Asia could overtake North America as the global center for venture capital funding as early as next year, according to a study backed by a unit of Singapore state investment company Temasek.

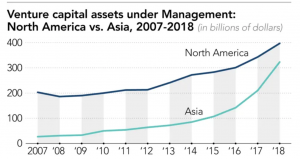

Asia-focused venture capital funds had USD 323 billion worth of assets under management at the end of last year, the report found, fast closing the gap with venture capital funds centered on North America, which had USD 397 billion worth of assets under management.

The USD 74 billion gap between the two regions stands in stark contrast to five years ago, when North America-focused funds led Asia-centered funds by USD 169 billion, said the study by Temasek subsidiary Vertex Venture Holdings and U.S.-based alternative assets information service Preqin.

“If we project those growth rates forward, it looks as though Asia-focused funds would hold more assets then North America-focused funds by the end of 2020,” Ee Fai Kam, head of operations at Preqin, told the Nikkei Asian Review.

The study, which classified venture funds according to which region they intended to invest the bulk of their capital — including specialist single-country funds and broader regional vehicles — found that Asia-focused funds have grown 30% a year, on average, since 2010, compared to 9% annual growth for their North America-centered counterparts.

As more investors seek access to cutting-edge technology, top-tier innovation hubs such as Beijing and Shanghai dominated the surge in Asia-focused investment, with the 10 largest Asia-based venture capital funds headquartered in China.

“There is no shortage of entrepreneurs targeting basic infrastructure-building, (like) payments, lending, and logistics — a breeding ground for new business model innovation,” said Jixun Foo, managing partner at GGV Capital, which has offices in Beijing and Shanghai. He added that rising disposable incomes and mobile phone penetration in Asia offers compelling business opportunities for a new wave of tech startups.

Asia is also driving the expansion of venture capital worldwide, with the number of institutions in Asia pouring cash into venture funds doubling over the past five years, as the U.S. share of global venture capital investors fell to 50% in 2018, from 55% in 2013, the study found.

Patrick Yeo, head of PwC Singapore’s Venture Hub, said that with investor demand mostly driven by returns, Asia offered more opportunities.

“From an investor’s perspective, they will steer and go towards markets where there are still opportunities to derive higher returns,” said Yeo. “Those tend to be developing countries, and the bulk of high-growth, developing countries tend to be in Asia.”

Southeast Asia’s profile has received a boost from a number of prominent startups including ride-hailing companies Grab and Go-Jek, which both enjoy valuations in excess of USD 10 billion.

A DealStreetAsia report released this month further underscored Southeast Asia’s growing momentum, showing that in the seven months to July 31, venture capitalists focusing on the region had raised USD 3.13 billion in capital commitments, surpassing the USD 2.12 billion raised in 2018.

Southeast Asia also enjoys strong government backing for entrepreneurship, backed by a rising, affluent, middle class, said Scott Russell, president for Asia Pacific Japan at German software provider SAP, whose SAP.iO Foundry fund based in Singapore is in the process of accelerating seven early-stage startups.

“We see innovative and ambitious startups developing across the region,” said Russell. “This is driving deal flow and overall interest from venture capitalists to invest.”

Vertex Holdings recently closed its fourth Southeast Asia and India fund recently at a record USD 305 million, and in September announced the latest addition to its global venture capital network, the Vertex Growth Fund, had raised USD 290 million to back tech startups in the growth stage.

Still, with a number of recent stumbles deflating the value of high-profile startups, including WeWork, and disappointing IPOs for companies such as Uber and Lyft, Vertex CEO Chua Kee Lock warned of tougher times ahead for entrepreneurs seeking heady valuations for their businesses.

“Entrepreneurs, by nature, believe that their company is worth more than what it is,” said Chua, adding that venture capitalists, on the other hand, have more reason to demand better justifications for high valuations before putting their money on the table.

“Some entrepreneurs are much more practical,” said Chua. “They realize that the market has changed: I cannot ask for USD 100 million now, I must ask for USD 14 million or whatever the number is.”

This article first appeared on Nikkei Asian Review. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei. 36Kr is KrASIA’s parent company.