E-commerce platform Lazada made an unusual call for cooperation in an industry better known for cash-burning competition and bids to “lock in” both users and merchants.

As it tries to claw back the top spot in Southeast Asia’s e-commerce market now taken by Singapore-based Shopee, Lazada told Nikkei Asia it will invest in logistics, payments, and mobile shopping.

The online store is owned by Alibaba, which also faced antitrust fines in its home market of China, where the state banned internet giants from blocking links to one another’s platforms and other exclusionary practices.

In Vietnam, Lazada once had what a co-founder called nearly unbeatable dominance, but Shopee, owned by Nasdaq-listed Sea Group, has pulled ahead by internet traffic in markets from Vietnam to Thailand to the Philippines.

“We believe that working together is the way forward,” a Lazada representative said. “While we compete to give consumers the best options and solutions, industry players should work together to drive sustainable progress by creating an open network in this digital economy.”

It is unclear how competitors would keep networks open, though Lazada Group CEO Chun Li has cited lessons learned in China and criticized “walled garden super apps,” which aim to meet as many customer needs as possible on a single platform. Instead, Li argued, companies should collaborate to give shoppers multiple online and offline channels.

The push to tear down the walls between tech platforms is gaining traction more broadly. The European Union, for example, recently agreed on rules aimed at forcing large “gatekeeper platforms” like Google and Apple to open up their systems to other businesses. People soon could send messages from WhatsApp to Signal, for instance, just as they can send emails or make phone calls across rival providers.

In the e-commerce field, payments are one way that platforms have tried to edge out competition.

An ex-CEO of Lazada Vietnam, Chris Beselin, told Nikkei at the end of 2020 that locking customers into proprietary digital wallets would have been a “holy grail” for e-commerce players, but that has not proved feasible.

Other ways that platforms could still try to lock in customers involve “making it more difficult to leave, rather than making it more attractive to stay,” such as giving them loyalty points that can’t be used elsewhere, said RMIT University Vietnam finance lecturer Kok Seng Kiong.

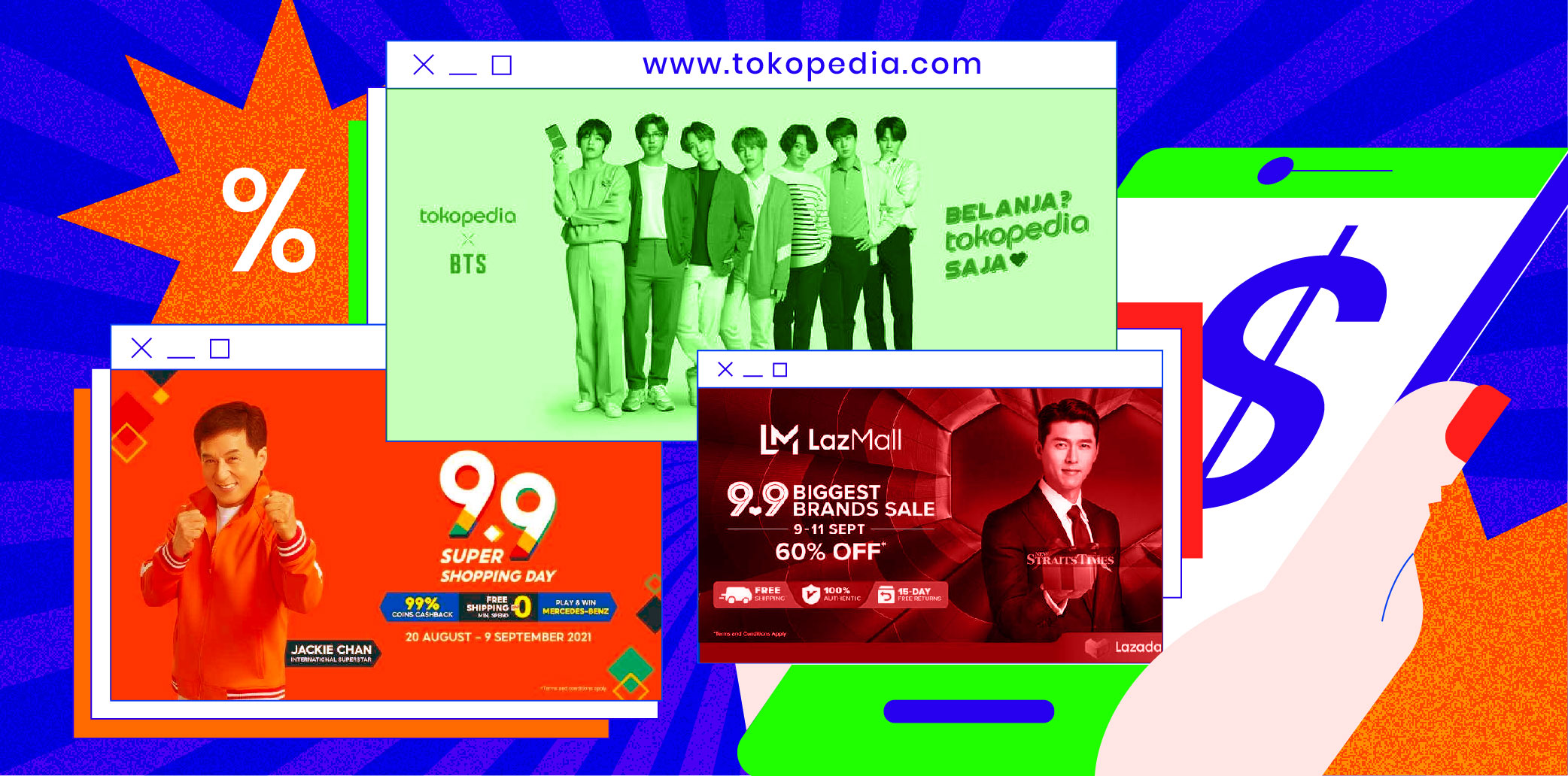

Currently the marketplace strategy is to entice customers with mega-sales on days like November 11—the date of Alibaba’s massive “Singles’ Day” sales in China—raising questions about how many shoppers will return if the monthly promotions don’t.

“Deep-pocketed e-commerce firms’ … objectives may just be to outlive—as opposed to out-profit—the competition,” Kok told Nikkei.

Among Southeast Asians, 73% now consider e-commerce an important part of everyday life, up from 60% in 2020, according to a survey conducted by Milieu Insight and released by Lazada last week. The highest figure, 81%, came from Vietnam, which had the region’s toughest COVID-19 lockdown last summer, when residents were fined for leaving their homes and workers slept at factories.

Lazada announced the survey to coincide with its tenth birthday. A decade ago Beselin, who no longer works at the company, co-founded Lazada Vietnam before it was bought by Alibaba.

“The position that Lazada had in Vietnam shouldn’t have been possible to overtake by a new entrant like Shopee,” he previously said by phone. “But still they did. And it can flip again.”

Despite its popularity on Facebook and early-mover advantage, Lazada ceded pole position to Shopee, which in the fourth quarter attracted the most Vietnamese users on the Web, smartphone apps, YouTube, and Instagram, according to iPrice Group. Shopee initially was known for its focus on third-party sellers and for making free shipping so popular that “free ship” became English slang in Vietnam, though rivals Lazada, Tiki, and Sen Do now have similar business practices.

This article first appeared on Nikkei Asia. It has been republished here as part of 36Kr’s ongoing partnership with Nikkei.