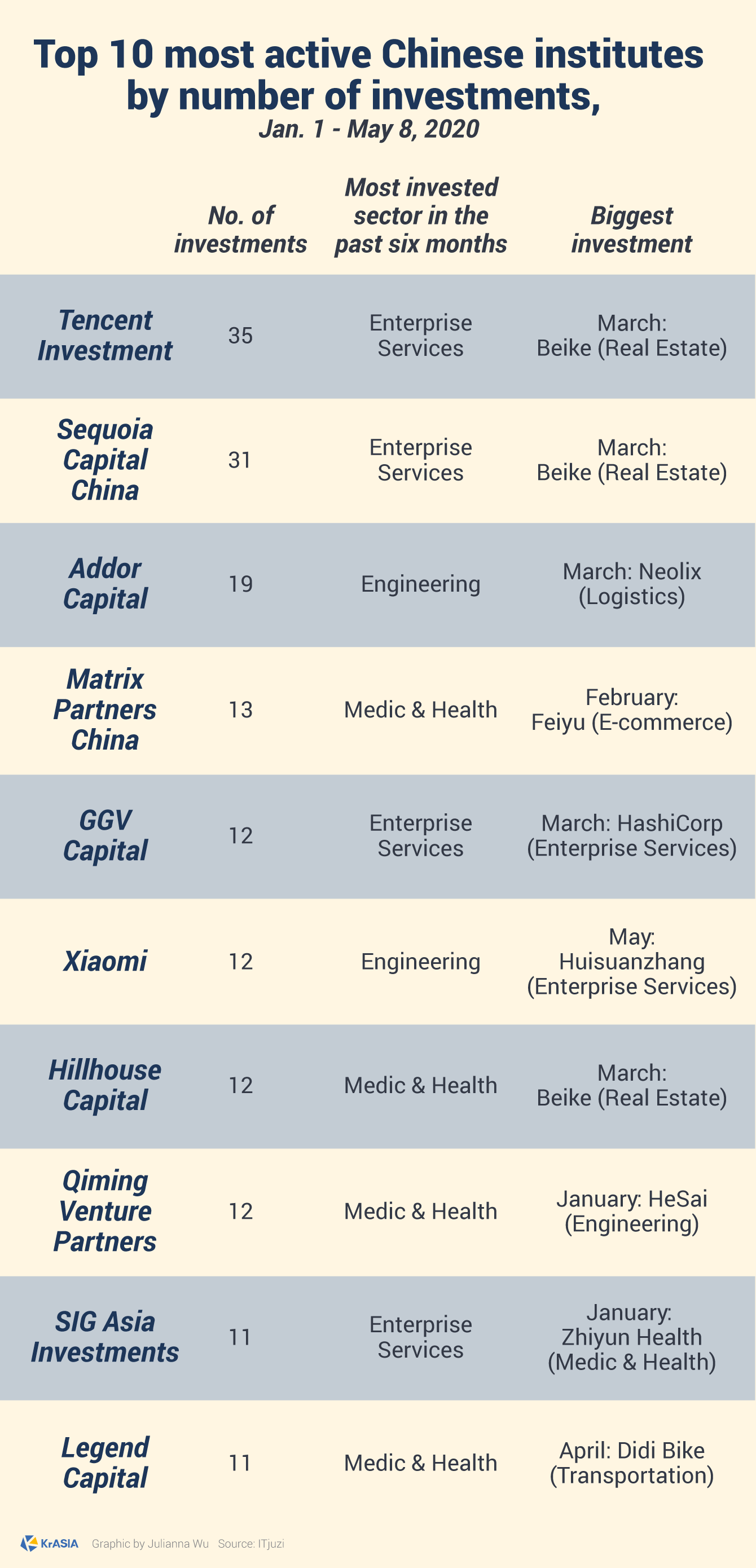

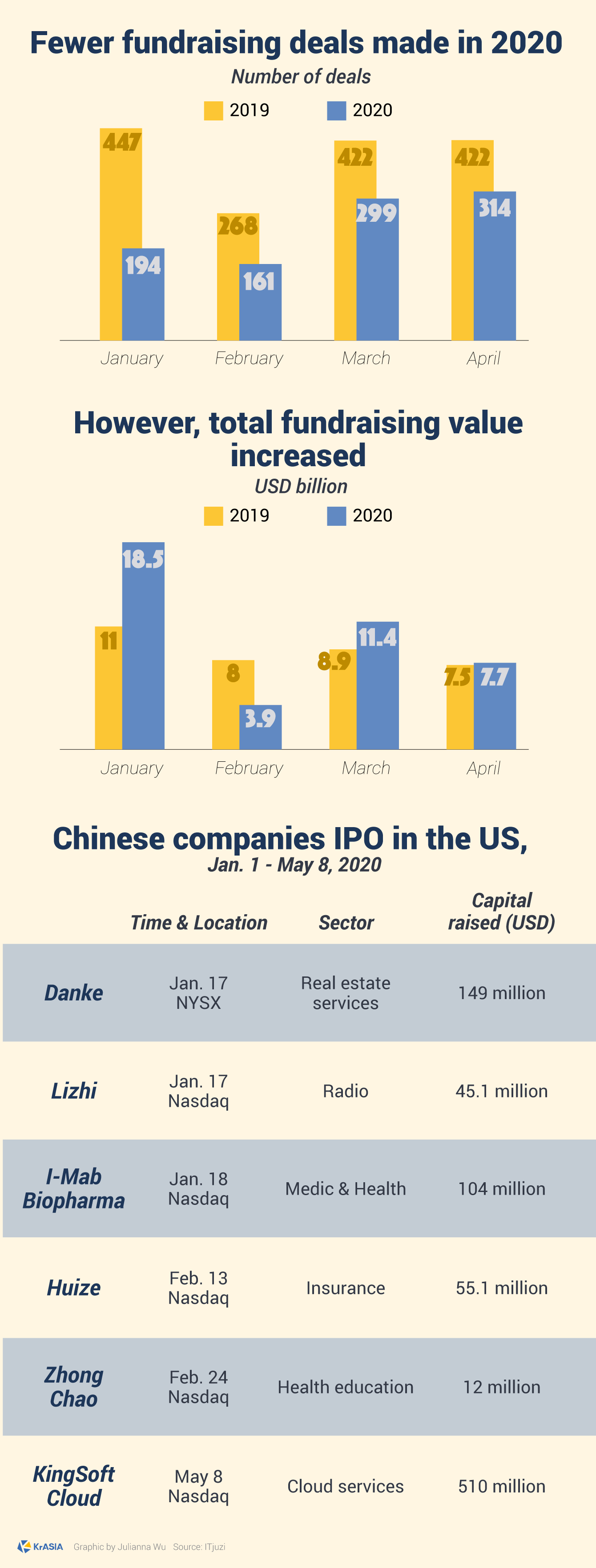

In the past months, as the Coronavirus erupted, China experienced the longest quarantine period in modern history and one of the major public health crises. The consequence? A 6.8% shrank in GDP and the most inactive first-quarter for investments in almost a decade.

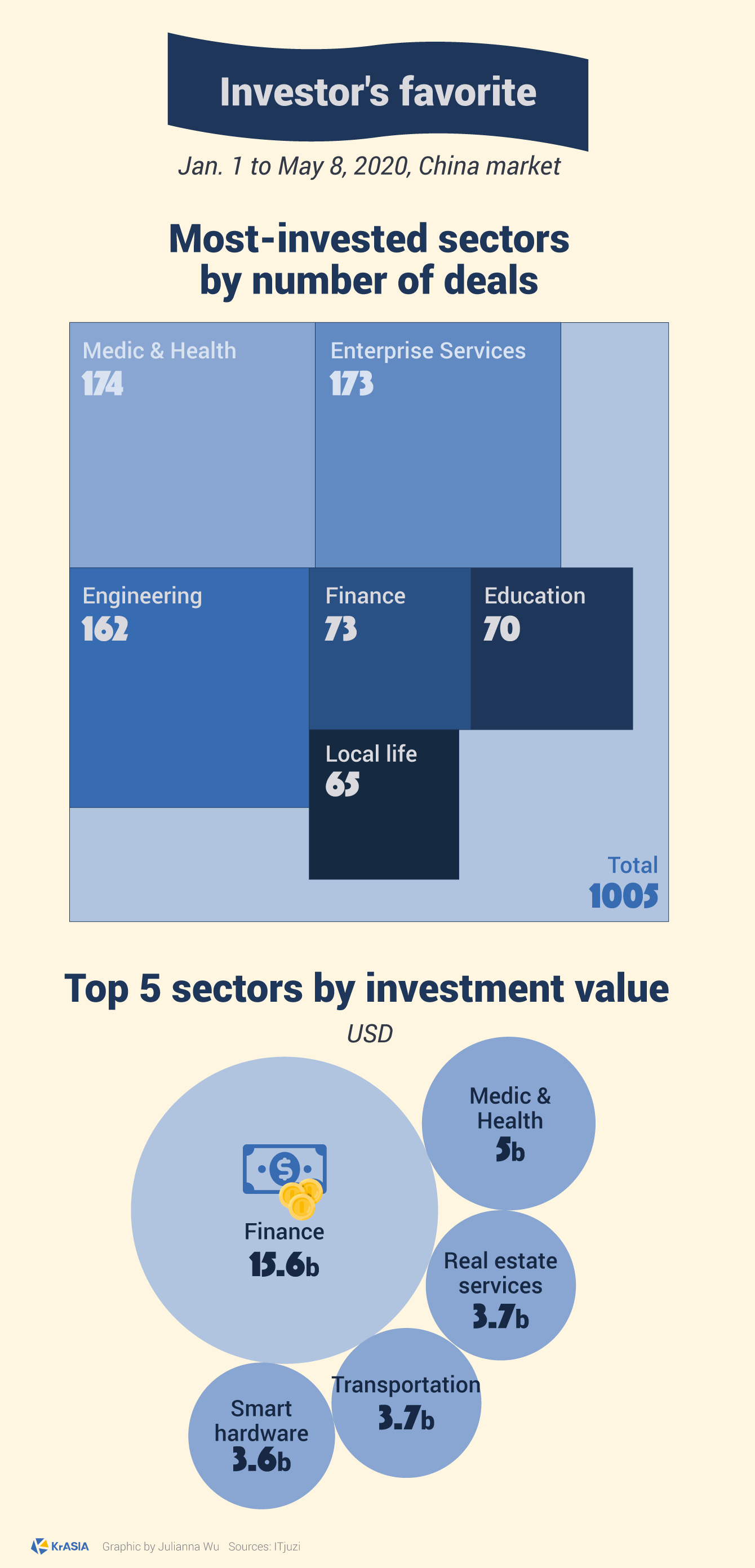

It’s not only bad news, though. There are industries and companies that have gained from the pandemic’s disruption of normalcy. They stood out in an upside-down business world and kept attracting fundings from investors.

In spite of the double pressure coming from the pandemic and the scandals involving US-listed Chinese companies, as of May 8, six firms from China went abroad to list on the US stock market, compared to nine in the same period of time in 2019.

The latest company, Kingsoft Cloud, made a solid Nasdaq debut with its stock price rising by 40.2% in its initial public offering on Friday 8, KrASIA reported. Kingsoft Cloud’s IPO comes after Luckin Coffee shocked the United States capital market by admitting inflated sales. Following Luckin, Baidu’s video platform iQiyi was also hit by fraud allegations, while Beijing-based TAL Education Group (NYSE: TAL) also disclosed sales fraud.

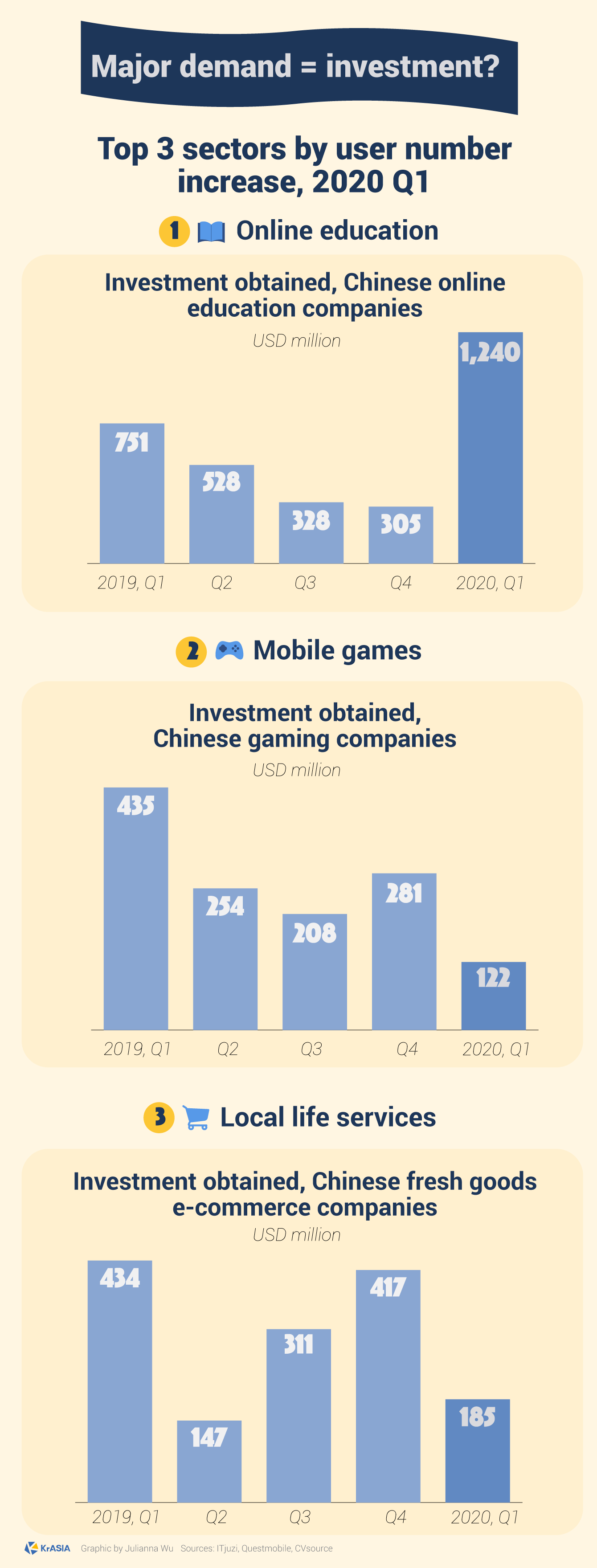

The public health crisis also led to an increase of users in some sectors. Many businesses that were hanging on the edge of survival in 2019, for example, fresh good delivery, saw a flush of new customers amid the coronavirus outbreak.

Other sectors, such as medtech startups and online education operators, had the opportunity to highlight their services amid the COVID-19 pandemic.

However, major demand has not generated the same investment attention for all industries. The gaming business, for example, though experienced a boom in both user numbers and gameplay time, still saw the lowest quarterly investment value in 2020.