For years, China’s efforts to develop a digital currency seemed intended for domestic use only. The introduction of an “e-yuan,” which is still being tested, would help China go cashless while giving the central bank tight centralized control over digital money.

However, a new development appeared on July 16: A government white paper shook up financial markets by saying China was exploring cross-border payments for the e-yuan.

The digital yuan now appears to be the latest in a decade-long series of steps to internationalize China’s currency and ultimately curb the global dominance of the dollar settlement system.

The White House, according to several news reports, regards the new Chinese e-currency as a possible effort to undermine the dollar. Meanwhile, the future of the greenback as the undisputed hegemon in global finance is being questioned as the US prints money to pay for economic stimulus programs. Other countries, fearful that their reserves of dollars will be debased, may seek alternatives. This applies most of all to China, the largest foreign holder of US dollar reserves.

The situation is oddly symmetrical to that of 50 years ago this month, when the present era of global finance was created by then-US President Richard Nixon. In August 1971, he took the US off the international gold standard and allowed the dollar to devalue.

Today, a new era in global economics is dawning that is as unpredictable as the last.

China has stepped up its efforts to internationalize the yuan, partly to limit any fallout to its own economy from increasing tensions with Washington. In addition, China is responding to concerns that Washington is weaponizing the dollar to impose sanctions on China. Already Washington has sanctioned Chinese companies like Huawei Technologies as well as Chinese officials dealing with Hong Kong and Xinjiang.

“China’s race to develop a central bank digital currency has to be seen in the context of Beijing’s efforts to wrest global influence and power from the US,” said Diana Choyleva, chief economist at Enodo Economics, which focuses on China. The digital yuan “is a key component of an alternative to the dollar-based order that Beijing is building.”

The success of the digital yuan depends on adoption by other countries, she said.

“By making cross-border payments easier and cheaper, the embryonic yuan system could hold particular appeal for emerging markets that are held back by costly access to dollar-based global payments but also want to reduce their dependence on the dollar for geostrategic reasons,” Choyleva said.

The end of the Bretton Woods currency system in 1971 paved the way for a system of exchange rates determined solely by market forces. Currencies are not fixed to others nor backed by gold. Nothing tangible backs currencies, only domestic economic conditions and trust in a country’s policies.

This system continues today, and the dollar remains the world’s preeminent currency, thanks to a global reliance on the US economy, trust in its institutions, and its role as the only global superpower. It has brought the US enormous economic and political clout.

But now, experts say, the global economy faces another inflection point. Significant inflation looms, the US budget and trade deficits are soaring, and a rise in interest rates could send the dollar into overvalued territory.

China’s growing economic clout, mainly its trade links with several Asian and African nations, could also hasten the acceptance of the yuan as the main rival to the US currency, according to investors and economists.

Read more: Asia is fertile ground for central bank digital currencies

China’s digital approach “should accelerate the elevation of the yuan on the world stage,” said Michael Hasenstab, who runs the Templeton Global Bond Fund.

A cross-border digital payments system means China is setting the stage for fuller yuan convertibility, which would accelerate the use of the currency in foreign exchange settlements.

“In the future, we will continue to steadily promote the yuan internationalization to serve the real economy, based on market principles,” the People’s Bank of China said in 2020.

China will make it easier for foreign investors to use the yuan to invest in Chinese bonds and stocks and will promote the development of offshore yuan markets, it said. The central bank also expects the yuan to play a bigger role in pricing crude oil, iron ore, and other commodities, and in settling transactions.

Progress has been slow, notably lagging the rise of the Chinese economy. While China accounts for almost a fifth of global economic output, its currency has been held back by a lack of assets to invest in and full convertibility, thanks to Beijing’s determination to retain capital controls.

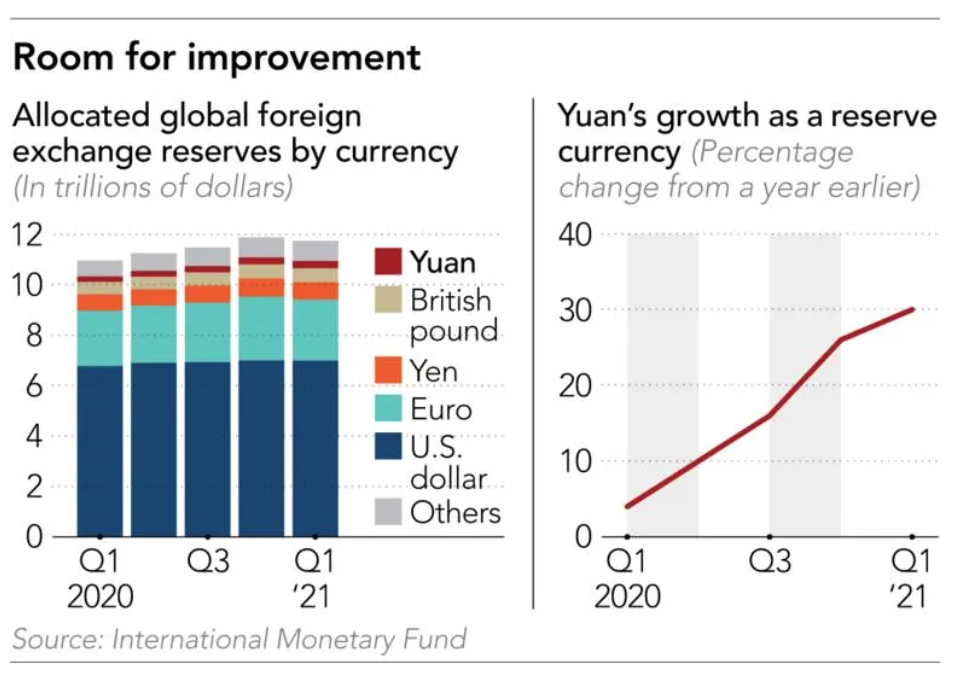

A decade ago, almost none of China’s trade was being settled in yuan, but in 2019 that number was 14% for goods and 24% for services according to the PBOC. The yuan’s share in global foreign exchange reserves, however, is at a distant fifth with a 2.5% shares despite recent strides, still lagging the greenback, euro, yen, and pound sterling.

The dollar remains the undisputed king of global finance, accounting for 59.5% of global reserves in the first three months of the year, according to the IMF. The yuan, meanwhile, accounts for 2.5% of global cross-border payments. While that is a five-year high, it compares with 40% for the dollar, according to the Society for Worldwide Interbank Financial Telecommunications.

China’s last attempt to internationalize its currency and challenge the dollar ended badly. In 2015, following capital outflows estimated at USD 1 trillion, it was forced to undo six years of capital account liberalization and tighten controls once again.

That previous effort had included establishing the “dim sum” bond market, which refers to yuan bonds issued outside the mainland. China had also expanded its Cross-Border Trade RMB Settlement Pilot Project and opened up a stock ownership mechanism. The moves sparked hopes for full convertibility that were ultimately dashed.

The situation is again in flux: Capital inflows to China have surged in recent years, partly because of the inclusion of yuan assets in global stock and bond indexes that are tracked by trillions of dollars worth of assets.

In March, FTSE Russell became the latest index provider to confirm plans to include Chinese government debt in its global bond index, a move that HSBC Holdings estimates will attract inflows of USD 150 billion a year.

Foreign holding of yuan-denominated bonds and stocks stood at a record RMB 7.6 trillion as of June, according to data compiled by the nation’s central bank.

The nation is also opening up its USD 50 trillion financial market, attracting billions in investment from the likes of Goldman Sachs and JPMorgan Chase.

But the centerpiece of the current effort at internationalization is the digital yuan. Work on it began in 2014. By 2017, the central bank was working with commercial institutions to test the currency. The research and development of the currency’s design and function have been completed, the central bank said in a white paper in July.

Since late 2019, the PBOC has initiated pilot programs for the e-CNY, as it is called, in some representative regions. The trials have reached RMB 34.5 billion in transaction value, and more than 20.8 million individuals have opened a virtual wallet that stores the digital currency.

The issuance and circulation of e-CNY are identical to the same processes for physical yuan. The e-CNY has value that is digitally transferred, it is backed by sovereign credit and considered legal tender.

“Based on experiences of domestic trials and international demand and preconditioned on mutual respect to monetary sovereignty and compliance, the PBOC will explore pilot cross-border payment programs and will work with relevant central banks and monetary authorities to set up exchange arrangement,” the central bank said in its white paper.

Cross-border success will depend on other countries’ willingness to embrace China’s financial innovations. The digital yuan offers benefits that emerging markets poorly served by current arrangements should find particularly appealing. In these economies, a “correspondent” bank must be used as an intermediary for another to facilitate transfers.

“The development of the e-CNY may eventually contribute to the PBOC’s long-term goal of the RMB’s internationalization,” Paul Mackel, global head of FX research at HSBC said. “If a more cost-efficient peer-to-peer transfer becomes widely accepted in cross-border transactions,” non-US and Chinese entities “may be able to directly exchange currencies without involving the dollar.”

Simultaneously, China’s trade with fellow Asian and African nations has soared, allowing the country to increasingly bill in yuan. Charles Gave of Gavekal Research has dubbed this “Asia’s new monetary order.”

The cross-border use of the yuan rose 24% through 2018 and 2019 to RMB 19.67 trillion, a record high in terms of volume, China’s central bank said in its 2020 RMB Internationalization Report.

While trade between Asian countries still takes place largely in dollars, a “parallel infrastructure” is now in place, Gave said. Old dollar-centric arrangements can be discarded in a matter of days without precipitating a collapse in regional trade because of the lack of a means of payment. During the 2008 financial crisis, Asian nations, which held vast dollar reserves, could not mobilize their holdings quickly and had to borrow from a dollar swap liquidity backstop.

That episode was followed by monetary stimulus in the US that threatened to devalue the dollar, pushing Chinese authorities to propose a system in which countries could bill their exports in their own currency. The idea was mooted to reduce dollar dependence, cut volatility between Asian currencies, especially in regard to China’s, and turn the PBOC into the lender of last resort through its swap lines. The latter two points have been achieved with exchange rates stabilized and the PBOC’s role rising in the region, Gave said.

Under the new order, countries in the system seek to stabilize their exchange rates against the yuan rather than against the dollar. With cross-rate volatility between currencies in the system therefore low, the cost of hedging is also low.

The changes, Gave said, “insulate Asian intraregional commerce against a future US dollar or euro crisis, making another collapse in trade, like those of 1997-98 and 2008, highly improbable.”

Under this new system, the prospective lender of last resort is not the US Federal Reserve or the International Monetary Fund but the People’s Bank of China via swap agreements signed with other central banks.

Between January 2009 and January 2020, the People’s Bank of China entered into bilateral swap arrangements with 41 countries. Most of these were put in place from 2009 to 2016 and were normally valid for three-year periods. Many of these arrangements have been repeatedly renewed, with the number of active agreements peaking at 33 in 2016 and standing at 27 by the end of 2019.

Despite the slight decline in the number of active arrangements, the maximum liquidity that can be made available through the arrangements has been stable, averaging RMB 2.22 trillion, according to data from the PBOC.

In a swap transaction, a central bank looking to access liquidity in foreign currency sells to the source bank a specified volume of its own domestic currency in return for foreign currency at the prevailing market exchange rate.

Given the importance of China as a provider of goods as well as a source of investments and credit to developing countries, and its effort to internationalize the yuan, these swaps suit China and its partners.

“If the goal was to pave the way for the de-dollarization of trade between Asian countries, then to a large extent it has been achieved,” Gave said, referring to the parallel infrastructure that allows countries to move between currencies.

While authorities were pushing for the internationalization of the yuan, the Chinese central bank’s digital currency research institute and clearing center in February set up a joint venture with the Society for Worldwide Interbank Financial Telecommunication or SWIFT, the global system for financial messaging and cross-border payment, in the first signs that Beijing is exploring the global use of its planned sovereign digital currency.

The new entity, called Finance Gateway Information Services Co, was established in Beijing in January, just when concerns emerged that US could cut off China from the SWIFT platform amid escalating tensions.

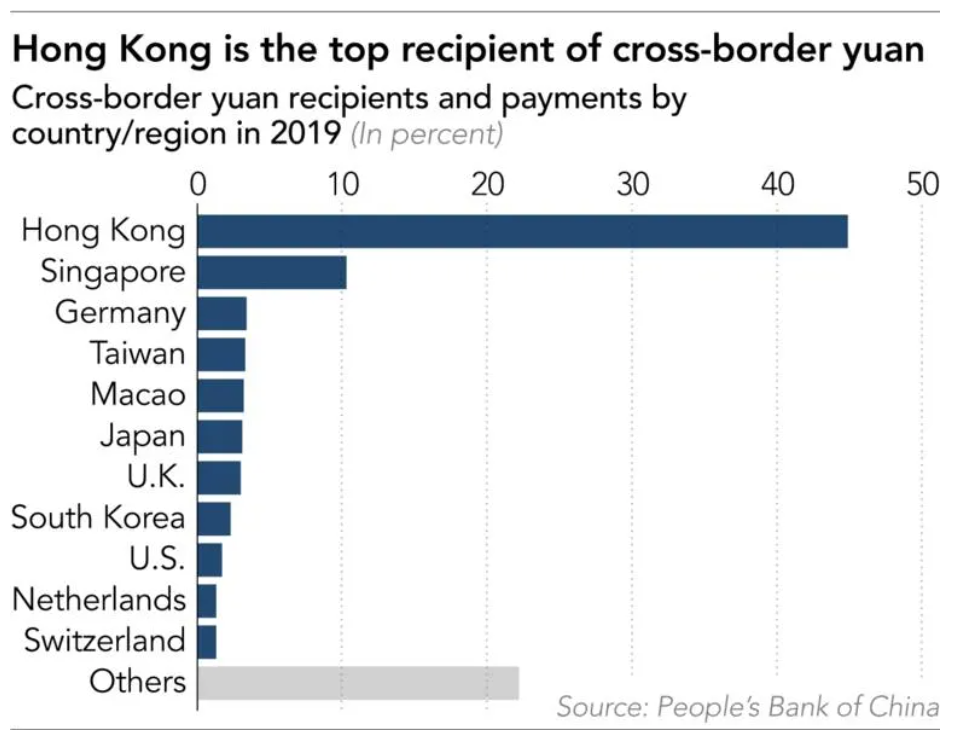

The PBOC has also begun working with its counterparts in Hong Kong, Thailand, and the United Arab Emirates, in addition to the Bank for International Settlements, on using a digital ledger of transactions. The aim is to harness central banks’ digital currencies to make multicurrency cross-border payments simpler and cheaper.

In Washington, the administration of President Joe Biden is stepping up its scrutiny of China’s plans for a digital yuan, Bloomberg reported in April. It said some officials were concerned the digital currency could kick off a long-term bid to topple the dollar as the world’s dominant reserve currency, according to people familiar with the matter.

The fears are not unfounded as the latest moves by China could be the biggest attempt yet to threaten the dollar’s global status as well as the monetary system that emerged after World War II.

Analysts already consider the US dollar overvalued against a basket of its peers as demand for the greenback, a hawkish Fed amid hopes of an economic recovery in the largest economy that it is trading above its fundamental value.

“It is important to cultivate an investor base at home and deepen capital markets in the region, in particular by further developing local currency bond markets to limit the dependence on US dollar funding in the region, and so reduce vulnerabilities to external shocks,” according to a paper issued this year by the Asian Development Bank. Analysts also caution that the difference between the dollar’s theoretical and actual values may eventually cause a sudden reversal that could shake the global economy and lead to market gyrations with the potential to harm emerging Asia.

Certainly, the greenback has proved resilient and survived many doomsday scenarios in the past. Very few are ready to pen an obituary for the currency’s hegemony.

Fifty years ago, President Nixon and his team made some hard decisions that enshrined the dollar’s status as a global reserve. The current president and his successors will face a similar moment of reckoning.

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.