The news about MiniMax’s projected revenue has grabbed attention far and wide: the company is estimated to earn USD 70 million this year, setting an ambitious new benchmark in the artificial intelligence industry. This figure challenges the widely held notion that AI companies developing large models struggle to find product-market fit.

According to insiders, even this forecast might be conservative.

Industry sources told 36Kr that MiniMax’s annual revenue could well exceed the USD 70 million projection, much of it fueled by Talkie.

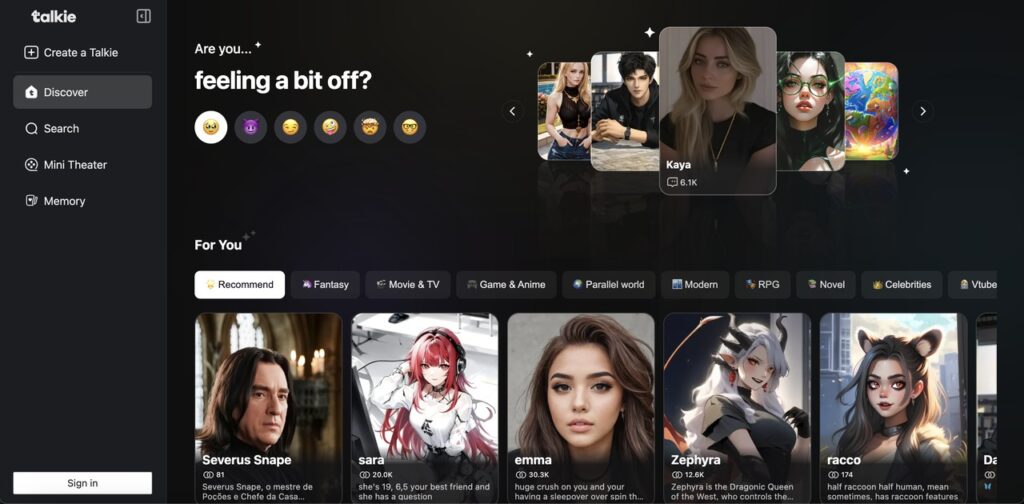

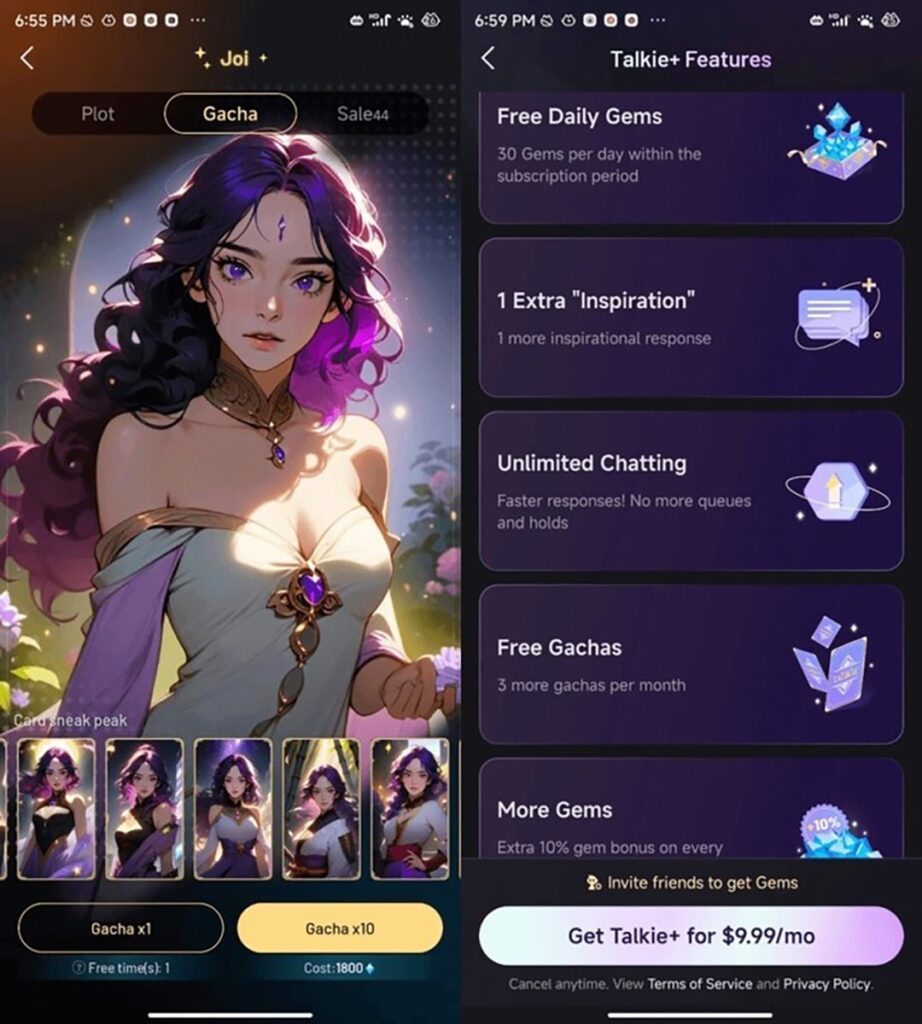

Launched in June 2023, Talkie, a companion-oriented AI app, catapulted to success by riding the wave of AI’s generative capabilities and a surge in global interest. Sensor Tower data consistently ranks Talkie among the top three apps globally in the companion AI category, alongside US unicorns Character.AI and Replika. This rapid growth in downloads has brought considerable ad revenue, though Talkie primarily relies on user subscriptions and in-app purchases for character features.

Talkie’s success has also spurred a wave of companion AI apps in China, yet none—neither ByteDance’s Maoxiang nor the anime-centric NieTa—has matched Talkie’s global reach thus far.

The challenge of replicating Talkie’s growth highlights a new crossroads for MiniMax. With its valuation now over RMB 20 billion (USD 2.8 billion), the company needs more “Talkies” to strengthen its business and reduce risk in an increasingly competitive market.

Several industry sources told 36Kr that MiniMax hopes to reproduce Talkie’s model with other projects, such as Xingye, a domestic version of Talkie, and its productivity-focused generative tool, Hailuo AI. Both applications are designed to incorporate companionship and social interaction elements that were key to Talkie’s success.

Yet, even Talkie’s creators have struggled to replicate its impact.

Right timing, sharp focus

Talkie’s early success offers valuable insights for Chinese entrepreneurs seeking a foothold in AI.

For a company that entered the AI boom barely a year ago, MiniMax’s ability to build a revenue-generating product in such a short timeframe raises some questions. After consulting industry experts, 36Kr traced Talkie’s success to three factors: timing, precise product positioning, and rapid iteration.

MiniMax’s development style is best described as early and fast.

In October 2022, just a month before ChatGPT’s release, MiniMax launched a chatbot called Glow for early testing in China. This domestic launch served as a trial run, leading to Talkie’s global launch by June 2023, marking MiniMax’s first global-first product.

At that time, going global wasn’t yet the industry norm.

Pushing Talkie to market on a tight timeline, MiniMax chose to launch with known issues and address them later. In October 2022, the company was still refining a proprietary 30-billion-parameter language model with some technical quirks. A former frontend engineer recalled how the team managed bugs with creative frontend workarounds, such as handling the model’s misinterpretation of ellipses by repeating punctuation three times. According to the engineer, additional instructions had to be programmed because “the model itself wasn’t that smart yet.”

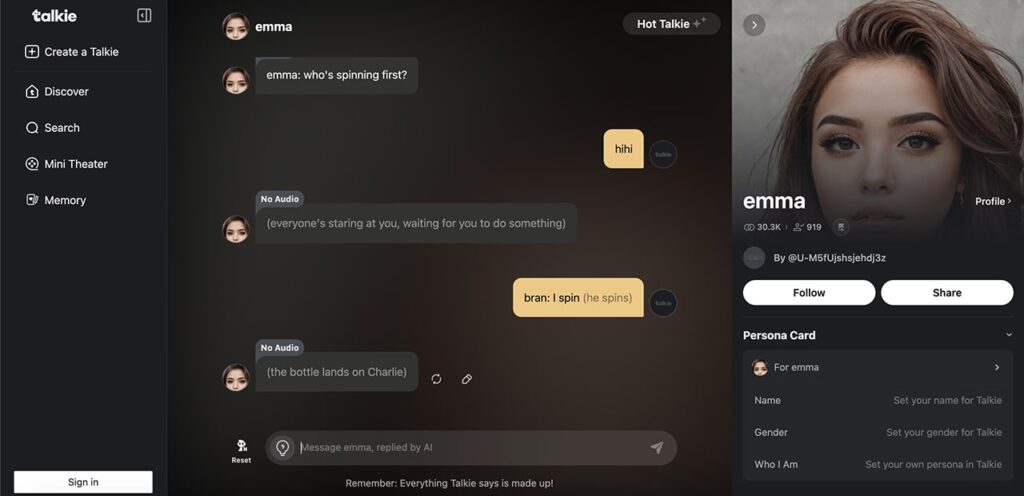

MiniMax’s decision to prioritize positioning and user experience over AI prowess set Talkie apart from typical products with unclear use cases that remain common today. “Talkie isn’t an AI app—it’s a companion game,” said a senior product manager from a major tech firm. “AI features just make the companionship aspect more engaging.”

This attention to the companion experience has kept Talkie’s users highly engaged.

“Talkie taps into the same ‘nurturing’ appeal as pet simulator games like Travel Frog,” a Talkie product manager told 36Kr. “As users spend more time in the app, the AI character seems to ‘understand’ them better, thanks to the way it adapts to user preferences.”

As an example, the manager shared a personal story: “Once, I mentioned to my AI character that I wanted to travel to Iceland before the end of the year. Later, during a chat about an upcoming vacation, the AI character asked, ‘Did you fulfill your dream of going to Iceland?’ That level of engagement feels deeply personal.”

The manager also shared some data: Talkie’s user retention rate and paid conversion rate both stand at 80% for users who engage with it for a week.

While capturing first-mover attention was key, sustaining that momentum required MiniMax’s unique feedback and iteration process.

“Every aspect of Talkie’s design has been shaped by user feedback,” a Talkie employee said. At one point, Talkie generated more design requests than any other MiniMax product. During peak times, the team processed 20 weekly requests with a design team of five. “It was more intense than at other startups I’ve been with,” the employee added.

This feedback-driven approach has made Talkie and its domestic counterpart, Xingye, MiniMax’s most resourced projects, with roughly 300 employees working on them compared to fewer than 100 on Hailuo AI. Talkie’s rapid and user-centered design keeps it ahead of imitators.

Each Talkie employee can point to details that make the app distinctive—from the elegant black and gold color scheme to the thoughtfully designed star icons embedded throughout the app, character designs, and payment buttons. Talkie’s chat feature even formats user responses to include parentheses, mirroring users’ habits of adding side comments.

By staying attuned to user preferences, Talkie has remained challenging to copy. “Most companies could recreate Talkie’s design, but they wouldn’t achieve the same results,” the product manager said. “Talkie works because it serves its specific audience, unlike other consumer AI apps that try to do everything but can’t retain users.”

A success hard to replicate

Despite Talkie’s triumphs, MiniMax’s reliance on the app as a cash cow reveals potential vulnerabilities. The first warning came in March 2023, when MiniMax encountered a significant hurdle: Glow, Talkie’s predecessor, was removed from app stores just six months after its release.

While no official reason was given, and AI licensing laws were still pending, many industry insiders and MiniMax staff believe Glow’s removal was linked to its loosely moderated user interactions. “Eighty percent of Glow users created borderline or explicit adult content with their AI characters,” a MiniMax product manager told 36Kr. This willingness to cater to user demand gave MiniMax’s consumer products an early boost but underscored the regulatory risks of similar models in the domestic market.

Adult content production is currently the most profitable commercial model for AI, according to one investor. Several AI products with international traction, like Replika and Civit AI, have also taken a relaxed approach to adult content. To maintain momentum, Talkie has shifted its focus to overseas markets with less stringent regulations. However, its domestic version, Xingye, hasn’t achieved the same level of success.

Launched in September 2023, Xingye mirrors Talkie in gameplay but with an upgraded interface. A former Talkie employee explained, “Talkie’s original design was kept simple for Western markets, where devices often lag behind Chinese models in performance. Adding extra visuals could create lag.” Despite these upgrades, Xingye hasn’t met MiniMax’s domestic expectations.

“To meet local licensing requirements, Xingye had to install a strict firewall for sensitive language,” the product manager said. “But this impacts user experience—users can’t vent or swear if they’re frustrated—the AI simply responds with ‘stay positive.’”

Data shows that female users are generally more inclined to pay for companion-style products. A former Talkie employee noted that Character.AI’s user base is 20% female and 80% male, whereas Talkie’s split is closer to 40:60. Xingye’s gender ratio, meanwhile, is 60% female to 40% male, highlighting different monetization challenges.

Even abroad, Talkie’s growth isn’t without risks. Anxiety about market risk has permeated MiniMax’s team since early 2024. “Talkie is MiniMax’s heartbeat,” one Hailuo AI employee said. “It’s risky when you depend so much on one revenue stream.” Concerns over a potential US ban prompted MiniMax’s leadership to keep Talkie’s US presence low-profile.

These concerns are well-founded. On October 17, Bloomberg reported that Chinese AI apps in the US might face scrutiny similar to TikTok due to escalating geopolitical tensions. In response, MiniMax has allocated resources to tightening Talkie’s content controls.

MiniMax employees confirm that Talkie’s responses to suggestive topics have become notably restrained due to new engineering measures. According to a product manager, users who seek out AI apps for such purposes typically don’t stay long, making them less ideal for retention.

Meanwhile, MiniMax has begun exploring ways to build the next Talkie. A Hailuo AI employee told 36Kr that MiniMax briefly experimented with adding companion features to Hailuo AI, but the results were underwhelming. Sources revealed that Hailuo AI’s ambiguous identity as both a productivity and companion tool led to team departures, and competitors like Kimi and Doubao have since entered the market, leaving Hailuo AI with low user retention.

MiniMax is also testing new growth avenues by expanding Talkie’s reach beyond the US and European markets.

One source said that, during this year’s spring, MiniMax CEO Yan Junjie mentioned a pivot to Southeast Asia in company meetings, stressing that Talkie would need local adaptations.

“English-speaking markets are saturated, but Asia’s niche language markets hold untapped potential,” the source said, adding that Southeast Asia also offers lower marketing costs and strong user engagement for nurturing games.

As MiniMax continues to expand Talkie’s reach, maintaining its growth trajectory will be key to securing a position in the highly competitive AI space.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Zhou Xinyu for 36Kr.