A recent report by Galen Growth Asia, a healthcare innovation ecosystem builder, indicates that aggregate funding as at H1 2018 for Asia’s healthcare sector has surpassed funding levels for the whole of 2017 by more than US$550 million, reaching US$3.3 billion across 107 deals and ranking as the second largest health tech ecosystem globally by deal value despite heightened investor caution.

However, while deal size has grown, deal volume has declined – the number of deals for H1 2018 is 32% lower than the number of deals in the H1 2017 – a development that dovetails with a similar trend highlighted by a CB Insights/PwC report for Q1 2018, with investors being more risk-averse.

This is reflected in the larger proportion of Series C and Series D deals in H1 2018, compared with the early and growth-stage rounds previously observed.

Since 2016, early & pre-Series A deals for the healthcare sector peaked accounted for more than 50% of the deal volume in mid-2017. As of Q2 2018, they only accounted for 39% of deal volume. This is partially attributed to the higher chance for enterprise failure among healthcare technology startups at earlier stages.

Q2 2018 this year saw the largest volume of late-stage deals being closed, boosting the total funding for health tech startups.

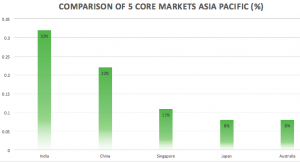

China and India account for 22% and 32% of healthcare technology investments in Asia, thanks to their sheer population size. In terms of IPO, China came the first with the $1.1 billion Ping An Hao Daifu IPO. Meanwhile, India’s investments, despite being the largest in Asia’s healthcare tech sector, fell by up to 42% Q2 2018 while China’s rose by 202% for the same period, with the rest of Asia growing 22.4%.

Singapore, Japan, Australia and Indonesia accounted for the rest of the healthcare technology deals, with Japan posting 10 deals and Singapore posting six transactions for H1 2018.

Japan’s deal volume could be rooted in the growing healthcare needs of its ageing society. Some notable deals in Japan that closed in H1 2018 include Genesis Healthcare, a genomics-related startup, and Cureapp, a patient solution startup. Meanwhile, Singapore retains its appeal thanks to its stable economy, solid legal framework, and government incentives, with UCare.io, a Singapore-based medical and data analytics startup, raising an $8.2 billion Series A.

Driven by its demographics, limited medical infrastructure & healthcare burden, Indonesia represents a significant growth opportunity for healthcare entrepreneurs.

Editor: Shiwen Yap