As tech unicorns have lost some of their magic, it’s time to turn to “rhinos”—companies which arrive at USD 1 billion valuations based on their price-to-earnings (PE) ratios.

Nick Nash, co-founder of Singapore-based private equity firm Asia Partners and former president of Sea Group, describes rhinos as creatures with four attributes: they’re humble, thick-skinned, systematic and focused.

Founded in June this year, Asia Partners made its first investment in RedDoorz in August. The firm said the Singapore-based hotel startup fits its definition of rhino companies and is on the path to delivering tangible results. Asia Partners is looking to cut checks above USD 20 million to support high-growth tech companies in the region.

KrASIA spoke with the leadership team at Asia Partners to hear them dissect the funding gap in Southeast Asia. They explained why filling that gap is key to unlocking another wave of homegrown companies with billion-dollar valuations.

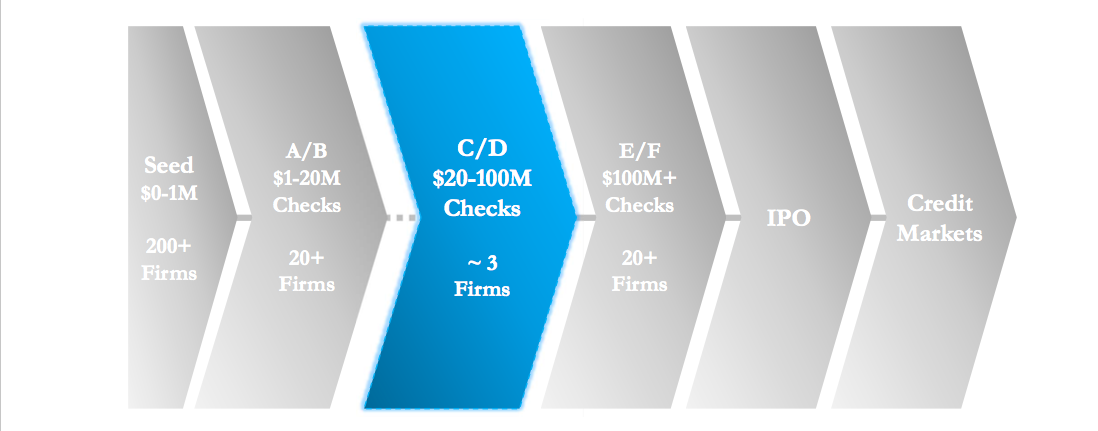

KrASIA (Kr): In your report, Southeast Asia’s Golden Age, you point out that the USD 20–100 million investment is the crucial bottleneck in Southeast Asia, forming a gap of nearly USD 1 billion per year. Why is there a “missing middle” in the region despite the influx of capital?

Oliver Rippel (OR): What is not in doubt is the existence of the gap. In China, about 30% of startups that raise a USD 1–20 million round, then “convert” to raising a USD 20–100 million round. In Southeast Asia, it’s just 20%. It’s a huge issue but also a huge commercial opportunity. There are only three firms that specialize in this growth equity segment in Southeast Asia, versus over two dozen in the upstream segment of USD 1–20 million.

It’s also very natural for the very small-end of the check size ladder to fill in first, with the middle coming in next. That’s very much what happened in China, where early-stage venture capital was dominant from 1993 to 2004, and then only in 2005 did growth equity emerge. Southeast Asia is about 11 years behind China in terms of affluence per capita, so it stands to reason that growth equity here would happen a bit later than in China.

What is surprising—and we think this is a function of the fragmentation of Southeast Asia—is that rather than happening “on schedule” in 2016, precisely 11 years after China growth equity emerged, it’s now happening in 2020. But better late than never, as they say, and it’s well-deserved by the terrific entrepreneurs of our region.

Kien Nguyen (KN): Frankly, it’s a bit of a puzzle as to why that is. Let’s try to answer the question by process of elimination. Is it because of a lack of market opportunity? The answer appears to be no. Southeast Asia is already several years into its golden age of affluence—the zone between USD 3,500 and USD 7,000 per year of income. And it’s home to 9% of humanity. Those two facts together point to a clear market opportunity.

Is it because of a lack of companies that are funded by earlier stage VCs? Again, here the answer is quite clearly no. Our report shows that there were over 500 Series A and B stage investments—that is, USD 1–20 million equity checks—from January 2014 to October 2019. And if Southeast Asia had the same conversion statistics as China, about one-third of those should scale over time to be ready for USD 20–100 million equity checks.

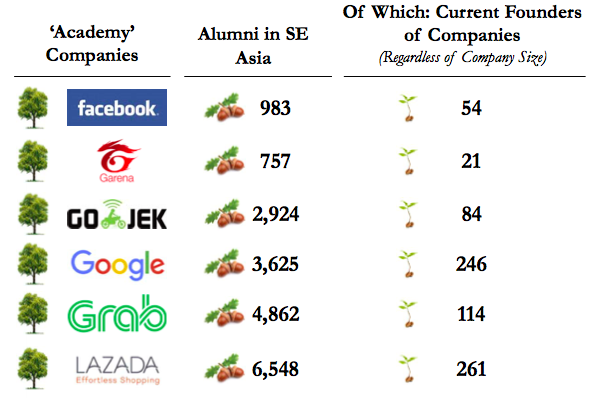

Is it a lack of talent? Again, the data show a clear story: no. One key measure is the amount of on the job training. There are now 28,000 alumni of the first generation of internet platform companies, both homegrown and global players, and over 1,000 of those graduates have founded companies in Southeast Asia. While the region would clearly benefit from more computer scientists and data scientists, that’s not going to hold back the inevitable.

It’s important to look upstream to the suppliers of capital to potential growth equity firms that would serve the USD 20–100 million segment. That is the global limited partner community, or the LPs. Over the past decade, the deep success of technology investments in China has understandably encouraged many of the world’s LPs to focus on China, with somewhat less emphasis on emerging markets.

India has been disappointing for many LPs in the past decade—quite the contrast to China—and frankly we sense that many LPs are assessing whether Southeast Asia will be more like India, or more like China. Our research indicates the latter is a much more likely “movie trailer” for Southeast Asia, and sharing it widely has helped to advance the global perception of the region.

The larger check sizes, beyond USD 100 million, are much more competitive than the USD 20–100 million segment. In the segment north of USD 100 million, there are already a large number of global investment firms that are looking to place larger bets.

Kr: Back in those days, what did it take for China to fill the USD 20–100 million gap? What lessons can Southeast Asia learn from what unfolded in China?

KN: Southeast Asian average annual income per capita today (USD 4,600) is equivalent to Chinese real incomes about 11 years ago. China went through its golden age of GDP per capita between USD 3,500 and 7,000 from 2003 to 2013, and it was during that era when the giant internet companies went public. In fact, in today’s market cap of technology companies in China, 68% by value went public in or around that golden decade.

The challenges for Southeast Asia and companies operating across these markets will be the ability to navigate multiple languages, cultures, and jurisdictions. However, having been in the region over the past decade, we have seen tremendous progress in integration. It’s now faster to go from Ho Chi Minh City to Singapore than to Hanoi, and air travel between various countries are getting more and more seamless and visa-free. Smartphones will also help make cross-border operation simpler for a large number of business models.

Kr: Asia Partners has been talking about the rise of rhinos, which are companies that reach USD 1 billion valuations based on their PE ratios. Many of the region’s unicorns are in ride-hailing or e-commerce. Where can we find the rhinos?

Nick Nash (NN): One of the remarkable facts about the Southeast Asian ecosystem is the uneven distribution of capital allocation. There are over a dozen compelling sub-sectors that will likely support billion-dollar value companies over time. Many of them will go public, but the vast majority of capital raising to date in dollar terms has been for a subset of those sub-sectors, particularly ride-hailing and horizontal e-commerce.

That’s a terrific investment opportunity, since investment returns are often inversely proportional to how much capital has been raised overall in the subsector. We love finding those somewhat underappreciated subsectors and backing the emerging winners.

KN: The first wave of unicorns were mostly valued based on sales. The cash-burning game to build scale we have seen in e-commerce and ride-hailing will continue. However, as the startup ecosystem in the region matures, we will start to see companies that are likely not in mainstream segments that investors have focused on historically, but relentlessly deliver sustainable and profitable growth. These are the “rhinos” that we are looking for.

OR: The story of Southeast Asia is only half-written. Our study shows that out of the key business models that have generated publicly traded technology companies in China, only half have generated public companies in Southeast Asia. The story of the next then years—the 2020s—is about fulfilling that clear potential.

Kr: The firm’s made its first investment in August with RedDoorz, a Singapore-based hotel startup looking to capture Southeast Asia’s burgeoning budget accommodation market. How does RedDoorz fit your definition of a rhino company?

OR: We see in RedDoorz all the characteristics that fit our “rhino” definition. The company’s operations are deeply local, rather than trying to solve problems in all of the world’s markets simultaneously. The focus is clearly Southeast Asia, having first started out in Indonesia with a city-by-city focus, and now with a significant presence in Singapore, the Philippines, and Vietnam. And they have an asset-light strategy, with true local knowledge, that exemplifies the rhino approach. Amit Saberwal [RedDoorz founder and CEO] and his management team are extremely focused in what they do to deliver results for shareholders.

Kr: The US and China are in the middle of a trade war and some analysts have pointed toward the fact that Southeast Asian countries have benefited from that development, as manufacturers have to flee China. Have we taken advantage of this power struggle sufficiently?

OR: What is more predictable is that Southeast Asia has strong inherent positives, which are shining brightly through the more foggy outlook for global growth. Its golden age is self-generated, rather than anchored on inbound investment as a primary driver.

The 20th century had three key consumer markets: the United States, Japan, and Europe. The 21st century has India, China, and Southeast Asia, with Southeast Asia as the European equivalent. And just like Europe, the multi-jurisdictional diversity is a challenge, but ultimately a positive. It creates opportunities for national specialization—witness Singapore playing a similar role to that of Great Britain as a financial hub for the region.

NN: [British economist] David Ricardo was right: in purely economic terms, no one really “wins” a trade war. They are always Pyrrhic victories for the participants, if even that, and often create turmoil and uncertainty for non-combatants.

The interview was edited for clarity and brevity.