Six years ago, Autohome introduced e-commerce-style promotions to the automotive sector with its inaugural “818” car shopping festival. Initially viewed as a seasonal campaign, essentially a car-focused counterpart to Singles’ Day, it was considered a one-off sales event.

Today, the festival has matured into a broader platform for experimentation. Now in its seventh year, it acts as a staging ground for new business models, emerging technologies, and evolving marketing strategies.

This year’s edition, which began on August 1 and runs through September 30, carries the theme “20 Years of Trust, Smart Future with AI, Powered by Love,” reflecting both a celebration of the company’s legacy and a forward-looking embrace of artificial intelligence. The campaign fuses nationwide subsidies, offline activations, and digital perks to deliver an immersive, tech-enhanced consumer experience.

Drawing on years of operational and brand development experience, Autohome’s recalibrated market strategy is beginning to show up in its financial performance. The company reported revenue of about RMB 1.76 billion (USD 246.4 million) for the second quarter of 2025, with online marketing and other business segments posting 20.5% year-on-year growth. These gains highlight steady progress in integrating retail, marketing, and financial services.

Building on this momentum, Autohome is transitioning from a vertical media platform into a full-stack service provider within the automotive value chain, leveraging AI, online-to-offline (O2O) infrastructure, and a growing international presence.

From traffic to ecosystems: The evolution of IP

While earlier editions of the 818 festival focused on boosting online traffic through flash sales, this year marks a shift toward ecosystem building.

According to Wu Jiang, senior vice president at Autohome, the company is now prioritizing value delivery. Central to that shift is a series of cash-equivalent subsidies designed to reduce purchase costs for consumers and incentivize more meaningful transactions for merchants.

These subsidies extend across the entire customer journey. Online, Autohome has consolidated funds from national, regional, OEM (original equipment manufacturer), and platform-level programs. Offline, it offers experiential perks such as showroom gifts, test-drive incentives, and gamified rewards. Music festivals and mobile gaming events further enhance engagement, contributing to an immersive, consumer-centric experience.

The company has also restructured its budget. It has moved away from celebrity-driven galas and instead focused resources on tangible benefits for car buyers. New engagement tools have been introduced, such as multichannel reward redemption, a live streaming ecosystem, and influencer-led interactions. These additions mark a shift from traffic generation to value-sharing across the supply chain.

At the festival, Autohome is formally introducing its AI initiatives. These include previews of AI-powered buyer assistants, AI-guided test drives, and a VR (virtual reality) automotive film experience. Through these features, the company aims to bridge the gap between online research and offline purchasing, offering personalized support throughout the customer journey.

For businesses, Autohome has rolled out an AI toolkit to support marketing, lead generation, sales enablement, and used car valuation. These tools are designed to reduce costs and improve operational efficiency for manufacturers and dealers alike.

In this iteration of the festival, Autohome is placing less emphasis on steep discounts and more on showcasing its “All in AI” strategy and expanding its O2O capabilities.

Why now?

Part of the shift is being driven by changing consumer behavior. Price is no longer the sole deciding factor for car buyers. Increasingly, consumers expect experiences. Many want to see how vehicles perform under real-world smart driving conditions, not just compare technical specifications. Autohome is responding with a more holistic O2O ecosystem, enabled by AI, to meet those expectations.

At the same time, industry dynamics are shifting rapidly. Over the past two years, China’s automotive market has grown more competitive, shaped by the rise of new energy vehicles (NEVs), widespread adoption of smart driving technologies, and sustained price competition. According to the China Passenger Car Association, retail passenger vehicle sales rose 10.8% in the first half of 2025. Yet profits declined 11.9% between January and May, with margins falling to 4.3%, below the downstream manufacturing average of 5.7%.

This margin squeeze has prompted many Chinese automakers to look overseas. In 2024, China exported more than five million vehicles, making it the world’s largest car exporter, according to the China Association of Automobile Manufacturers.

Autohome is adjusting in parallel. What began as a domestic media platform is now evolving into a global ecosystem provider, serving users, partners, and international markets.

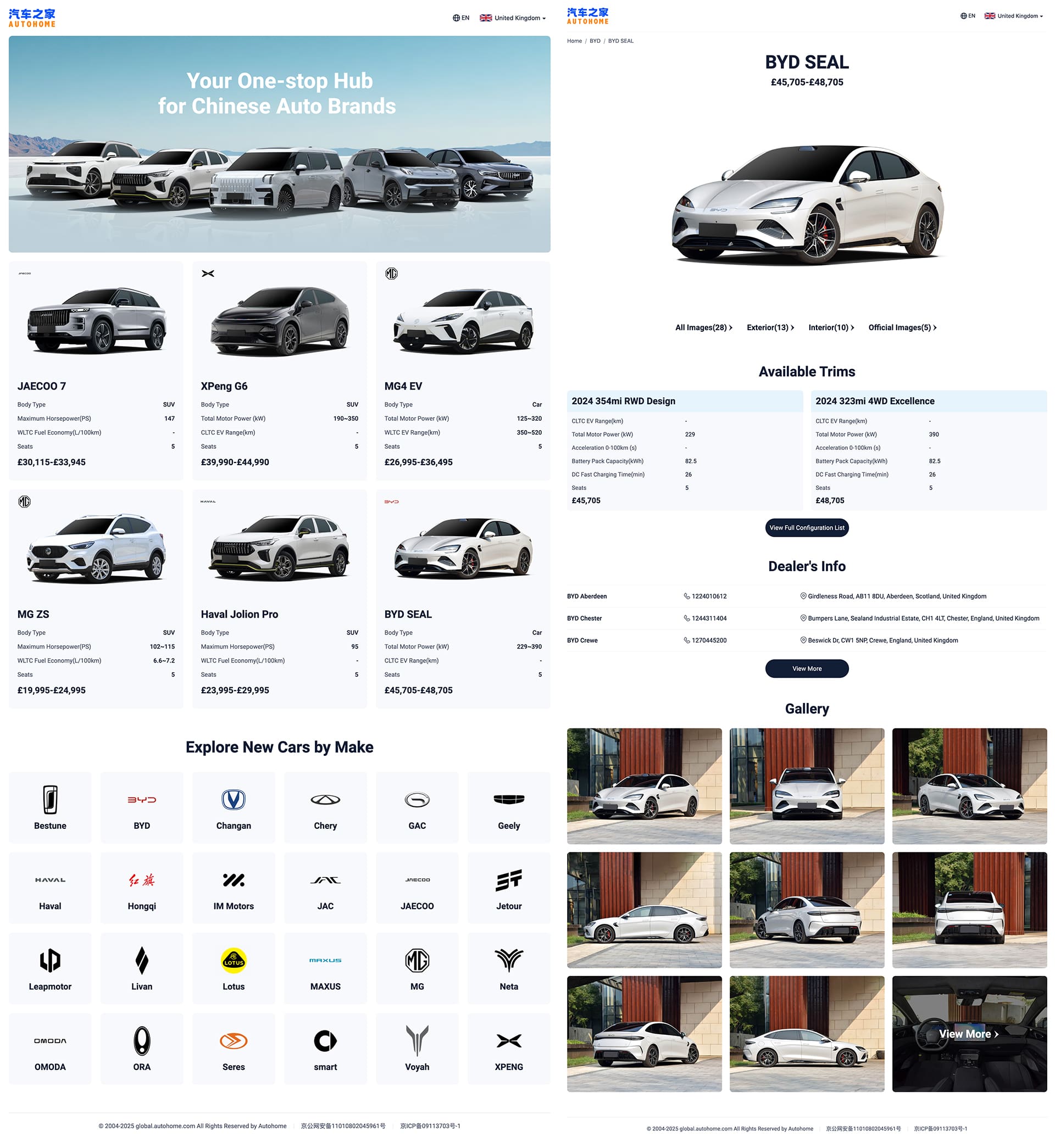

At the end of June, it launched an English-language website showcasing Chinese export brands and models. The move aligned with the 818 festival’s twin goals: stimulating domestic demand and boosting global visibility.

Bridging online and offline channels to go global

As Chinese NEV brands expand abroad by building local showrooms, manufacturing bases, and dealer networks, Autohome is positioning itself as a key enabler of this international push.

At the China Automotive Forum held in Shanghai in July, Autohome CEO Yang Song joined Chery chairman Yin Tongyue to discuss global expansion. Yin emphasized the importance of brand integrity, warning that one mishap abroad could damage the collective image of Chinese carmakers. He argued that exports must be supported by reputation, not just technology and output.

Autohome aims to serve as a global automotive service hub, helping industry players build stronger international operations.

In an interview with KrASIA, Yang explained the company’s two-pronged strategy: bolster online infrastructure while establishing localized offline presence.

Online, Autohome now hosts more than 50 brands and over 2,000 models with localized content including specifications, visuals, pricing, and dealership listings. It has also expanded onto platforms such as YouTube, Facebook, and Instagram to promote Chinese brands and highlight their manufacturing strengths.

Offline, Autohome plans to establish AI-powered “experience hubs” in overseas markets. These will feature multiple Chinese brands under one roof, aiming to reduce expansion costs and accelerate scale. Discussions for the first location are underway.

Ultimately, the long-term ambition is to elevate Chinese auto exports from a fragmented offering into a unified, globally recognizable brand identity.

Autohome’s international roadmap includes Southeast Asia, the Middle East, South America, Australia and New Zealand, and Europe. Localization will begin with support for traditional Chinese and Spanish content.

“Going global is the right direction. It’s a real way to contribute to the Chinese automotive industry, and to society,” Yang told KrASIA.

Still, hurdles remain. Regulatory barriers, cultural nuances, and consumer preferences vary significantly across regions. AI and VR features, along with content, must be tailored to each market. Moreover, established players like AutoTrader and CarMax pose serious competition.

Autohome must also address logistical complexities, global cost structures, and geopolitical risks. Its success will depend on how well it balances rapid growth with deep local integration to become a core infrastructure provider for China’s global automotive strategy.

What’s next for China’s automotive sector?

Over the past two decades, Autohome has become a central figure in China’s automotive ecosystem. Looking ahead, CEO Yang Song believes that reinvigorating demand both at home and abroad will be essential.

“The real solution to weak automotive demand lies in stimulating it, from the local market to exports. Autohome is ready to invest real money into subsidies, and use AI to help partners cut costs and drive efficiency,” he said.

This year’s 818 festival could mark an inflection point. As Autohome doubles down on AI and scales its O2O ecosystem, it is betting on technology and globalization to shape the next chapter of the automotive industry.

Still, key questions remain.

What happens when subsidies stop working? What does sustainable, high-quality growth look like in a saturated market? And if international expansion becomes the new norm, how far can it really go?

These are the questions Autohome—and the broader sector—must now begin to answer.

This article was written in partnership with Autohome.