Indonesian unicorn e-commerce Bukalapak has launched an online credit card application service in collaboration with fintech platform Cermati.

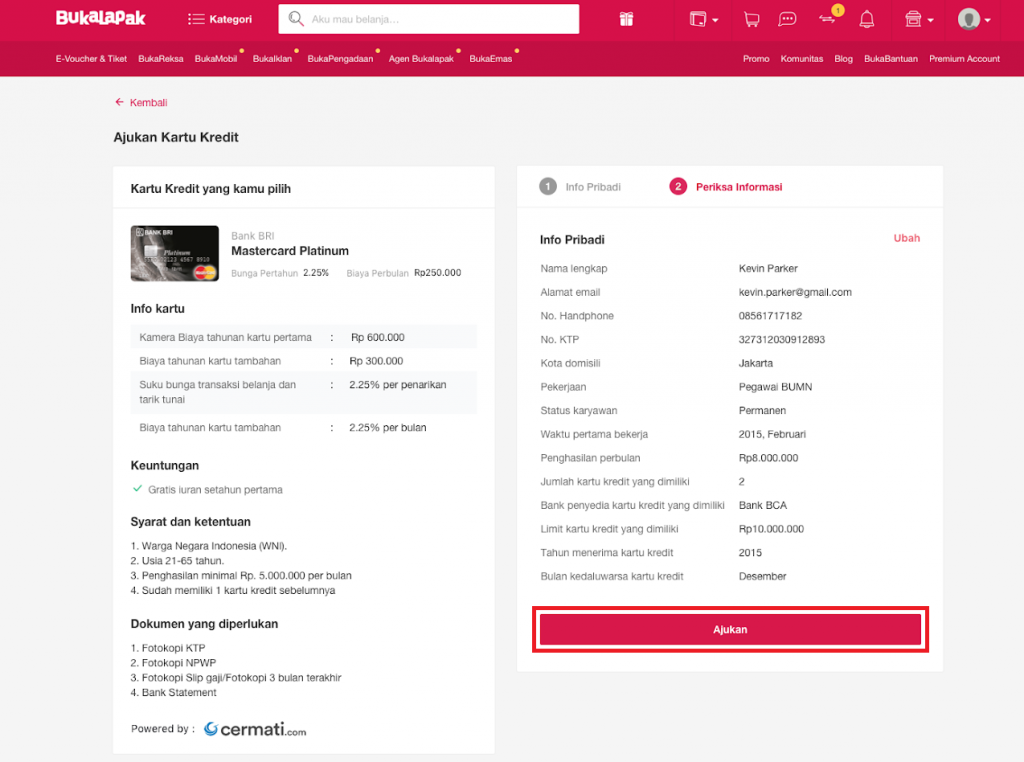

Powered by Cermati, Bukalapak’s users will be able to choose a credit card from various banks including BRI, Bank Mega, and Citi. After selecting the type of card, users must fill out a personal data form for verification. The admission process takes up to three days, and users will be contacted via phone or e-mail by the Bukalapak team to confirm their application, said the company.

According to Bukalapak’s co-founder and president Fajrin Rasyid, this collaboration is a strategic initiative for the firm to expand the credit card user base through the digital platform.

“To date, there are around 17 million Bukalapak users who have never used credit cards. Therefore, the Bukalapak partnership with Cermati is an important move where we offer an alternative transaction method that is safe, convenient, and beneficial for customers,” Rasyid said in an official statement.

Rasyid added that he expects this feature to attract at least 5,000 users in the first quarter after its launch.

Cermati is a financial product marketplace founded in 2015 by software engineer Oby Sumampouw, Andhy Koesnandar, and industrial engineer Carlo Gandasubrata. The platform assists users with financial information, and also supports financial companies with user acquisition, risk assessments, and other services.

In September 2016, the startup raised USD 1.9 million in a Series A funding round by East Ventures, and later in September 2018 collected an undisclosed Series B funding series from Djarum Group.

Bukalapak is one of the largest e-commerce companies in Indonesia and announced its “unicorn” status in January 2018, making it the fourth unicorn company in the country. The platform has more than 70 million active users and over four million sellers.

The online credit card feature adds to the long list of financial products under the Bukalapak portfolio. Among other Bukalapak’s financial offerings are gold investment and SMEs loans.