Iuiga (stylized as “IUIGA”), a leading Singaporean lifestyle brand, has entered the Chinese market, announcing its foray into Chengdu, Sichuan, in November this year. Its entry into mainland China follows a period of positive growth, having amassed a significant customer base across Singapore, Indonesia, and Hong Kong.

Utilizing a hybrid strategy that combines transparent product pricing with an original design manufacturer (ODM) business model, Iuiga is said to have served over a million households since its founding and aims to replicate its successes in China.

Working with ODMs to keep prices affordable and transparent

Formally established in 2017, Iuiga’s foundation was built on a simple premise of offering quality goods at affordable prices. This stems mainly from a dilemma commonly encountered when shopping for home products: either buy from premium brands with exorbitant prices or purchase from mass-market retailers that may compromise quality to keep their prices low.

This value proposition comes with a caveat. To sell quality goods at prices that are wallet-friendly, Iuiga’s primary strategy is to eliminate middlemen, working directly with ODMs to lower manufacturing and logistics costs. Its transparent pricing strategy complements this approach, highlighting the cost savings that Iuiga passes on to consumers. Iuiga’s products are labeled with price tags that break down each item’s production costs and markup, enabling consumers to know what they are paying for. This challenges the assumption that price is a surrogate for quality and is designed to reveal the significant markups charged by other companies, which are typically 8–15 times the cost price, according to Jaslyn Chan, co-founder and chief growth officer of Iuiga.

Working with ODMs benefits Iuiga because it simplifies an otherwise complex supply chain structure that comprises multiple layers of intermediaries. ODMs are typically capable of undertaking the full spectrum of tasks, from product R&D to manufacturing the actual products based on a buying firm’s desired specifications. This means that ODMs can cover the bulk of the design and production process, leaving buying firms like Iuiga with the sole responsibility of selling the products to consumers as the front-facing brand.

This is an arrangement that appeals to the ODMs too, as they are usually able to retain the product design copyrights, enabling them to sell to multiple clients and accruing operational efficiency, optimizing their capacity utilization rates, and lowering production costs. Iuiga works with hundreds of ODMs that have also produced for major brands such as Samsonite, Sephora, and WMF, among others.

Venturing into Chengdu as first mainland China base

As one of China’s emerging business and commerce hubs, Chengdu offers an intriguing base for Iuiga to target a new market while moving closer to production operations. Chengdu is known for streamlining its supply chains under various economic zones such as the Chengdu Hi-tech Industrial Development Zone and the Chengdu Export Processing Zone, consolidating manufacturers, suppliers, logistics companies, and end consumers under one roof.

In tandem with favorable local policies, a well-connected transportation network, as well as competitive labor and operational costs, entering Chengdu will offer Iuiga opportunities to unveil new economies of scale that could further enhance its market competitiveness.

It’s worth noting, however, that while commerce remains one of the fastest-growing sectors, each market is inherently different from one another in characteristics. As such, Iuiga’s success in mainland China may be contingent on its ability to adapt its offerings to fit the local populace, rather than wholly replicate its current strategy.

For example, Iuiga’s key value proposition of selling high-quality products at lower prices, while aligning well with its transparent pricing strategy, could complicate its market positioning when taking into consideration the economic and industry landscape.

While economic growth in Southeast Asian countries like Indonesia has risen on par with China in recent years, Chinese spending power is notably distributed differently. According to Goldman Sachs, spending power in China will increasingly be concentrated amongst two main segments: the “urban middle” and the “urban mass” classes, with notable expenditure differences. For instance, the former holds significantly more spending power and may gravitate toward higher-end and luxury goods, while the latter may be more price-sensitive and favor transparent, affordably priced options. Such intricacies inevitably complicate the formulation of go-to-market strategies.

In addition, China comprises a composition of companies that Iuiga will likely find familiar, including Miniso and Muji, which also have presences in the countries where Iuiga operates. The difference is that Miniso has the homegrown advantage while Muji has stronger brand equity due to its longer history and association with the Japanese “kaizen” value.

Moreover, Iuiga’s click-and-mortar model of starting off online before bridging into the experiential retail space seemingly goes against the grain of commerce trends. As things stand, e-commerce remains on track to account for an increasingly larger share of the overall commerce market in China—similar to what’s unfolding in Southeast Asia.

Will Iuiga’s click-and-mortar model work in China?

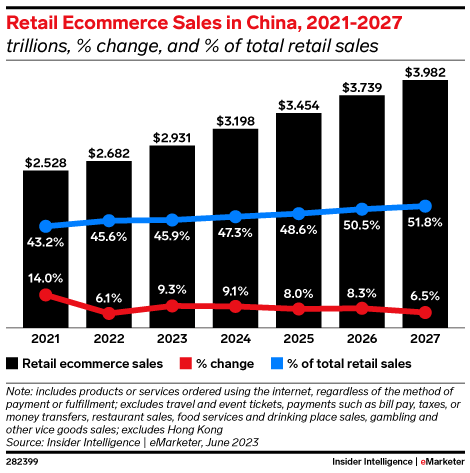

While Iuiga has not disclosed the latest percentages of its online and offline sales, Chan said in an interview with Vulcan Post in 2020 that, at that time, around 95% of Iuiga’s conversions were happening offline, justifying placing greater emphasis on serving customers in stores while identifying growth avenues in e-commerce. This percentage was, however, specific to Southeast Asia, with Chan having acknowledged that the online penetration rates in markets like mainland China were significantly higher, between 25–30%. The reality is that e-commerce is growing at a quicker rate than in-store retail in China and will account for the majority of the overall commerce market by 2026, according to a forecast by Insider Intelligence.

Therefore, it is unclear if Iuiga’s delivery of quality retail experiences will be sufficient to captivate Chinese consumers who may very well prefer purchasing products of the same categories from e-tailers on platforms like Taobao, Tmall, and Pinduoduo, among others, if the price points and value propositions are ultimately similar.

The silver lining to this approach is that brick-and-mortar commerce remains underutilized and might help Iuiga develop a strong brand presence in China. In a gargantuan and multifaceted market like China, vying for attention solely in the online sphere can be a tumultuous task. Retail stores can help create points of interest with potential for deeper engagement and personalization.

In the end, Iuiga’s success in mainland China may hinge on two primary factors. One, whether it can develop sufficient brand equity in the Chinese market based on the uniqueness of its value proposition, or two, if the market segment it’s targeting is large enough for it to thrive despite intense competition. The odds weigh heavily in favor of the former, as Chinese companies increasingly look to other regions for business opportunities due to overcompetition on home ground. Specific to the verticals that Iuiga is targeting, more than a handful of Chinese companies, such as Nome, have already seemingly called time on their ambitions.

Success may require prioritizing factors beyond “uiga”

In that case, how might Iuiga find success?

Aside from doubling down on emphasizing its existing value proposition of selling “uiga”—which means quality in Samaon—products at lower prices, as well as micro-offerings like next-day deliveries, which are relatively easy for competitors to emulate, Iuiga could consider two potential approaches.

The first is to target less common product categories. While Iuiga started off focusing primarily on home and living products—such as furniture and homeware—it has since expanded to cover other categories such as health and wellness, travel and fitness, electronics, and more. It is also known for creating product ranges for less conventional categories, selling face masks during the pandemic, mooncakes during the period adjacent to the Mid-Autumn Festival, and even diamond rings to accommodate potential demand.

The second is to explore brand collaborations. Last year, Iuiga embarked on a cross-industry collaboration with Indonesian fashion brand Purana (stylized as “PURANA”), presenting a limited collection of luggage products that were designed with unique Indonesian nuances. The Chinese market is seemingly in favor of such collaborations, as more brands have undertaken this approach in recent times.

In the coffee industry, one of Luckin Coffee’s most popular drinks is an alcohol-infused latte co-developed with Kweichow Moutai, a well-known Chinese alcohol company. Chinese consumer electronics company Xiaomi has partnered with Disney to launch a Lotso-themed Civi 3 smartphone. Beauty brand SK2 (stylized as “SK-II”) also jointly developed a special “Pitera Essence” product with Chinese candy brand White Rabbit.

These examples not only highlight the potential of utilizing brand collaborations to tap into new consumer bases but also the opportunity for foreign companies like Iuiga to localize their offerings through tie-ups with homegrown brands that hold a significant local following.

Iuiga last raised funding in May 2020, when it bagged a USD 7 million investment in a Series A funding round led by Konimex Group.