Imagine feeling peckish and coming across a little convenience store. You’re after a quick snack, so you swing the door open, only to be met with a turnstile at the store’s entrance, barring entry. You whip out your phone, scan your personal QR identification code, and the turnstile swings open.

Inside, you observe row upon row of sundry items stacked neatly on gray shelves situated precisely 1 meter apart from each other. A gentle whir stirs behind you, and you turn around to see a cuboid robot on wheels glide smoothly across the store to restock a tessellation of bread loaves with its mechanical arms.

Aside from a tinny pop song playing over the loudspeakers, the store is hushed. Looking upward, you cast your eyes upon a large television screen with a panoramic view of the store’s layout, and notice another customer lingering at the opposite end of the premises—the only other human being in sight. You see that the fruit section is two aisles away and breathe a sigh of relief. Unlike many other convenience stores in your city, this one automatically restocks bananas.

You pick a banana from a shelf, shuffle over to a payment booth, and place your piece of fruit squarely on a touch-sensitive panel. “A dollar, please,” a chirpy, non-human voice says, the display flashing green upon recognizing your product. You select an e-wallet payment option before placing your phone’s QR code underneath the scanner. Peeling your banana, you head to the exit, again scanning your QR code to exit through the turnstiles. You were in and out in barely a minute: a picture of seamless digital perfection.

Dystopian future? Not quite. That was an automated convenience store in China—one of the flagship stores designed and built by internet giants such as JD.com and Alibaba.

Read this: Indonesian e-commerce firm Blibli launches first cashless offline store

E-payments are the foundation for digitized retail

Bianlifeng, a Chinese automated convenience store chain, was founded three years ago and has been on the rise since. It currently has more than 1,500 stores in 20 cities around the country. In late May, Bianlifeng said it hit profitability. The company characterizes itself as a cut above other Chinese convenience store chains by cutting into the digitization space, mainly through data-driven decision-making. Store locations and stock choices are determined by proprietary algorithms. Myriad streams of customer data—such as purchase frequency, product favorites, and time spent lingering in particular product aisles—can all be mined to drive new consumer insights.

The same sort of data-driven digitization solutions are needed in Southeast Asia to optimize efficiency and fine-tune business operations. In particular, the many mom-and-pop stores whose clients live nearby can reap huge benefits from these fundamental changes.

Data-driven restocking decisions can be useful in Southeast Asia, but the insights that are gleaned from local consumer behavior may look very different from the results in China and Japan. For instance, fresh, takeaway food sets have the highest profit margins in East Asian countries, but demand for this may be lacking in Southeast Asia given the plethora of cheap, roadside, or hawker food available. Identifying new FCMG value drivers of profit, such as beauty or sundry products, will be crucial to ensuring the sustainability of convenience chains.

Going cashless, however, will be difficult to replicate in Southeast Asia. China has the world’s most advanced e-payments infrastructure via Alipay and WeChat Pay, with some consumers forgoing physical banknotes altogether. In contrast, for now, Southeast Asia is far from being a cashless society—this is a problem tied to low banking penetration, with only 47% of people in Southeast Asia having a bank account.

But that is changing. The race for e-payment dominance is on, with Google, Temasek, and Bain & Company predicting that digital payments will cross USD 1 trillion by 2025, covering nearly one in every two dollars spent. Vietnam, in particular, is speeding toward this. According to a recent PwC report, the percentage of consumers in Vietnam using mobile payments increased from 37% to 61% in 2019.

This development is laying the groundwork for automated retail. Taking recent history in China as a reference, unmanned stores are able to operate smoothly in part because consumers in the country are familiar with e-payments. Once the same habits are formed in Southeast Asia, transformations can happen too.

In fact, for Southeast Asian consumers, convenience stores can serve as a bridge to ease consumers into a digital future, leveraging their accessible locations to serve as centralized payment portals or collections points for people who are unbanked. One of Vietnam’s most popular e-wallets, Momo, caught on to this early and formed a partnership with two convenience store chains, Circle K and Ministop, so that users could pay electronic bills, remit money, and pay for purchases at these nodes. Alfamart and Indomaret in Indonesia also have tie-ups with Tokopedia, where e-commerce shoppers can order items online, then pick up and pay for their packages at nearby Alfamart and Indomaret stores.

Automation may be hard to accept and harder to fund

Automation, however, is a different story. It requires a convergence of cultural acceptance and massive investment. In Southeast Asia, neighborhood stores function not only as points of retail, but also communal nodes. An unmanned store with limited communal draw is unlikely to prompt non-impulse purchases. Being familiar with an independent shop owner (possibly enough so to buy things on informal credit), and having conversations about neighborhood matters—these are magnets for repeat business, and they cannot be replicated in automated retail locations.

Full automation requires massive investments in security as well as features like facial recognition. Unmanned stores simply may not fit some locations. Since 2017, Indonesia has tried to operate school canteens without attendants as part of an anti-corruption program. Most of them ended up going bankrupt or ran out of capital; many of their customers simply didn’t pay for their items.

Yet there are trailblazers who are running pilot programs in this direction. In 2018, JD opened its first unmanned store outside of China, launching it in an upper-class residential neighborhood in Jakarta. The store, JD.ID X-Mart, incorporates the same technology used in its counterparts in China. In February, conglomerate-backed e-commerce platform Blibli also launched its first offline store, operating with no cashiers and only accepting e-payments, much like JD’s X-Mart. However, these shops still employ shopkeepers to monitor and assist customers.

For now, the risk and uncertainties have put off some investors. JD.ID and Blibli’s niche experiments in unmanned convenience stores are outliers in Southeast Asia. Replicating these operations at scale would require massive capital expenditure with relative uncertainty regarding rewards, especially given lackluster demand and low labor costs in much of the region. Simply put, innovation for its own sake does not solve a problem that doesn’t exist.

Less innovation, more collaboration

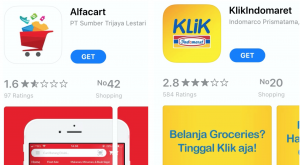

While Chinese players are ramping up digital transformation in their stores, Southeast Asia is unlikely to follow suit, at least not to a tee. So far, various attempts to emulate these developments have come short. For instance, Indonesia’s Indomaret and Alfamart launched online platforms called KlikIndomaret and Alfacart. However, those apps are marred by technical problems, such as login difficulties and outdated stock inventories, which frustrated users.

Rather than build their own tech, existing retail players might prefer to collaborate with tech platforms to digitize their services and cultivate an omnichannel sales strategy. Aside from e-commerce platforms, convenience stores in Indonesia also partner with on-demand apps such as Gojek and Grab for online delivery. Their items are available on the apps’ grocery sections, and users can pay by cash or through e-payment services such as GoPay or Ovo.

Local needs are of paramount importance in any digital transformation. According to a 2019 study by global research company Nielsen, customers in Indonesia, Malaysia, Vietnam, and the Philippines see convenience in terms of physical proximity; while Singaporeans gravitate toward online shopping and digital payments. Ignoring these varying sentiments would be detrimental to any attempts to digitize retail.

There is one aspect of convenience store operations that new tech can improve immediately—product selection. Companies can utilize AI to analyze consumer purchasing patterns and tailor subsequent store offerings.

So far, only Thailand’s 7-Eleven chain is following Bianlifeng’s playbook. Since 2018, it has been using facial and gesture recognition to collect and analyze data points about in-store traffic, staff activities, how long customers linger in front of specific displays, and even the emotions of people as they enter stores. The data gathered is processed using machine learning to determine what to stock on shelves, as well as where and when to do so.

The direction of convenience stores’ digital transformation in Southeast Asia remains unclear. But this also means that there is plenty of room for innovation and collaboration in the future.

This report’s coverage of Bianlifeng is based on an article published by 36Kr Japan.