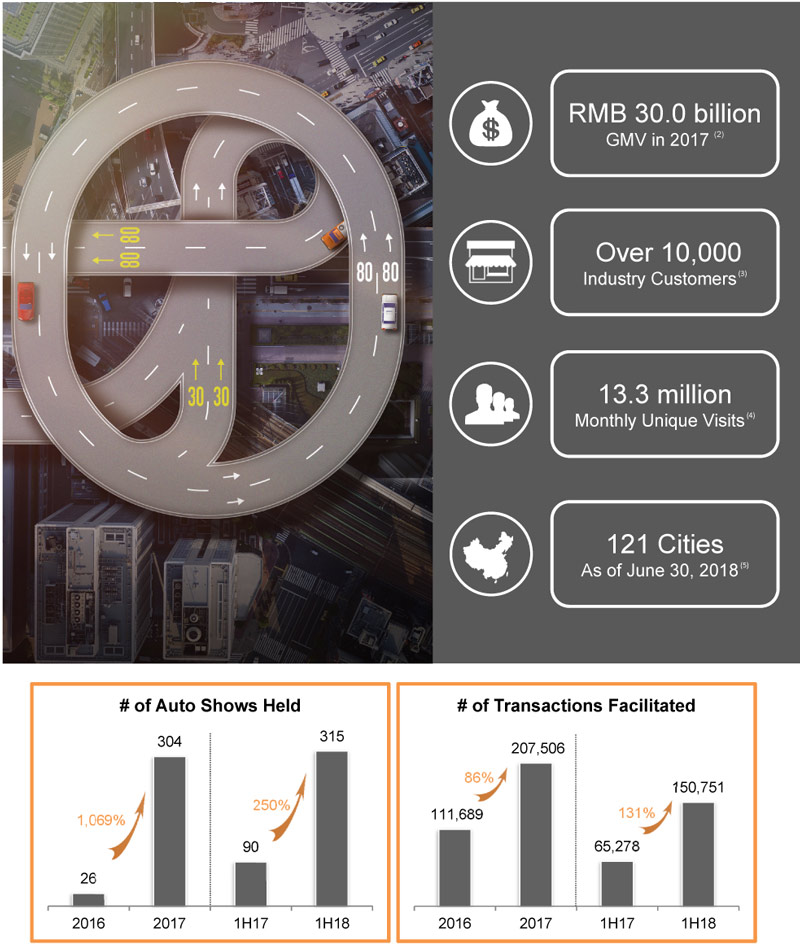

Tuanche.com operates in 121 cities as of end June 2018 and currently serves more than 10,000 industry customers. In terms of user numbers, it has 13.3 million monthly unique visits and a gross merchandise value (GMV) of RMB 30b (US$4.3b), according to its prospectus.

As for Tuanche.com’s business model, its revenue comes from three main sources – auto shows, group-purchase facilitation, and virtual dealership. It is important to mention that while a commission is charged group-purchase facilitation and virtual dealership, auto show sales performance pay no fee for their sales. Only a rental fee is required when participants rent their respective booths at offline events.

Tuanche.com is also seeing strong growth both for its number of auto shows as well as the number of transactions on its platforms. The former jumped by 1,069% from 26 in 2016 to 304 in 2017, while the latter increased by 86% year-on-year from 111,689 to 207,506 during the same period. This could be, in part, a consequence of the steady growth in China’s car sales – both new and used cars – market over the past 4 years. And the compound annual growth rate (CAGR) of 8.9% is forecasted to continue up to 2022 per market researcher iResearch data.

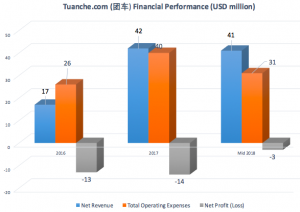

Narrowing losses

Overall, the firm has managed to contain rising operating expenses as revenue rises and has since managed to shrink its losses over the past 2+ years. This could be a positive sign to instil confidence amongst investors amidst wide market volatility, in addition to a positive growth forecast in China’s automotive industry.

A relative nobody

Though claiming to be the third largest automotive marketplace in China in terms of both volume and GMV of new automobiles sold in 2017, Tuanche, comparing to Nasdaq-listed Uxin or recently funded Chehaoduo, which are both household names made through commercials, is relatively lesser known in the market.

However, the company, commencing business in 2010, has a long history that goes back to the first group buy tide in China. It started as one of the vertical group buying services targeting new car sales, managed to survive the Chinese group buy bubble burst, and pivoted to reduce its reliance on group buying facilitation and to expand virtual dealership business.

The iResearch report might have casted a forecasted rosy picture for new car sales in China, however, Chinese new auto market sagged in July.

Facing a challenging market and competitive rivals like Uxin, Chehaoduo, and Renrenche, Tuanche still has a lot need to prove.

Editor: Ben Jiang