When Zeng Longfei has a spare moment in between serving customers in a shop in Beijing’s northwestern suburb, he sometimes holds his smartphone close to his face, then taps on the screen to open one of his favorite apps. He listens to music, a chapter of a novel, or a news article that is read out loud. Sound is the center of the 30-year-old blind masseur’s life, after a fever took away most of his vision nearly two decades ago.

For years, Zeng’s smartphone has been the Henan man’s favorite tech tool. He listens to music, converses with other people on WeChat, shops online on Taobao, performs transactions on Alipay, orders food that is delivered to his doorstep, and uses GPS-enabled street maps to navigate around unfamiliar locales.

“I am so addicted to and dependent on my smartphone that I keep it close to me when I go to bed at night,” he said, sparing no affection.

But Zeng’s smartphone has a few competitors—the smart speakers in his workplace.

“Xiaodu Xiaodu, close the curtain,” Zeng commands as he walks into the room. The yellowish curtain moves slowly along a metal rail, forming a barrier between two massage beds. He follows up with, “Xiaodu Xiaodu, play some music.” The melody of a Chinese pop song by a little-known male artist fills the room.

The Xiaodu smart speaker has yet to grasp Zeng’s taste for music. He prefers folk music to pop tunes, but the AI program’s choice was good enough entertainment. “Sometimes when I am busy playing with my phone and don’t have time to look up a playlist, I will just talk to the smart speaker and ask it to play some music for me. I can use my phone and listen to music at the same time. It’s quite enjoyable,” Zeng said.

Smart speakers first entered Zeng’s life in 2017, when he was working in a coastal province in Eastern China. A fellow blind masseur brought over a Xiaomi smart speaker and showed off what it could do—play music, read news articles out loud, set timers, and answer questions, among other functions.

Over time, talking to smart speakers became a pastime for Zeng and his colleagues. They would ask the smart speakers to play sounds of different objects and animals, like motorbikes, tigers, wolves, lions, leopards, and even the sound of a nuclear missile launch. “The funniest of all is asking the speaker to play the fart sound,” Zeng said. “You can make a full room of people laugh by simply asking it to play the fart sound. It was such fun.”

Smart speakers were still novelty gadgets in 2017, even though it was three years after Amazon debuted Echo, the world’s first smart speaker, which came with a nearly USD 200 price tag. In 2015, JD tested Chinese consumers’ appetite for this sort of device with its Dingdong smart speaker.

JD sold 100,000 units of Dingdong in 2016. For comparison, in the first ten months of 2017, roughly 100,000 smart speakers were sold in all of China, according to Counterpoint Research. (A lesson in the importance of being a first mover in a market.)

Despite somewhat miserable early domestic sales figures for smart speakers, three Chinese tech giants—Alibaba, Xiaomi, and Baidu—decided to make their forays into the business. All three companies launched their own smart speakers in the second half of 2017.

The arrival of these tech giants, along with their deep pockets, reshaped the industry. A little more than four months after the debut of its Tmall Genie X1 in July 2017, Alibaba sold 1 million units on Singles Day, the annual shopping spree introduced by the e-commerce top dog in 2009. That was double what they actually had in their inventory. The surge in sales was mostly driven by hefty subsidies—the Hangzhou-based company slashed the Genie’s price from RMB 499 to RMB 99 (USD 70 to 14) for the promotion.

The Singles Day promotion alone cost Alibaba millions in subsidies.

“[Customers] do not have the incentive to purchase [a smart speaker] because they don’t know if they would need it,” Chen Lijuan, who is in charge of Alibaba’s AI research and smart speaker business, explained the rationale behind the huge discounts and subsidies in a 36Kr interview later that year. Even now, Alibaba is eager to keep prices low for curious customers.

For clear-eyed Chinese smart speaker vendors, the overnight success of Alibaba’s Tmall Genie proved that subsidies and low prices work. Xiaomi subsequently cut the retail price of its second smart speaker product to under USD 24 in April 2018. Baidu, after releasing a flop with the costly Raven H (which cost nearly USD 240), introduced its own brand Xiaodu and launched a smart display (smart speaker with a touch screen built-in) at roughly USD 70 in February 2018, following up with a regular smart speaker priced at USD 12.5 four months later.

“Chinese users have a relatively lower acceptance level of smart home products such as smart speakers, hence vendors want to lure in more users with their subsidies,” Counterpoint Research analyst Zhang Mengmeng told KrASIA.

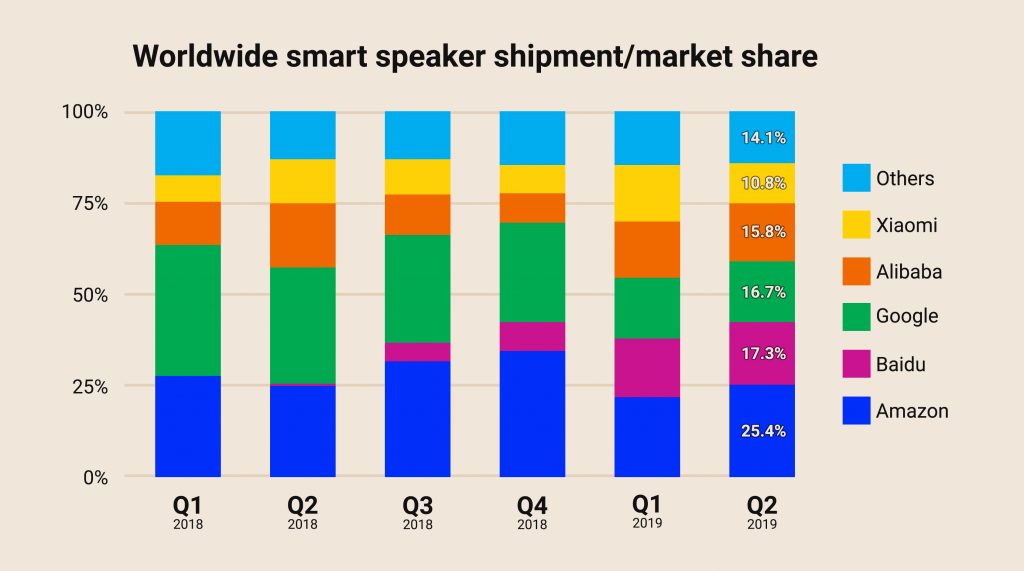

Source: Canalys estimates, Smart Speaker Analysis

After rounds of promotions and subsidies campaigns, the domestic market saw an explosive growth—21.9 million smart speakers were shipped in China in 2018. Alibaba, Xiaomi, and Baidu together sold about 19.6 million units that year, dwarfing even the most optimistic forecast—an aggregate of about 5 million global shipments for all Chinese vendors—made by industry leaders at the beginning of that year. These three Chinese tech heavyweights were all among the top five global smart speaker vendors in 2018.

This year, Baidu double-downed on its smart speaker business and splashed millions on subsidies and marketing campaigns. The Beijing-based search giant sponsored China’s Spring Festival Gala on state broadcaster China Central Television (CCTV) and a popular reality show on Hunan TV, one of the country’s most popular channels. The company sold 4.5 million smart speakers in the past quarter, outpacing Google by 200,000 units and ascending to the number two spot in terms of shipments and market share, according to data from Canalys. Jing Kun, the executive behind Baidu’s smart speaker, was promoted to vice president of the company in May, soon after Baidu dethroned Alibaba as the biggest Chinese smart speaker vendor.

“The competition between brands is very fierce now,” said Jason Low, a senior analyst at research firm Canalys in Shanghai who has been closely following the rise of China’s smart speaker industry. Chinese tech giants see smart speakers as a gateway product with the potential to lure in users for their other products and services. They spare no efforts to promote and popularize smart speakers “because they think it’s very important for them to build up their user bases,” Low said.

In the heyday of smart speaker startups, there were 112 solution providers in a square kilometer in Shenzhen’s Nanshan District. The southern coastal city bordering Hong Kong is home to more than two-thirds of the world’s smart speaker production. But since 2018, small players have found themselves in an increasingly hostile environment, undercut by Baidu, Alibaba, and Xiaomi, and then snubbed by the capital market.

Smart speakers’ high subsidies and low prices have made it difficult to break into the business, which is increasingly becoming a game solely played by major Chinese vendors that have advantages in technology, distribution, and marketing. More importantly, they can burn through banknotes to reach new users and to grab market share.

Carol Wu, vice president of Mobvoi, a Beijing-based smart hardware startup, said the subsidies of the tech giants posed a “huge challenge” to her company’s smart speaker business. Major tech corporations selling products at prices below their actual production cost has led to a “distorted market” and would hurt tech innovation in the long run, she observed.

“For startups like us, we could not afford and would not play the subsidies game,” Wu said. Despite being one of the first vendors to launch smart speaker products, Mobvoi has dropped out of the consumer smart speaker market and now focuses on making customized products for businesses.

Charles, an industry veteran who was involved in the development of several smart speakers by smaller vendors, said the war between tech giants had spooked the capital market. “If you talk to investors, they would immediately tell you that [the smart speaker business] is something uncertain. The capital market is very realistic, and people there do not like to touch uncertain projects,” he said. Therefore, he has decided to take the backseat because of the lack of a clear monetization plan for developers like him.

“It’s like a marathon, a game of perseverance,” observed Charles, the industry veteran. “The situation won’t improve unless Baidu or one of the giants finds a clear path for monetization.”

But for many users, once the novelty wears off, the smart speaker might become just a regular speaker. Zeng, the blind masseur, said he mostly uses his device only to play music. “Basically, the smart speaker is not essential for me. It doesn’t have me hooked yet.”

Video and graph by James Chan.