When you hear about the astronomical sales during Alibaba Group’s Singles Day — usually in the tens of billions of dollars — you would hardly imagine that China ranks 55th on a global index for e-commerce.

Despite being home to some of the world’s largest e-commerce companies, the country received a lower score than Ukraine and Oman on the latest business-to-consumer e-commerce index published on Wednesday, which measures an economy’s online shopping support.

The index was compiled by the United Nations Conference on Trade and Development.

According to UNCTAD, the scale of a country’s e-commerce is not factored into the index and China lags in relative comparisons regarding access to secure internet servers and the share of individuals using the internet. The country’s internet penetration was among the lower half of the 152 nations and territories covered by the index.

“China’s ranking was dragged down by some infrastructure limitations,” said Ken Lo, head of e-commerce for Hong Kong and Macao at SF DHL Supply Chain China. “But the low ranking can be a good thing, because it shows there is still ample room for e-commerce growth in China, which could provide lots of business opportunities.”

China’s internet penetration reached 64.5% as of March 2020, according to the China Internet Network Information Center. But the rate for rural areas was only 46.2%, where more than 500 million people live.

On the other hand, up to 75% of internet users shop online in China, compared with 38% in Hong Kong and 66% in Singapore, according to UNCTAD data. Singapore and Hong Kong made it into the index’s top 10.

“China continues to be the most important market for Asia and the world, because of its sheer size, capital investment, and innovation,” said Jonathan Cheng, head of Bain & Company’s greater China retail practice.

Cheng argues that as an internet innovation hub for B2C e-commerce, China is at the forefront on multiple different fronts, including customer engagement, personalized marketing, and variations of e-commerce.

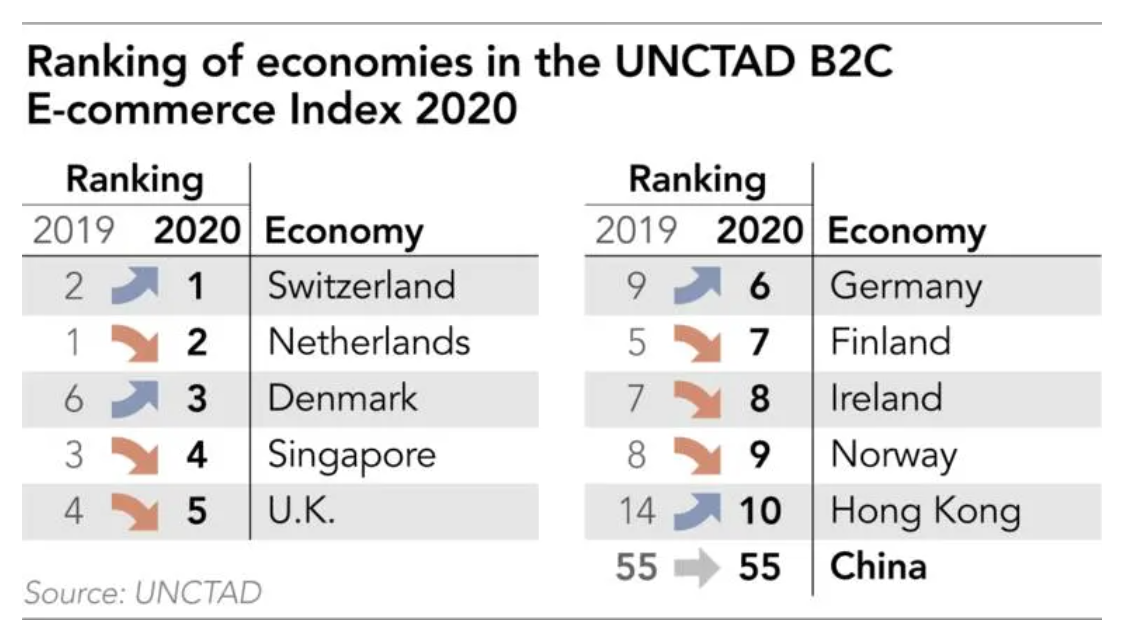

Singapore led Asian nations to dominate the top positions for developing economies. The city-state slipped one place from its 2019 ranking to fourth, trailing Switzerland, the Netherlands, and Denmark.

The COVID-19 pandemic has boosted the digital economy worldwide. UNCTAD research showed that millions of people shopped online for the first time during the pandemic in some developing countries.

“Offline to online has always been a trend, but what COVID did is basically accelerate it by 24 to 36 months,” said Cheng, who noted that offline traffic has dropped between 10% and 20% and traffic is going to be permanently shifted online.

Hong Kong is a newcomer to the world’s top 10, rising four places from a year ago, thanks to more people using the internet and the number of secure servers.

Watch this: Is Sea Group Southeast Asia’s answer to Tencent and Alibaba?

The city of 7.5 million has been known as a shoppers’ paradise for easy access to all kinds of stores, but the pandemic has pushed a large number of residents to shop online.

“Many Hong Kongers were reluctant to shop online because they were worried about internet safety,” said Lo of SF DHL Supply Chain. “But when the pandemic hit last year, health became the first priority and people avoided going outside … so they switched to online.”

Lo believes the pandemic has contributed to “a change of mindset” in the former British colony and that people will stick to the convenience brought by e-commerce even after COVID.

Regarding e-commerce penetration in Southeast Asia, Malaysia ranks 30th, Thailand 42nd, and Vietnam 63rd. The sector has become a heated battleground in the region. The growth of Southeast Asia’s best-known tech startups — such as Singapore’s Grab and Indonesia’s Gojek — was spurred by ride-hailing and other services. And the rapid rise of Sea, which has become the region’s most valuable company at over USD 100 billion, is triggering fresh tie-ups and acquisitions that are set to redraw the landscape in 2021 as economies recover.

Cheng from Bain & Company noted that India is another place worth looking at because it is one of the markets “where some of the big giants are going head to head,” including Amazon, Walmart and previously Alibaba.

Elsewhere on the UNCTAD list, the US, South Korea, and Japan rank 12th, 18th and 20th respectively.

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.