At the end of 2017, Tang Ying had several long, frank talks with the core members of her team about the direction of their startup—an online English education platform for college students.

Despite an RMB 3 million (USD 435,900) early-stage investment from two domestic venture capital firms, Uxue Education wasn’t a blockbuster success. There were several companies jostling in the same corner of the market, and investors had already placed their bets on one of Uxue’s competitors. In order to minimize costs, her ten-member team had been working from a residential unit rather than renting an office.

“At that time, online education was a magnet for investment—except for adult education,” she observed recently.

Many investors suggested that her team should shift their focus to K–12 education and take on students who were somewhere between preschool and 12th grade. But Tang quickly shrugged off that idea. “I’m just not that interested in kids. And I think if you are not very interested in the target users of your product, you can’t possibly make a good product.”

But what would be their new project? It was a life-or-death question for her team. Tang wondered: What was she passionate about that also had great market potential? It didn’t take long for her to figure that out—cats.

Sansan, the American Shorthair that Tang would sometimes refer to as her “eldest son,” was the center of her life outside work. Tang took him home from a pet store after closing their first funding round and Sansan stayed by Tang’s side through her entrepreneurial journey.

As any indulging cat mom would do, Tang strived to give Sansan the best as often as she could, which sometimes involved asking her brother, who was living in New York, to place orders on PetSmart or Chewy.com for cat food that was made and sold abroad. But that was a frustrating process—cat food is heavy, so shipping costs were high. She usually had to wait until her brother or one of his friends visited Beijing for them to ferry the supplies to her. (That arrangement was far from ideal, as their luggage typically had limited space.)

“China has one of the most developed e-commerce industries,” Tang thought to herself. “How come customers’ demands aren’t being met in this niche market?” It occurred to her that this could be it. Her objective of giving Sansan the best care possible set her on a path of building a business that would deliver the same to other pets in the country.

Pets: From outcasts to kin

We’re all familiar with China’s rise. Its economy has been growing at a breakneck pace since the late 1970s, when reforms were introduced. In recent years, pets have become part of modern Chinese family life. According to last year’s Pet Industry White Paper published by online pet community Goumin.com, China now has 73.55 million pet owners. Among them, 33.9 million households have at least one dog at home, while 22.58 million live with cats.

More than 40.6 million feline friends and 50.85 million pet dogs roam in Chinese homes, a sea change from a little more than four decades ago when pets were denounced as objects of bourgeois vanity during the Cultural Revolution (1966–76). During those fateful years, families or individuals keeping pets risked being cast into the “Five Black Categories”—landlords, wealthy farmers, counter-revolutionaries, “bad elements,” and rightists—in the frenzied purges.

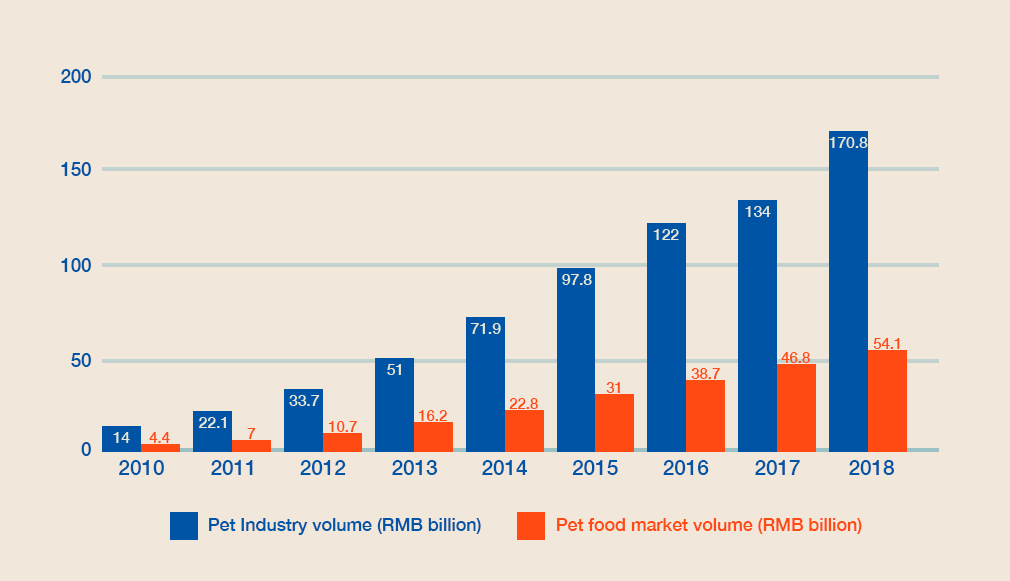

Today, the country’s pet industry has an annual transaction volume of RMB 170.8 billion (USD 24.8 billion), with cat owners spending RMB 65.2 billion on food, snacks, care products, as well as spa and medical services each year. That means, on average, each cat owner spent RMB 4,311 annually. Cat food alone accounts for about 44% of that expenditure.

But that’s just the starting point, Legend Capital analyst Brandon Wang told KrASIA. “We think China’s pet industry is still at the early stage of development . . . Generally speaking, Chinese people are still not spending enough on the food they are feeding their pets,” he said, adding that there’s plenty of room for consumption upgrade.

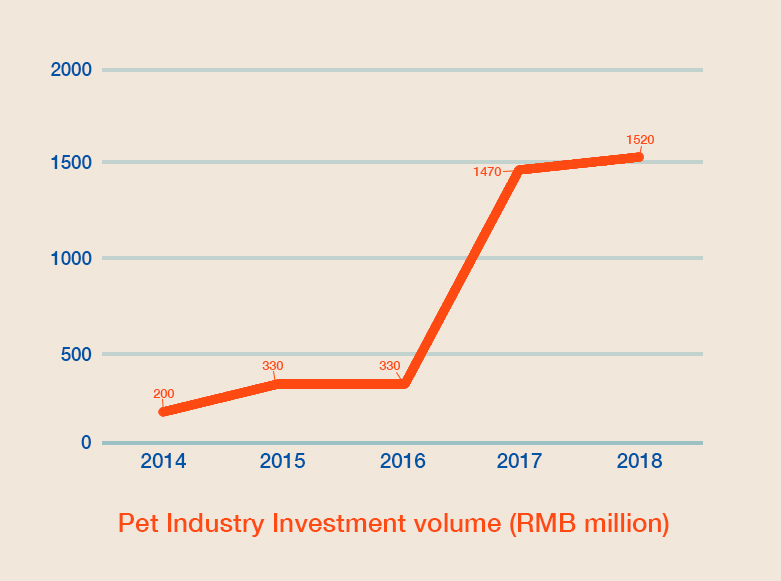

The pet industry’s rapid growth has attracted an influx of capital. In less than five years’ time, companies in this sector have courted 120 rounds of funding, totaling more than RMB 5 billion in investments. Pet food manufacturing, pet e-commerce, and pet clinic chains are investors’ favorite bets.

Beijing-based venture firm Guangdian Capital’s founding partner Zack Fu has observed a massive expansion of China’s pet industry in recent years. “If we look mainly at the data, the growth [of the pet industry] is faster than many other consumer goods . . . even faster than beauty products and maternal-infant care products,” he said, explaining why the pet industry has all of a sudden become the fair-haired child for many investors. Fu’s firm has recently participated in a USD 43.4 million funding round of online pet care brand Crazy Dog.

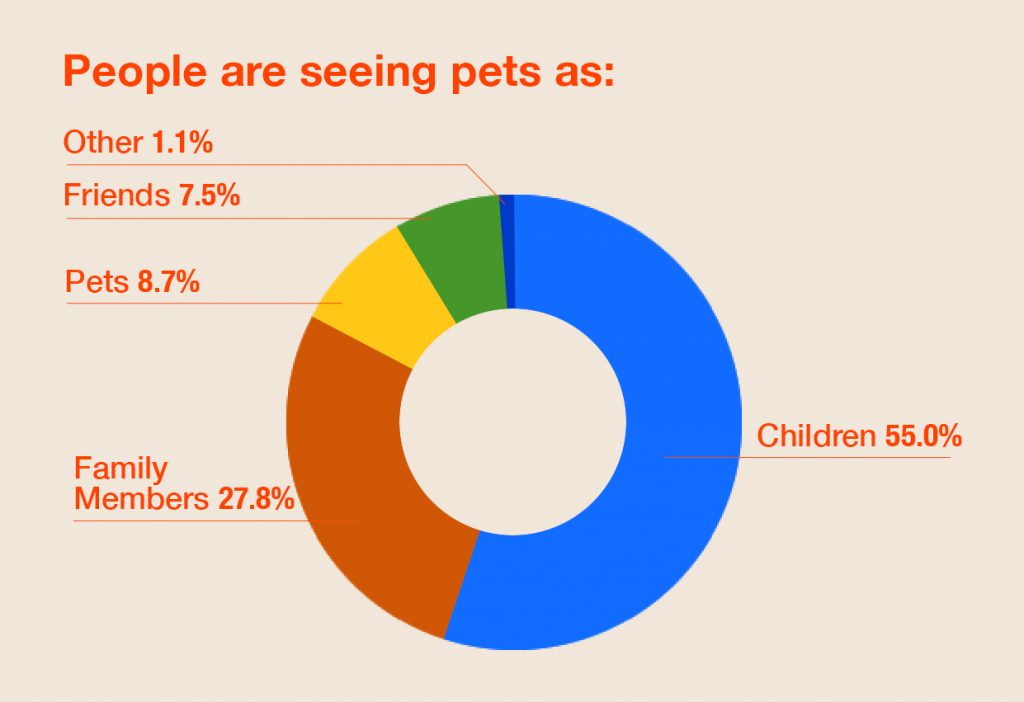

Charles Zhang, an associate partner at Lightspeed China Partners in Beijing, compared the pet industry to the country’s booming baby industry. In both cases, those who are shelling out are not the end users, but they generally willing to pay a premium for peace of mind.

But unlike the baby industry, where parents need to use different e-commerce platforms as their child gets older, pet owners are much more likely to stick to one marketplace. “We can see that users of pet e-commerce platforms like Chewy.com are exhibiting stable purchase behavior for five or even ten years,” Zhang told KrASIA.

And that’s how Tang struck gold with her first foray into the pet industry.

WeChat mini-programs and social commerce: A success story

Her second startup, PetPlus, which owns an array of e-commerce platforms based on WeChat’s mini-programs, has recently closed a USD 5 million Series A round with investments from LB Investment, Z&H Investment, and Lightspeed China Partners, valuing it at USD 20 million.

Looking back, the successful launch of PetPlus’ e-commerce business was almost surreal. During their trial run in January 2018, they sold over 6,000 bowl-shaped scratching boards on their WeChat public account in 72 hours. “The factory which made this [scratching board] did not even have enough stock to fulfill the orders. They had no idea how we managed to do that,” Tang said. Even the team at PetPlus was shocked.

Four months later, when Tang and her team launched a sales portal based on mini-programs, they broke that sales record again, with more than 10,000 units sold. Their mini-program, Chanshiguan Aishengqian (translation: “cat owners love saving money”), was so popular that a tidal wave of traffic overloaded their servers shortly after their debut.

It was a good problem to have. Their customers’ enthusiasm surprised the team, especially given that the starting point for sales was merely a link for the product that was tacked on at the end of an article shared in a WeChat group with about 70 cat owners.

Fast forward to the present: Tang’s pet e-commerce platforms now have close to 4 million registered users. PetPlus’ secret to success? It’s social commerce blended with mini-programs.

Their fanbase swelled, fueled by word of mouth recommendations that pet owners shared with each other, one WeChat group after another. Existing members get discounts by sharing links to products and bringing in new customers. Like Pinduoduo, the more clicks a user generates and the more signups she facilitates, the steeper her discounts are.

Since all of this took place in WeChat groups, the choice to build marketplaces using mini-programs instead of a standalone app was a no-brainer. Besides, WeChat’s ubiquity among their target buyers also made it necessary to run WeChat-specific promotion campaigns. “You won’t use a pet-related app every day, but you are most likely to check your WeChat several times a day. And when you do that, we have our ways of ‘polluting’ your eyeballs,” Tang joked.

Compared to other players in the industry of e-commerce for pets, Tang and her team are latecomers. Shanghai-based Boqi, the top dog of the industry that has backing from Goldman Sachs, closed its Series D funding round in 2017 and is reportedly planning an oversea initial public offering. Echong, a Chongqing-based online marketplace set up in 2008, closed its Series B funding round with USD 50 million in 2017 as well.

But PetPlus’ strength in user engagement might help it catch up with the pioneers.

“For pet e-commerce platforms, what matters the most is user stickiness, and the cut-in point is also very important. Otherwise, users would eventually turn to shop on Taobao or JD,” said Scarlett Ho, an analyst at Gobi Venture Capital.

Changing attitudes toward sharing a same roof with furry friends are also contributing to PetPlus’ success. “Keeping pets is a relatively low-cost way of having emotional support and companionship. It’s much cheaper than starting a family or having kids . . . That’s why many young people are treating their pets like their own kids and willing to spend more on them,” Tang said.

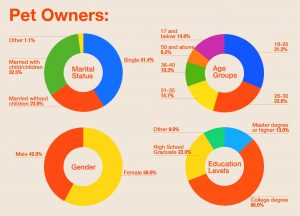

Nearly 80% of the Middle Kingdom’s cat owners are born in the 1980s and ’90s, and they are predominately female white-collar workers who have completed their education at university. As today’s young Chinese are more likely to get married later and have smaller families than their parents, pets are no longer just pets. More than 80% of pet owners now see their cats or dogs as their own kids or family members, according to a research note published by TF Securities.

That’s something that Tang knows too well. A single woman in her early thirties, Tang lives in the country’s capital with three adorable feline kids, each spoiled just enough by their favorite human.

Charts and graphics by James Chan.