When Tencent (HKG:0700) announced last week its preliminary non-binding offer to take Sogou —China’s second-largest search engine— private, in a USD 2.1 billion deal, the market erupted, with Sogou’s stock price soaring by 48%.

If completed, the deal would see Sogou (NYSE: SOGO) become a wholly-owned subsidiary of Tencent, joining a wave of Chinese companies that have recently delisted from American exchanges. What does this acquisition mean, and what is driving it forward?

An already symbiotic relationship with Tencent

The Sogou Search engine was launched in 2004 by a team lead by Wang Xiaochuan, a former senior manager at internet company Sohu (Nasdaq: SOHU). In 2006, Wang was responsible for developing and launching the Sogou Input Method, an input system for Chinese characters based on pinyin romanization which is currently the preferred typing method for millions of Chinese users.

The successful launch of these two products catapulted Sogou to success and by 2010, the firm split from Sohu to become an independent company, with Wang as its founder and CEO.

By that time, Tencent was developing an in-house search engine named Soso, but in September 2013, it decided to invest USD 448 million to buy a 36.5% stake in Sogou. Following the investment, Tencent discontinued Soso and absorbed its operations under Sogou, underlying Tencent’s confidence in Sogou’s capabilities.

Tencent then utilized Sogou as its default search engine across its extensive ecosystem of apps, including WeChat, QQ, and Tencent News, which altogether accounts for over 55% of mobile internet use among Chinese consumers. WeChat, in particular, is China’s pre-eminent super-app, boasting monthly active userbase of 1.2 billion as of Q1 2020. Sogou is also the sole search engine able to scour public WeChat accounts.

What motivated Tencent to fully buy Sogou?

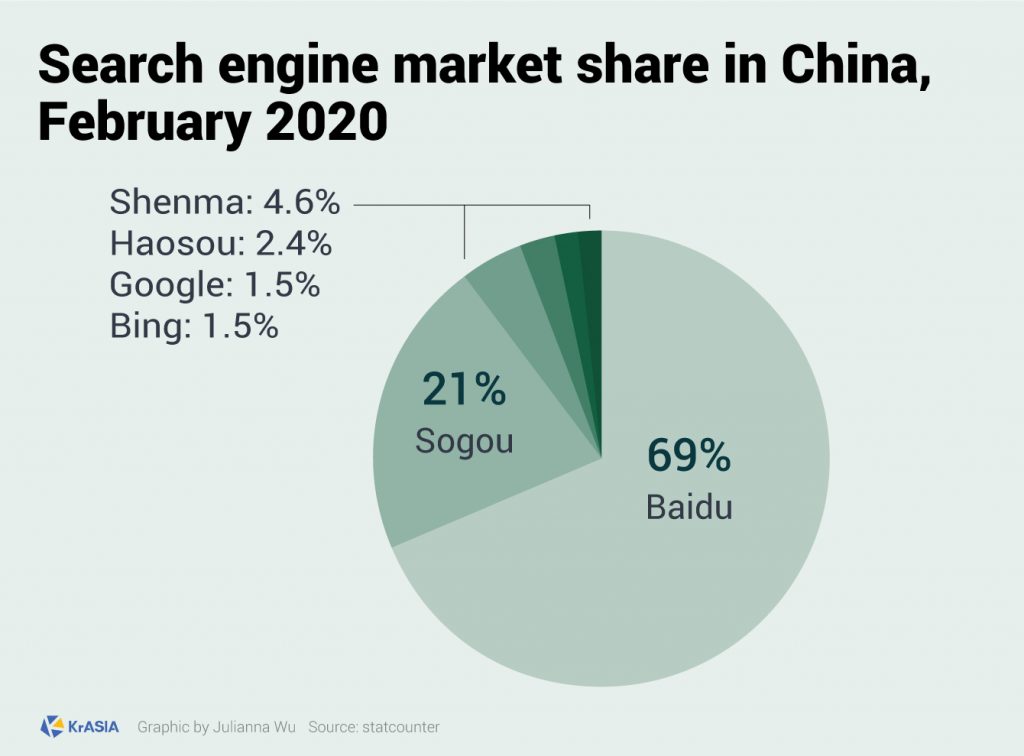

Sogou has performed well with a 21% market share in the Chinese search engine market. If Tencent was marking its territory in the search engine sector with its previous investment, a potential bold acquisition now plants a flag.

“It is probably in Tencent’s best interest to gain a secure share of the search market. By doing so, Tencent has to increase the width and depth of its contents,” told Ashley Galina Dudarenok, marketing expert and founder of ChoZan and Alarice, to KrASIA.

“Tencent would be able to improve ad performance and potentially benefit from higher revenue in ads, as Sogou’s search contains a large amount of users’ baseline data,” she added.

According to Dudarenok, Sogou lacks Baidu’s larger market share but possesses better search technology and algorithms, allowing for better user experience. In particular, its ability to scour specific verticals such as WeChat, Mingyi (Medical), Xueshu (Scholar), and Zhihu (China’s Quora) are core differentiators.

The privatization also makes sense for Sogou since its performance on the public markets has not been ideal. Since Sogou’s listing in 2017, its stock price has fallen below intrinsic value. Privatization under Tencent would offer a modicum of financial assurance to push forth with its extensive R&D ventures.

In addition, Tencent’s ecosystem of apps already contributes to over 35% of Sogou’s traffic, while competition is increasing Sogou’s traffic acquisition costs. As of Q1 2020, this remained the primary driver of Sogou’s costs of revenues, increasing by 27% year-on-year (YoY) and representing 70.5% of total revenues compared to 56.6% the previous year.

Sogou’s acquisition is an anomaly in Tencent’s playbook, however, as Tencent is known to shy away from outright acquisitions and instead favor strategic partnerships, in contrast to other giants such as Alibaba (NYSE: BABA) and Baidu (Nasdaq: BIDU).

Yet, the high stakes behind the search engine market might be the reason behind Tencent’s move. “Internet companies have now very tight control over their own content and data, and have very clear-cut strategies in locking users in their own platform,” suggests Dudarenok, emphasizing the security perspective as essential in this acquisition.

China’s search engine sector has also become increasingly competitive in the past months with the upsurge of new players. For instance, rising star ByteDance’s powerful search engine algorithms have powered the company’s products Jinri Toutiao, Douyin, Tiktok, and future B2B product pipeline, while the firm has recently launched Toutiao Search, a search portal optimized for mobile devices.

ByteDance’s overtaking of Tencent and Baidu in digital ad revenue has also made Tencent decidedly nervous. Deriving increasing utility from search algorithms, while acquiring new data sources, would solidify Tencent’s assets in the face of the impending threat.

Finally, the acquisition also secures Tencent’s access to Sogou’s expertise, talent, and related technologies. Sogou Mobile Keyboard had 482 million daily average users (DAUs) ad in the first quarter of 2020, processing up to 1.4 billion daily requests as China’s largest voice recognition app.

Sogou has also forayed into the AI development of language-centric technologies. Sogou’s own push into AI, therefore, rings harmoniously with Tencent’s goals, as the firm is the one that has invested the most in AI compared to Alibaba and Baidu.

Sogou had its pick of the lot

The deal is far from an inevitable acquisition of a quivering target. Sogou is deeply rooted in China’s Internet industry: its spinoff from Sohu was precipitated by Alibaba’s equity investment back in 2010. Later suitors also included Baidu and Qihoo 360, which were turned away over Sogou’s fears that as search engine competitors, they would wipe Sogou out.

“Selling to Qihoo 360 would crush Sogou to nourish Qihoo 360’s growth…now […] we have a future,” said Zhang Chaoyang, the CEO of Sohu in 2013, which retains a 33.8% stake in Sogou even after the split.

With Alibaba being one of Sogou’s first investors in 2010, the relationship has soured as Sogou shied away from approaching Alibaba for further investment, and it later bought back Alibaba’s shares in 2012. Just before Tencent made its investment in 2013, Wang Xiaochuan hinted at shortfalls in Sogou and Alibaba’s relationship in an interview with Global Business.

“There may not be so many values [in this partnership]. Jack Ma still aims to maximize Alibaba, and he still needs to find his own position in between ideals and reality,” said Wang Xiaochuan, even when reminded of Jack Ma’s public commitment to building “a new civilization of commerce“.

In contrast, Tencent seems to respect Sogou’s independence, finding congruence in a mutual focus on product development and shoring up Sogou’s traffic.

The seven-year-long courtship between Tencent and Sogou has culminated in a favorable marriage. After news of Tencent’s offer went public, Wang issued a statement on WeChat thanking Tencent “for its recognition of Sogou’s value, technical capabilities, and product innovation capabilities”. Later, Sogou also said that it would be “convening an independent committee to discuss and study the offer.”

Although Sohu has yet to release an official statement, Sogou mentioned that “Zhang Chaoyang would use all of his voting rights to support this transaction,” hinting that the deal is likely to go through.

At USD 9 per share, Sohu would receive an estimated USD 1.165 billion in cash for its 33.8% shareholding: an amount outstripping the company’s entire market capitalization (at USD 754.4 million) at the moment.

The acquisition may also signal a battlefield cleanup in China’s internet industry. “It is likely that more mid-tier companies will be acquired,” suggests Dudarenok. “The landscape has now moved from competition to coexistence.”