Singapore’s tech major Grab, founded in 2012 as a ride-hailing service and dashing to become the everyday app in Southeast Asia, can draw lessons from the growth of China’s Meituan-Dianping and WeChat, which have evolved to become major online-to-offline (O2O) platforms in the mainland Chinese market and beyond.

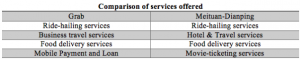

Having evolved into a consumer-oriented online-to-offline lifestyle app, Grab now offers food delivery and mobile payments in addition to its core ride-hailing services, accelerating its business transformation since the exit of Uber from Southeast Asia.

It has also engaged its investor, Didi Chuxing, in discussions for promoting autonomous vehicles (AVs), and most recently worked with Sea’s e-commerce arm Shopee to deliver e-commerce shopping items in the Philippines – all in the name of becoming an all-in-one platform offering a plethora of services for everyday use.

With a presence across Southeast Asia, there are several points of comparison to be made between the two Asian technology majors.

A review of Meituan’s context offers two key insights – the use of a systemic and sequential approach, coupled with a vision to build a services ecosystem – are areas that could enable Grab to compete against Go-Jek on a more sustainable basis.

Meituan’s entry into the OTA space in March displaced the incumbent player Ctrip and illustrates how a systematic and sequential approach can enable new players to successfully compete against market leaders.

Secondly, Meituan can drive its competitors into areas where it can leverage its comparative advantage as an O2O platform – such as its entry into ride-hailing services – that smaller players require continued innovation to stay relevant.

Such moves by Meituan highlight the need for diversification by O2O platforms like Grab. But details from its IPO filing in June reveal that the venture-backed technology enterprise, which is seeking a $60 billion valuation on its public float, also highlight the significant losses it is facing.

Backed by Tencent Holdings, which owns in excess of 20% of Meituan, it is looking to raise capital from public markets to fund its business operations, which are engaged in a price war with other major Chinese Internet firms.

Meituan posted a net loss of 19 billion yuan ($2.9 billion) in 2017, due to increased expenditures on marketing and research. However, it also more than doubled its revenue to 33.9 billion yuan and will seek to highlight its rapid top-line expansion to investors, like other technology enterprises which have adopted short-term loss strategies as they seek to build market share.

On another note, while Meituan seems to have extended itself into more business lines than Grab, in terms of its competitive edge, Grab may be better positioned.

Meituan is competing with other major players in all its business lines: against Chinese ride-hailing giant Didi for ride-sharing; its online travel competes with Chinese OTA leader Ctrip; it is facing Ele.me in the food delivery face; and it is also fighting for market share against Taopiaopiao – which is backed by Alibaba – in movie ticketing.

In a nutshell, Meituan faces fierce competition from major firms in all its business lines.

The lesson can be learnt from here, is a cautionary tale that an extended battlefield might not serve Grab well in the sense that warfare is cash/team-consuming, it causes money and one’s focus.

Having said that, Grab has leveraged Uber’s exit to establish a dominant position in a number of geographies in areas such as ride-hailing and food delivery services in the region. Its acquisition of UberEats – which serves the McDonalds franchise – grants it a major competitive advantage over players such as FoodPanda, Deliveroo, and Honest Bee.

Meanwhile, Tencent-backed WeChat is another instance of a super-app, having started as a social network messaging app that evolved into a super-app; it now offers gaming, payment, messaging and other social networking activities.

The launch of Grab’s payment service, GrabPay, in the 2016/2017 period, as well as the inception of Grab Ventures, follows elements of the WeChat growth story; WeChat Pay is reportedly the second most popular payment channel in China after Ant Financial’s Alipay.

Notably, WeChat Pay is launching in Malaysia, where it will compete with payment services such as GrabPay and RazerPay, as well as local incumbents. However, WeChat Pay will be able to leverage its existing 20 million users in Malaysia and is the first foreign app that can transfer funds in the Malaysian ringgit.

Grab sits in the centre of the competitive strategies offered by WeChat and Meituan, in terms of offering partnerships as WeChat does and launching its own services as a first-move.

Understanding China’s super-app market may aid Grab’s corporate development team in preparing a playbook to compete with the Chinese technology majors entering the region, as well as reshape their growth strategy to optimise their reach in Southeast Asia.