A relative newcomer to China’s e-commerce scene, Pinduoduo was founded in September 2015. In the past four years, the company quickly found loyal customers and established itself as a household name. By the end of the second quarter in 2018, it surpassed JD.com to become the second largest e-commerce company by annual active users. The company has only strengthened its standing since then. In the 12 months leading up to the end of September this year, 536.3 million buyers made purchases on the platform, marking year-on-year growth of 39%.

In its development, Pinduoduo is cracking a problem that companies like Alibaba and JD.com are struggling with: Where will they find new users?

Alibaba set an eye-watering sales record during the Singles’ Day sales bonanza on November 11, surpassing USD 38 billion. Yet behind that number was the conglomerate’s slowest year-on-year growth ever at a mere 26%.

Unlike Alibaba’s Taobao or JD.com, Shanghai-based Pinduoduo encourages users take part in bulk purchases to reduce the prices of products on its online platform, which covers everything between fresh cabbage, toiletries, and iPhones.

Pinduoduo incentivizes users to share links on social networks like WeChat and QQ, allowing them to form shopping groups. It’s a way of shopping that is particularly popular with people living in China’s lower-tier cities and rural areas.

The company has also used an aggressive strategy of using coupons, discounts, and other giveaways to attract new customers. In August, Pinduoduo started a 12-day online sales promotion for produce, collaborating with 20,000 merchants to generate 100 million orders.

A market for “second-rate” products?

So far, despite operating in an increasingly crowded market, Pinduoduo’s approach to slashing prices has paid off.

Pinduoduo has been dogged since its inception by a reputation for hawking “second-rate” goods, with mentions of its brand on social media often associated with cheap or poorly made products of questionable origins.

Still, Pinduoduo has shrugged off its reputation to succeed where others have failed. During its inaugural Singles’ Day promotion last year, it managed to rake in RMB 940 million (USD 133 million) worth of sales, surpassing that of Guangzhou-based Vipshop, another Chinese e-commerce outlet known for using major discounts to attract customers to buy branded goods.

Both Pinduoduo and Vipshop—which are listed in the United States on the Nasdaq and New York Stock Exchange, respectively—have also seen contrasting fortunes. Since going public in July last year, Pinduoduo’s market capitalization has shot over USD 36 billion, more than four times that of Vipshop, which had its IPO in 2012.

Yet despite its spectacular growth, there are storm clouds emerging over the horizon for Pinduoduo.

Third quarter results released on November 20 fell short of analyst estimates across the board. Gross merchandise volume stood at RMB 840 billion (USD 117.5 billion). This represented a growth of 144% year-on-year, well below the estimate of 173% forecast by 36Kr Research.

Total revenue reached USD 1.05 billion, up 123% year-on-year. But this was below market estimates by around USD 30 million, and down from the previous quarter, when revenue grew by 169% compared to the same time last year.

The price of Pinduoduo shares plunged by over 20% after the company’s earnings report was released. By the end of the trading day, the company was trading at USD 31.40 per share, down from the previous day’s USD 40.72.

In a further blow to investor confidence, Pinduoduo’s competitors made significant inroads in capturing a key part of its customer base—the shoppers of China’s lower-tier cities.

In August, Alibaba announced plans to host an annual “99 Bargain” festival on its Juhuasuan retail platform, which offers products at highly discounted prices for short periods of time. The flash sale, which will last for 10 days every September, is designed to attract shoppers located in towns outside China’s major economic hubs. They’re typically less likely to be loyal to specific brands, and seek out the lowest prices instead. The company also launched four operational tools, including a cleaner sales interface, designed to help brands attract less frequent or first-time buyers.

JD.com has in turn leveraged its reputation for quick delivery times to target consumers in China’s tier-4, tier-5, and tier-6 cities — in other words, small cities and counties. Dubbed the “46/24” plan, the company announced in October that it will deliver packages to customers within 24 hours after they click “confirm order,” even if they live in remote villages in far-flung Xinjiang. JD.com is also angling to mimic Pinduoduo’s stickiness on social media by launching a standalone social e-commerce app called Jingxi, a mini-program of which is also available on WeChat.

Pinduoduo’s new gamble

While Pinduduo fends off challenges on multiple fronts, it has been dragged into an aggressive price war with market leaders like Suning, JD.com, and Alibaba, which burn billions on major sales events and giveaways.

Data from QuestMobile, which provides research on China’s mobile market, suggests that the company’s ability to retain customer loyalty is in doubt. More than 80% of consumers from low-tier cities appear to be primarily concerned with their bottom line. They spend less than RMB 1,000 on online purchases each month, with over 42% spending no more than RMB 200.

This puts Pinduoduo at a disadvantage against larger firms with hefty financial firepower. The established juggernauts that Pinduoduo must face off with can more aggressively slash prices to target consumers that are sensitive to price fluctuations and bargains.

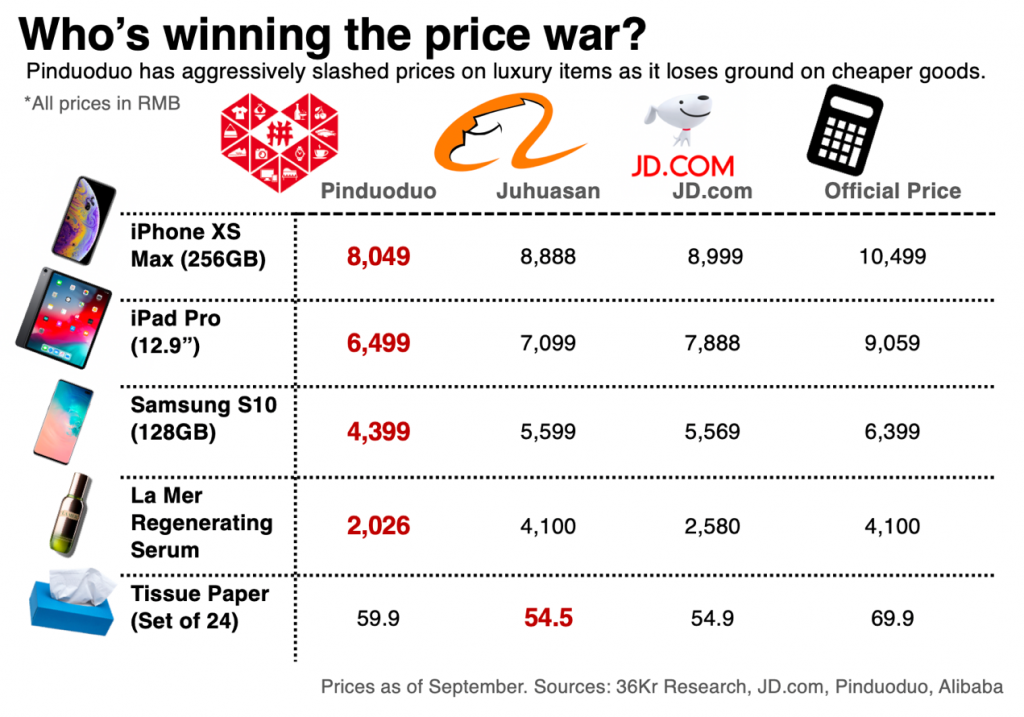

Analysis from 36Kr Research suggests that the company has changed tack in the face of competition, choosing to offer discounts on luxury goods, pivoting from their previous focus on low-cost merchandise.

In June, Pinduduo partnered with some brands to provide RMB 10 billion in subsidies to keep the prices of popular products on its sales platform lower than its competitors.

Initial comparisons show that subsidies have primarily been channeled toward electronics and luxury skincare products. For instance, the Samsung S10, iPhone XS Max, and anti-wrinkle cream sold at significant discounts compared to listings on JD.com and Alibaba’s Juhuasuan.

Pinduoduo has in turn been edged out on goods like diapers and tissues, which retail at a lower price on Juhuasuan. Analysts say that Pinduoduo may be seeking to attract new customers from the growing middle class in China’s major cities—a move that greatly deviates from its previous sales strategy. While the e-commerce giant has managed to attract more active buyers compared to rivals like JD.com, the weaker spending power of its low-income customer base, and the low profit margin inherent in the sale of cheap household goods and groceries, have led the company to incur more losses. In fact, at the end of September, Pinduoduo’s monetization rate averaged at just 3%.

But Pinduoduo’s new gamble to tap customers with higher disposable income may backfire. Targeting high-end consumers means having to fight its e-commerce rivals on their own turf, with many already offering perks to attract the loyalty of more demanding shoppers. For example, JD.com offers faster deliveries.

It is also unclear whether Pinduoduo can sustain long-term rebates to attract and retain the loyalty of new consumers as it burns through significant sums of cash. The firm announced plans in September to borrow up to USD 1 billion in convertible debt to buoy its operations.

Initial data from Super Symmetry Technologies, a market research firm, suggests that Pinduduo’s rebate scheme is working, with the average selling price of its products rising to RMB 41—up from RMB 35 in the second quarter. But it remains to be seen if this upward trend will continue.

For now, the company risks being squeezed from both sides, as its customer base erodes. As Pinduoduo confronts growing pains, it faces the same pitfalls that have befallen other discount-based e-commerce platforms in the past, such as international service and travel platform Groupon. Like the US-based firm, whose customers were drained away in a race with deep-pocketed competitors, Pinduoduo risks becoming the victim of its own success.

The original article was written by Cecilia Xu and Jia Baoqi for 36Kr, KrASIA’s parent company. The English version was adapted by Low De Wei and Song Jingli.