Soccer moms in the United States often favor SUVs for their spaciousness, but in some places in China, parents prefer smaller cars. Tan Yang, a 39-year-old full-time mom and part-time photographer in the Southern city of Liuzhou, purchased a Wuling Hongguang mini electric vehicle in March so she could drive her son from their home to kindergarten and back.

Tan’s reasons behind the choice? The car’s avocado shade and the newly added airbags, which its first generation lacked. “As a local enterprise, Wuling has a large customer base here; you can see Wuling EVs everywhere,” Tan said, recognizing the car’s ubiquity as dependability. Besides, it’s easy to park her mini car.

China is the largest car market and second largest EV market in the world. Sales in the country represented 41% of global EV transactions in 2020, next to 42% for all of Europe, according to tech market analyst firm Canalys. As this sector continues to boom, domestic automakers are in a race to claim their corner as drivers ditch combustion engines for battery packs, but few have managed to distinguish themselves among cutting-edge car brands that are driving China’s vehicular electrification.

“Many Chinese brands are still testing the waters, and not many are as unique and memorable as Wuling Hongguang,” said Ray Ju, associate director of Labbrand New York, a brand consulting agency. Starting at RMB 28,800 (USD 4,500), the Wuling Hongguang mini EV topped new energy vehicle sales with 26,592 units, beating Tesla in year-to-date sales up to May, according to the China Passenger Car Association (CPCA). Specifically, the company received over 10,000 pre-orders in under 24 hours in late March, Yicai reported. It’s a case of Wuling setting itself apart from a bouquet of options for EVs in a sector that is becoming more crowded with each passing month.

Great minds think alike?

Typically, a gas car takes five to six years to go from the drawing board to rolling off the production line. But an EV, with complex combustion engines replaced by electronic and electrical systems, needs just two to three years to progress from zero to road-ready, experts say. Alongside rapid technical development are fleets of specialists who set out to cultivate distinct perceptions for each car.

Ju observed that many conventional automakers started the process of creating new brands in 2018, and they tended to follow similar trajectories. “They all want to be premium to differentiate themselves from the everyday cars on the street. They want to demonstrate their technological innovation and vision for sustainability,” he said.

Additionally, many EV makers in China have been eager to demonstrate elements of the “Chinese Dream,” Ju said. The term was coined by President Xi Jinping in 2012 and is associated with ideas of collective endeavors and national rejuvenation.

Labbrand has worked on the Chinese and English naming as well as the logo of Voyah, a high-end EV brand of state-owned automaker Dongfeng Motor, which is due to deliver its first orders in Q3 2021. “Our brief from the client for Voyah has made things like the Chinese Dream and Chinese innovation a prominent point,” Ju said. Dongfeng Motor eventually went with Lán Tú as the name of its first EV, a term that evokes crisp valley winds and grand perspective, and is a homophone of “blueprint.”

Referencing grandiose rhetoric isn’t just about pledging a brand to a larger political cause. From a technical point of view, when it comes to personal vehicles, the fact is there are few fresh angles to cultivate, “given the complexities and limitations of cars as an industrial product,” said Shin Muto, founder and director at Shanghai-based Hylight & Partners, an automotive-focused design consultancy that has shaped Weltmeister’s vehicular exteriors and interiors.

Appealing to the world’s pickiest customers

Car buyers in China are “among the smartest and toughest consumers in the world,” according to Muto. They seek maximum bang for their buck, so a brand’s heritage may not carry weight in their purchasing decisions, unlike buyers in the West.

Wuling’s mini rides are memorable not only because of their petite footprint but also for their “macaron” paint jobs. Yet, how do the makers behind regular-sized sedans differentiate from each other as fleets of new makes and models become available to the public?

Although reasons like pricing and subsidies encourage some Chinese consumers to open their wallets, image is still the determinant factor. As early adopters of EVs, 35-year-old Li Yalin and her husband bought Nio’s first edition ES8 in 2018. Having driven it for three years, she was impressed by the overall experience. “Its design really fits my aesthetics; the recent models look premium, unlike other Chinese brands,” Li said.

Over in Suzhou, Zhu Yuyi, a 30-year-old university lecturer, is considering buying a car for work purposes. In his case, the car’s body style matters the most. Zhu favors BYD’s Han, a midsize luxury sedan that is currently the third best-selling EV model in China. “The look really appeals to a young person like me. I learned that Mercedes-Benz’s former chief designer designed its exteriors, and it has incorporated elements from popular models.” He’s leaning toward getting a hybrid but hasn’t made a final decision yet.

Consumers buy into how their own lives and a brand’s vision gel with each other, so what EV makers can offer beyond just a vehicle is key, according to Muto. “Nio represents a new lifestyle and offers a cool AI assistant and unique experiences, while Xpeng targets a separate segment with lower price points,” he said. In the case of Tesla, the “added value” may be the company’s vision to counter climate change and Elon Musk’s irreverent public image; it appeals to young consumers for being the cool and aspirational automaker, leaving incumbents in the dust at the starting line.

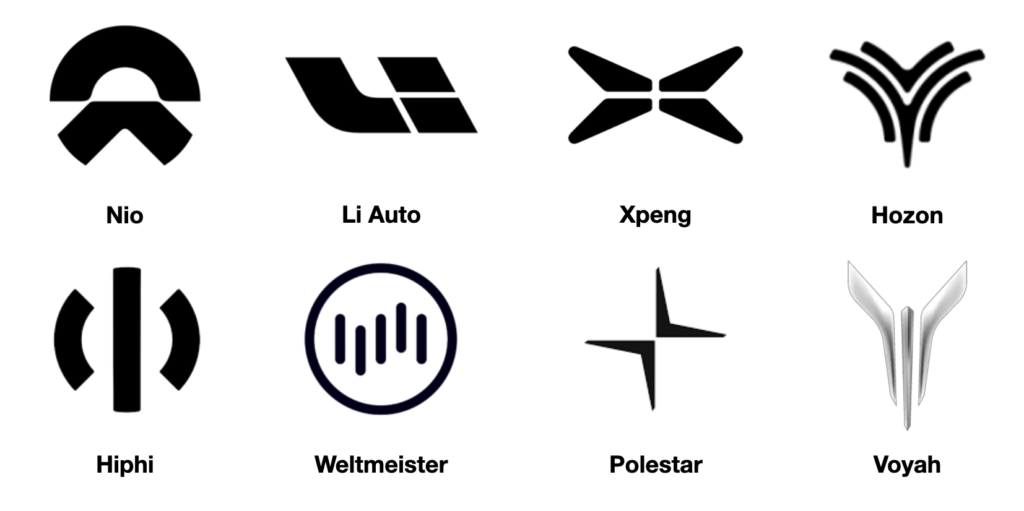

At the moment, Wuling, Tan’s favored model, is relatively unknown outside of China; other brands have a higher profile overseas, and some are even listed in New York. Forerunners include Nio, Li Auto, Xpeng, and Weltmeister. Meanwhile, tech giants like Xiaomi and Baidu have also joined the EV race, and conventional automakers like BYD and Dongfeng are making promising transitions to EVs. Volkswagen Group said it will launch six new electric models in China this year, including a China-only model ID.6.

The mix gives a glimpse of what a mature EV market looks like—a blend of familiar names and ambitious newcomers, with cars of all sizes and traits to suit each driver’s needs. If you think that there are already too many similar-looking EV logos and car models, then there’s plenty more where that came from.