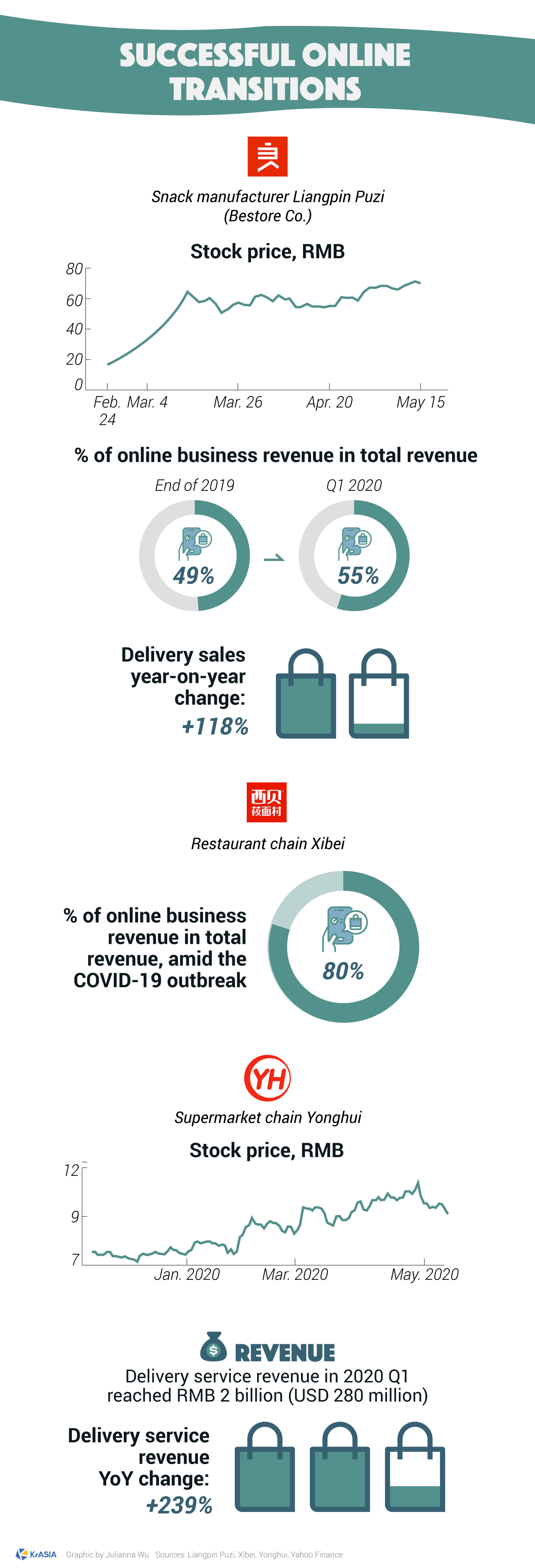

On February 24, 2020, many Chinese netizens woke up to the disturbing reality of the COVID-19 pandemic, as China’s total infected cases reached nearly 50,000. The same day, Liangpin Puzi, a snack brand also known as Bestore, held its initial public offering (IPO) via livestream on the Shanghai Stock Exchange (SHA: 603719), raising a total of RMB 488 million (USD 69 million).

The firm, based in Wuhan, the epicenter of COVID-19 in China, managed to beat market expectations, as revenue increased 4.16% in the first quarter of 2020, despite the fact over 90% of its offline stores were closed due to quarantine regulations.

Digitization as a form of “immunity”

In the first quarter of 2020, almost all offline retail stores in China were forced to close to contain the spread of the virus. E-commerce became then the only sales channel for many businesses.

At the end of January, as the virus was gaining momentum in China, Bestore held an emergency teleconference where it decided to shift its operational focus to online stores, while also implementing “contactless delivery” to keep the business running.

Another example is supermarket chain Yonghui, which also actively engaged in grocery delivery services amid the COVID-19 outbreak. Although less than 10% of its revenue in the previous quarter came from online sales, much less than Alibaba-backed competitor RT-Mart’s 17%, Yonghui earned a larger net profit in the first quarter of 2020 than the entirety of 2019.

Restaurant chain Xibei also embraced digitalization, and two-thirds of its restaurants started food delivery during the early period of the outbreak. The firm also launched a corporate catering service in mid-March when employees gradually returned to offices but most restaurants remained closed.

Fundraising during a hard time

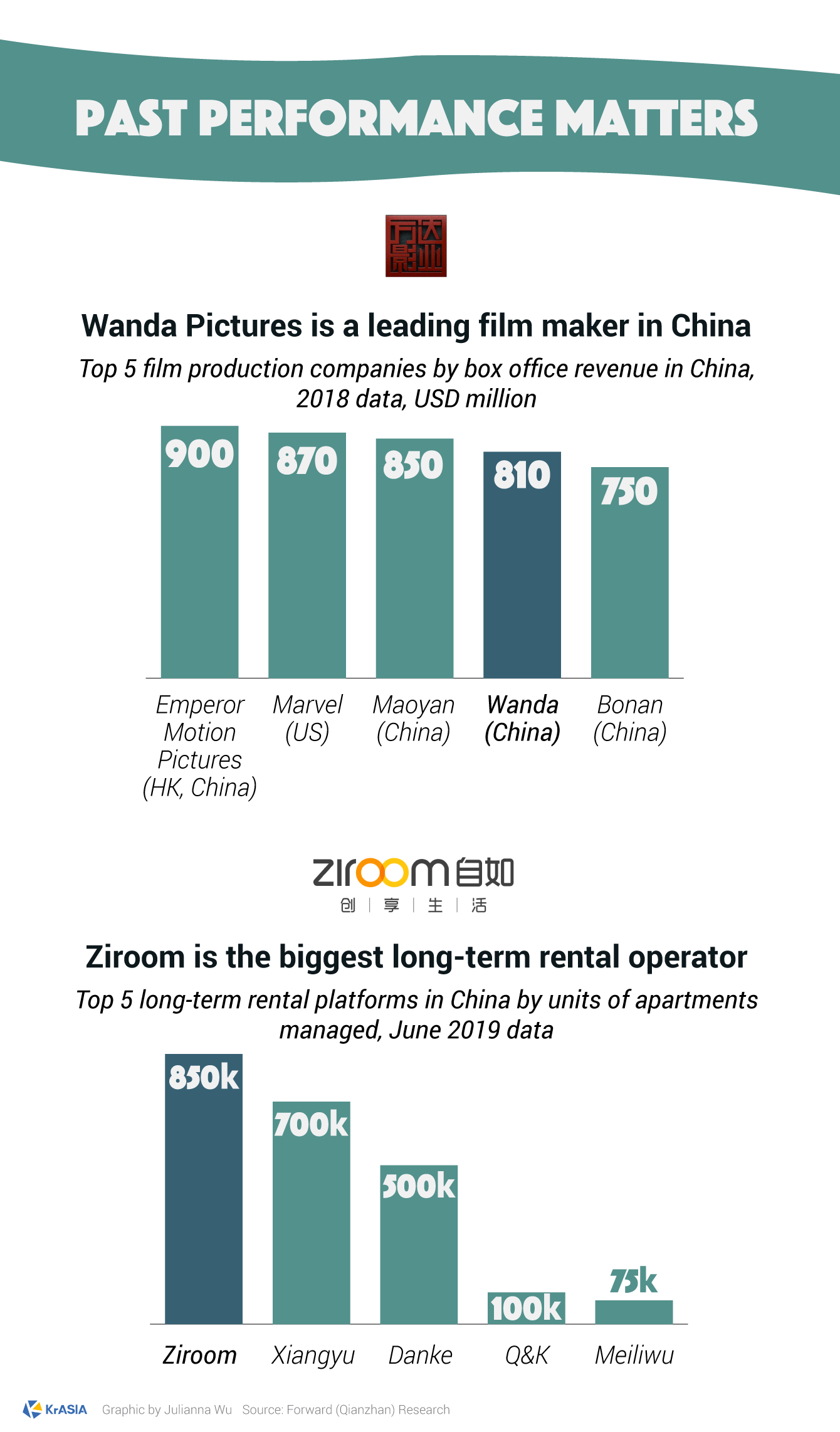

Unfortunately, digitization can’t help all businesses. The pandemic has severely impaired certain sectors, but some companies still won investors’ confidence with a track record of solid performance and raised much-needed capital to sustain their businesses.

The film industry, for example, depends mainly on the offline box office for revenue. The State Film Administration estimated that loss in box office revenue this year would exceed RMB 30 billion (USD 4.24 billion).

However, while the industry is experiencing a difficult period, Wanda Pictures, one of China’s top movie producers and the manager of the nation’s biggest cinema chain, will receive RMB 6.3 billion (USD 890 million) from its investors, and announced plans to open between 50 and 70 new cinemas this year.

In other sectors also affected by COVID-19, there are exceptional cases of companies announcing important fundraising rounds. Despite having an average 15 days empty period for the apartment units under management as the rental market suffered, Ziroom still bagged a USD 1 billion injection from SoftBank’s Vision Fund in early March.

Direct “benefit” from the pandemic

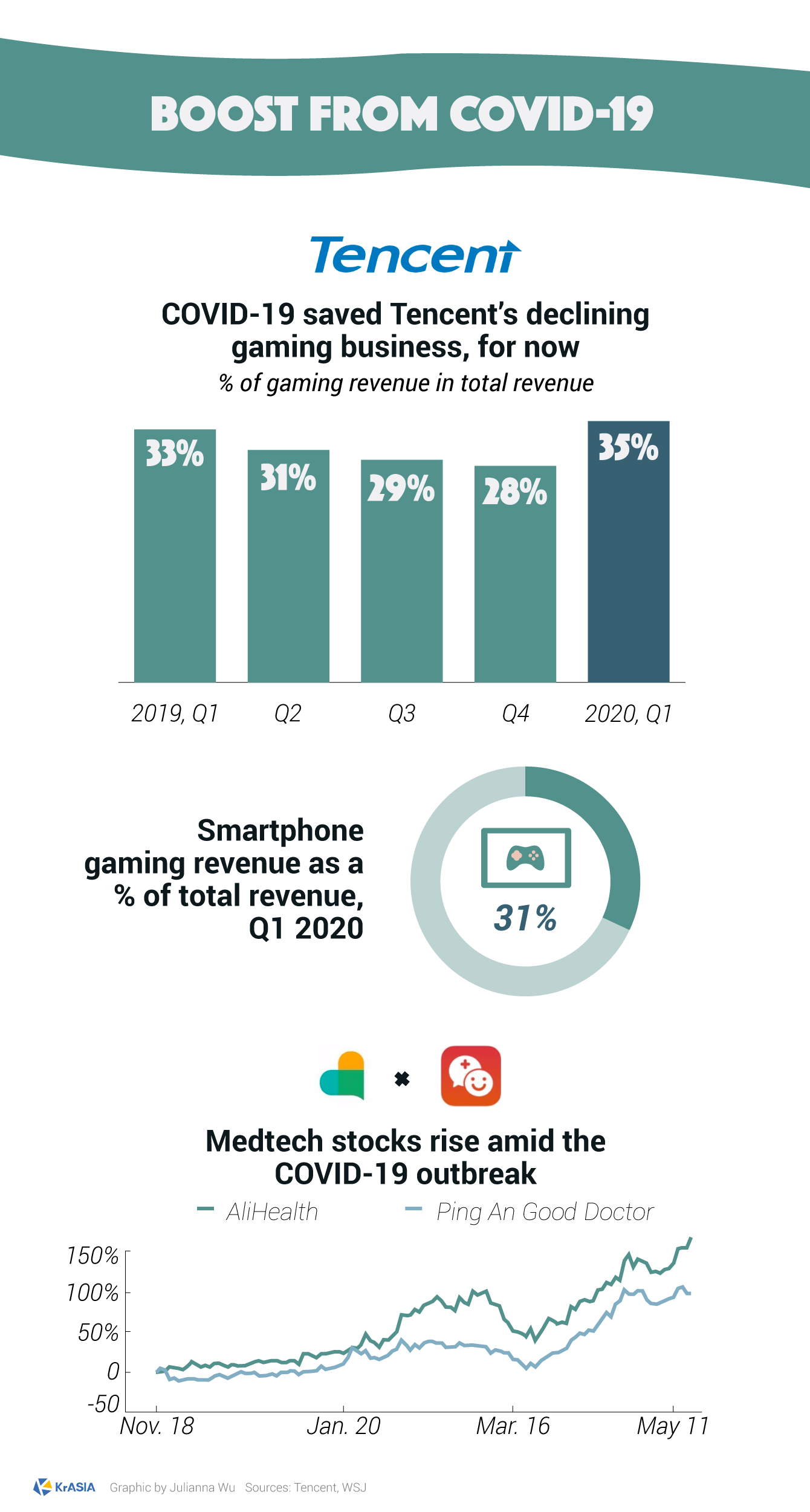

While the pandemic hit most companies hard, some found opportunities amid the crisis. Online games, for example, performed especially well in early 2020.

In Tencent’s (HKEX: 0700) first-quarter earnings report released last week, the firm’s online gaming revenues increased 31% year-on-year. Mobile gaming revenue accounted for nearly a third of the Shenzhen-based corporation’s total revenue.

Medtech companies also experienced a rapid rise amid the pandemic outbreak. The stocks of companies like SoftBank-backed Ping An Good Doctor (HKEX:1833) and AliHealth (HKEX:0241), the online medical consultation subsidiary of Alibaba (NYSE: BABA), all increased in value in the past few months.

SEE ALSO: Infographic | Coronavirus-impacted economy brings new opportunities to these tech sectors