The “Jio effect” has brought millions of Indians online in the last two years, and for many of these new mobile-first users WhatsApp is the Internet, YouTube is television—and personal referrals from family and friends play an outsized role in how they discover new products in this new digital world.

This has turned social platforms into powerful distribution channels for many businesses, who are leapfrogging web and going digital with social-first models. Meesho, for example, is empowering more than a million small entrepreneurs to run digital stores on social platforms; while not a perfect analogy the Shopify for India is being built on social platforms instead of the web.

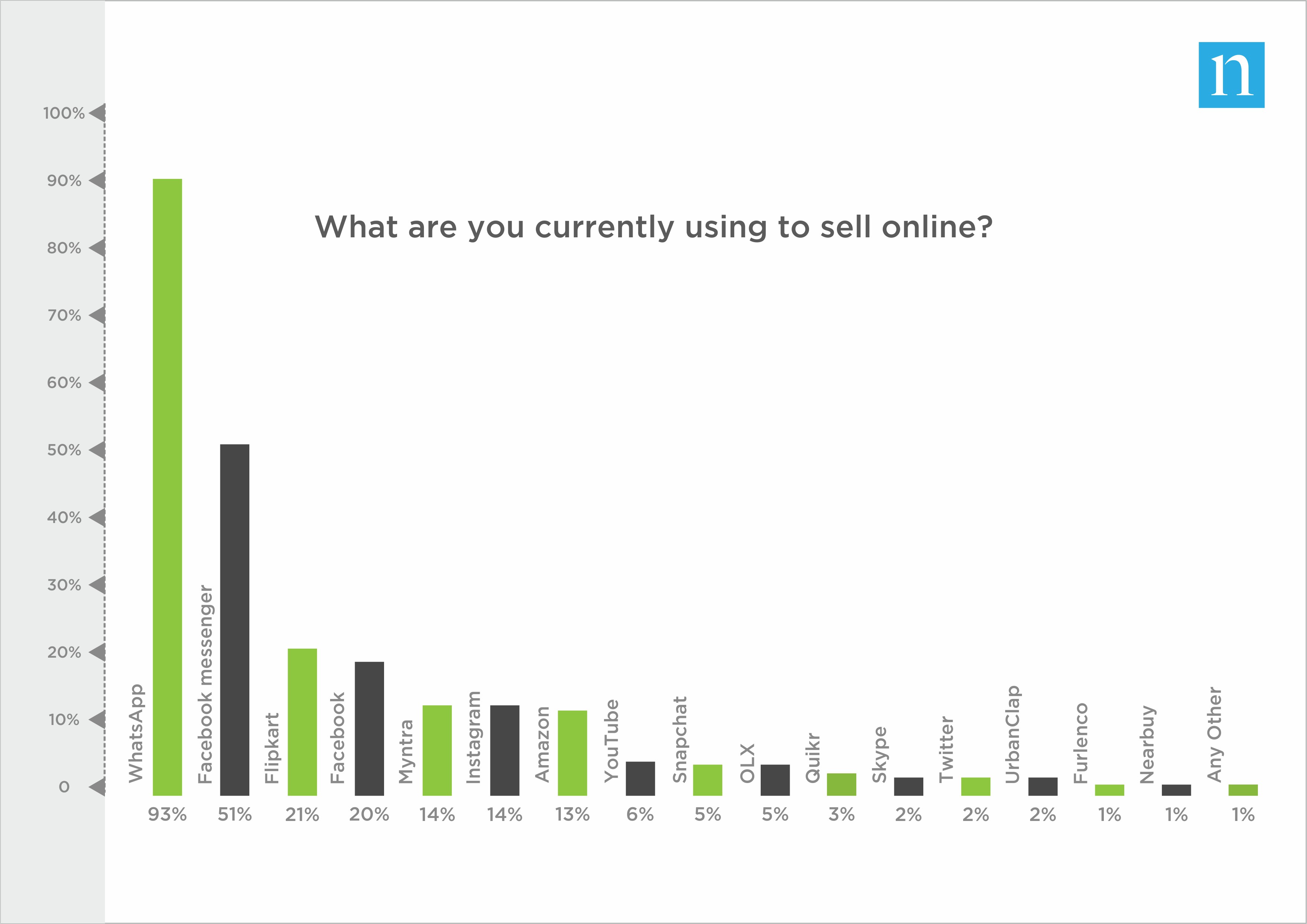

Over 90% of the small and medium businesses we spoke to in a recent survey sell directly through WhatsApp in India — more than 4x the number who sell on Flipkart and Amazon. It’s not surprising given that WhatsApp, at over 400 million users, has five times the daily active user base than any commerce platform in India.

This tectonic shift from web to social platforms is redefining India’s e-commerce landscape.

Social commerce in China has grown rapidly over the last few years and now accounts for over 15% of online retail sales in China, growing 2x the rate of the overall online retail sector¹. We think social commerce will track a similar trajectory in India and could account for 15% to 20% of online retail in India in the next 10 years, creating a market worth USD 70 billion² (more than 2x the size of the current e-commerce market in India).

There’s a huge opportunity in this emerging space, which is at the start of its evolution. To understand how Indian businesses are transacting on social, and gauge where the opportunities are, we conducted a survey³ of consumers and micro SMEs through Nielsen and also interviewed start-up founders building social-led businesses models. Here’s what we learnt.

Social is redefining India’s e-commerce landscape

Personal referrals play an extremely powerful role in online commerce. When a trusted friend shares a link on a chat to a group on (for example) homewares, holidays or electronics to a new user on a platform like WhatsApp, they’re very likely to join in. Nearly 60% of the consumers surveyed, said they click on links sent in commerce category groups they’re in to read more about the subject; 50% said they click on links to view the offering — and 44% said they forward interesting content from those groups to friends.

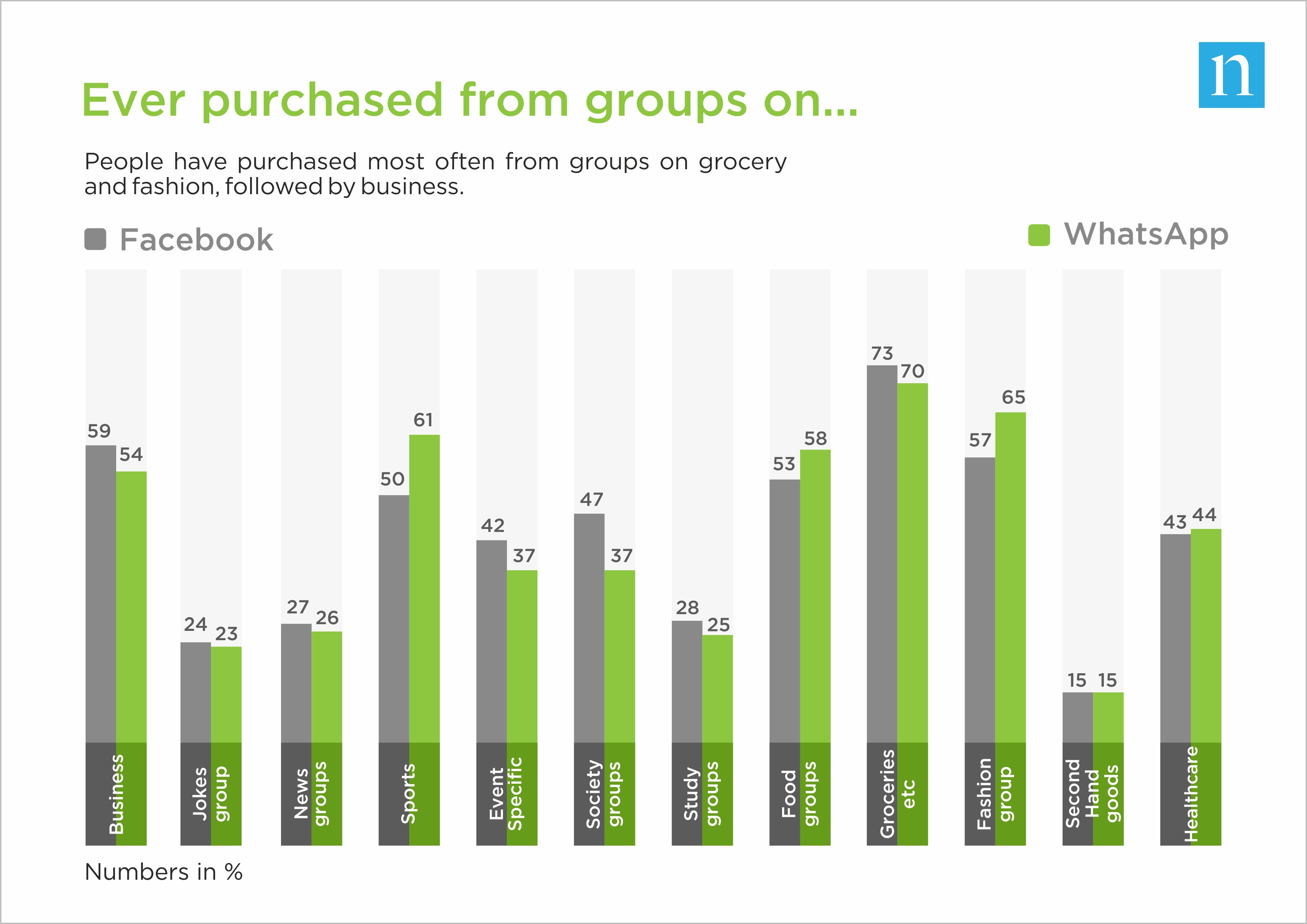

This level of engagement is creating entirely new shopping habits. The majority of the consumers we surveyed have actually gone on to purchase products via business, sports, food, grocery, and fashion groups they’re a part of on Facebook and WhatsApp.

Businesses are acting swiftly to reach these consumers. Social platforms are far and away from the preferred choice for commerce by micro/small businesses we surveyed: 93% sell on WhatsApp and 51% on Facebook, compared to 21% on a focused e-commerce platform like Flipkart.

The fragmented nature of India’s retail and services sectors amplifies both the push and pull of social commerce. Think of all those small marketplaces across India where thousands of small shops sell everything from phone chargers to lehengas. Social offers them a new platform to reach consumers in their community — and invites to chat by family and friends helps consumers figure out which local travel agent or realtor they can trust. The Nielsen survey showed the products and services sold by SMEs on social platforms spans a wide range of categories, mirroring the fragmented marketplaces of India.

Groups, Communities, and influencers are driving down the CAC (customer acquisition cost)

What’s even more interesting is how India’s nimble micro SMEs are using social channels in creative ways they weren’t necessarily designed for — to drive down their cost of customer acquisition or sales.

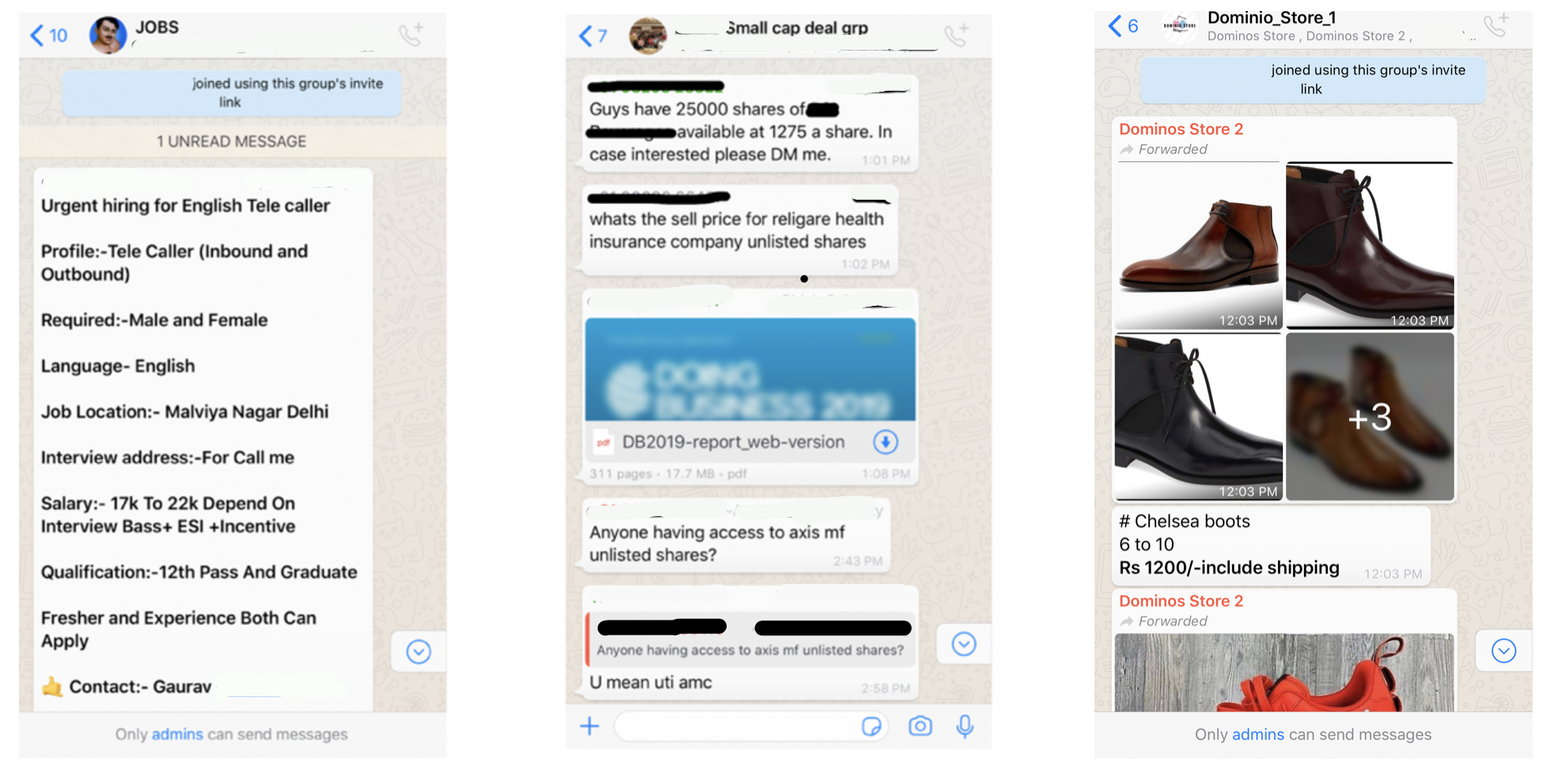

For instance, group chats across various platforms are proving to be powerful tools for low-cost customer acquisition. By creating communities of people with common interests and sharing content that customers can share with just one click on a platform they’re already on, businesses are able to build an ever-expanding direct marketing and direct sales network with virtually zero costs. Mark Zuckerberg recently also described group chats as one of the “fastest-growing areas on online communication”.

How Indian consumers are discovering everything from products, content, new jobs and even stock market tips is being redefined through chat groups. Check out a few such examples below:

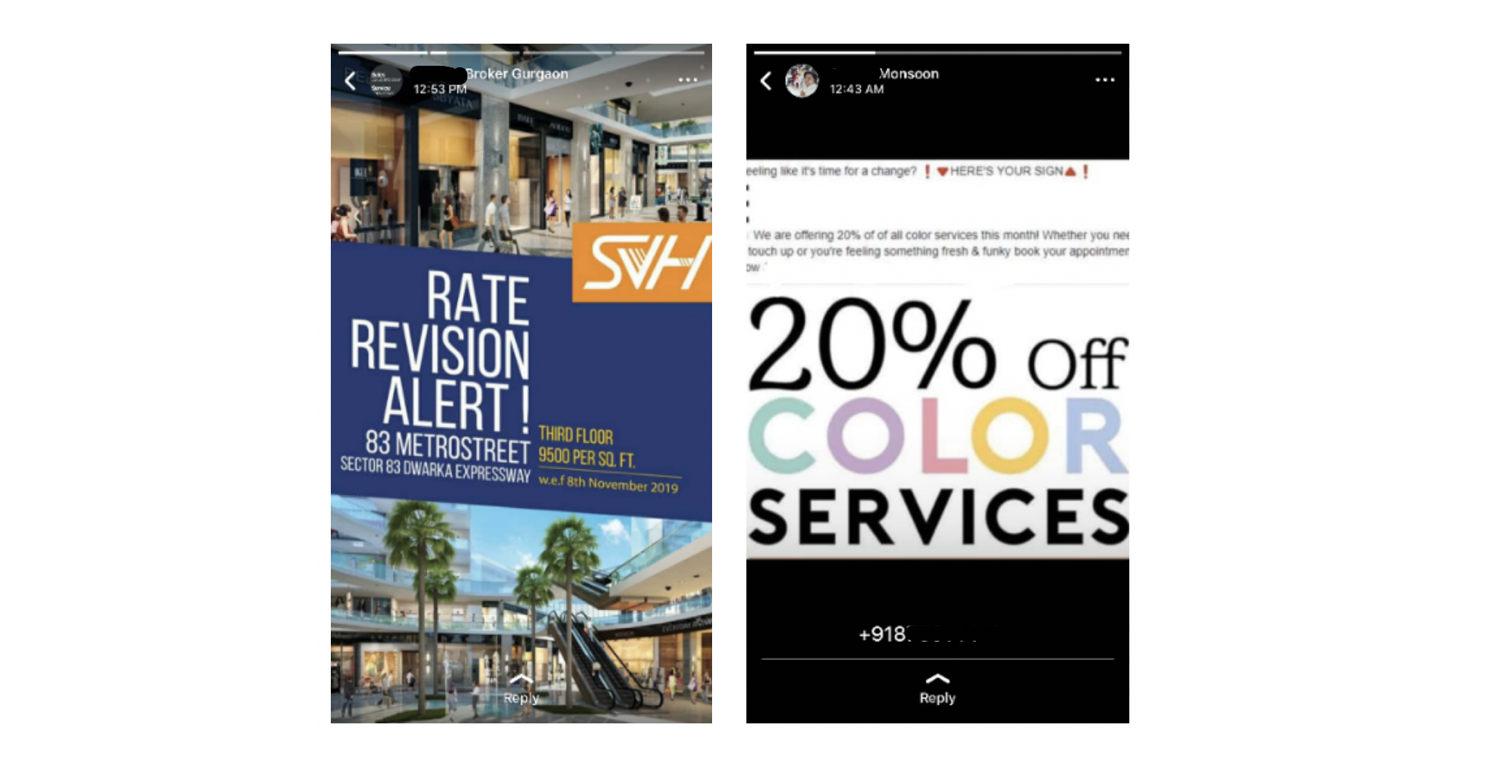

The Nielsen survey also showed that WhatsApp’s Status feature is also emerging as a key channel to generate leads. SMEs we surveyed are making creative use of WhatsApp Status stories which, like Instagram, let users post images, text, and videos on their profile that disappear after 24 hours. Check out a couple of examples here:

Non-commerce companies across sectors are also leveraging this behavior to drive customer acquisition. Over 60 million content pieces from Dailyhunt, India’s largest vernacular content platform, are shared from their app to WhatsApp groups every month, which drives a significant portion of their mobile-web traffic and app installs. Doubtnut is reaching millions of students in India using their ask-a-question on WhatsApp service and chat groups which are loved by students.

The rise of social media and the dramatic change in content consumption behavior is also redefining what celebrity means in Bollywood-mad India, giving more firepower to social-led commerce. New-to-Internet users are leapfrogging TV and consuming almost all their entertainment on YouTube, TikTok, Instagram and other social platforms, giving rise to a new generation of digital celebrities who connect directly with their fans. The new-age consumers want authenticity and a deeper emotional connection, and these influencers are stepping up to fill that gap.

Bulbul.tv is reimagining video commerce, leveraging new age influencers who have deeper connects with their followers. Several D2C brands, powered by social influencers, are growing nicely through Instagram and YouTube, with extremely low customer acquisition costs. We think this trend will gain strong momentum in the coming years.

The next billion-dollar opportunity for India

Online commerce 1.0 (Amazon) removed the barriers of geographic coverage, allowing brands access to millions of customers across regions they never had access to. E-commerce 2.0 saw the advent of marketplaces (Taobao, Tmall) that enabled small businesses to list their products online, but sellers were limited by the eyeballs they could drive to their products on these marketplaces or the vagaries of search and advertising on these marketplaces. The rise of social-first models democratizes e-commerce further still. A small business selling on WhatsApp doesn’t need to pay huge marketing expenses to get consumers. They can also talk directly to consumers about products and trends they care about in their own language, building deep roots in their community while leveraging their customer’s personal networks. In our view, the evolution of this model is a process of decentralization and fits with modern consumers’ need for more personalized and differentiated products.

WeChat, the leading messaging app of China, has now become one of the most powerful distribution platforms globally. It offers 1 billion-plus DAUs⁴ compared to 300 million on Taobao/Tmall (largest commerce platforms in China) to businesses using its platform. WeChat now drives USD 150 billion-plus in trade annually⁵ and has given rise to several multi-billion-dollar companies across various categories in China.

We think the opportunities to build new social-led business models in India are limitless — and, if and when social platforms open up their APIs it could only broaden the horizon over time. Here are some areas we think have lots of potential:

High-value e-commerce: High-value products or services typically have lower conversion rates, particularly so in countries like India where the trust deficit amplifies this further. This makes the customer acquisition cost in such businesses incredibly high. We think such businesses will find it useful to build social-first models where a community-based product could lower the trust deficit. Think of a travel group where users can recommend and suggest to members of the group what hotels to book, places to visit among other things. Real estate, jewelry, auto, among other spaces are some categories that could potentially be rethought using social-first models.

Unlocking new consumer segments: While social commerce is taking off among the mass market and tier 2/3 city consumers, it’s yet to penetrate as strongly among more affluent, urban consumers. Products or offerings targeted to the needs of this base will likely change this over time. Unlocking commerce for this segment is a big opportunity. Use cases like FMCG (fast-moving consumer goods) and Grocery, where people in India enjoy buying as a group, might be a way to engage this demographic. Multiple companies in China have scaled well with social commerce models in such categories.

Enablers for the social-commerce ecosystem: Logistics and payments are key enablers to any e-commerce ecosystem. Much of the commerce behavior in this ecosystem currently continues to be extremely hyperlocal; think of small businesses like kirana grocery stores, home chefs, boutiques, among others, that create their network of customers using local connections. Almost half the SMEs (45%) in our survey spend <5% of product value on average on logistics and another 25% spend between 6% to 10%, and only 38% use formal organized logistics providers. Addressing commerce for this segment will require a new approach to logistics which is more affordable, efficient and localized than the current solutions. Digital payments are also under-penetrated in this ecosystem and there’s no WeChat Pay-like offering yet in India’s social commerce universe — an area that’s ripe for innovation.

Big shifts in user behavior have created massive opportunities globally — we continue to be very excited about the rise of social-first digital businesses in India. If you’re building one and would like to brainstorm with us do drop us a note and keep following this space for more updates!

Sources:

(1) Internet Society of China and Chuangqi Social Commerce Research Center Report 2019: EMarketer report China

(2) Unraveling the Indian Consumer 2019 — RAI Deloitte report; Sequoia internal estimates

(3) Based on a survey conducted by Nielsen for Sequoia India, across 2170 MSMEs and 1,561 consumers in India in 2019

(4) Questmobile/Techcrunch

(5) https://www.nobleuniversal.com/new-blog/20/3/2019/digital-china-in-2019-trends-and-recommendations

Shraeyansh Thakur is the Vice President of Sequoia Capital India LLP. This article first appeared on a Medium blog.