Though a tad too late in China’s smart speaker industry comparing to other Chinese tech giants, Baidu, a prominent Chinese internet search engine operator, remains undeterred by the stiff competition.

Alibaba, Xiaomi, and JD.com have all launched their low-priced smart speakers.

On the 11th of June, Monday, Baidu launched Xiaodu, a new versatile smart speaker, with the capability of playing more than 7,000 music tags that associated with different scenarios or moods. It will be sold for RMB 89 (US$14), at one-third the normal retail price of smart speakers produced by its competitors.

The move comes as the third one for the giant over the span of a short 8 months.

‘’Over-priced’’ Baidu’s Raven H Smart Speaker

Towards the end of 2017, Baidu started its initial foray into the smart speaker sector with its very own, Baidu-made Raven H.

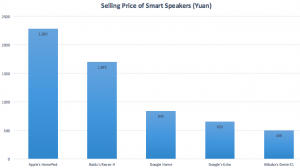

Boasting of its unique look and Baidu’s artificial intelligence platform, Raven H was priced up to 3 times the price of Alibaba’s Genie X1. The wide price difference was further exacerbated by Alibaba’s constant promotions of Genie X1.

The exorbitant pricing runs contrary to the mass market positioning of Baidu, given that its price is actually closer to Apple’s HomePod, a high-end audio gear.

Unsurprisingly, Baidu’s new speaker never took off.

While the very affordable smart speakers made by Alibaba and Xiaomi catapulted them to top market share position by Q1 2018, only 10,000 units of Raven H were manufactured, a far cry from the original 100,000 planned.

Blood-bleeding Price War

The greater the potential of the smart speaker market, the more intense the competition will be.

China today, boasts of the highest proportion of its people owning an AI device, such as a smart speaker, with a whopping 52% of its population looking to purchase AI-device in the future, according to a PwC Global Consumer Insights Survey 2018.

Baidu’s predatory pricing strategy could be the new approach, given its spectacular failure of Raven H.

Jing Kun, the general manager of Baidu’s Smart Living Group, even made it clear that the company is prepared to offer subsidies for its AI speakers until its funds run dry.

Still, the battle is far from over.

Chinese internet giant, Tencent is looking to hop on the bandwagon. Tingting, a mobile and battery-operated smart speaker, will be the company’s first AI smart home product. The company has also claimed that Tingting’s WeChat messaging capabilities via voice command.