Bloks Group, the world’s third largest maker of construction toys, has released its 2025 midyear earnings. In the first half of the year, the company reported revenue of RMB 1.34 billion (USD 187.6 million), up 27.9% year-on-year. Net profit reached RMB 297 million (USD 41.6 million), reversing a loss of RMB 255 million (USD 35.7 million) in the same period last year.

On paper, Bloks has finally turned profitable after four consecutive years of losses. But operationally, it was already in the black: excluding preferred share losses and stock-based compensation, it posted adjusted profits of RMB 73 million (USD 10.2 million) in 2023 and RMB 292 million (USD 40.9 million) in the first half of 2024. Its adjusted profit margin stood at 27.9% in the first half of 2024.

Growth, however, has slowed. Revenue rose 27.9% in the first half of 2025, compared with 56.1% and 47.1% in the same periods of 2023 and 2024. In China, sales leaned heavily on a RMB 9.9 (USD 1.4) product line. Since November 2024, the company has sold a Transformers blind box series at this low price point. Within seven months, the line reportedly sold 48.6 million units, generating more than RMB 200 million (USD 28 million) thanks to its affordability, simple assembly, and official licensing.

Yet, the bigger story came from overseas.

North America emerges as a surprise market

A bigger shift came from overseas. Just a year ago, Bloks’ international sales were negligible. Before 2024, overseas revenue accounted for about 2% of the total. Even with momentum in late 2024, the share reached only 2.9% for the year.

That changed in 2025. In the first half, Bloks booked more than RMB 100 million (USD 14 million) in overseas sales, or 8.3% of total revenue. Southeast Asia and North America were the main contributors. Sales in Southeast Asia reached RMB 57.1 million (USD 8 million), up 6.5 times from a year earlier, while North America surged to RMB 42.8 million (USD 6 million), a 21-fold increase. Indonesia and the US were the top individual markets.

Like Pop Mart and Miniso, which both chose Thailand as their first overseas stop, Bloks found early traction in Southeast Asia, a nearby and demographically favorable region with large Chinese diasporas. Indonesia, as the region’s largest economy and the world’s fourth most populous nation, was a natural entry point.

The US, however, was less expected.

Bloks has long relied on Ultraman, a Japanese franchise that once contributed more than half its revenue. First broadcast in 1966, Ultraman became a cultural phenomenon in China in the 1990s after the release of Ultraman Tiga. Its catchphrase, “Do you believe in light?” still resonates.

But while Japanese anime drives pop culture across Asia, the US favors family-friendly IPs and collector-heavy franchises. Market research firm Circana reported that between January and April 2024, Lego, Transformers, and Disney tie-ins topped US toy sales. Meanwhile, Ultraman did not rank in the top ten.

Bloks adjusted its strategy. It launched 273 new SKUs in the first half of 2025, including Minions, Sesame Street, Transformers, and Marvel’s The Infinity Saga. To appeal to American buyers, it staged world premieres for its Minions and Sesame Street sets at Toy Fair New York, one of the world’s largest toy exhibitions.

Price remains its biggest edge abroad. Globally, Lego and Bandai Namco dominate the construction toy market with products priced between USD 20–200. Bloks positions itself in the value segment, with toys priced at USD 3–16.

Distribution also differs. In China, more than 90% of sales come from offline channels. Overseas, the mix is roughly 30% online and 70% offline. In the US, Amazon drives online sales, while in Southeast Asia, Bloks relies on local distributors and population growth to scale.

Like Pop Mart, which has monetized its IP overseas, Bloks sees international expansion as a critical growth driver. Covering both emerging and developed markets shows early proof of its ability to scale abroad.

But low prices cut both ways. They allow Bloks to compete with global giants but also require a steady stream of new SKUs to keep consumers engaged. Without strong original IPs abroad, the company remains dependent on licensed properties. Its future will hinge on expanding licensing deals and improving channel efficiency.

Doubling down on IP investment

Pop Mart remains the benchmark for IP-driven companies, but its path is difficult to replicate. Since pivoting from block toys to construction sets in 2022, Bloks Group has faced scrutiny over its reliance on Ultraman.

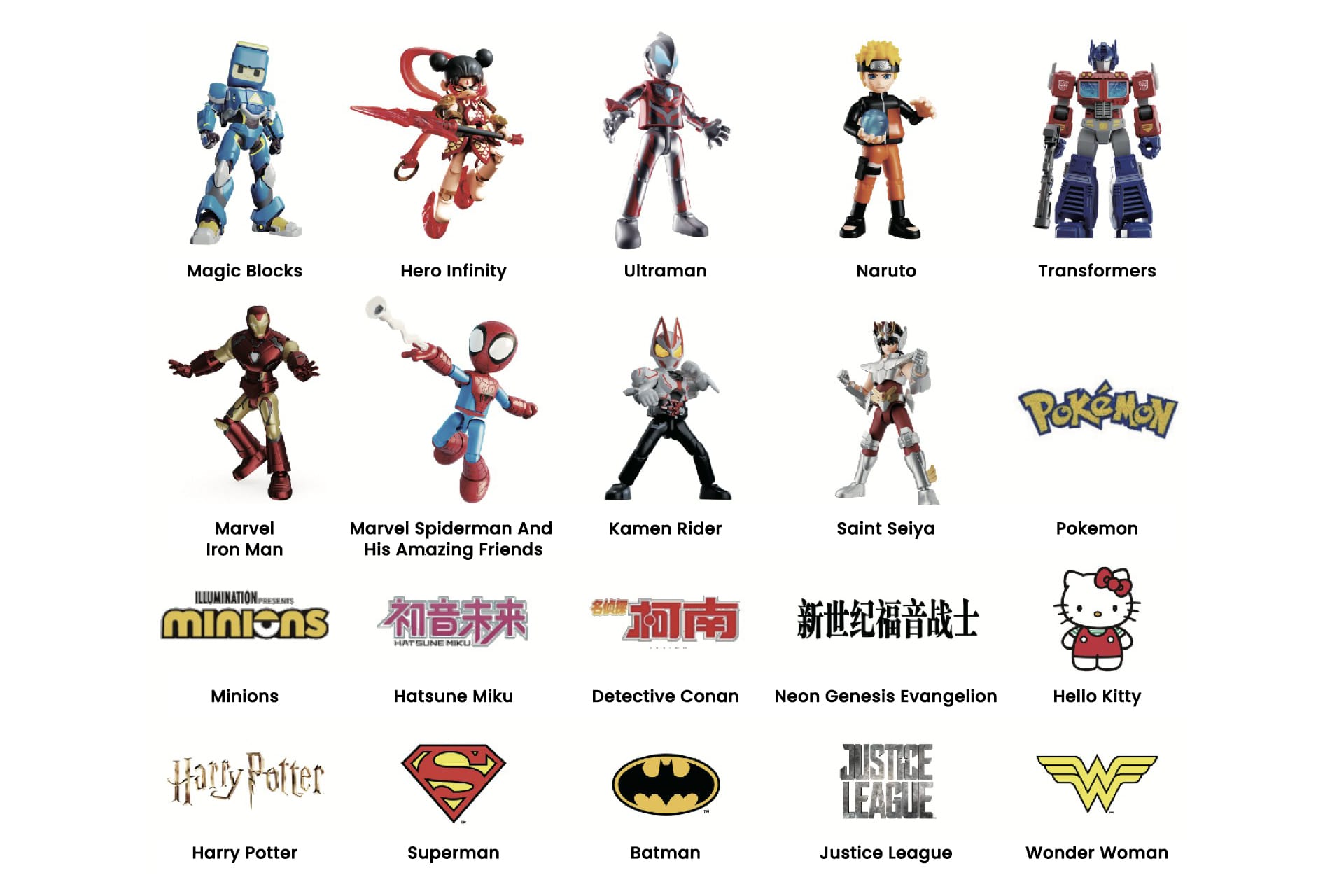

That reliance is both a strength and a constraint. Ultraman-themed products accounted for 63.5% of Bloks’ revenue in 2023. The share fell to 49% in 2024, and the latest report suggests further decline, though no figure was disclosed. In the first half of 2025, the company said its top four IPs made up 83.1% of revenue, down from 92.3% across the top three a year earlier.

Diversifying and building its own IP portfolio has become a priority. But the path is costly. Developing original franchises requires long supply chains and high tooling expenses. Lego’s success rests not only on IP partnerships but also on its direct-to-consumer model, which strengthens brand equity. Bloks, by contrast, depends on third-party distributors and multi-brand retail outlets, where demand is driven more by popular IPs than brand loyalty.

As of mid-2024, Bloks had only two self-developed IPs: Magic Blocks and Herospire. Magic Blocks contributed less than 1% of revenue, while Herospire ranked as its fourth largest IP at 16.5%. Both lag far behind licensed franchises.

The company is now stepping up efforts. In the first half of 2025, it signed 13 new IPs, expanding its total to about 50. R&D spending rose to RMB 129 million (USD 18.1 million), up 69.5% year on year.

It also released 273 new SKUs, which accounted for 53.1% of revenue during the period. The goal is to broaden its audience beyond boys aged 6–16 who grew up on Ultraman. In 2024, Bloks launched products for adult collectors priced at RMB 100–200 (USD 14–28). In the first half of 2025, buyers aged 16 and above contributed 14.8% of revenue, up from 10.4% a year earlier.

The company has also tested products aimed at younger girls. IPs such as Yeluo Li and Pokémon underperformed, so Bloks is now shifting to scenario-based sets to target that demographic.

These efforts come at a cost. Rising R&D spending, higher tooling fees from new SKUs, and the expansion of low-priced products dragged gross margin down 4.5 percentage points year on year.

The company also highlighted user experience in its report. Unlike Pop Mart, whose collectibles thrive on aesthetics and scarcity, construction toys rely on creativity. That explains why Lego invests heavily in community engagement, co-creation, and theme parks to reinforce its “creation” narrative.

Bloks is experimenting with a similar approach. This year, it is continuing the Blokees Figures Creators (BFC) competition across 150 cities in China. Parents traveled long distances with their children to attend, drawn by the belief that such contests foster creativity.

Founded in 2014, Bloks spent its first eight years as a block toy maker before pivoting to construction sets in 2022. The shift boosted margins and growth, culminating in its Hong Kong IPO. By mid-2024, it had partnered with more than 450 distributors, covering all top-tier cities in China and over 80% of lower-tier ones.

While Lego and Bandai Namco remain the global leaders, Bloks has risen quickly. By sidestepping Lego’s niche in small bricks and focusing instead on larger, more affordable pieces, it carved out a value-driven segment and built a broad offline distribution network.

Still young, Bloks has room to shape its own path. But its latest results underline the central question: how long it can monetize licensed IPs at scale, and whether that strategy will resonate both in China and overseas.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Zhong Yixuan for 36Kr.