Subscribe to our newsletter to read this first thing on Friday morning. This is the preview of what you will receive in your inbox.

It’s well known that International Women’s day is celebrated on March 8 to commemorate the cultural, political, and socioeconomic achievements of women all over the world. But not many know there is another day dedicated to women: International Day of Action for Women’s Health that is observed on May 28 every year since the last 34 years. And it is not surprising.

Women’s health remains a subject that doesn’t get much attention, except from certain medical communities. However, a slew of startups in India is trying to change that by offering technological solutions, which help in diagnosing and healing women-specific diseases, while raising awareness about such medical conditions.

For this week’s big read we looked at how Indian medtech startups are addressing some of these women health issues that not only cause physical pain but also mental trauma as the topic still remains taboo.

The Big Read

These Indian medtech startups are changing how women take care of their health

What Happened

Over the past decade, more and more women have been challenged by illnesses such as infertility, Polycystic Ovary Syndrome (PCOS), and breast cancer worldwide. To address these women health issues—which is set to become a USD 41.05 billion industry globally—several startups in India have been creating technologies that can assist in detecting and curing diseases specific to females.

For instance, Chennai-based in-vitro-fertilization (IVF) startup GoHealthe provides artificial intelligence-powered solution to improve the probability of pregnancy by at least 25%—than the manual selection done by a seasoned embryologist—by helping doctors pick the best embryo.

In 2018, the market size of IVF in India was USD 478.2 millionand is estimated to reach USD 1.4 billion by 2026, with a CAGR of 14.7%. However, before the arrival of startups like GoHealthe, infertile couples would think twice before opting in for the IVF treatment, as the entire process is quite expensive. Because its success is largely left to chance, most couples typically get successfully pregnant after a minimum of two to three IVF cycles.

“My wife and I made the decision to go for an IVF after three months of trying to have timely intercourse. We had to consider the fact that each cycle of IVF cost two months of our salary,” Giri Philip, a software developer at Hewlett Packard, told KrASIA.

GoHealthe, which claims to reduce the number of IVF cycles needed and helps prevent emotional burnout of couples, is tapping the booming IVF market in the world’s second-most populous country, which is ironically facing a 50% fall in fertility rate.

Similarly Niramai is offering non-invasive and painless diagnosis technique for breast cancer, while Veera Health connects PCOS patients with doctors, dieticians, and caregivers to create a personalized treatment and healthcare plan.

What Does It Mean

Since these startups, with the help of technology—AI and computer vision—are providing females with an easy alternate to diagnose as well as cure the diseases, it attracts more and more women to use these services without any fear of bodily pain or facing societal taboo.

Last year during the pandemic, Niramai launched a breast screening service that women can use from the comfort of their home. It has diagnosed 36,000 women so far and is present in 14 cities with over 50 hospitals using its breast screening technology.

As these companies see an uptick in terms of usage from patients as well as doctors and hospitals, they have started attracting the attention of top-tier venture funds.

In 2019, Niramai raised USD 6 million in Series A funding led by Japanese VC firm Dream Incubator, Beenext, Flipkart co-founder Binny Bansal, pi Ventures, and Axilor Ventures, among others. The ovulation testing kit manufacturer Inito is backed by Y Combinator and has raised USD 1.8 million from several angel investors.

Last month, Veera Health, a digital health platform for women, received USD 3 million from Sequoia Capital India’s Surge, Global Founders Capital, Y Combinator, CloudNine Hospitals’ co-founder Rohit M.A, Tinder India Head Taru Kapoor, and other angels.

The Weekly Buzz

1. Indian conglomerate Tata looks to invest in Dunzo, but deal stuck over stake size. Dunzo doesn’t want to be owned by the Mumbai-headquartered conglomerate by selling a majority stake, although it is open to the idea of Tata being the single largest shareholder, said a report by local media Economic Times, citing sources. Dunzo’s co-founder and CEO Kabeer Biswas is reportedly looking to raise anywhere between USD 100–120 million at a valuation of USD 500–600 million, without ceding control of the company.

2. Amazon places its bet on India’s wealth tech space with investment in Smallcase. Bengaluru-based wealth management startup Smallcase has raised USD 40 million in its Series C round of funding led by Faering Capital with participation from new investors, Amazon and Premji Invest. Prior to its investment in Smallcase, Amazon has backed Indian startups such as bus-hailing startup Shuttl, online invoice discounting company M1Xchange, and direct-to-consumer beauty brand MyGlamm. In April this year, Amazon announced a USD 250 million venture fund to invest in Indian startups.

3. Indian D2C beauty brand MyGlamm acquires online parenting platform BabyChakra. Financial details of the transaction were not disclosed. After this acquisition, MyGlamm and BabyChakra will invest INR 1 billion (USD 13.4 million) in building a “mother-and-baby content-to-commerce platform” over the next three years, the two companies said in a statement. This is the second acquisition by MyGlamm, which was founded in 2017 and counts Amazon, Accel, Ascent Capital, Bessemer Venture Partners, Trifecta, and Strides Venture, as backers.

4. Online shoppers from smaller towns expected to drive Indian e-commerce market to USD 140 billion by FY 2026. The Indian e-commerce market grew by 25% to reach USD 38 billion in the financial year ending March 2021, according to a new report by consultancy firm Bain & Co and Walmart-owned Flipkart. The overall retail market shrunk 5% to USD 810 billion due to sustained lockdowns amid the COVID-19 pandemic.

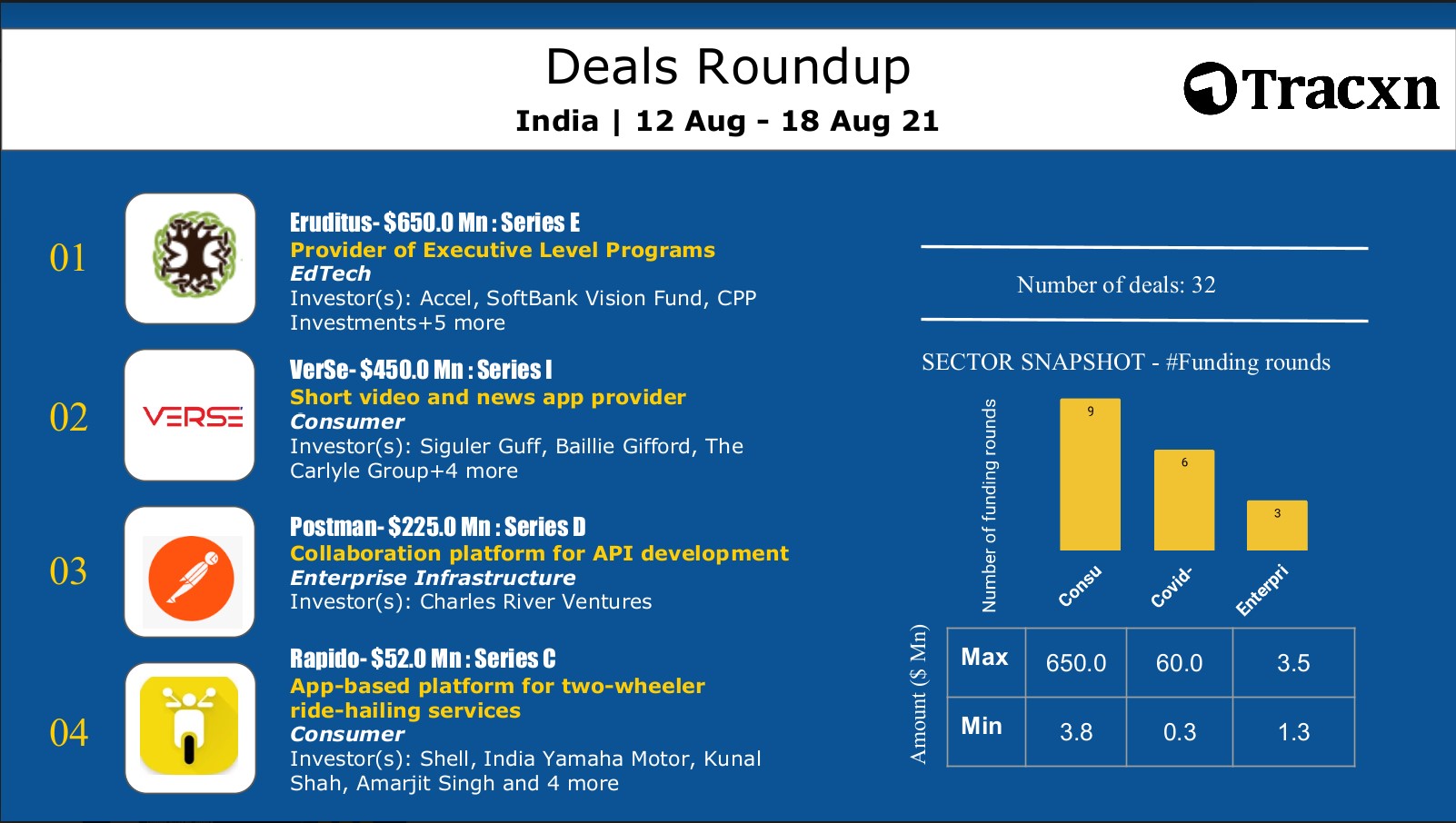

5. Bike taxi startup Rapido raises USD 52 million from WestBridge Capital and others. The Series C round saw participation from few investors including Shell Ventures, Yamaha, Cred’s founder Kunal Shah, Spotify India CEO Amarjit Singh Batra, and Positive Moves Consulting. The funding round comes less than a month after the Karnataka High Court said that electric bikes could be used as taxis for hire by passengers. The six-year-old bike taxi startup ran into regulatory issues in the South Indian state of Karnataka in 2019, when the local transport department raised legal issues around the usage of two-wheelers as commercial taxis.

6. Indian travel booking firm ixigo files for USD 215 million IPO. The offer comprises a fresh issue of equity share worth INR 7.5 billion and an offer of sale (OFS) by existing investors for INR 8.5 billion. The stakeholders offloading their shares in the IPO include ixigo co-founder and CEO Aloke Bajpai, co-founder and CTO Rajnish Kumar, Elevation Capital (formerly SAIF Partners), and Micromax, a local smartphone company.

7. Indian gaming unicorn Dream Sports sets up a USD 250 million fund to invest and acquire startups. The move will help the Mumbai-based startup to diversify its operations beyond fantasy games. Dream Sports will use the fund, dubbed Dream Capital, which is financed from the company’s own power chest, to make minority investments as well as acquisitions. It will cut checks of USD 1 million or more and will have the ability to pump in as much as USD 100 million.

Q&A Of The Week

4 thoughts on cryptocurrency trading in India from Sumit Gupta, co-founder of CoinDCX

In the past eight years, policymakers in India have been at odds with cryptocurrency exchanges and cautioned retail investors of the pitfalls of buying and selling virtual currencies. On several occasions, government panels have recommended a ban on them. Taking a harder stance on the matter, in 2018, the Reserve Bank of India (RBI) asked financial institutions to freeze the bank accounts of entities that allow crypto trading. However, the Supreme Court of India struck down RBI’s notice two years later.

Despite uncertainties around crypto, Indians are investing in virtual currencies in droves. In April 2020, total investments hit USD 923 million. But that number ballooned to USD 6.6 billion in May 2021, according to blockchain analytics firm Chainalysis.

This month, three-year-old Mumbai-based CoinDCX became the first cryptocurrency startup in India to attain unicorn status following a USD 90 million Series C round led by B Capital Group. The company was founded by Sumit Gupta and Neeraj Khandelwal in 2018 and now has more than 3.5 million users.

We spoke with Gupta, co-founder and CEO of CoinDCX, to find out more about India’s cryptocurrency market and the relevant regulations.

Deals This Week

What We Are Reading

When is it too late to buy bitcoin?

Many people struggle to figure out when is the right time to buy bitcoins. Should I wait for a month and see the price is going to drop or go right in now? Should I buy Ethereum or some other cryptocurrency or invest altogether in different assets like gold or real estate? This article probes these common questions and argues why the right time to buy it is right now.

The Spoiler

Tune in next week to find out a global early stage investor’s take on the changing startup landscape in Asia.