Hi there! In the new age of AI technology, we are initiating this bold AI-powered pilot project.

KrASIA’s parent company, 36Kr, is the leading tech and business media company in China. Every day, 36Kr delivers an enormous amount of news on Chinese startups. KrASIA wants to share these articles first-hand, but it was impossible to translate huge amount of information manually in the past.

Now, with AI, we have a solution: AI-powered translation with minimal human effort. Therefore, please understand that the translation may affect your reading experience. Nonetheless, feel free to contact us ([email protected]) should you have any feedback.

Enjoy!

Southeast Asia has a large population and its geographical location is similar to that of China. Many Chinese companies flock to SEA in search for more opportunities. In recent years, especially those in e-commerce and finance.

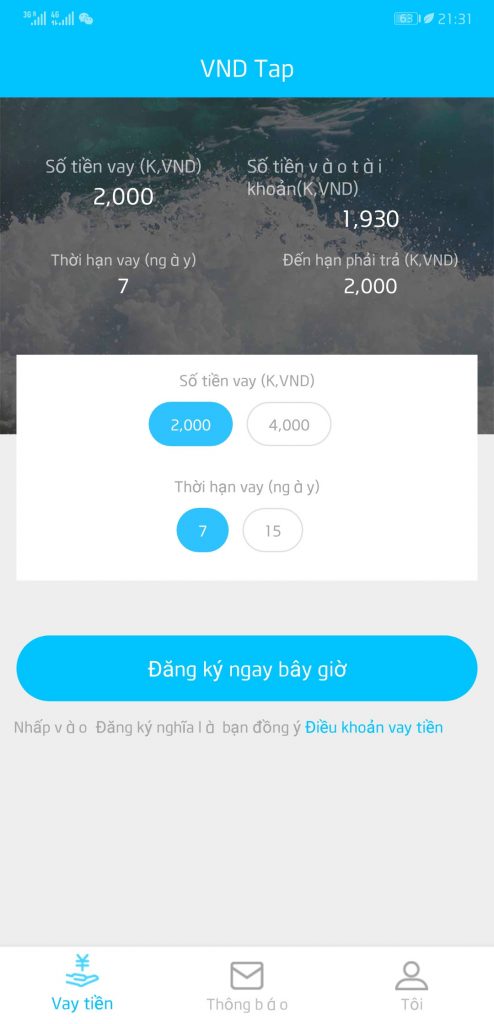

VND Tap

VND Tap is a lending platform, providing online loans and installment services for local college students in Vietnam.

Founder and CEO Zhou Guanya told 36Kr that the total number of colleges and universities in Vietnam is more than 2 million, which is equivalent to one-fourth of the Chinese university student market. The development of online payment platforms for students is also in its infancy. The social credit system is still immature and credit cards are not popular among young people especially college students. VND Tap chose to target campus students and allow them to pay by installments.

Although Southeast Asia has been doing very well recently, SEA countries are very different. In Vietnam, the penetration rate of bank cards, credit cards, and mobile payments are not high. For example, among local banks, users’ bank accounts and card numbers may not match. According to public information, 91% of Vietnamese people buy goods online using cash. Other payment methods include bank transfer, credit card, carrier billing and scratch card (coupon on merchants’ website to redeem).

In the consumer-oriented finance sector, Vietnam started late. The more established finance company, Tima (provides small loans to consumers and SME operators) was only established in 2015. As of late December 2016, only nearly 2 million loans were issued out of the 115 million US dollars. Such Chinese companies venturing overseas include Home Credit and Idong.

VND Tap provides small short-term loans for local students as long as the user is schooling. They will have to submit their information online, pay a certain fee, and receive approval to apply for a credit loan. The current quota is about 2,000 yuan and is possible to receive the money within 10 minutes.

The company cooperates with campuses and businesses to gain student reach. Students can apply for a loan through their app and pay their loans by scanning a QR code payment at their campus cafeteria and stores. The procedures are similar to that of China.

At present, VND Tap has covered 10 colleges and universities in Hanoi (the capital of Vietnam) with about 200,000 college students. The growth rate of platform users is about 300-400 users per month, and the monthly transaction volume is nearly one million RMB.

Zhou said that at present VND Tap mainly uses offline marketing tools and social media to educate existing users and familiarize them with cash loans. In the future, VND Tap will set up an office in Vietnam to expand its business in southern Vietnam.

There is still a gap in the level of economic development in Vietnam. Although per capita consumption is not high, students have a strong demand for small loans and installment payments for accommodation and daily consumption.

The VND Tap builds their own risk control system. “Vietnam’s credit information system is still very immature, so we need time to accumulate users’ data,” Zhou Guanya said. The campus is a relative secluded and highly credible target group and hence relatively easy to manage.

Zhou emphasizes that the campus will not be the only group VND Tap targets. VND Tap first connects the canteens, mom-and-pop shops, and carports on the campus, in order to establish a closed loop system. This allows students to the procedures and pays by scanning. In the future, VND Tap will also provide financial services support for young users and expand to other target customers.

Zhou was a founding team member of Beibei.com and a senior operation director of Chuchu Street Chinese mobile e-commerce platform with product deals). Among the local Vietnamese team, Ke Keyong was the former manager of the Oceanbank business department in Vietnam. Wu Fang served as the accounting chief of Huawei Vietnam. They have also recruited former executives from Tencent (campus sales department).

VND Tap’s strategic partner for technology is Feng Rong Wang, a consumer-oriented lending platform from Shanghai, focusing on providing Internet banking services such as P2P investment financing and online lending.

VND Tap currently is seeking a Pre-A series funding of USD 5 million and post-money valuation of US$50 million. The funds will be used for recruiting new talents and technology development.