The question I often hear in the tech scene, being an investor based in Thailand, is “why is there no Thai unicorn?” This question makes me wonder why we need one. Perhaps, the person who asks assumes that if we have a unicorn, there will be more interest to fund Thai startups, then there will be more Thai startups. But, the truth is unicorns are rare. In fact, only 1% of startups become unicorns. Should we even bother wanting one? Do we need one?!

Let’s start with why. If the goal of having a unicorn is to promote the local startup ecosystem, then I don’t think we need one. Here’s why.

No unicorns? That’s normal!

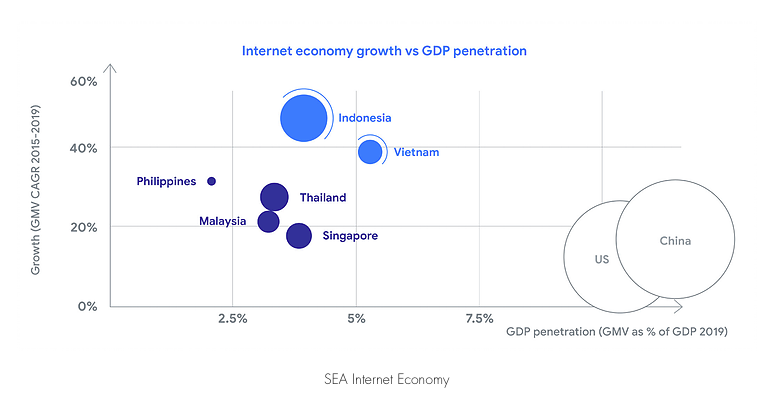

Southeast Asia (SEA) as a whole has only a handful of technology companies valued at more than USD 1 billion. It’s not surprising since the region’s tech scene started about less than a decade ago with pioneers such as Sea Group (2009) and Lazada (2012). The internet economy has recently shaped up as the population’s income level rises, resulting in large consumption power for online services.

But, SEA’s internet economy is valued at only USD 100 billion in 2018 (<3% of GDP) vs USD 1.5 trillion (8%) in the U.S. and USD 854 billion (7%) in China. There’s much more room to grow and much more opportunity for unicorns to be born. So far, SEA has only 11 unicorns, that’s 2.5% of 447 unicorns in the world! The U.S., on the other hand, has 206 unicorns, followed by China at 109. The reason we don’t have that many unicorns could be because we are still in the early-stage of the technology life cycle.

Don’t care about unicorns, care about exits

What we need is actually abundant exit opportunities for startups, not unicorns. Startups, by definition, means a business that has high growth and a scalable business model. To achieve that goal, startups have to take high risks, leaving the business unprofitable in the initial stage and making it dependant on external funding. Banks won’t fund unprofitable businesses. This means that startups are highly dependent on venture capital (VC) funding.

VCs, in turn, are driven by financial returns which are gained when the company that the VC invested into has an exit, either through an acquisition or through a stock listing on public stock exchanges, the so-called IPO. Thus, an exit opportunity determines the amount of VC interest, and VC funding determines the chance that startups will survive—and eventually—turn into unicorns.

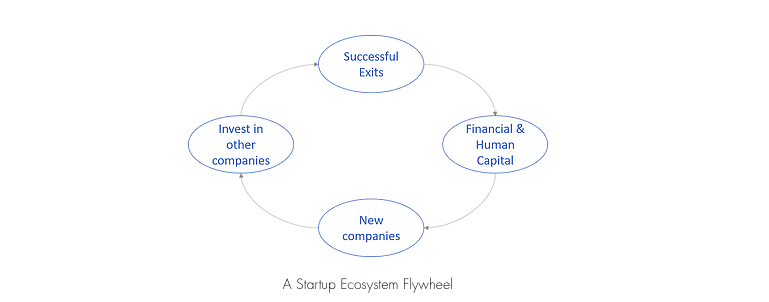

Another important reason why exit matters for an ecosystem—more so than unicorns—is that a successful exit will kickstart a “startup ecosystem flywheel.” When founders and early employees of a successful company sell their shares in an exit event, they generally go about starting new companies or investing in other startups. The act of doing so naturally increases funding supply and the number of startups in respective locations. Silicon Valley happened that way. About 92 public companies traded on the US stock market in 2014 could be traced back to Fairchild Semiconductor, a company that started Silicon Valley in 1957. Similarly, after Paypal was sold to eBay, the Paypal Mafia went on to start 13 companies, eight of which are unicorns. In SEA, the Lazada founding team subsequently started many companies after Lazada was sold to Alibaba, including companies such as Pomelo, Aspire, and Intrepid.

With an exit, the financial capital resulting from that exit will fuel the next generations of founders, investors, and startups.

So, how’s the exit opportunity for Southeast Asian startups?

Now that we’ve established why the exit opportunity is important for a thriving startup ecosystem, let’s look at the exit landscape in SEA.

There are two types of exits in the startup world: an acquisition (M&A) and an IPO. Like in other parts of the world, the M&A is a more common exit option in this region. Part of the reason is that the median size of an M&A deal is much bigger than an IPO in this region, about eleven times more to be exact [1]. Being acquired often results in larger financial returns than going public, especially if the acquirer has a strong strategic interest in the region. SEA has a massive population pool of 650M people, half of whom are very active online. It’s no surprise global companies—particularly Chinese ones —choose acquisition as a mode of entry into SEA markets.

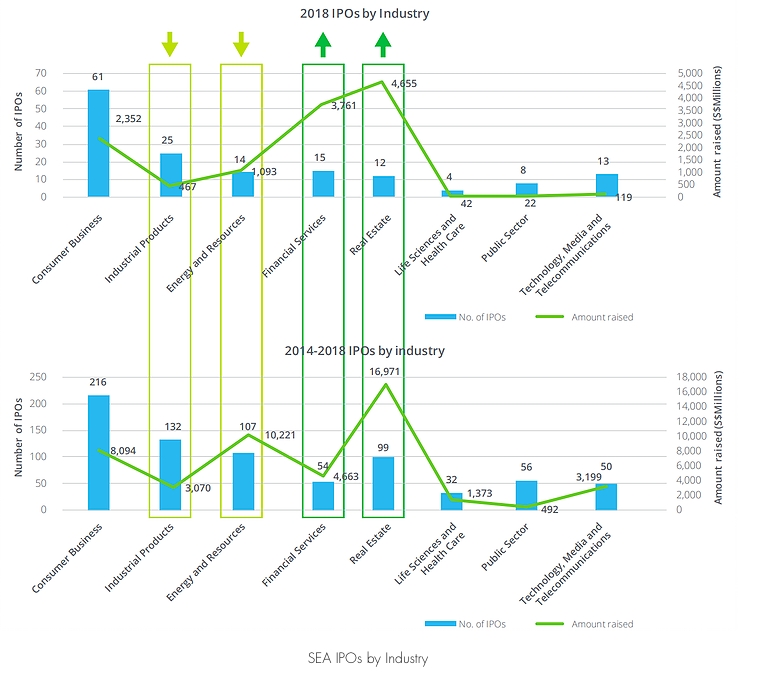

However, only hundreds of IPO happen on SEA stock exchanges each year compared to thousands of M&A deals in the Asian region. Insofar, there have been only 15 startup IPOs, and only seven had their IPOs on Southeast Asian stock exchanges.

In the past, it may be the case that being a unicorn was requisite to have a decent IPO on international stock exchanges where listing rules are supportive, liquidity is ample, and investor appetite is stronger for tech companies than regional exchanges. But, that does not have to be the case anymore. There are things we can do to improve exit opportunities for startups—particularly in boosting the number of IPOs—in our region:

1) Promote listing criteria that support startup IPOs

This includes not only the revenue or profitability requirement, but also the compliance cost, the efficiency of the process, and the speed of consideration. It’s no surprise that Singapore fares better than other countries in the region. It has created a listing board for high growth companies called “Catalist”. Its main exchange—the SGX—also has lower earnings requirements than that of Thailand’s SET. Nonetheless, SGX’s requirements are still not as supportive as Australia’s ASX, which may be the reason why Patrick Grove took four of his companies public in ASX instead.

Corporate governance issues could also prevent companies from listing in regional exchanges. Some exchanges, like Hong Kong’s HKEX, does not allow companies to be domiciled in the Cayman Islands, a reason which may have caused Alibaba to be listed on the NYSE instead. Another example is SGX which does not allow companies to have a dual listing, a preferred method of listing for founders—including Mark Zuckerberg—who want to retain their power over their company’s day-to-day operations.

2) Increase investor appetite for technology companies

Another reason affecting the decision of where to list is investor appetite. The degree of appetite is driven by how much investors know about the industry. Mining companies like to list in Canada or Australia because mining is the biggest sector in those countries and investors are more inclined to invest in industries they are accustomed to. Similarly, tech companies tend to be listed in the US and consumer companies in Asia.

Where retail investors represent a much larger proportion of trading volume, such as Thailand’s SET, companies are better off if retail investors understand the company’s profitability path and life cycle. Investor appetite can also be affected by the number of analysts covering the sector. The more research that is available, the more opportunities retail investors have to learn about the sector. Today, SEA exchanges are dominated by consumer businesses, industrial products, and energy sectors. But, it’s not going to be long before technology companies thrive in regional exchanges.

3) Increase the liquidity and depth of the stock market to support IPO valuation

Lastly, companies choose a market that allows them to raise as much capital as possible at the lowest possible dilution (in other words, the highest valuation possible). Sea Group raised a total of USD 1 billion from the Nasdaq in 2017, representing the fifth largest IPO in the world that year. To put things into perspective, the APAC median IPO size was only USD 47 million that same quarter. The liquidity and depth of the Nasdaq enabled Sea Group to be valued more than USD 4 billion. Had it had its IPO in Asia, that valuation would have been a stretch given that the APAC’s median post-IPO market capitalization during that period was only USD 193 million.

Let’s say, if Grab were to IPO tomorrow with its USD 10 billion valuation and that it wants to raise USD 1.5 billion in an IPO (assuming a typical 15% dilution), none of the SEA exchanges would be able to support it when the region’s median IPO proceeds were only USD 82 million [2].

Having a unicorn may affect investors’ views towards tech companies, but it does not materially improve exit opportunities. The first step is to create listing rules that support startup IPOs. With that, medium-sized startups can then choose to IPO in regional markets. The more IPOs there are, the more investors become accustomed to tech companies, and the more liquid the market will become, creating a snowball effect that improves exit opportunities for other startups in the long-run.

It’s not why we don’t have a unicorn, but how we can get the market ready to support startup exits. A mid-sized exit through an IPO in a regional exchange will get the ball rolling, build momentum, and enable the market to be able to absorb more exits and larger IPOs in the future. Then, we may have a better chance of having a (Thai) unicorn.

[1] Based on 2018 data. Source: Statista 1, Statista 2, and Deloitte.

[2] Based on 2018 data

This article first appeared on nattariya.com

To read similar stories, please hop on to Oasis, the brainchild of KrASIA.

Disclaimer: This article was written by a community contributor. All content is written by and reflects the personal perspective of the interviewee herself. If you’d like to contribute, you can apply here.