With Swiggy’s recent USD 1.25 billion funding from SoftBank, Zomato’s acquisition of Uber Eats’ India business last March for USD 206 million, Amazon’s entry into the food delivery sector, and the recent IPO of Zomato, India’s online food delivery market is surely heating up and garnering a lot of global attention and investments.

Recently at Measurable AI, we wrote an article on the food delivery market in Hong Kong. On the back of our unique e-receipt data, we now take a deeper look at the Indian food delivery market. We will focus mainly on the giants Swiggy and Zomato, as well as Uber Eats.

The industry overview

The global online food delivery market, estimated to be about USD 113 billion in 2020, is one of the few industries which is growing at a double-digit compounded annual growth rate (CAGR). In India alone, the online food delivery market was worth around USD 4.66 billion in 2020 and is one of the fastest-growing sectors, attracting a lot of heavy investments. Compared to the year before, the market size was around USD 2.9 billion. By 2026, the industry is forecasted to be worth USD 21.41 billion, with a staggering CAGR of 28.95% during 2020–2026.

So, on what basis can this rapid growth be explained?

One factor propelling the accelerated growth of India’s online food delivery market is the changing lifestyle and eating habits of its local population. Hectic schedules compounded by growing disposable income levels in India are pushing people towards ready-to-eat food available at a cheaper rate. The one-click, on-demand feature has popularized food delivery options among busy urbanites. Rising digitalization among millennials, an increasing proportion of working women, and the prevalence of double-income families who prefer eating out have driven online food delivery trends in India.

Finally, the COVID-19 lockdowns have indubitably impacted the industry. Interestingly enough, while the impact has been negative at first, post lockdown, we witnessed some interesting trends such as order volumes surpassing pre-COVID-19 volumes of last year and the propensity to choose online payment methods instead of cash.

Who has the biggest plate?

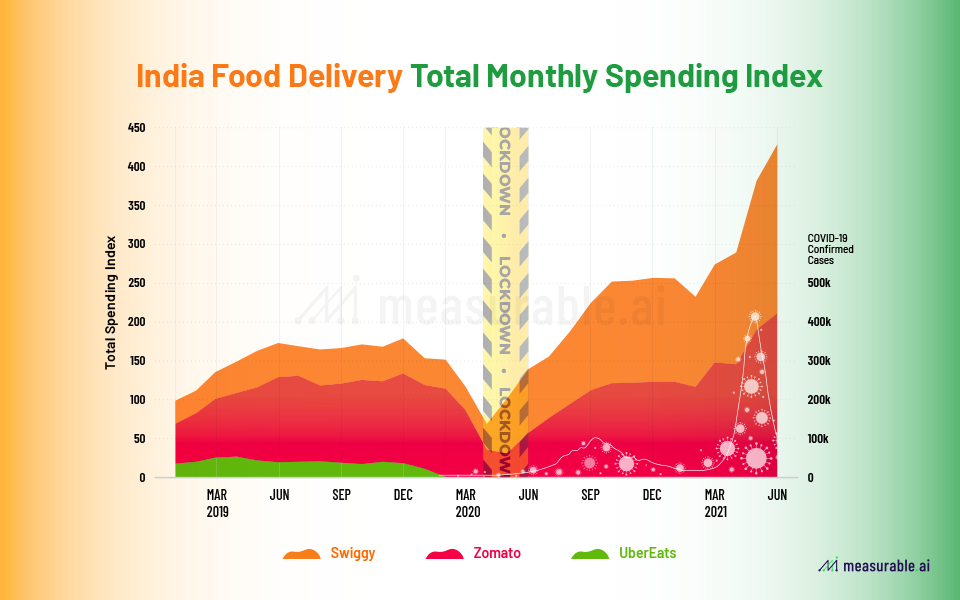

Since January 2019, Zomato has always dominated the market in terms of revenues. As seen in the graphic below, Zomato had a much wider lead over Swiggy and managed to keep up its sales momentum until the beginning of April 2020. This is when COVID-19 struck, and the nationwide lockdowns began.

It was not until the end of May 2021 that Swiggy sales caught up with Zomato’s, and the two competitors became more on par.

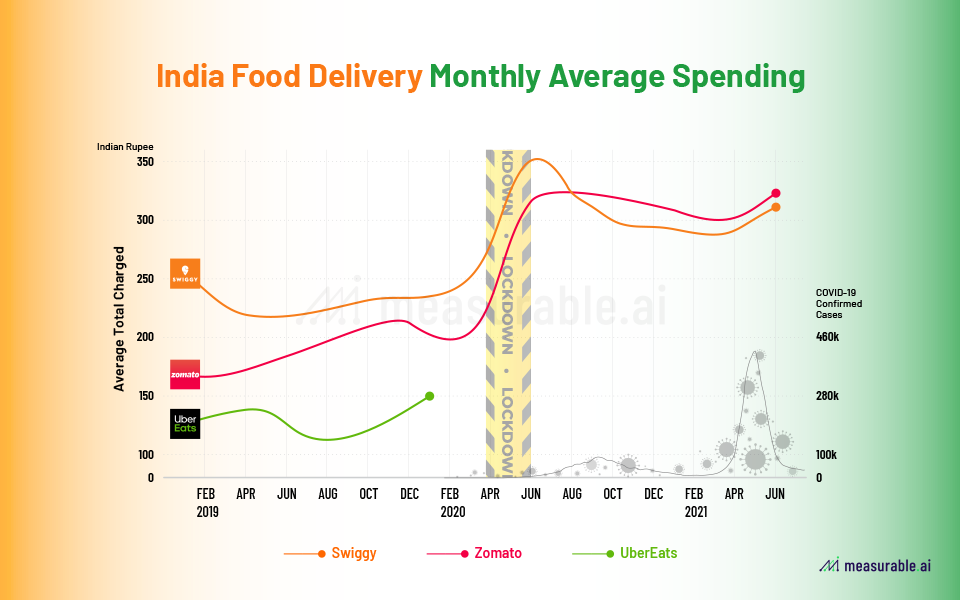

In terms of average monthly spending among the players, we gathered that users on Swiggy would spend more per transaction than on Zomato. Pre-COVID-19, the average spend on Swiggy was roughly INR 220–250 (USD 3–5). Spending seems to have picked up by a whopping 30% during the 2nd stage of the lockdown [between late April and May], with average transaction values hovering at around INR 300–350 (USD 4–5).

We attribute the first drop in spending to most restaurants being shut during the first lockdown in late March 2020. Consumers have shied away from online food ordering due to apprehensions about safety and a general preference for home-cooked food. However, after a month or two of lockdowns, things have picked up again, and recovery has been fast. We attribute this largely to the prolonged boredom from eating at home and the desire to eat outside again, along with the re-opening of restaurants for food delivery.

Indian food delivery market demographic

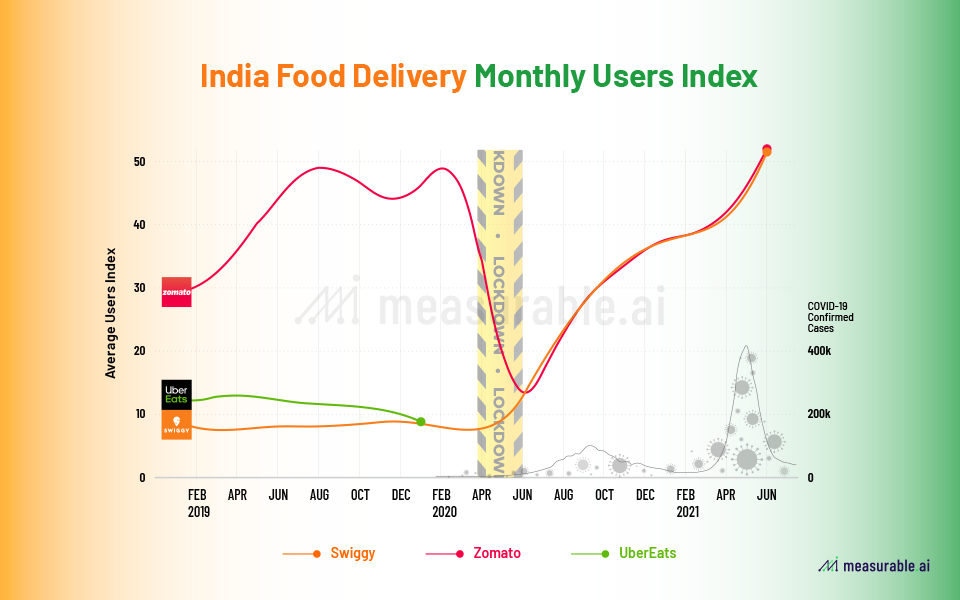

The graph below illustrates an index of the monthly users across the three players and how they stack up against one another from January 2019 to June 2021. It seems that the pandemic has helped Zomato and Swiggy to improve their user economics and add more consumers as the frequency to dine out has dropped.

Initially, Zomato has always taken the lead before the onset of COVID-19. However, our data says that Zomato suffered a huge drop in users when the first lockdown began, and more than 95% of restaurants suspended their services.

Also, Zomato acquired Uber Eats in January 2020, and there may have been some handover friction (we suspect some users may have switched to Swiggy). After the lockdown ended in May 2021, we noticed that online deliveries picked up again as restaurants resumed their services, and the frequency of dining out dwindled.

Transaction volumes and the impact of COVID-19

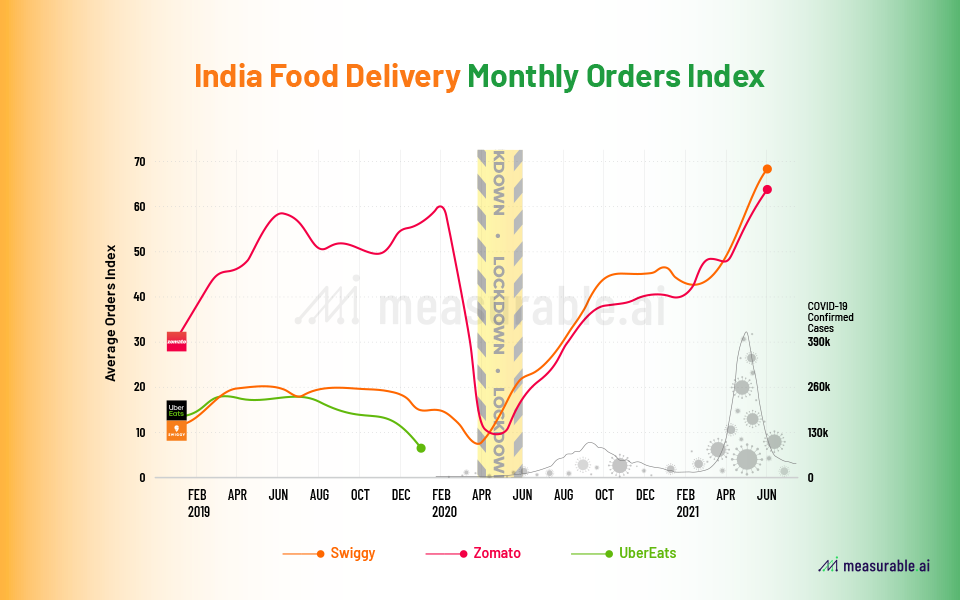

The impact of COVID-19 has evidently damaged delivery volumes for most online platforms. From our consumer panel, Zomato has always taken the lead in order volumes, but during the abrupt nationwide lockdown, they experienced a 70% sharp decline in order volumes, along with a massive drop in users.

The lockdown also resulted in an exodus of migrant workers from the big cities to their hometowns. Don’t forget that these migrant owners form the bulk of the delivery fleet for online food delivery operators in India. As such, it was inevitable that when the lockdown was lifted, the delivery operators would face a supply problem and would need time to get things up and running again.

Lastly, unlike the US and Europe, where the alternative to dining-out is primarily delivery, in India, the alternative can be either delivery or cooking at home. Cooking at home was particularly favored in the early pandemic days, as a delivery boy from one of the major delivery operators tested positive for COVID-19—this hurt consumer sentiment and trust in the safety of food delivery operators.

As illustrated above, it was not until September 2020 that the food delivery volumes returned to 60–80% of the pre-COVID-19 time. Volumes have picked up on the back of stringent safety measures put in place by delivery operators to win back customers’ trust. Due to a decreased customer base, delivery operators have also tried to venture into adjacent categories like grocery, pharma, and alcohol delivery.

What might be surprising is that Swiggy is slightly leading Zomato in terms of order volumes post-COVID-19. Why is this so? We dive into our data and realize that this is in parallel with Swiggy’s delivery fees being lower—sometimes free—and more aggressive than Zomato’s post the lockdown period.

Which app is more popular?

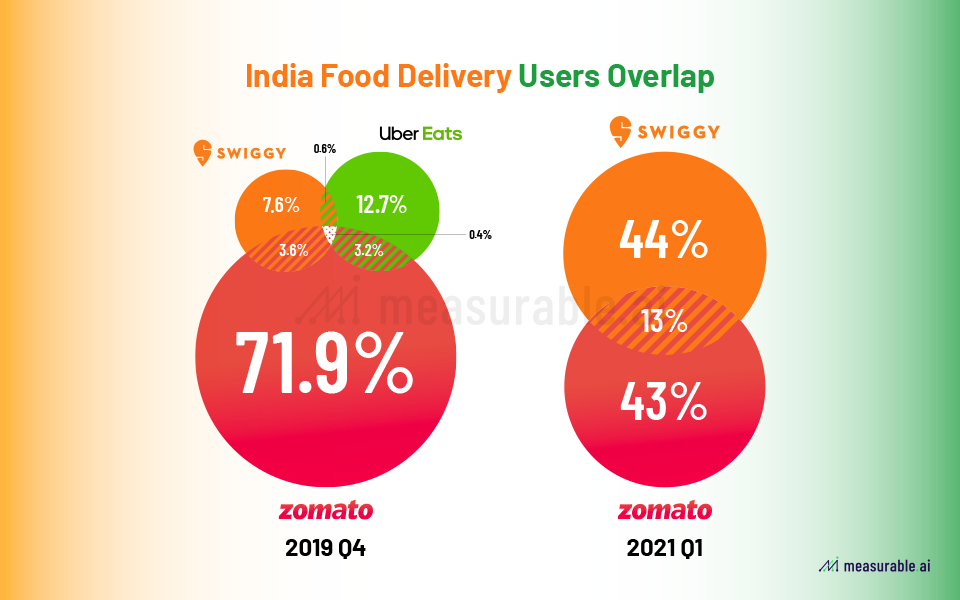

When it comes to app popularity, we noticed that before lockdowns, Zomato dominated the market with over 70% of users in the online food delivery market. On the other hand, Swiggy and Uber Eats had a combined market share of less than 30%. There seems to be little overlap in the user base among the players.

Post lockdown, Swiggy seems to have emerged stronger with roughly the same market share as Zomato. In Q1 2021, Swiggy and Zomato shared roughly 13% of the same user base.

So why and how did Swiggy suddenly emerge so victoriously right after the lockdown? As mentioned above, we believe this has to do with Swiggy lowering its delivery fee more aggressively than Zomato.

In terms of payment methods, for Zomato alone, we noticed that post-COVID-19, more people are choosing to pay online via the app as opposed to using cash. Particularly in the second wave of infections between April and May 2021, there was a rapid increase in online payment methods in lieu of cash.

Conclusion

The Indian online food delivery market is surely undergoing revolutionary times, with significant consolidation and sizable investments from tier-1 investors. The Indian food delivery market is almost like a duopoly, where both Swiggy and Zomato will continue to operate as independent aggregators. While both Indian food tech giants are flush with funds and pass the USD 1 billion unicorn mark, the upcoming fight is no longer about market share but rather, expansion into adjacent sectors.

Zomato has chosen to deepen its focus on B2B services for restaurants, while Swiggy is going all-in and investing its energy into new non-food categories like Swiggy Go and Instamart.

This piece originally appeared in Measuable AI’s corporate blog.