In the modern era that we live in, the rise of entrepreneurship and advanced technology have impacted many basic facets of traditional business – both consumer and enterprise. This brings about a deeper interest in the innovation economy.

The rapid rise of technology that culminated in the dotcom bubble was but a prelude to a new and advancing technology world we live in today. Macro environment, availability of funds and cost of borrowing worked dynamically for the success and failure of any type of economy.

With this in mind, let’s explore the present macro outlook.

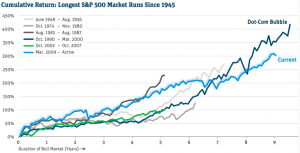

Persistent Bull-Market

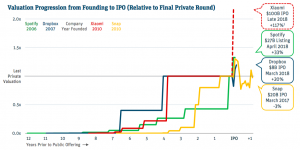

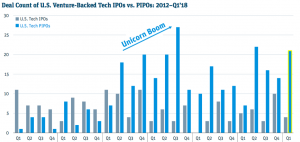

Coming from a strong performing 2017, the first quarter of 2018 ushered in several high profile IPOs. Some examples are – the Spotify who offers music, podcast and video streaming services, DocuSign, an electronic signature startup and software company Smartsheet.

Trade wars and impending interest rate hikes to put an end to ‘’easy money’’ did bring in the reemergence of market uncertainty and a host of new risks.

Nonetheless, the bull market marches on, with money continue to flow into the innovation economy.

Worryingly, this depicts the second longest bull market since the second world war. Will history repeat itself and if so, how long more will the market charge on – are some questions that’s rife in the minds of investors, consumers and business owners.

These tech companies thrive on open markets and rich valuations despite growing caveats like a potential trade war and rising interest rates. The market maintained undeterred optimism.

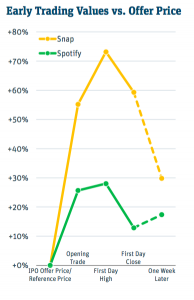

Swedish entertainment company – Spotify’s successful non traditional IPO listing amidst a surge in volatility, is an example of the buoyant mood.

When comparing Spotify with other growth stories, only Snap bucked the overall positive trend.

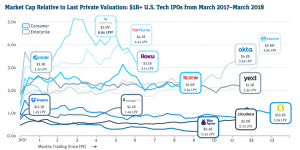

Yet again, Snap & Blue Apron’s sinking valuation failed to drag public’s faith in the growth stories of consumer tech, as both consumer-facing & enterprise businesses continue to reap great rewards relative to private valuations, as seen by the diagram.

Changing perception to traditional IPO-routes

While a bull market bodes well for IPO, not all businesses would jump onto the bandwagon. It could be because a relatively young startup might not be ready, or that some of the owners are not used to the discomfort that comes with the scrutiny of the public markets.

In the past 4 years, the private markets actually dominate IPOs, with these mega rounds outpacing the latter in the US.

What changed the dynamics for financing for the innovation economy?

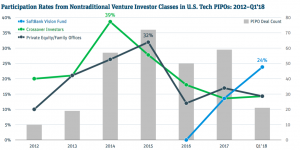

Traditional venture capitalists, mutual funds, hedge funds and private equities – have stalled their investment plans – possibly due to risks or looking for more favorable odds.

SoftBank, a Japanese multi conglomerate, took the opportunity to fill in the gap, spearheaded the force for innovative technologies.

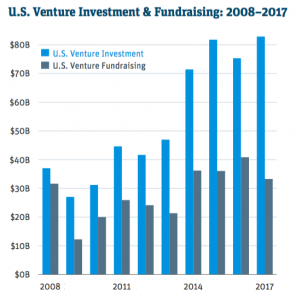

Other non-traditional investors like corporates, international investors and venture-backed companies jumped on board, resulting in a persistent rise in investments to the dizzy heights of today. The ‘risk-greedy’ VCs have also met their match, with VC-backed companies raising 2.5 times more.

Despite the resurgence of market volatility in 2018 and the deepening tensions between China and the US, globally – investors are still awash with cash and continue to be in search for the next technology deal.

Optimal environment for Tech Companies

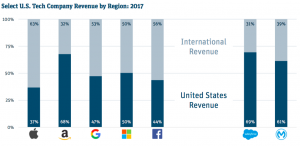

It is interesting to note – technology removes borders, promotes multilateral trades and thrives via open markets. Technology giants in the US for instance, are highly dependent on overseas markets, as seen by the diagram below.

International expansion plans are etched on the minds of technology giants.

Chinese smartphone maker, Xiaomi’s successes in India & Indonesia, Ride-hailing giant, Grab’s ambition in the Southeast Asia region and Chinese ride-hailing tycoon, Didi Chuxing’s expansion into Mexico are some of the recent trends.

Technology that is used to solve ‘common needs’ like travel, food and entertainment tends to have greater propensity to expand even faster.

Ride-sharing illustration

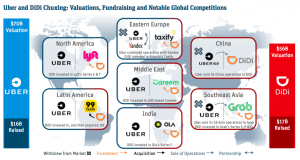

An infamous technology disruption to public transport and the taxi community – Ride-sharing services, has effectively lured people with cheap convenience, thereby changing the daily commute patterns of many. It spread worldwide with Uber, Lyft, Grab, Didi Chuxing among others.

Thus, a closer look at the ride-sharing segment posits a comprehensive example of how international expansions are pivotal for these giants.

With a $40 billion valuation, Uber was confident to establish a global network, expanding rapidly. This resulted in extreme burn rates and the eventual selling of operations to local players.

It is thus imperative to mention that while tech companies bring with it many upsides, international expansions are still fraught with difficulties. Domestic players tend to have the comparative advantage to understand the local culture and way of life.

The first major sell-off of Uber was in China to Didi, signifying a dominant growth in the rise of Chinese tech companies.

China’s rise to becoming a global leader in technology

In the past few years, China’s technology companies grew phenomenally and is now recognized globally.

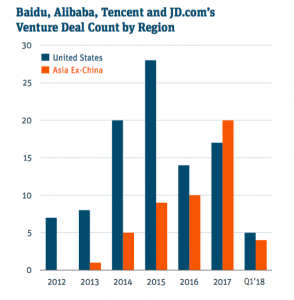

Online shopping giant – Alibaba, Chinese internet conglomerate – Tencent, Chinese search giant, Baidu and Chinese e-commerce giant JD.com are some of these examples.

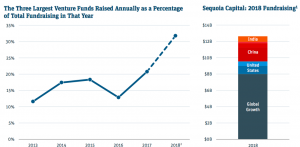

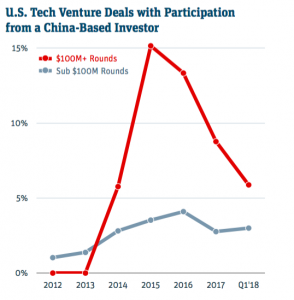

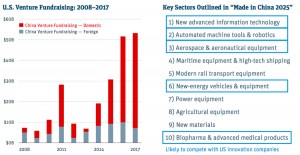

Today, with more attractive investment opportunities in China, less investments are going to the US or other countries, as seen by the diagrams below. A structural change to fund China’s bold ambitions in technology.

The Chinese has also set sights on becoming the global leader in several advanced technology areas, backed by venture funds commitment, domestic enthusiasm and government commitment.

The great awakening of tech valuations

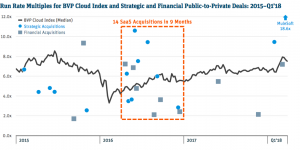

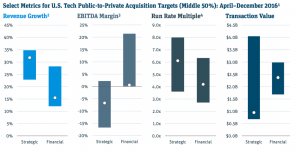

Back in 2016, public multiples tumbled – indicating the fear of a ‘bubble’. However, both financial and strategic buyers leapt forward, buying up a dozen public-to-private acquisition, restoring investor confidence back into the market, avoiding a market collapse, and markets have rebounded ever since.

With the faith in technology companies having huge potential, there were no short of buyers even as private equities shy away.

Future of the Innovation Economy

The law of diminishing marginal returns – is common to all, even technology companies. Ballooning capital investments in China is now at levels higher than the established Western world. Looking at data of the most recent financial crisis, some would worry if the stellar growth can continue, would the enlarged commitments hold up.

Trade wars can also significantly affect tech companies, considering how they thrive on the modern open economies, making huge waves of international expansions.

Maybe, sovereign wealth funds from the world’s oil production leaders might be the game changer – supplying funds to support the enormous tech growth in the name of diversification.

Nevertheless, the innovation economy has thus far managed to beat nature, finding a way to beat the odds and sustain the growth.

Editor: Ben Jiang