App developers are taking advantage of a surge in interest in mobile dating across Southeast Asia where spending in some countries has surged by up to 260% over the last three years.

According to mobile data and analytics company App Annie, would-be lovers in Indonesia, Malaysia and Singapore have led the shift to handheld devices.

Indonesians spent USD 5.8 million on mobile dating apps last year, compared to USD 1.6 million in 2017, a 260% increase. Malaysians also spent around USD 5.8 million on dating apps last year, up from USD 1.8 million in 2017.

“The triple-digit growth in Malaysia and Indonesia illustrates that there is a strong demand for such services in the region,” Cindy Deng, App Annie managing director for Asia Pacific, told the Nikkei Asian Review. “The size of the population, access to smartphones and the pace of mobile internet will continue to play a key role for the growth of these apps.”

As more people have success finding partners through their electronic devices, Deng added, mobile dating platforms have further entrenched themselves into the modern day matchmaking culture.

Singapore singles accounted for the biggest spend of any Southeast Asian country, shelling out USD 7.1 million last year, up from USD 3.9 million in 2017, which App Annie attributed to the country’s higher per capita income.

“Spend on online dating services in any market is directly dependent of two main factors — market affluence and the absolute size of the smartphone audience,” said Kabeer Chaudhary, managing partner for Asia-Pacific at digital media agency M&C Saatchi Performance.

“While Singapore has a much more affluent audience than Indonesia and Malaysia, their growth in smartphone audiences is limited,” Chaudhary noted, adding that the sheer numbers of users in the two larger countries will drive future increases in their app spending.

Southeast Asia’s potential has not been lost on app makers, with several developers increasing their efforts to capture growth across the region as more singles lean on technology to connect with each other.

Match Group, which owns the popular Tinder dating app, has said it has made dating products in Asia a priority, appointing a general manager for South Korea and Southeast Asia last year as well as setting up offices Japan and Indonesia.

Social dating app Bumble has partnered with the Singapore Tourism Board to offer a service aimed at helping professionals network and make contacts, while the Dating.com Group has stated that it is on the lookout for dating company acquisitions in Asia to fuel its growth.

Globally, App Annie said consumers spent over USD 2.2 billion on dating apps last year — twice the amount spent in 2017. And while Tinder led the pack, other newcomers are starting to catch up.

In Southeast Asia, where digital penetration is exploding as more people get their hands on the latest smartphones, App Annie said platforms such as Coffee Meets Bagel and China’s Tantan ranked among the top 10 mobile dating apps.

Overall, mobile users in Southeast Asia downloaded 13.2 billion apps of all kinds last year — a 20% increase from 2017, with Indonesian consumers alone downloading 6 billion apps last year — a 40% increase since 2017.

Indonesia ranked fifth last year in terms of the highest number of apps downloaded by country — behind China, India, the US, and Brazil.

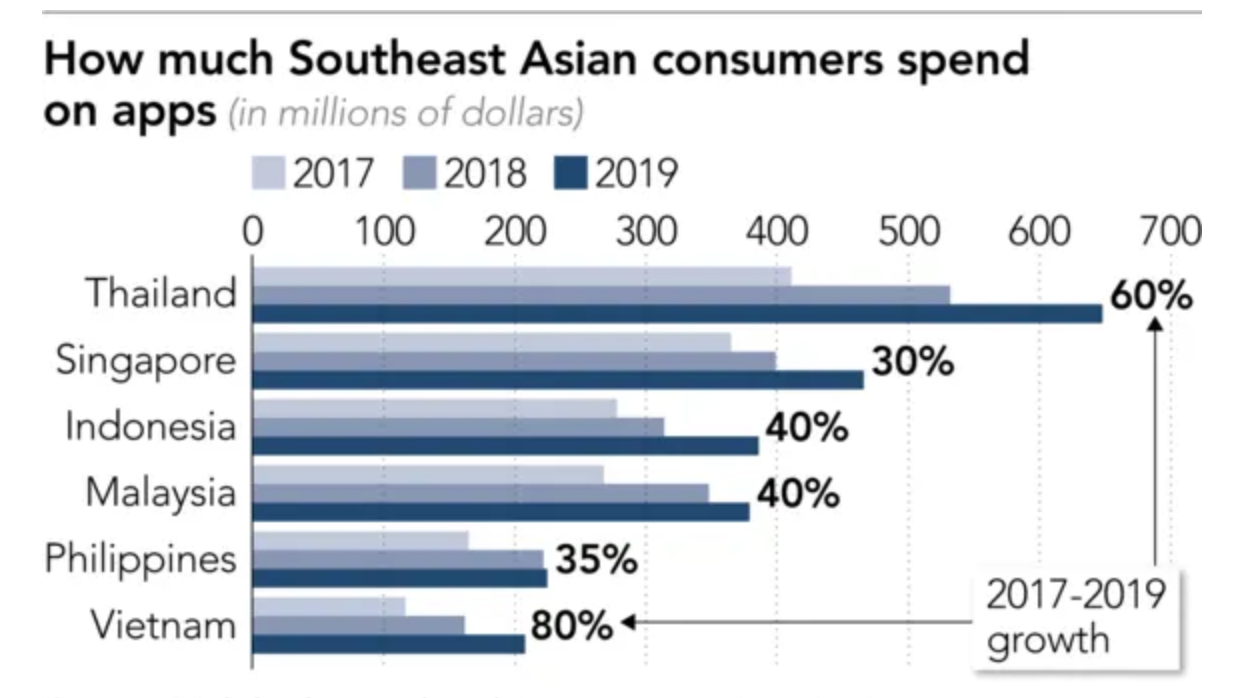

When it came to consumer spending on apps in Southeast Asia, Thailand took the top spot, generating USD 648 million in annual mobile revenues last year, up 60% since 2017.

Singapore was in second spot with USD 466 million last year, followed by Indonesia at USD 386 million, Malaysia at USD 379 million, the Philippines at USD 225 million and Vietnam at USD 208 million.

This article first appeared on Nikkei Asian Review. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei. 36Kr is KrASIA’s parent company.