Investment in Southeast Asian startups jumped in the April-June quarter despite headwinds from the coronavirus pandemic, led by e-commerce and fintech companies that gained momentum as COVID-19 reshapes home and the workplace.

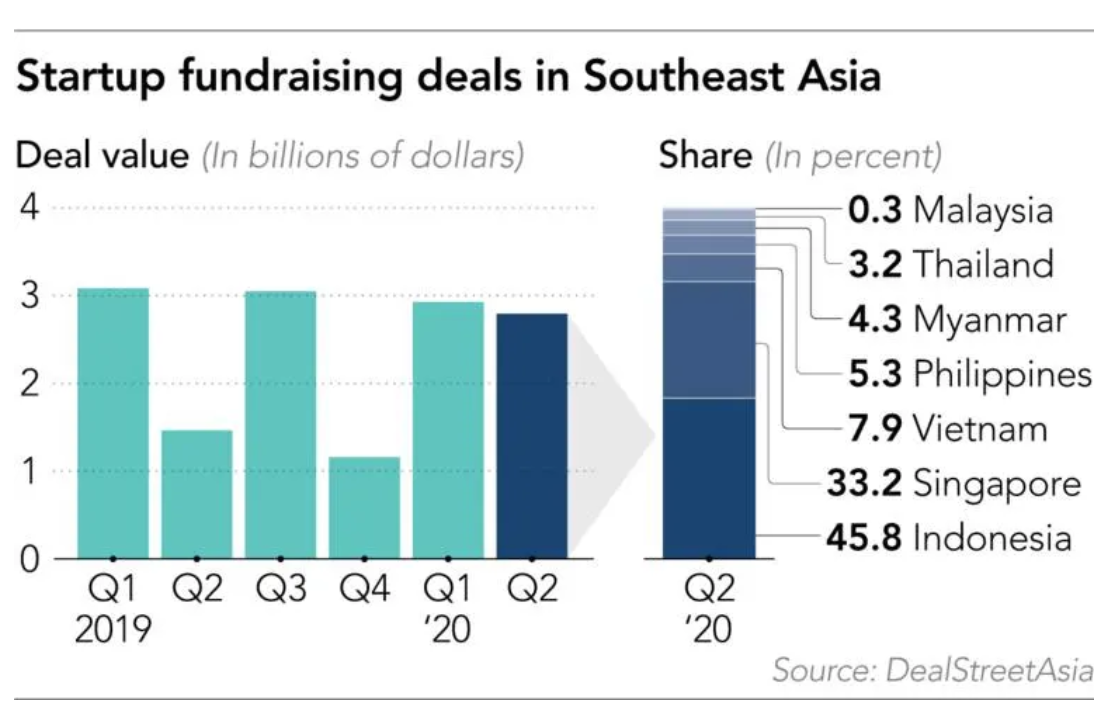

According to data compiled by Singapore-based startup information platform DealStreetAsia, the value of fundraising deals in the region rose 91% on the year to USD 2.7 billion, while the number of transactions climbed 59% to 184 for the three months through June, up from 116 in the same period a year earlier.

During the quarter, many countries were under lockdown, which limited deal making opportunities. And uncertainty dampened sentiment among some investors. But others put cash on the table. “A significant amount of capital was raised by various venture capital funds last year,” Kuo Yi Lim, co-founder and managing partner at Singapore-based Monk’s Hill Ventures, which invests in the region’s startups, told the Nikkei Asian Review, pointing out that most deals were in the pipeline from early in the year.

Since the mid-2010s, Southeast Asia’s startup funding boom has been led by Singapore’s Grab and Indonesia’s Gojek, the two big ride-hailing companies in the region. In the first quarter of 2020, they together raised more than $2 billion, about 70% of the regional total.

Data for the latest quarter paints a different picture: Leading the region were the e-commerce sector, which raised USD 691 million, logistics, at USD 360 million, and fintech at USD 496 million. Some locally operating companies also pulled in considerable funds, indicating the pandemic has created opportunities for a broader range of new companies.

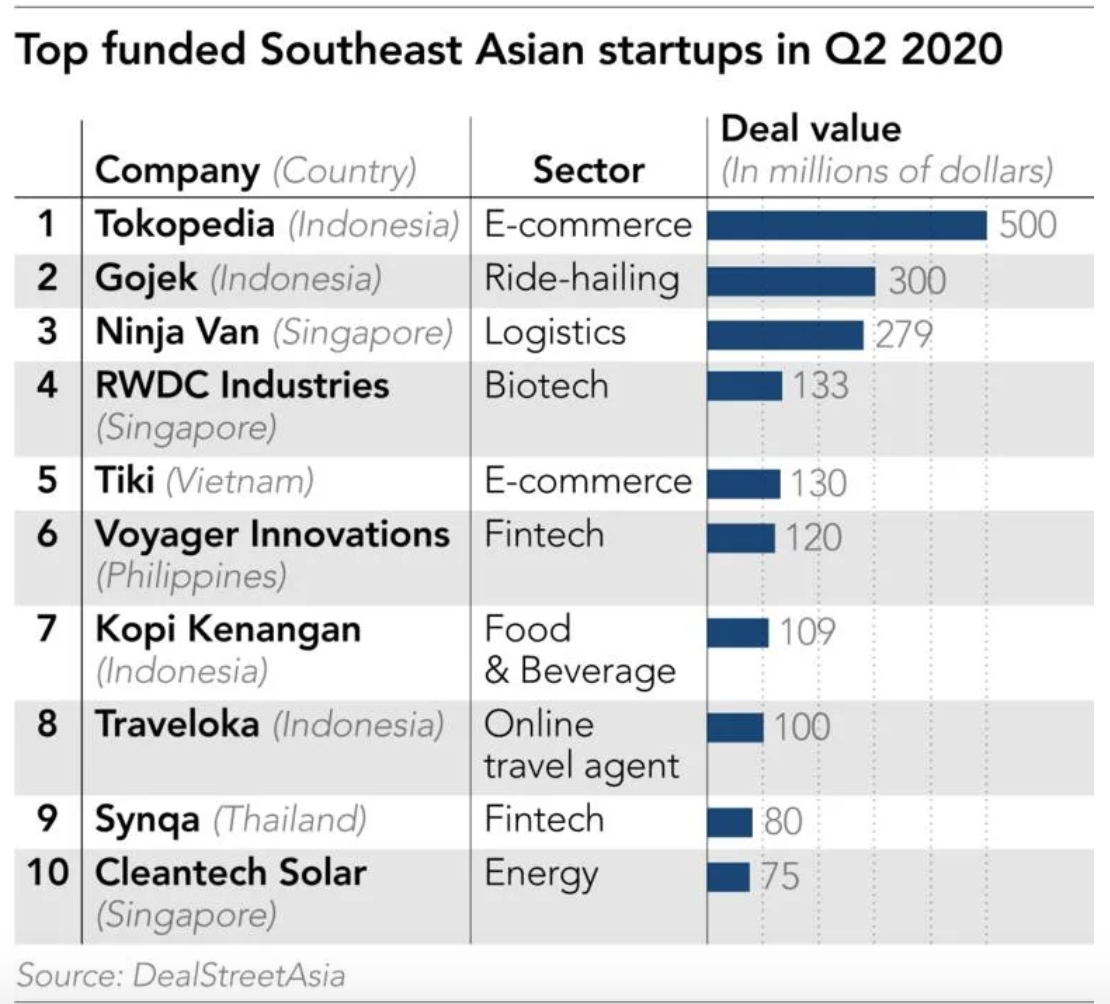

The biggest capital raiser for the quarter was Indonesian e-commerce unicorn Tokopedia, which secured USD 500 million from Singapore state investment firm Temasek Holdings, as reported by DealStreetAsia.

Tiki, a Vietnamese e-commerce company, raised USD 130 million in a deal led by private equity fund Northstar Group. It saw “significant growth in customers’ shopping needs [during the pandemic], especially for face masks, hand washes and necessities,” according to Ngo Hoang Gia Khanh, Tiki’s group vice president for corporate development.

Competition in Vietnam’s e-commerce business is heating up among both local and regional players, but Tiki differentiates itself with its unique services. Using a nationwide network of order fulfillment centers, it offers an express delivery service called TikiNow. The service ships parcels to the customer within two hours of receiving an order, which is faster than rivals, Tiki says. It also offers free, immediate installation for heavy and bulky items.

As demand for online shopping grows in Southeast Asia, logistics and delivery startups have also picked up steam. Singapore’s Ninja Van in May announced a USD 279 million fundraising round, and Indonesia’s Kargo Technologies pulled in USD 31 million.

Fintech also has rising stars. Voyager Innovations, the company behind Philippine mobile payment app Paymaya, raised USD 120 million in April from existing shareholders, including US private equity fund KKR and Chinese tech giant Tencent Holdings. The funding round, its first since 2018, gave the company additional financial muscle to compete with domestic rival Mynt, which is backed by Alibaba Group Holding.

The fundraising came as demand for digital financial services exploded in the Philippines amid the lockdown. In the six months through June, Paymaya reported a 150% on-year increase in transaction volume, helped by mobile payments and remittances. The company also helped distribute government cash handouts to Filipinos.

In Myanmar, Digital Money Myanmar, known for its Wave Money brand, announced in May that China’s Ant Financial Group, operator of Alipay, will invest USD 73.5 million in the company. Wave Money is the leading mobile financial services provider in Myanmar, allowing people to transfer money digitally instead of carrying cash. In 2019, Wave Money transfers totaled USD 4.3 billion in Myanmar, more than tripling the previous year’s USD 1.3 billion.

Wave Money was set up as a joint venture between Myanmar conglomerate Yoma Group and Norwegian telecom operator Telenor Group in 2015. In June, Yoma Group announced that Telenor will divest from the business, which will be restructured as a joint venture between Yoma and Ant Financial. Ant Financial will hold 33% of Wave Money when the transaction, scheduled for November, is complete.

Bangkok-based fintech startup Synqa Holdings raised USD 80 million from Thai and Japanese investors. “Despite these challenging times, I see a lot of opportunities in accelerating digital payments and digital transformation for enterprises,” said Synqa founder and CEO Jun Hasegawa.

In times of social distancing, Synqa is uniquely positioned as the parent company of a provider of “payment gateways,” which handle day-to-day credit card and other payments for e-commerce quickly and securely.

While these startups seized opportunities amid the pandemic, others, especially those in transport and travel, have been hit hard. They are now cutting costs to stay afloat.

But even in sectors facing an unprecedented challenge, some companies managed to raise large sums of money. Gojek bagged USD 300 million, while Indonesian unicorn Traveloka, an online travel company, raised USD 100 million in the second quarter of this year. Both were also forced to lay off a significant portion of their staff to cut overheads.

Gojek’s presence in the daily lives of Indonesians — from payments, to ride-hailing, to food delivery — still makes it an attractive investment for companies eager to raise their regional profile; Facebook’s investment in the company was its first in an Indonesian startup.

The same cannot be said of Traveloka, whose business hinges on people traveling. But investors are betting the company will return to growth once travel resumes in the region.

Looking ahead, with the pandemic potentially lingering, deal making in Southeast Asia may slow, investors say. “Over time, we do expect capital to be tighter, particularly at the later stages, which are typically driven by international investors,” said Monk’s Hill Ventures’ Lim. “The global recession and travel restrictions will impact their appetite for investing.”

On the other hand, Michael Lints, a partner at Singapore’s Golden Gate Ventures, said fundraising by “earlier-stage companies might see a bit of a slowdown in the second half the year, especially if the economic crisis deepens.”

This article first appeared on Nikkei Asian Review. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei. 36Kr is KrASIA’s parent company.