Gold is often seen as a safe haven investment that maintains stable value during moments of financial downturn and uncertainty. In Indonesia, the price of gold has risen by around 33% since the beginning of the year, reaching its highest price ever. That momentum is expected to be carried until the end of the year; meanwhile, there will likely be a continued slowdown in global economic growth because of the COVID-19 pandemic.

“We believe that gold is the safest investment choice in a time of crisis like this, where the entire world is printing more money, which can cause hyperinflation. Gold protects people’s money as it is considered a hedge against inflation. The popularity of gold investment has increased in the past eight months because people started to worry that their money will lose its value,” co-founder and CEO of Indonesian digital investment startup Pluang, Claudia Kolonas, told KrASIA in a recent interview.

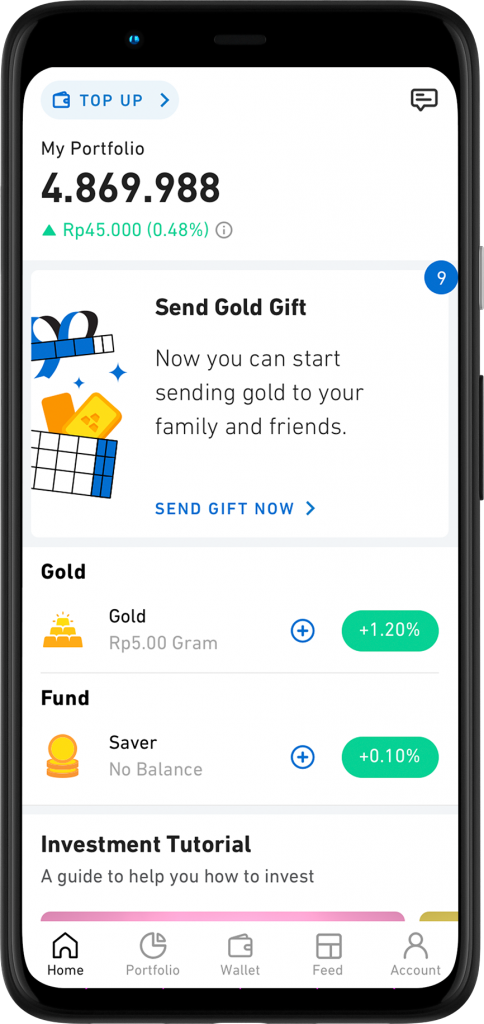

Kolonas said that this sentiment has led to a significant increase in the number of Pluang’s users. “The flow [of traffic and activities] has been very positive this year for us due to the COVID-19 crisis. Gold is less volatile than stocks, so it is more friendly, especially for novice investors. We see that many people who were initially more interested in investing in stocks or mutual funds have now moved to gold.”

The CEO did not share Pluang’s user count, but she said collaborations with a number of platforms have brought additions to its user base. In May, Pluang collaborated with Gojek to roll out GoInvestasi, the first investment product offered on the super app. More recently, the startup teamed up with mobile wallet platform Dana for a new gold investment feature.

Pluang has also partnered with e-commerce unicorn Bukalapak since last year, allowing users to purchase or invest gold in installments. “I think what makes us different from other players is that we have strong business-to-business (B2B) partnerships, which we value very much. Other than Gojek, Dana, and Bukalapak, Pluang is also integrated with other e-commerce platforms such as Shopee, Lazada, JD.id, and Blibli, as well as with digital payment apps True Money and Pede. This way, users have different payment options to invest and save gold,” Kolonas said.

Read this: Gojek is venturing into online investments in collaboration with fintech firm Pluang

Safe and steady

The idea for Pluang came when Kolonas and her co-founder Richard Chua took a class called “business at the base of pyramid” at Harvard Business School in 2016. The class required students to think creatively in order to develop innovations for improving financial inclusion in emerging markets. “Banking penetration was very low at the time, so we were trying to find the right product that fits young Indonesians to solve this problem. We then realized that although gold had always been a popular investment in the country, the current market was not very conducive for local consumers,” she said.

Feeling inspired, the pair set out to make Indonesia’s gold market more attractive for the country’s young people. Kolonas said there were no players in the space back then, other than banks and the state-owned pawn broker Pegadaian. At the time, people were losing interest in physical gold because of its rising price and the high cost of initial investments.

After returning to Indonesia, Kolonas and Chua, who are now married, presented their concept to Indonesia’s Commodity Futures Trading Regulatory Agency (Bappebti), the state-owned clearing house Kliring Berjangka Indonesia, as well as with the Jakarta Futures Exchange to shape their idea for planting physical gold investments in the digital realm in a safe manner. “From there, we started a digital platform that allows people to start investing in gold—as little as 0.01 gram,” said Kolonas.

The company started in August 2018 under the name EmasDigi. Initially, Kolonas and Chua were not involved with the startup full-time as they were still working for other companies, but that changed after EmasDigi raised USD 3 million from Go-Ventures in September 2019.

“People from Go-Ventures said that if we were serious about this, we needed to join the company full-time to build a proper startup and grow it right. So we did, and we rebranded into Pluang right after that investment,” Kolonas explained.

Today, Pluang is not the sole player in the gold investment segment. Other startups offer small-scale digital gold transactions too, like Treasury, IndoGold, and Masduit. E-commerce giants Tokopedia and Bukalapak also provide this service on their platforms.

Although it is now a popular choice, digital gold investment is still in a regulatory gray area and receives less oversight compared to other fintech services, according to Kolonas.

“When we talk about digital gold investment, the first question that comes to people’s minds is probably about its safety and where the gold would be stored. Since the regulation is not very strict right now, there are companies that store the gold in their office, which we don’t think very safe. Therefore, we work with Bappebti and Jakarta Futures Exchange to create this whole system where the gold is kept and guaranteed by the state-owned clearinghouse Kliring Berjangka Indonesia. Even if Pluang went bankrupt, users wouldn’t lose their investment,” Kolonas explained.

Read this: Crack open every wallet | Indonesia’s crowded fintech sector is about to change

Pluang means “opportunity” in Indonesian. Moving forward, the startup has a long-term vision to diversify its financial products beyond gold. Kolonas’ impression is that millennials are increasingly eager to invest their savings. Based on a survey conducted by Pluang, many of its users are interested in exploring new investment choices. The startup is exploring the possibility of adding mutual funds to its lineup, although it is proceeding with care and caution.

“We are waiting for the market to be calmer because we don’t want to release high-risk and volatile products which potentially give bad experience for users. However, we have a very clear path to introduce more financial products as we want to be a part of users’ everyday experience,” Kolonas said.

This article is part of KrASIA’s “Startup Stories” series, where the writers of KrASIA speak with founders of tech companies in South and Southeast Asia.