The global electric vehicle sector just saw a new round of interesting developments coming from China, thanks to Beijing-based electric SUV maker Li Auto’s fresh public market debut and Guangzhou-based Xpeng Motors’ latest financing round, signaling that despite all the difficulties and challenges awaiting ahead, the industry, after all the ups and downs in 2019, is moving into the fast lane.

Last Thursday, Li Auto (NASDAQ: LI), also known as Lixiang in China, closed its first Nasdaq trading day up 43% from its offering price, KrASIA reported. Three days later, its frenemy Xpeng Motors reportedly bagged more than USD 300 million in a new round led by Alibaba (NYSE: BABA; HKEX: 9988), paving the way for a potential August public listing in the US, per 36Kr.

Capital black hole

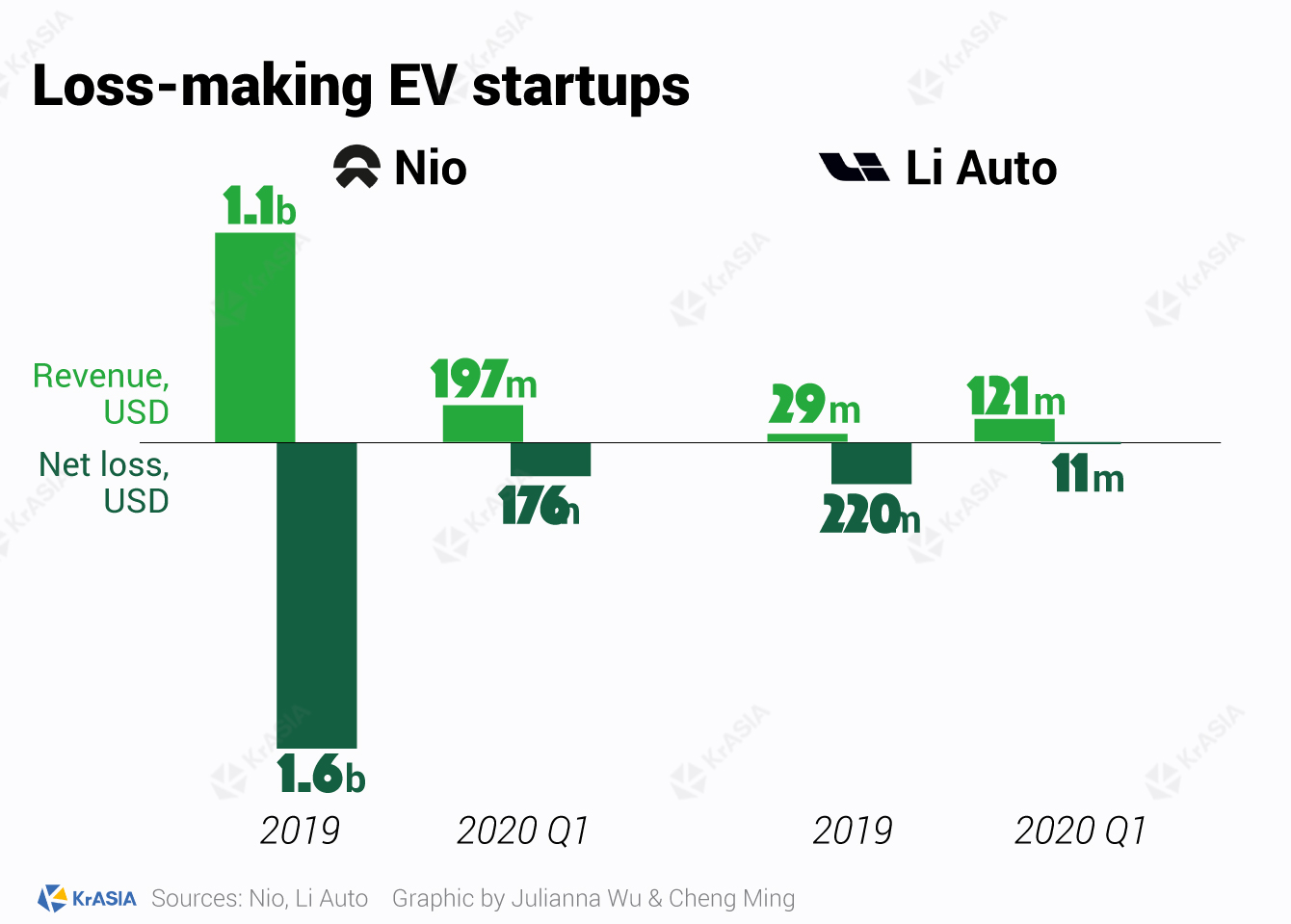

EV startups are known for their chronic capital thirst. Understandably, manufacturing a technologically advanced and safe four-wheeler is different from orchestrating a team of software developers to make an app. Furthermore, profitability is another issue to deal with, which exacerbates EV startups’ financial woes.

Founded around 2015, after five years of operations, China’s four major EV forces including Li Auto, Nio (NYSE: NIO), Xpeng, and Weltmeister, still require significant cash to sustain their loss-booking businesses.

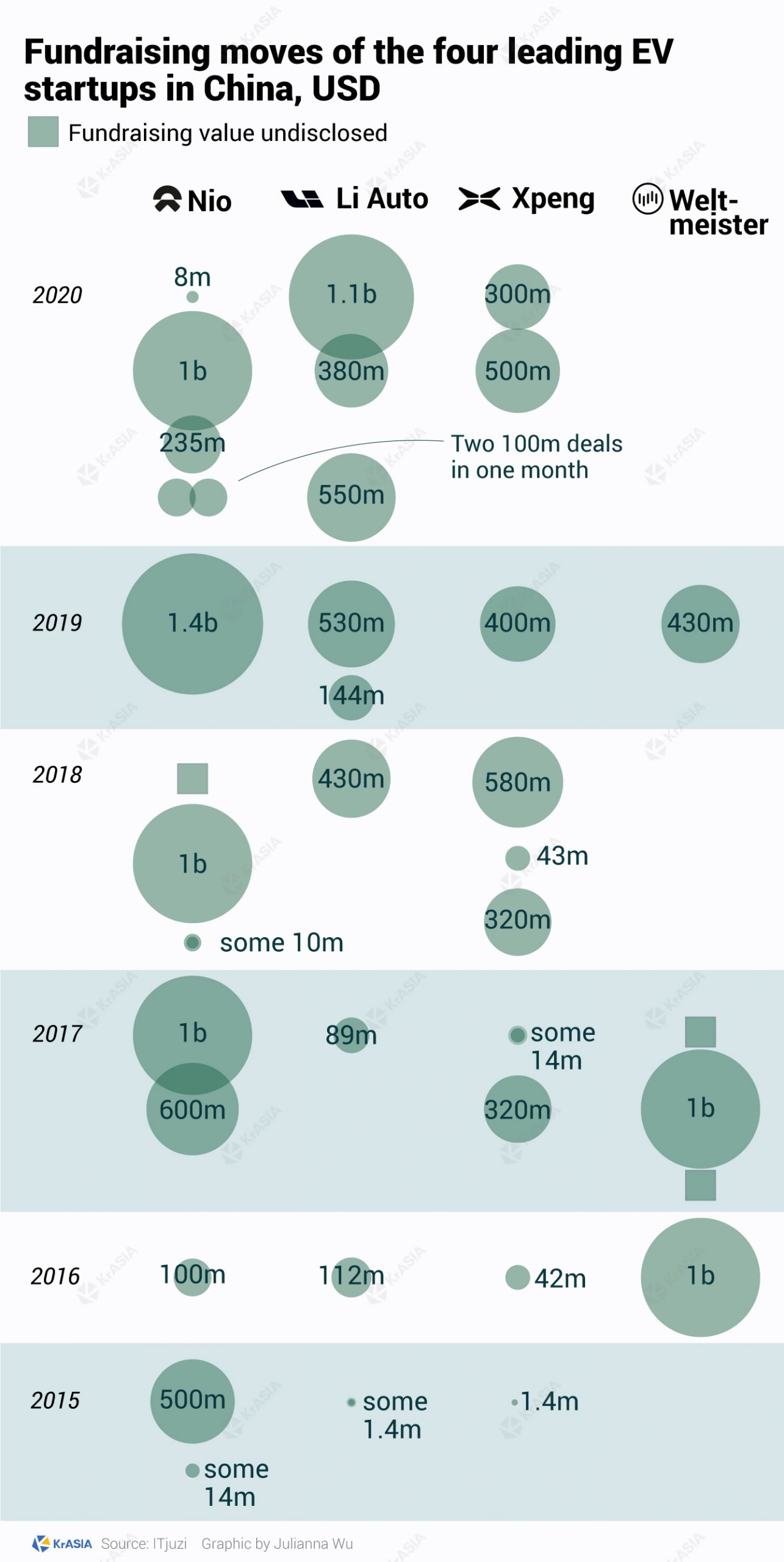

For instance, Nio has been in constant search of more capital, having closed five fundraising rounds so far this year. On the other hand, Xpeng completed two rounds of a total USD 800 million fundraising in less than a month, data from ITjuzi showed.

And given the gap between what they are trying to pull off and how much they could raise from the primary market to underpin that ambition, resorting to the public market for bigger cheques has become a prime source for funding for the cash hunger startups.

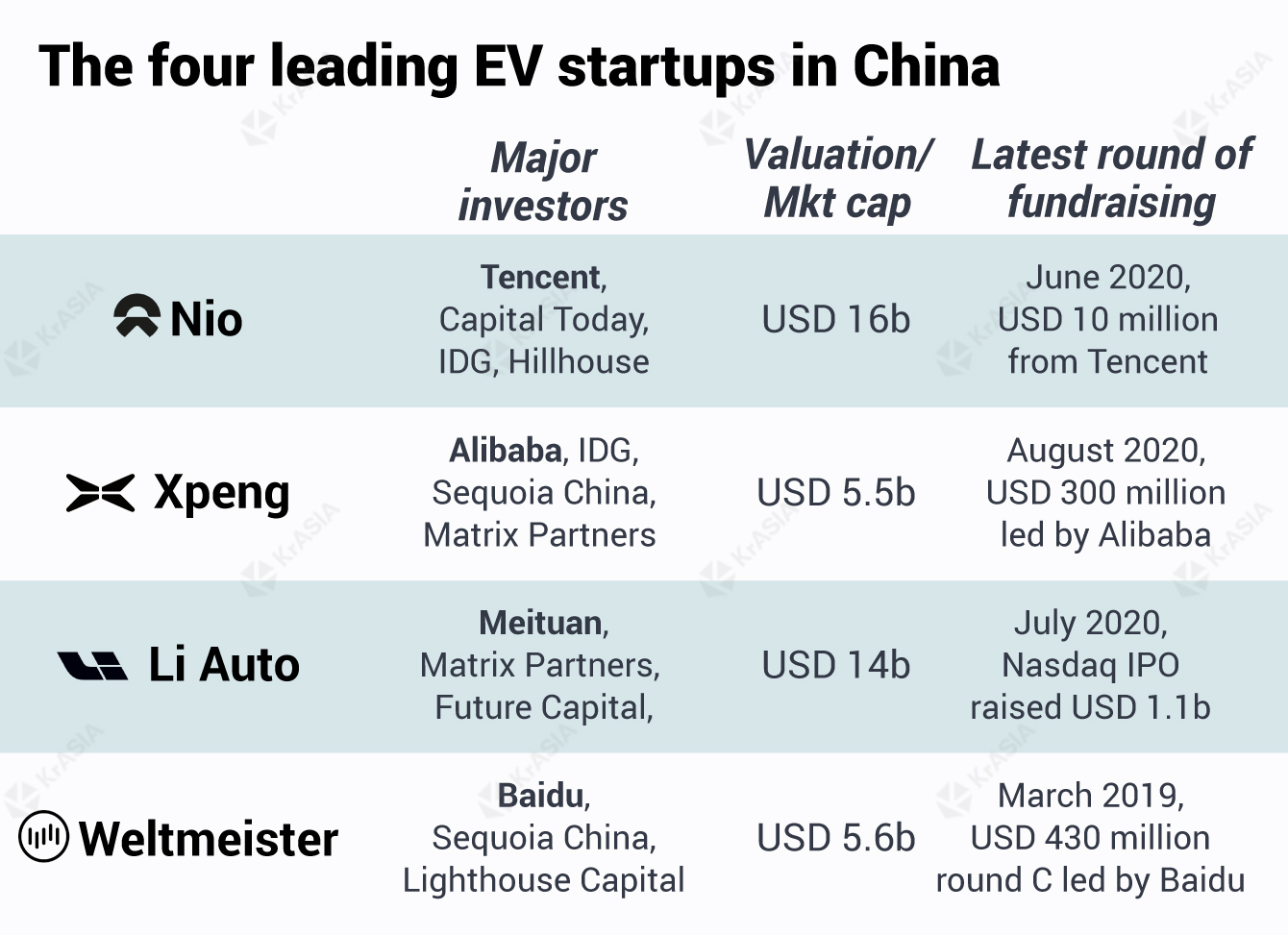

Li Auto collected more than USD 1 billion from its recent IPO, while the average capital raised in previous fundraising rounds was only USD 320 million, according to KrASIA‘s calculation base on ITjuzi data. This unquenchable thirst for available financings has attracted some of China’s top investors to the long list of backers behind the aforementioned four Chinese EV startups, including IDG, Sequoia, Matrix Partners, Capital Today, and Hillhouse, among others.

While these investment firms are backing EV makers for a prospective return, local internet giants are pouring money in for a different reason—they are betting on a chance of integrating their own business empire into what’s believed to become the next consumer trend.

Local life services giant Meituan (HKEX: 3690) has already led two investment rounds worth USD 930 million in Li Auto before its IPO, while Tencent (HKG: 0700) consolidated its status as the second-largest shareholder of Nio following several strategic investments early this year. At the same time, Alibaba and search engine giant Baidu (NASDAQ: BIDU) backed Xpeng and Weltmeister respectively.

The race is on

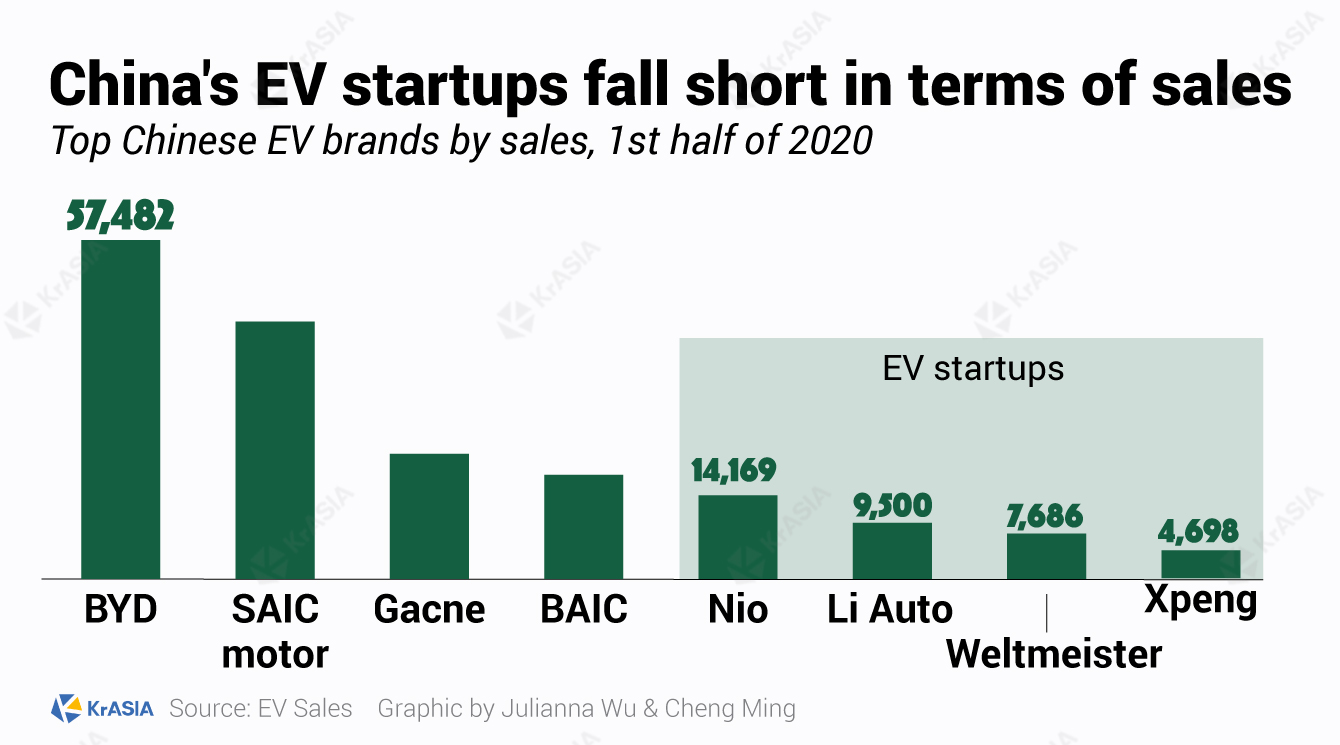

The four major EV players are not just competing against each other for market share. They all share the same formidable competitors, which are established manufacturing powerhouses, including conventional automakers such as SAIC Motor and BAIC Group. They usually led the sales league due to relatively cheaper products.

With their newest automobiles priced almost on par with Tesla, Nio, Xpeng, Li Auto, and Weltmeister are considered premium EV brands in China. Li Auto’s signature model the Li Xiang One, for instance, has a starting price of RMB 328,000 (USD 47,300), while the Tesla Model 3 produced in China charges an average price of RMB 340,000 (USD 49,000) after subsidies.

At the same time, BYD and Geely’s newest models cost less than half of the premium options, according to their official websites, due in large part to the fact that they usually own their own factories and have years of manufacturing vehicles, because they could bring down the cost for their models.

This explains why more affordable EVs from them can be seen everywhere on the streets of China. Furthermore, they are the common suppliers for local electric taxis and buses in big Chinese cities like Shenzhen, Shanghai, and Hangzhou thanks to their price competitiveness.

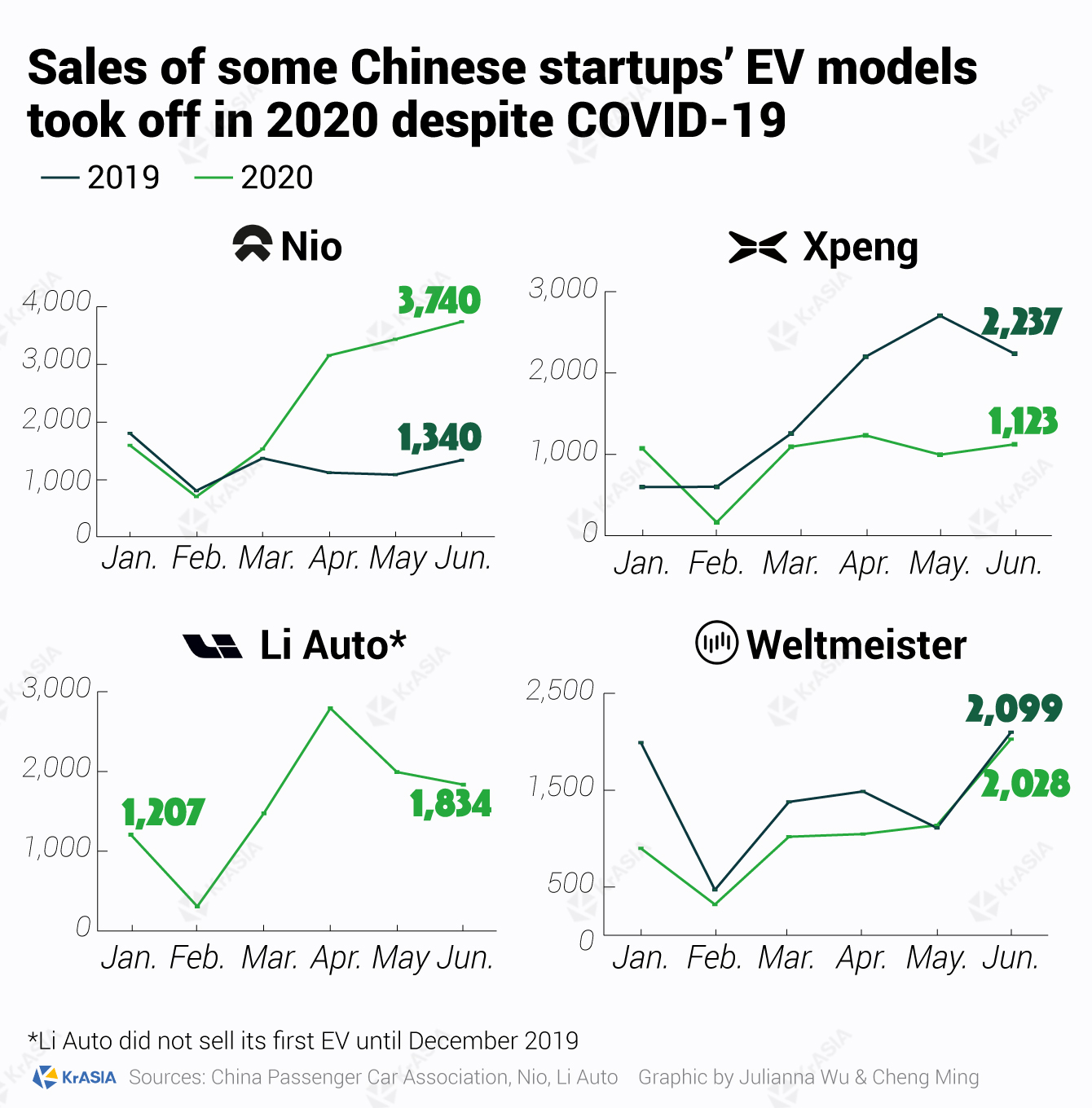

In 2020, except for Xpeng, EV startups managed to generate decent sales results despite the disruption caused by the COVID-19 pandemic. But the road ahead is full of uncertainties, as fierce competition from both domestic brands and international rivals like Tesla adds pressure to these cash-burning EV makers.

In order to stand out from its peers, Nio has focused on providing its customers with premium services. In addition to detail and patient service when purchasing, owners of its EVs get to enjoy a series of benefits including a conditional lifetime warranty, free roadside assistance, as well as free battery swap services for first-time buyers. Upon purchase, customers join the Nio community and are able to access the cafe, kids’ place, and even shared workspace, among other facilities in Nio’s private clubs located at its retail stores.

Nio managed to build up a loyal customer base partly due to these community initiatives and attention to customer service. As a result, almost 70% of its new orders in March 2020 were from customer referrals, said its founder and CEO Li Bin.

Meanwhile, other brands have taken a technical approach to differentiate themselves. Li Auto’s hybrid model hopes to solve the range restrictions associated with EVs, while Xpeng has committed significant resources to upgrade its autonomous driving and parking software.

SEE ALSO: BIZ IN GRAPHICS | China EV market hit hard by coronavirus after a tough 2019 [Update]