KrASIA released an article featuring 5 animal representatives with prominent traits among investors today.

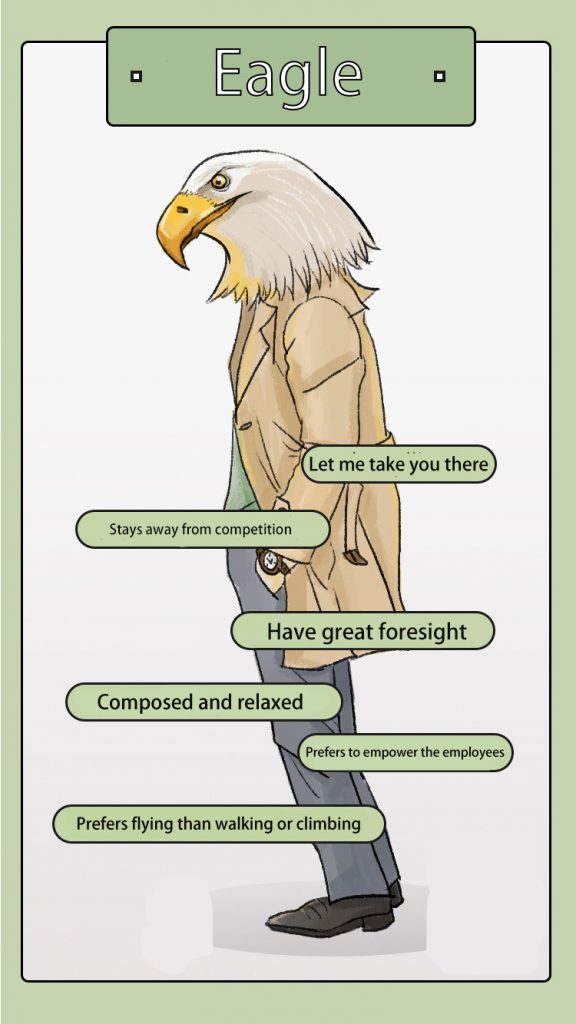

Today, we will share stories about the Eagle, Alibaba and Tencent

Read also:

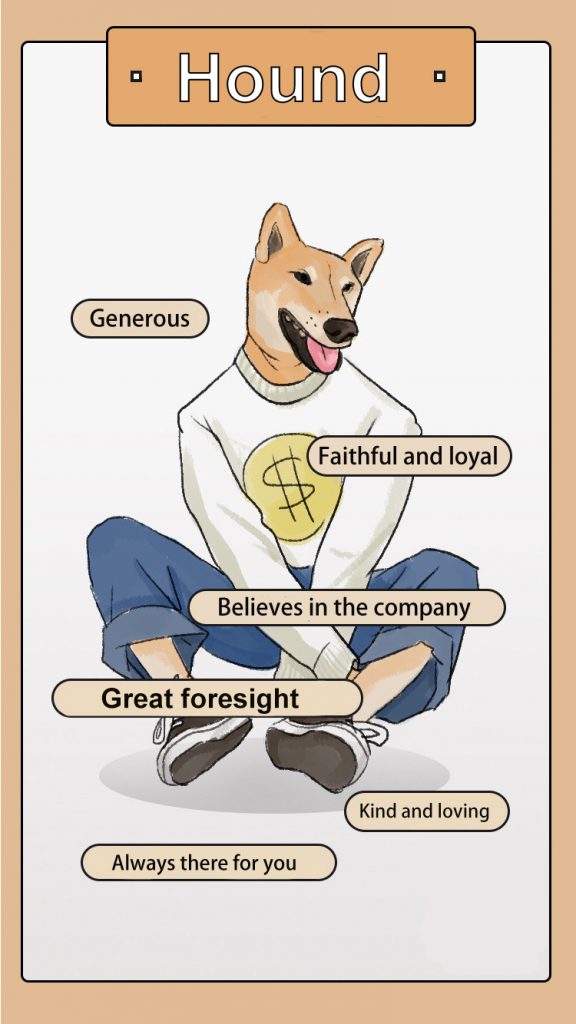

The Hound: Investors behind Alibaba, Tencent and Bytedance

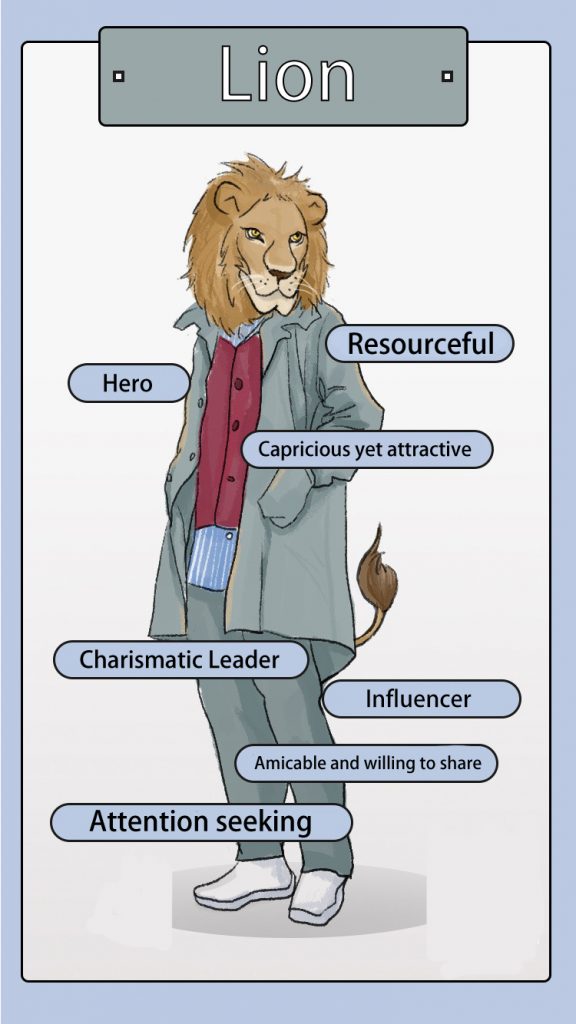

The Lion: Investors behind Ele.me, Xiaomi, OPPO and Vivo

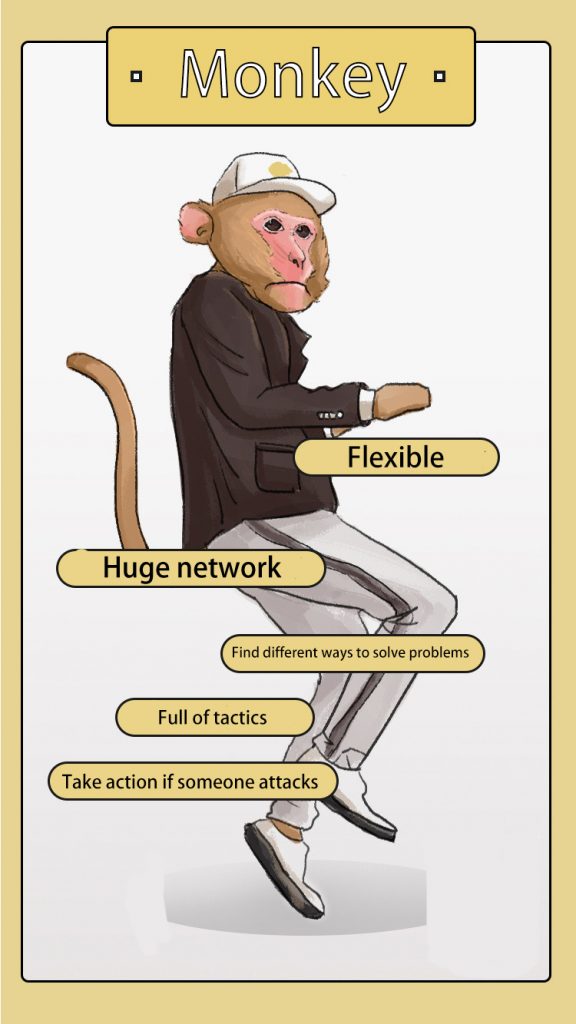

The Monkey: Investors behind Didi and ofo

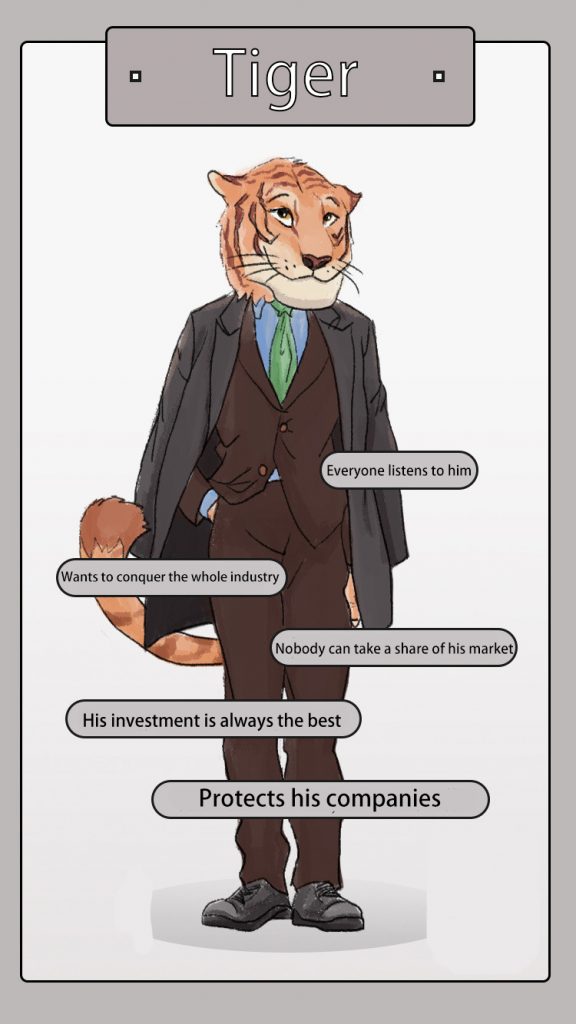

The Tiger: Investors behind Tencent and JD.com

If Tiger investor is king, Eagle investor is supernatural and extraterrestrial. They are visionaries. They are also tech powerhouses with far-reaching global ambitions. They invest in startups beyond their core services, local and abroad. They are futuristic, bold, valued for almost 1 trillion USD combined, and are aggressively buying over innovative startups.

Alibaba VS Tencent

Alibaba and Tencent are exemplifications of an Eagle investor. In the 1990s, the two founders who are unrelated yet share the same surname 马 ‘Ma’ (Chinese character 马 signifies a horse) started with a vision. Jack Ma wanted Alibaba to empower SMEs with his mantra 让天下没有难做的生意 (to make business easy everywhere). Pony Ma’s vision for Tencent was to enhance the quality of life through Internet services.

Alibaba’s ‘open sesame’ to many aspiring startups

Alibaba was incorporated by Jack Ma in 1997. In a CNN interview, Jack recounted the story of his company name. He asked a waitress if she knows Alibaba, and she said: “Yes, ‘open sesame”.

He then went to ask 30 more people from all over the world and they all knew Alibaba.

“And I said yes, this is the name!”

Alibaba first developed their B2B platform for SMEs to trade goods globally, then later created B2C Taobao and financial service provider Alipay, building a huge e-commerce ecosystem. Alibaba’s shares doubled since it went public 4 years ago, reaching a market cap of about 428 billion USD.

Companies acquired by Alibaba include AutoNavi (Google map of China), South China Morning Post (a century old English-language newspaper), Youku (China’s Youtube) and Damai.cn (online ticket booking in China).

In the past year, Alibaba has made heavy investments in overseas e-commerce related companies such as South East Asia’s e-commerce platform Lazada, India’s fin-tech company Paytm Mall and Indonesia’s e-commerce company Tokopedia. Local investments include food delivery Ele.me, logistics company Cainiao, bike-sharing app Ofo, secondhand car marketplace Souche, and several grocery apps Yiguo, BigBasket and Sun Art.

Tencent as “Softbank of China”

Tencent is known as “SoftBank of China” (SoftBank is one of the most aggressive investors in the world). Founded in 1998 by Pony Ma, Tencent has built their own empire with their instant-messaging app QQ, and later the “ super app” WeChat (a one-stop portal for social media, messaging, voice and video calls, as well as payments). WeChat mini-programs also allow third-party services such as cab hailing, movie tickets purchase and food delivery, so that users can engage in these services within the app. All these functions are packed in one single app and used by 1.01 billion as of Q12018.

Many of Tencent’s investments are related to its core business – businesses that involve huge traction. They invested in Snapchat, Spotify, and Uber in the US. They also have a 5% stake in Tesla. Within China, they have stakes in rapidly growing companies such as Taobao’s rival JD.com, food delivery Meituan, online travel app C-trip, Sina News, Sohu, software company Kingsoft and so on. Recently, Tencent participated in several equity rounds with companies such as Indonesia’s ride-hailing app Go-Jek, India’s e-commerce platform Flipkart and Canadian story-sharing app Wattpad.

The whole startup ecosystem is essentially a two-horse race.

Thank you for reading

The Eagle closes our animal investor series. To readers who have been following KrASIA, we thank you for your support! If you’d like to read stories about other investors again, feel free to click on the links below:

The Hound: Investors behind Alibaba, Tencent and Bytedance

The Lion: Investors behind Ele.me, Xiaomi, OPPO and Vivo

The Monkey: Investors behind Didi and ofo

The Tiger: Investors behind Tencent and JD.com

If you’re an investor, tell us which animal is in you here. If you’re an entrepreneur, which animal do you prefer?

Cheers and have a nice weekend ahead.