Perpetual futures, known as perps for short, have become one of the driving forces of the crypto market. They have traditionally been traded on centralized exchanges (CEXs), where all trading activities are governed by a single entity.

However, decentralized trading of derivatives, including perps, is gaining traction in various markets with the rise of decentralized exchanges (DEXs). Unlike their centralized counterparts, DEXs operate on smart contracts which are self-executing programs. When certain conditions specified in a smart contract are met, it automatically executes the agreed-upon actions. By using smart contracts, the need for intermediaries is eliminated since the code itself enforces the agreement.

Derivatives and perps 101

Perps are a type of futures, and a form of derivatives. Derivatives are financial instruments that derive their value from other assets. They exist in all markets. In simple terms, derivatives are agreements that follow the value of something else, like an asset or commodity. This can range from the S&P 500 to gold, orange juice, the weather, and more.

Derivatives can be designed in various ways to result in different outcomes. In general, futures offer a straightforward payoff, similar to directly buying the underlying asset. Futures, including perps, may entail leveraging, which means traders can control a larger position with a smaller sum of money. While taking on high amounts of leverage can lead to potential losses and be financially fatal, the volatility of futures also enables savvy traders to achieve higher capital efficiency, which may explain their popularity.

Most futures in traditional markets are dated futures. Think of them as financial agreements between two parties to buy or sell an asset at a specific price and time in the future. They are priced based on the forecasted market price of the underlying asset, and have a specific expiration date. The contract is settled upon expiry, converging the contracted price with the price of the underlying asset.

In contrast, perps are designed to trade close to the underlying asset’s price, and their contracts do not expire or settle and can be held indefinitely. The price of perps is anchored to the underlying asset’s price via a funding rate mechanism. Periodically, typically every one or eight hours, money flows from one side of the contract to the other.

Perps: CEXs or DEXs

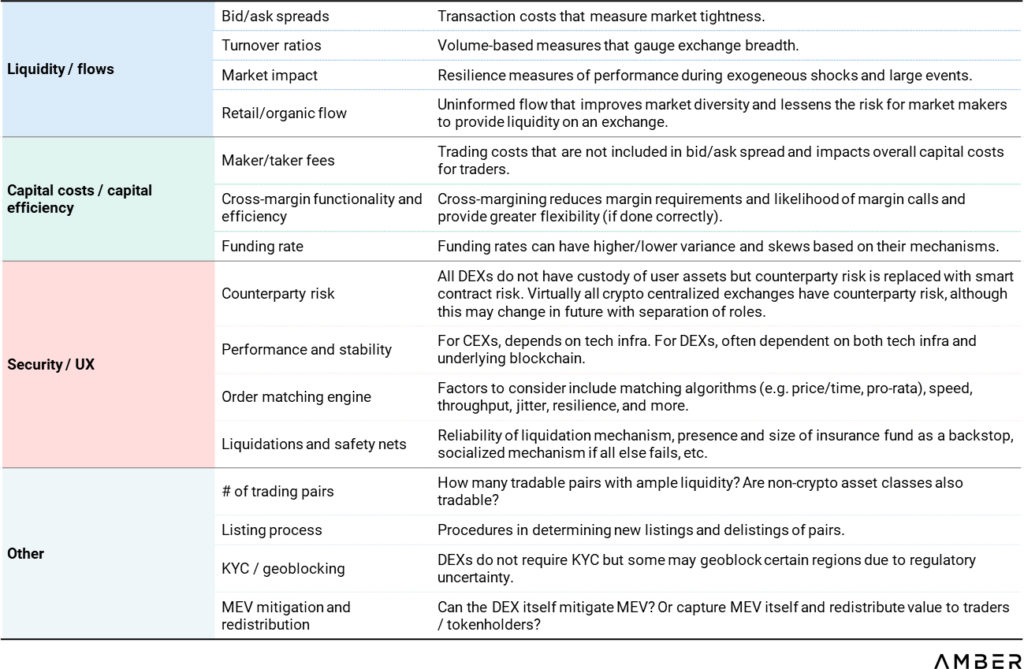

The primary challenge faced by decentralized exchanges lies in creating perp DEXs that can rival their centralized counterparts. Perps are complex instruments that involve multiple moving parts, including margin requirements, funding rates, leverage ratios, and more. Keeping pace with innovation in these areas is a complex process, but essential in order to compete in the derivatives market.

DEXs already have an advantage over CEXs based on unit economics. As they are decentralized, DEXs can outsource more key functions to improve their cost structure, allowing more capital for reinvestment. For example, DEXs do not need to invest in asset custody or hire lawyers to determine which assets to list. Transaction settlement can be outsourced to the blockchain layer too. Decentralization via token distribution could also incentivize a grassroots community to market and build upon the project.

Composability can also be a game changer. This refers to the ability for decentralized finance projects to plug into a perp DEX and create new features. For example, several projects on Arbitrum compose with either GMX’s liquidity pool or its perps exchange, such as Rage Trade, Rysk, and more.

Designing decentralized perps

In general, decentralized perps can adopt three designs: central limit order books (CLOBs), multi-asset pools, and single-asset pools:

- Central limit order books collate all buy and sell orders for an asset, facilitating trades where the buy and sell prices match.

- Multi-asset pools consist of multiple assets, including crypto and stablecoins, that are used to facilitate trading by acting as a counterparty.

- Single-asset pools consist of only one asset, often either a stablecoin like USDC, that is used to facilitate trading by acting as a counterparty.

CLOBs are a proven model used by traditional CEXs, but they cost more to port to blockchains due to their compute power, bandwidth, and storage requirements.

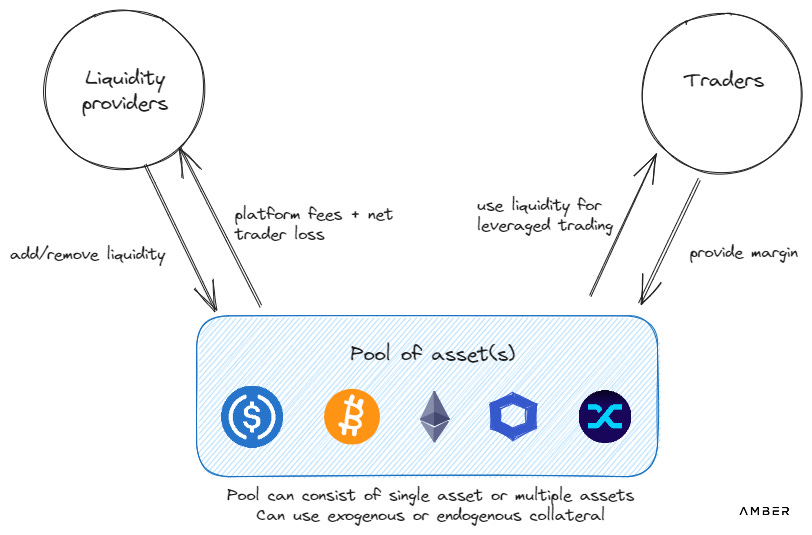

Pooled designs allow liquidity providers to outsource price discovery, which may result in more competitive execution prices for traders, but have unique challenges of their own. Liquidity providers provide liquidity to exchanges by depositing funds into the exchange’s smart contract. Traders, in turn, can execute trades against the liquidity provided.

In addition to design considerations, toxic flow and adverse selection are also challenges to be addressed:

- Toxic flow refers to orders that have a high probability of short-term trading profit due to information asymmetry. They are more common in pooled designs. For example, if a trader sees that the price of Ethereum has moved from USD 1,850 to USD 1,900 on Coinbase, the trader can attempt to trade on an oracle-reliant DEX at the price of USD 1,850, wait for the oracle to update the price to USD 1,900, then sell at a profit. Price oracles are mechanisms that provide asset prices to blockchains.

- Adverse selection refers to situations where one party to a trade has more information than the other party, leading the latter to make poorer decisions. They occur when a venue attracts only sharp traders who are very knowledgeable about the market and able to make profits consistently. If an exchange only attracts sharp traders, they could trade against liquidity providers only when it’s profitable to do so, leading to the latter losing money and making the exchange less attractive to traders in general.

Can decentralized perps win?

While awareness of DEXs is growing, perps are hitherto traded mainly on CEXs. The DEX penetration rate of perps remains low at 1–3%, and new strategies may be required for them to claim a bigger market share.

A possible approach for DEXs is to identify and leverage their unique value propositions to attract traders and LPs. The bottom line is to improve liquidity—without it, any exchange lacks appeal in the eyes of traders and market makers. Establishing cross-margin functionality is one way of enhancing liquidity by enabling traders and market makers to use their margins across multiple assets, lowering capital costs.

By continuing to innovate and evolve, DEXs could increase their significance and challenge the dominance of their centralized counterparts in the crypto industry.

This article was adapted based on a feature originally written by Steven Shi and published on Amber Labs’ Substack. Amber Labs is the incubation and research arm of digital asset company Amber Group. KrASIA is authorized to adapt and publish its contents.