Is Ethereum the king of Layer-1 blockchains?

Your perspective on blockchain technology is likely to shape your answer, but one fact remains indisputable: Ethereum hosts an unparalleled ecosystem of decentralized applications.

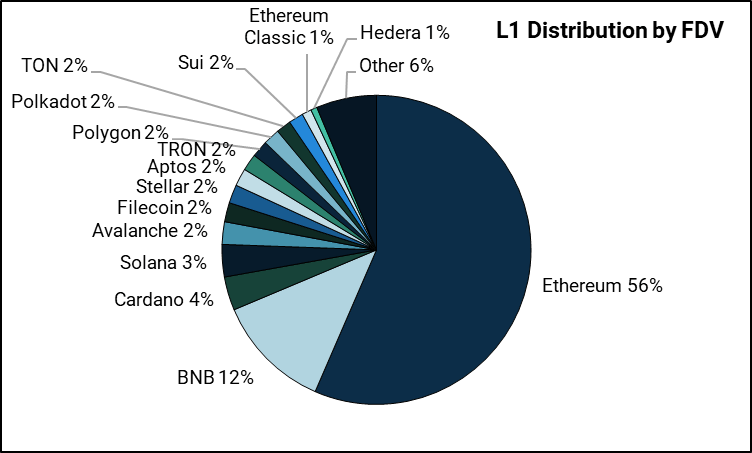

Ethereum’s preeminent position has not gone uncontested, with numerous competitors hoping to take its place. Consider this: over half of the top 20 cryptocurrencies, based on market capitalization, are native tokens of L1 blockchains, including Cardano (ADA), Solana (SOL), and BNB Smart Chain. The emergence of alternative L1 blockchains was a key theme during the 2017 and 2021 adoption cycles, when Ethereum grappled with congestion issues due to its limited blockspace, prompting users to migrate to other L1 blockchains with higher capacities and lower fees.

Yet, years later, Ethereum remains de facto the top L1 blockchain, while some alternatives have begun to resemble virtual ‘ghost towns’ due to stagnant or declining user counts.

Nevertheless, new L1 blockchains have been introduced over time, such as Aptos and Sui, to relative success. Both blockchains command a combined valuation of over USD 12 billion at the time of writing. More L1 blockchains are expected to launch at similar valuations, and some of them could rival Ethereum in due time.

Overview of L1 blockchains

With more alternative L1 blockchains emerging, a question looms large: can any of them overtake Ethereum? Unpacking this question requires a review of the history of L1 blockchains and analyzing them against Ethereum.

The genesis of most L1 blockchains, including Ethereum, finds its roots in Bitcoin’s limitations. Bitcoin’s original purpose was to be a trustless, peer-to-peer electronic cash system. When bitcoins became gradually recognized as a legitimate asset class, developers sought to emulate it by creating digital currencies atop Bitcoin. But this was largely unsuccessful due to the limitations of Bitcoin’s scripting language and social layer. Frustrations of these developers led to the introduction of Ethereum as a solution.

Like Bitcoin, early-stage Ethereum prioritized decentralization over scalability. As adoption grew, the network quickly hit throughput limits. This was exemplified by instances like the 2017 boom in initial coin offerings (ICOs), when the demand for blockspace far exceeded the network’s capacity. Clogged for hours, Ethereum’s gas fees, which are paid to conduct transactions on the blockchain, skyrocketed. A simple token transfer cost as much as USD 150 at one point.

Ethereum’s scalability issues paved the way for other L1 blockchains to emerge. During the ICO boom, blockchains like EOS, Tezos, and Cardano raised hundreds of millions of dollars, promising the development of faster L1 architecture. Many cited Ethereum’s low transactions per second and other limitations when raising funds.

State of the market

Many L1 blockchains have been launched since Ethereum’s inception, but the latter has retained its place as the leader, based on market capitalization. How has Ethereum maintained its lead, and what drives its high valuation?

Cheaper, faster L1 blockchains win out

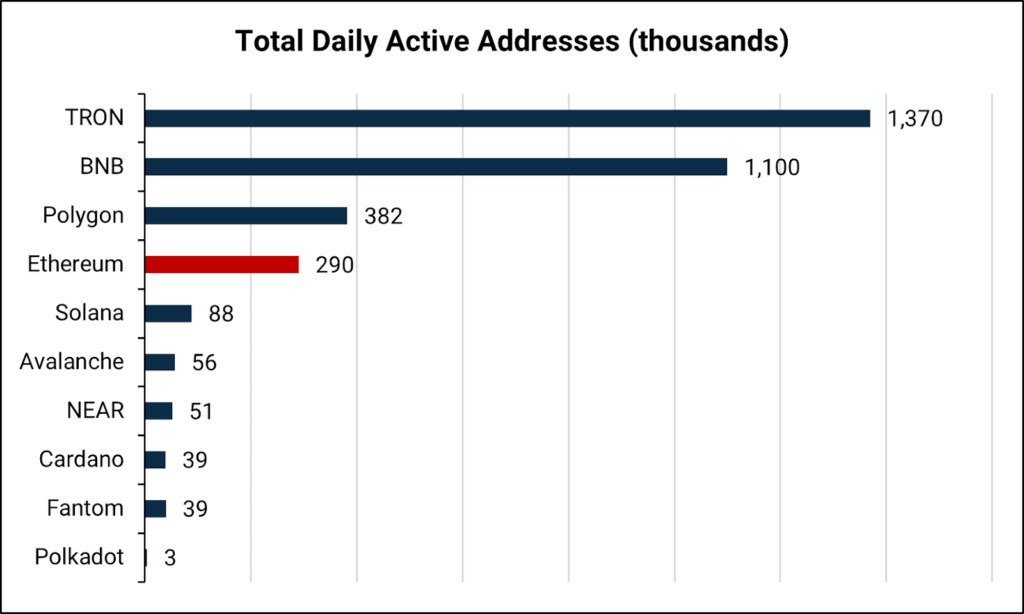

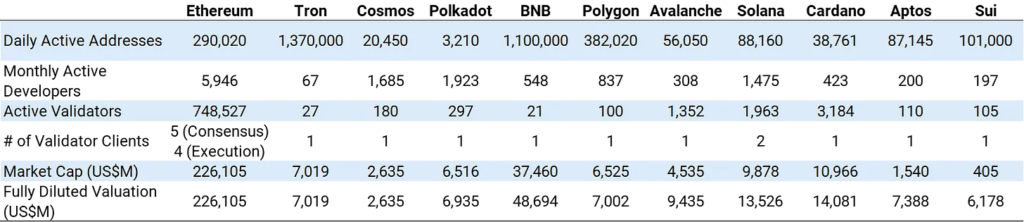

According to Metcalfe’s Law, users drive value, as network value is assumed to grow superlinearly to the number of users. Active user counts are difficult to assess due to the lack of anti-sybil systems and the ease of generating new addresses at will. Nonetheless, active addresses can provide a reasonable estimate of each L1 blockchain’s user count.

Ethereum has less active users than ‘cheaper’ blockchains like Tron, BNB Smart Chain, and Polygon despite its higher valuation, suggesting that user count and network value do not necessarily correlate with one another. Some other networks, such as Polkadot and Cardano, also have low active user counts, yet are valued comparatively higher, supporting this viewpoint.

Developers, developers, developers

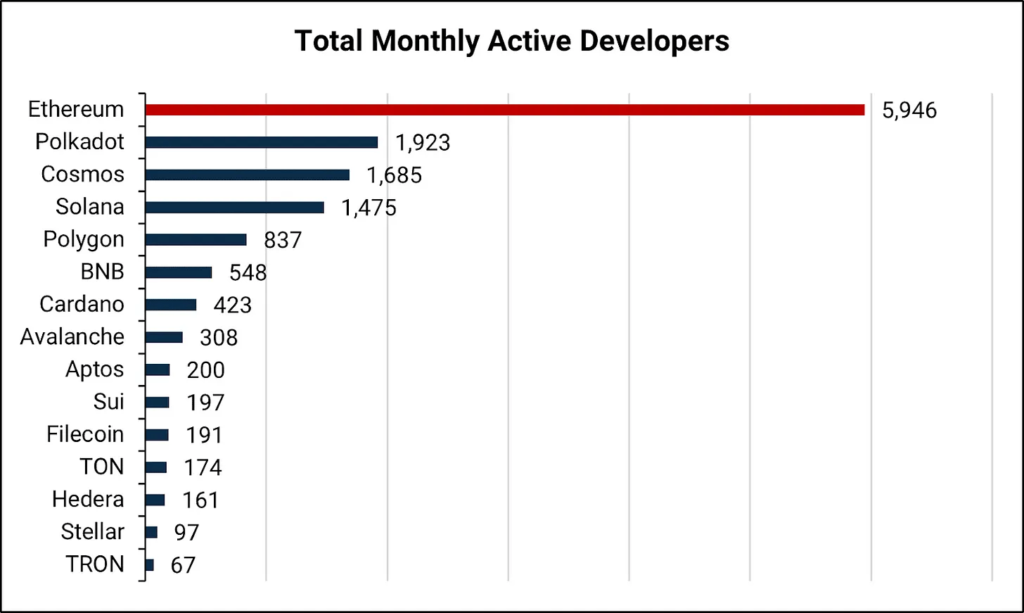

Developers serve as an additional gauge of network health, as they contribute value by maintaining and enhancing the protocol layer, in addition to building applications on L1 blockchains.

According to a report by Electric Capital, Ethereum has the highest aggregate of total active developers, though Polkadot, Cosmos, and Solana also possess notable developer counts, which could stem from them utilizing programming languages that differ from Ethereum’s Solidity language.

Liquidity

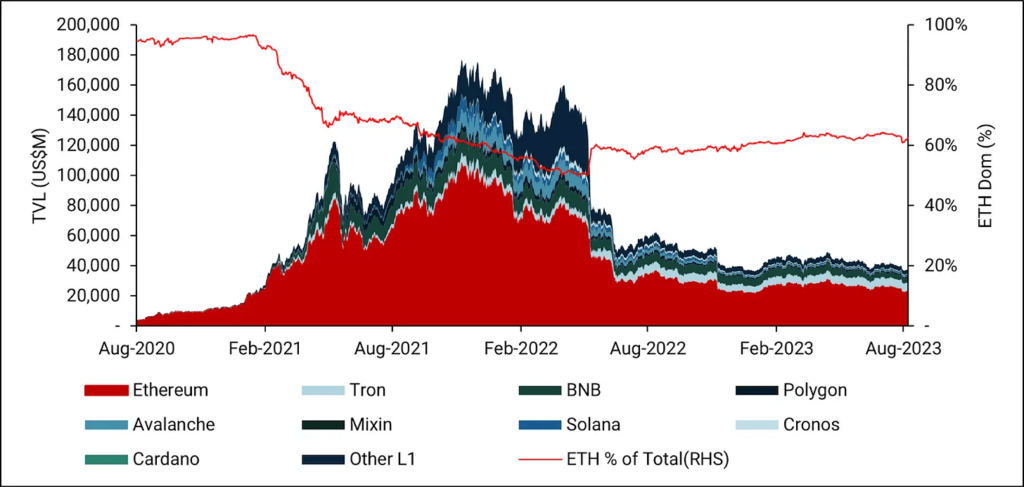

Liquidity is crucial for L1 blockchains because it directly impacts their functionality. By stabilizing prices and enabling efficient price discovery, it empowers users to engage in trading, transactions, and network involvement.

Therefore, liquidity signifies volume of tradable assets, and is typically measured using metrics such as total value locked (TVL), trading volume on decentralized exchanges (DEXs), count of trading pairs, and more.

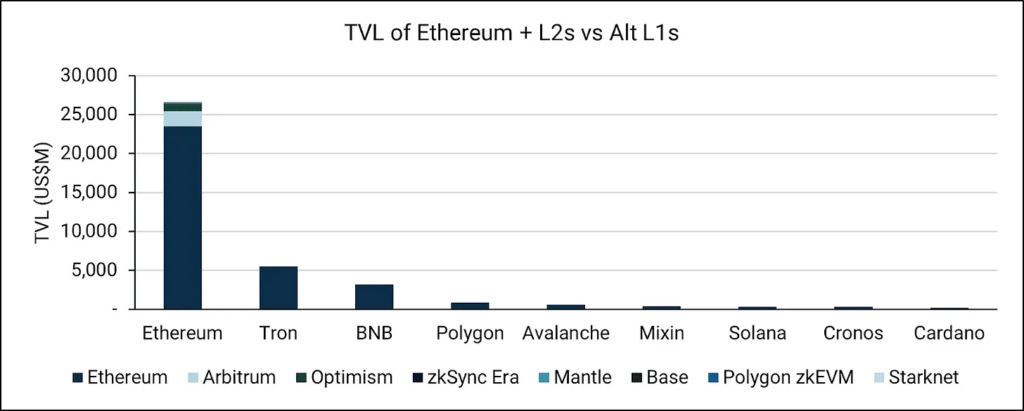

Ethereum has a clear lead in terms of liquidity, with its TVL market share hovering stably around 60% since the summer of 2022, after Terra collapsed.

Ethereum leads, but not without asterisks

While other factors exist, Ethereum’s predominance likely stems from its liquidity and capital flows, noting its weaker position in some aspects such as user adoption rates. This may suggest that the market places significant importance on capital. The following subsections delve into the factors behind the metrics discussed above, including active user count, liquidity, and developer activity.

Decentralization

Decentralization, as a fundamental characteristic of blockchains, yields benefits such as improved censorship resistance, network resilience and security, among others. It instills users with the confidence to store and transact value, with higher degrees of decentralization equating to higher value attributed to an L1 blockchain.

While decentralization can seem abstract, it can be gauged using several factors:

- Number of nodes and node distribution: Nodes participate in a network to maintain its blockchains and, depending on their type, validate and relay transactions. Spreading nodes out across geographies and organizations reduces the influence of single actors, improving network resilience and security. The Nakamoto coefficient is a useful gauge, quantifying the nodes needed to achieve a majority and thereby safeguard a blockchain. A higher coefficient typically signifies stronger decentralization, though this single metric may overlook certain nuances.

- Token holder distribution: When the majority of tokens is held within a small number of wallets, owners could have the authority to dictate the development of an entire network. This could deter users from transacting on the network.

- Governance model: Off-chain governance involves decision-making outside the blockchain through community coordination, while on-chain governance embeds governance directly into the protocol, enabling automated, token-based voting on changes. The impact varies. Off-chain governance is less affected by the concentration of token holders but is prone to political centralization and potentially faces high barriers to participation.

- Client diversity: Running more nodes could improve network resilience, but if a network is run only on a single client, a client bug can threaten the entire blockchain.

- Culture: A community culture with strong values can help defend a blockchain against centralization-related risks and threats, such as Bitcoin’s defense against app development in 2014. It’s an underrated but pivotal aspect of decentralization.

Network effects

Network effects encompass various dimensions in the context of L1 blockchains. One example is the interplay between users and developers, reminiscent of Web2 platforms. User growth attracts developers, leading to new apps and use cases, thereby attracting more users, thus perpetuating the cycle.

Such effects can also manifest in other ways, including the choice of programming language. Ethereum’s Solidity is a popular language, which can cultivate a larger pool of Solidity developers, fostering a bigger community and simplifying collaboration, hiring, and issue resolution. These factors could bolster innovation cycles by drawing in developers and expediting app launches.

Capital network effects are crucial, especially within financial applications. They tend to emerge on networks with substantial market size and liquidity. Stakeholder support bolsters these effects. Examples include Coinbase’s deposit and withdrawal features, Circle’s USDC issuance, and Fireblocks’ custody support.

Lindy effect

Given the nascency of digital assets and lack of historical data, the Lindy effect could be used to evaluate the success of L1 blockchains. It’s a model that theorizes the lifespan of non-perishable things, such as blockchains, is correlated to their current age. It is, in some ways, applicable: L1 blockchains that survive a myriad of challenges, such as technical issues, hacking attempts, market volatility, regulatory scrutiny, and competition, and still retain their users, are likely better positioned to thrive in future cycles.

This model suggests that mature L1 blockchains that have hitherto stayed relevant have better odds of eventually overtaking Ethereum.

Hysteresis

Hysteresis describes how systems, once set on a path, persist, making them harder to deviate the longer their trajectory stays unchanged. For example, Ethereum’s initial use of proof-of-work before transitioning to a proof-of-stake model facilitated widespread participation and token distribution. This type of distribution is incredibly difficult for new networks to replicate. Another example is FTX, despite its negative impact on the Solana ecosystem over the past few years. FTX’s affiliation helped propel Solana into the mainstream and become a leading L1 blockchain and ecosystem.

Viewed in this context, Ethereum’s leadership isn’t necessarily the result of technical superiority, but a culmination of its history, momentum gained over the past decade, and compounded effects generated of its own volition.

Differentiation

L1 blockchains may differentiate themselves by offering superior architecture or catering to specific niches. This could involve scalability, transaction costs, consensus mechanisms, privacy features, or specialized tools for specific industries. For example, Solana is committed to a monolithic blockchain architecture to maximize the benefits of composability and liquidity effects. Aptos and Sui offer Move as a more secure and intuitive programming language, which could make them more appealing to developers who want to minimize the occurrence of code bugs.

Monetary policy

A blockchain’s monetary policy could be a cornerstone for its success. It dictates how the native cryptocurrency of a blockchain is issued, distributed, and potentially burned, influencing both its scarcity and value proposition. A clear, consistent, and transparent monetary policy can foster trust among participants, attract investors, and stabilize the network’s economic environment.

Moreover, it determines the incentives for validators or miners, thereby impacting the security and functionality of blockchains. A well-balanced monetary policy can promote growth, adoption, and stability, differentiating a blockchain and improving its long-term viability.

Layer-2 blockchains

Alternative L1 blockchains are not the only way to scale anymore. Rollups became a key aspect of Ethereum’s scaling roadmap in October 2020. Since then, they have gradually garnered market share from other blockchains. Arbitrum and Optimism—both optimistic rollups—have more active users and TVL than most L1 blockchains. Coinbase’s optimistic rollup, Base, has also been gaining traction.

From a broader perspective, optimistic, zero-knowledge, and application-specific rollups all constitute integral components of the Ethereum ecosystem. When viewed holistically, the hurdle to overtake Ethereum becomes significantly higher.

Final verdict

Determining whether another L1 blockchain can overtake Ethereum is an exercise fraught with potential folly. The technology landscape, especially in a nascent field like crypto, is in constant flux and rife with uncertainties. The question also implies zero-sum thinking, suggesting that one L1 blockchain’s win is another’s loss. It may be more prudent to heed the words of Warren Buffett, who aptly stated: “Forecasts may tell you a great deal about the forecaster … they tell you nothing about the future.”

It seems likeliest that Ethereum will retain its leading position for the foreseeable future. It stands out in terms of decentralization and its ecosystem is pioneering a myriad of frontier technologies such as scaling and privacy solutions, zero-knowledge applications, and more.

Among the alternative L1 blockchains, Solana is seemingly the most promising contender. Its monolithic architecture is meaningfully different from Ethereum’s, and it is the only other network with multiple validator clients. Its community, hardened by recent events, is one of the most vibrant and ardent. Concurrently, its ecosystem teems with innovation, giving rise to solutions such as xNFTs, compressed NFTs, state compression, the Solana Mobile Stack, and more.

This article was adapted based on a feature originally written by Steven Shi and published on Amber Labs’ Substack. Amber Labs is the incubation and research arm of digital asset company Amber Group. KrASIA is authorized to adapt and publish its contents.