Despite being under the scrutiny spotlight for its loss-making deals in international major companies like WeWork, Uber, and Oyo, among others, SoftBank (TYO: 9984) remains a successful investor in China, where it helped build firms such as Alibaba.

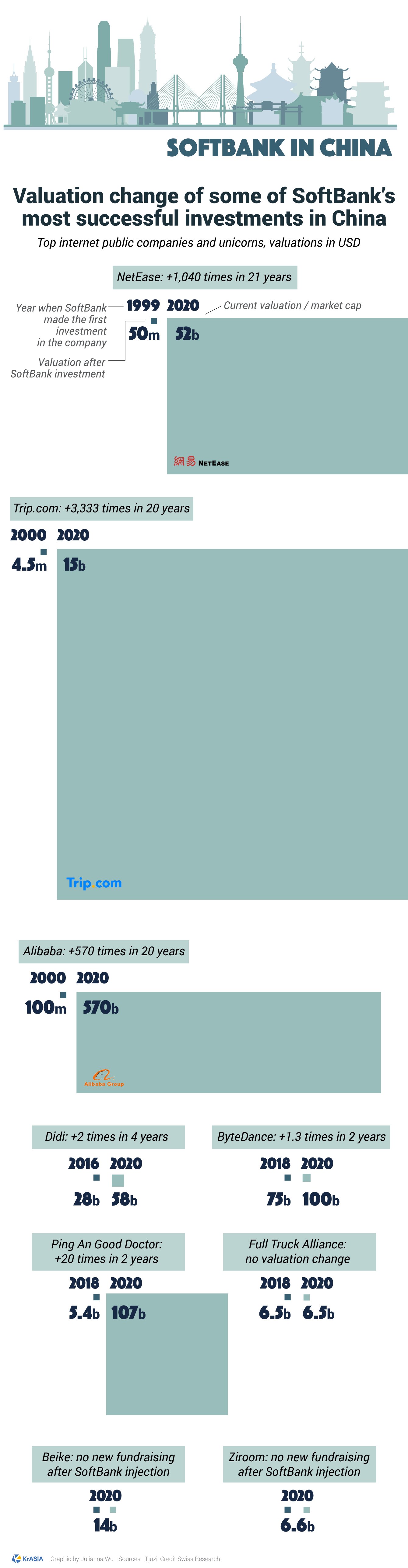

Known for his aggressive investment strategy and rapid-fire decision-making process, SoftBank CEO Masayoshi Son made a USD 200 million bet on e-commerce site Alibaba (NYSE: BABA) and its founder Jack Ma in 2000. Just about 20 years later, the Hangzhou-based company has grown into an internet mammoth and one of the world’s largest companies, with a valuation of over USD 500 billion. SoftBank’s Alibaba investment became known as one of the most successful deals in history in terms of returns.

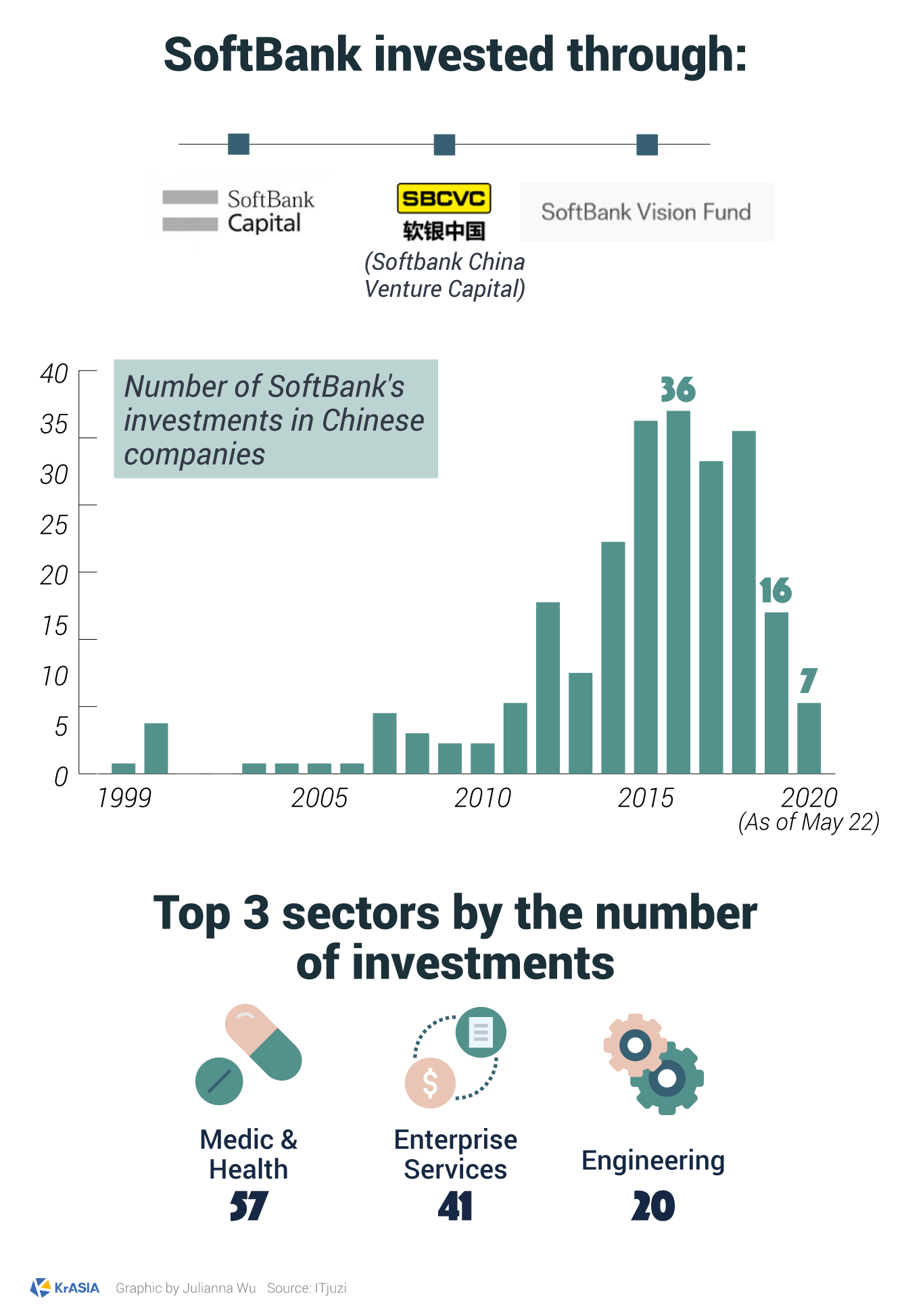

Throughout the years, the Japanese conglomerate has made a series of deals in China that shaped up the country’s business and tech: it backed gaming giant NetEase (NASDAQ: NTES) as early as 1999, when it was still an internet portal. The firm has also invested in Trip.com (NASDAQ: TCOM) —now China’s top online travel agency— during its Series A financing round, while it also shelled out USD 600 million into Kuaidi Dache in 2015, a startup that later consolidated into today’s Didi Chuxing, China’s major ride-sharing firm in which SoftBank also invested.

In 2018, the Japanese conglomerate, together with other investors, put USD 4 billion into ByteDance, helping the company behind short-video platform TikTok and Douyin to raise its valuation to USD 75 billion. Recently, ByteDance has reportedly grown its valuation in private transactions to more than USD 100 billion.

Recently, SoftBank made exclusive twin billion-dollar deals into real estate operators of Ziroom and Beike amid the COVID-19 outbreak in March, KrASIA reported.

However, as the majority of SoftBank Vision Fund’s portfolio companies suffered during the worst global health crisis ever, the group reported an operating loss of USD 13 billion and a net loss of USD 8.9 billion for the financial year ended March 31, 2020, the biggest ever loss since its listing in 1994.

While long-term partner Jack Ma ends his 13-year position as a board director in SoftBank, Son said 15 unicorns out of its 88 portfolio companies could go bankrupt, affected by the coronavirus pandemic.

It seems that 2020 could be a crucial turning point for SoftBank’s investments. In China, it remains the backer of many top unicorns that have been rumored for a public listing, including AI developer SenseTime, truck sharing service operator Full Truck Alliance, and ByteDance.