Travel is no doubt one of the hardest-hit industries during the COVID-19 pandemic

Prior to the crisis, China was the world’s top source market for travel, with 159 million outbound trips in 2019. With air transportation restricted, China saw air travel plummet more than 54% in the first quarter of 2020. Government subsidies were minimal, and the Chinese travel trades were largely left to fend for themselves. Some key Chinese travel agents, such as Alibaba-backed Baicheng, shuttered their operations, while smaller businesses made do by switching their operations to sell consumer goods.

While China has gradually allowed domestic air travel to resume since early April, about one-third of Chinese travel agencies have gone out of business, and the industry had already suffered RMB 1 trillion in losses. Those who survived were mostly those with robust online capabilities—the Chinese travel tech giants, which cultivated innovative means to engage their customers virtually. What doesn’t kill you makes you stronger—these Chinese travel tech giants that have been through the worst are often the toughest survivors.

Here are the five strategies that emerged from these Chinese travel companies’ relentless pursuit of survival

1. Pre-sales: Lock in travel demand

What to do when customers cannot travel, but Chinese travel tech giants must maintain their cash flow to stay afloat? The answer is to sell products in advance on livestreams at ridiculously attractive prices, with full refund policies. And don’t forget to have the founder perform on the livestreams.

Trip.com’s (previously Ctrip) executive chairman, James Liang, became a celebrity. He holds a pre-sale “Boss” livestream every Wednesday evening on WeChat and Trip.com. Domestically, he has traveled to 17 provinces and 43 cities, covering more than two-thirds of China for his livestreams. At each destination, he customizes the session to reflect its cultural and historical background. By dressing up in local traditional attire, he performs songs and dances to connect with the audience. He livestreams to pre-sell products from Korea, Thailand, Japan, and Singapore before international tourism restrictions are lifted.

These livestreams generated RMB 26.9 million in gross merchandise value for Trip.com, with 2.5 million viewers tuning in on average for every one-hour session. In the first quarter, these “Boss Livestream” marketing events have generated more than RMB 600 million in revenue.

2. Cloud Tourism: Bringing travel into audiences’ homes

When customers cannot travel, Chinese travel tech giants bring attractions to them. It’s almost like live-streaming a travel show. On the cloud, audience members can check in and enjoy scenic spots without actually visiting these locations, experiencing something that is fully “contactless.”

Trip.com also engaged well-known talk show hosts, such as “Village Chief” Li Rui, to whip up interest in the various locales that they promote. By having customers enjoy these sights and sounds from the comfort of their own homes, Chinese travel tech giants capture consumer awareness and uphold their status as travel providers until people can book flights again.

3. Curate niche products: Catering to specific interests

Chinese travelers are increasingly focusing on health and wellness in their leisure trips. Self-guided tours to city fringes and natural, scenic spots are picking up in popularity, and camper van itineraries are gaining traction among Chinese families with children. At the moment, since they can’t travel overseas, Chinese families are exploring their own country. Identifying the demand in this market, Chinese travel tech giants are curating new travel products based on the changing habits of the Chinese traveler.

Think about it—barriers to entry for domestic travel are low given the availability of travel information. The profit margin is also low since travelers can easily manage and package their experiences. Chinese travel tech giants come into the picture by renting out caravans and providing in-depth experiences for travelers, pulling consumers back to the travel products on their platform.

4. Diversification: Expanding cash flow channels

With their superior access to consumer products, transportation, and a large consumer base, Chinese travel tech giants are diversifying their cash flow channels to sustain their existence.

Trip.com has invested in 66 companies using their new RMB 100 million venture fund, covering everything from hotels to airlines, big data to catering. Other travel tech companies have pivoted to other industries, such as alcoholic beverages, food products, and mattresses.

5. Recovery Campaigns: Strengthening business partnerships

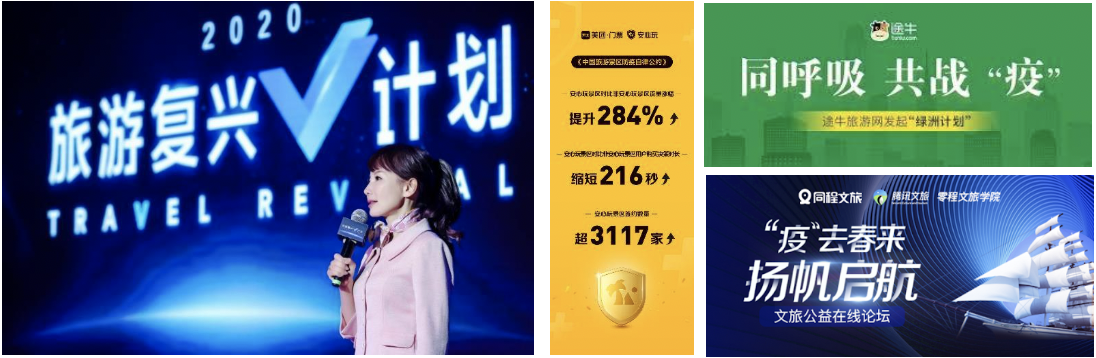

Chinese travel tech giants have reached out to their partners during the crisis to maintain confidence in travel industry’s recovery. Trip.com launched a Tourism Revival V Plan, a USD 500 million campaign that engaged more than 100 tourism bureaus and organizations. Meituan, Tuniu, and Tongcheng also followed suit with recovery campaigns of their own. COVID-19 presented an opportunity for them to garner support for their promotions.

The Chinese travel industry gives other sectors hope, as we can see how Chinese travel tech giants have been incredibly resilient while making adjustments to their market strategies. These lessons provide a good playbook for other consumer-facing tech companies that are contemplating ways to adapt and transform their business models in the new norm. While the road ahead is challenging, Chinese travel tech giants are finding their equilibrium. They are prepared to tackle the uncertainties head-on.

To read similar stories, please hop on to Oasis, the brainchild of KrASIA.

Halynne Shi is a business strategist with experience in travel and tech, currently building e-commerce for Changi Airport. She has worked extensively with Chinese travel tech giants like Trip.com and Tuniu to build their presence in Singapore and other countries in Southeast Asia. A sustainability enthusiast and a strong advocate for female empowerment, Shi enjoys meaningful conversations with like-minded energizers over a cup of hot water with a twist of lemon. You can connect with her on LinkedIn.

Disclaimer: This article was written by a community contributor. All content is written by and reflects the personal perspective of the interviewee herself. If you’d like to contribute, you can apply here.