If one were to sum up how the year 2020 was for the world’s third-largest startup ecosystem, it would be this: it threw Indian startups off the track.

As tech adoption rose manifold in the country, it brought them on a sharp growth trajectory, only this time startups sought to prioritize sustainability and profitability over their obsession with revenue growth.

When the pandemic struck, a majority of startups had to cut down on marketing spends and run lean teams to ensure cash runways. Indian entrepreneurs tweaked and evolved their business models to align with the changing needs of customers, which eventually led the larger startup community to come out of the economic slump stronger. To top it up, an increased digital adoption ensured there wouldn’t be a dearth of VC money in the market so long there’s demand.

Sectors like edtech, health tech, gaming, and enterprise tech and SaaS that attracted a huge chunk of VC money this year are expected to continue to be on investors’ radar in 2021. But beyond them, there are few themes that saw early signs of growth this year and are likely to gain steam next year.

One-on-one connect: Direct to consumers

Direct-to-consumer brands (D2C) have been slowly growing on consumers as well as investors since the last couple of years. This year was special for them as when consumers diverted their offline spends to online brands, D2C companies saw a huge surge. D2C brands sell directly to consumers, without any middlemen like wholesalers and retailers. They usually provide greater value for money because they save money on the middlemen and thus offer better prices to their consumers.

Investors told KrASIA the sector will further gain prominence next year since a few D2C brands have emerged as leaders in their respective categories. The list includes eyewear brand Lenskart, beauty and baby care products company Mamaearth, online meat platform Licious, coffee brand Sleepy Owl, and makeup brand Sugar Cosmetics.

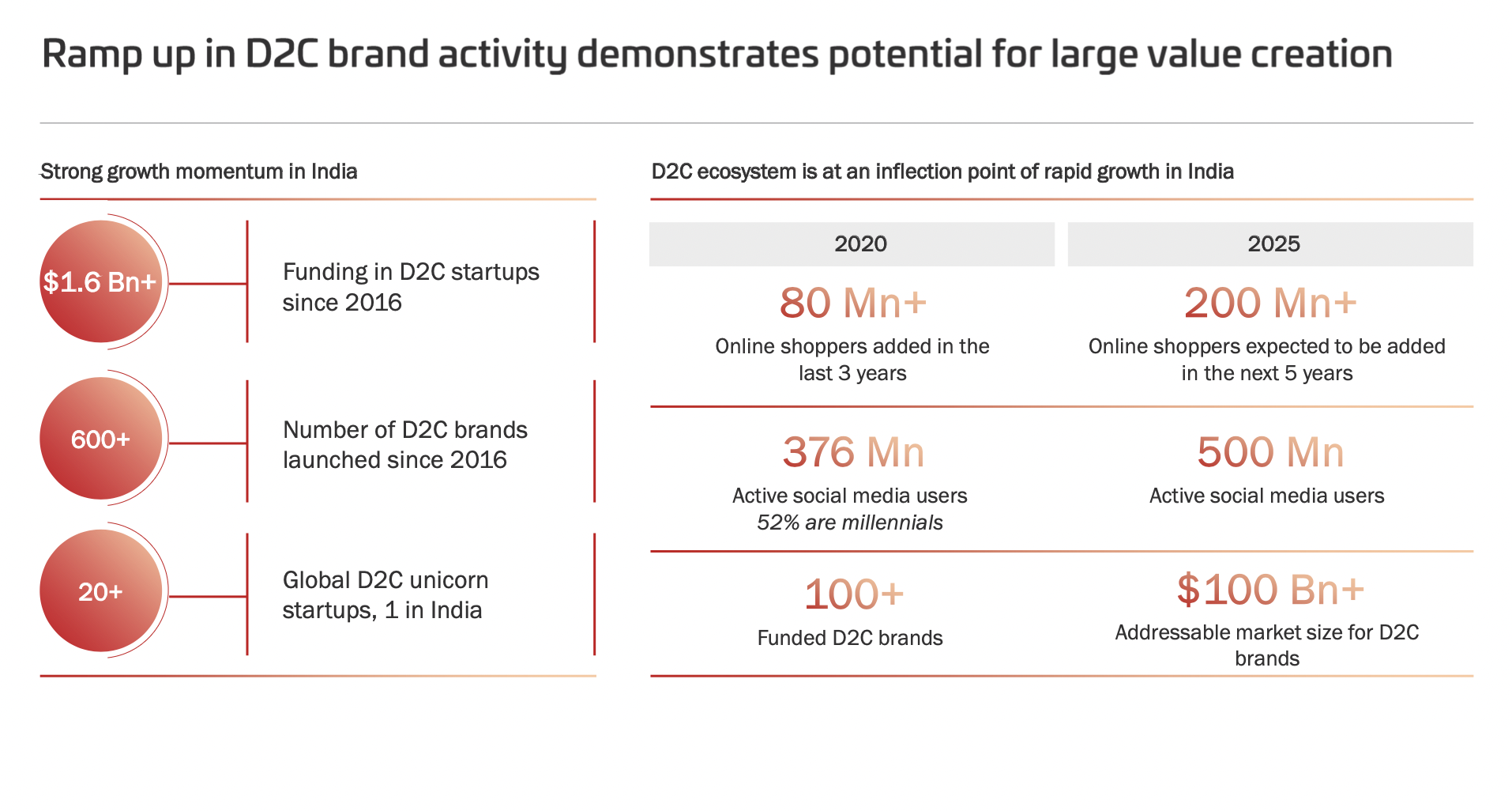

According to a recent report by New York-headquartered Avendus Capital, online spending in India is expected to grow from USD 39 billion in 2019 to USD 200 billion over the next five years. It said, the country will have roughly 330 million online shoppers by 2025 from the current 130 million. And that will help the addressable market for D2C brands to balloon to USD 100 billion by 2025.

As such, over 600 D2C brands have entered the market since 2016 till October this year, of which over 100 startups are funded and have raked in a total of USD 1.6 billion in funding.

“The cost of launching a brand online is minuscule compared to starting an offline business because now you can directly tie-up with a factory to develop a product, and there is no need to have large offices as everything can be virtual,” said Anirudh Damani, managing partner at Artha Venture Fund.

The growth in digital adoption and change in customer behavior would mean D2C brands need to not spend much on marketing, Damani said, adding that there would be an influx of new brands. He believes now D2C companies would take lesser time to become mainstream brands compared to previous years.

These brands offer niche products and target customers whose discretionary spending is high but haven’t been able to spend offline due to the restrictions on going out since the COVID-19 breakout.

“D2C brands primarily cater to the top percentage of the middle class of the country, which wasn’t that affected by the lockdown or pandemic,” said Utsav Somani, partner at AngelList. “People have become more aware of their needs and requirements. And D2C brands are fairly aspirational so a lot of people are adopting them.”

Digitizing India: Bringing small businesses online

In the last few years, there has been a gradual shift of offline retailers and micropreneurs adopting online tools to increase their business. However, there hasn’t been any external factor to speed up this process, until 2020 when having an online presence became a necessity.

The larger VC community is now betting big on startups that are tapping the shift in consumer behavior and enabling small businesses to operate online.

Companies like Dukaan, Khatabook, and OkCredit that digitize the ledger of SMEs are a few rising stars in this space. Similarly, platforms like Teachmint and Classplus that enable tutors to directly reach their students, without any middlemen, have caught the attention of VCs.

“India is the land of small entrepreneurs and digitizing them will continue to be a very large theme. There are millions of them that haven’t had the benefit of software in the past,” GV Ravishankar, managing director at Sequoia Capital India told KrASIA.

Sequoia Capital has already placed a couple of bets in this space such as Khatabook and PagarBook. It recently invested USD 15 million in PagarBook, an SMB focused staff management company.

“For the first time, they all have smartphones and are used to WhatsApp and other apps, so there is comfort in software. Companies are making very simple apps that make it very easy for people to learn and become more productive by tracking their expenses and payments,” he said. “We think there will be an acceleration of this theme next year.”

However, many investors feel this space is going to be a tough one to survive.

According to Damani, there is already a sort-of gold rush in the space, and people are creating all types of services and apps to empower micro-entrepreneurs. With investors pouring in millions of dollars in the segment, he believes there may already be over funding in the space.

In the end, entrepreneurs are not going to use multiple apps with similar features, he said, adding, there wouldn’t be space for too many companies that target same set of customers.

“These are pretty sticky systems. Once people have built ERP systems entailing everything from billing to delivery around a particular app, it would be difficult to switch to another app,” he said.

Ravishankar concurs. “While it will not be a winner takes all in this space, there will be a couple of companies that will, over a period of time consolidate the market,” he said. “And those companies will continue to offer more services around the same app ecosystem to make it easy for SMEs or individual retailers to conduct their business and improve their efficiencies.”

“While there may be many attempts by people who will start different things, I think only fewer people will be able to scale and build something meaningful over a period of time,” he added.

Empowering farmers: Agricultural technology

While the larger investor community was busy writing checks for sectors that witnessed tailwinds such as edtech, health tech, and gaming, there was another less noticeable sector that was going through the disruption–agritech.

Although agritech startups had already been slowly gaining investors’ attention over the last few years with the Narendra Modi-led government pushing for policy reforms to double the farmers’ income by 2022, it was only this year that the sector went through a complete overhaul.

The lockdown broke down the traditional supply chain systems in the agriculture sector during the nationwide lockdown, which led the government to set aside INR 1.5 trillion (USD 20.3 billion) for agricultural infrastructure and announce policy frameworks for barrier-free interstate trade as well as e-trading of farm produce. This was followed by controversial policy reforms in September that seek to remove middlemen and let farmers sell their produce directly to buyers including private institutions and retailers like Walmart without paying any taxes. The investor community expects these reforms to further spur the growth of agritech startups, which have already jumped in on the opportunity.

According to a recent report by Ernst & Young, the Indian agriculture technology sector, which has over 500 startups, has the potential to touch a turnover of USD 24.1 billion in the next five years from the current USD 204 million.

VCs have poured over USD 300 million so far in tech-enabled supply chain startups like Ninjacart, Waycool, Jumbotail, Bijak, and DeHaat. Aside from the startups that offer farmers logistics services and market access, investors are also betting on firms that provide them financial services, AI-based data for better yields, weather forecasts, and agricultural inputs related to seeds and fertilizers, among other things.

“I think agritech is a very large market and will be a major theme (in 2021),” said Sequoia’s Ravishankar. “And initially it would be about market access and selling farmers’ produce, etc., but over time I do think technology would get to the farms and find ways and means of making production to be more efficient.”

“There are already startups that are offering tech to deliver better yield in smaller spaces, but these are very early technologies today,” he added.

According to Venture Intelligence, funding in agritech startups went up to USD 312 million this year till November, compared to USD 245 million that went into this sector last year. The rise in investment is quite impressive considering VCs were busy with their own portfolio companies as there was a funding crunch in the first half of the year. VCs such as Sequoia Capital, Tiger Global, Nexus Ventures, Accel Partners, and InfoEdge, among others, have increasingly become active in this segment.

Connecting India: supply chain and logistics

The year 2020 has probably brought the third and most disruptive wave of growth for logistics startups.

They first caught the VCs’ fancy when e-commerce boomed in the country in 2015 and giants like Amazon, Flipkart, and Snapdeal spent almost 30% of their revenues on logistics. The second bout of growth came about in 2019 when B2B e-commerce and e-grocery took off in the country and logistics startups raised almost over USD 1 billion, more than double of USD 438 million they attracted in 2018.

The startups in the segment began 2020 on a high note, but soon after the pandemic struck and the country went under lockdown, they took a backseat as millions of consumers shopped online for only essentials like grocery, food, and medicines.

However, as digital commerce in India made a sharp V-shaped recovery with people staying indoors for the better part of the year, the demand for supply chain and logistics services shot through the roof.

“This is the first time companies like Amazon, Flipkart, Swiggy, and Zomato are getting traction in tier 3 or tier 4 cities because of the pandemic,” Alok Patnia, managing partner at TMG and ProfitBoard Ventures told KrASIA in a recent interview. “ I think these startups, for the last 10 years, were very much restricted to tier 1 and 2 cities, because behavior and habit change was not happening there.”

“But that change is happening now. So supply chain and logistics startups are something we are very hopeful about,” he added.

Aside from explosive growth in e-commerce on the back of this year’s festive sales that saw the major e-tailers grossing USD 8.3 billion, segments like e-grocery, e-health, D2C businesses, B2B e-commerce, and agri-tech, and hyperlocal services like food delivery witnessed a massive spurt in demand and supply.

“All the e-commerce and parcel delivery companies have had a terrific run in the last few months because online commerce suddenly got so much share from offline,” said Ravishankar, adding he expects some action among the startups building efficiencies for the logistics and supply chain sector.